Time To Print ETH From Thin Air

Here is an emerging bottleneck in crypto that can present us with massive opportunities.

The constraints of crypto present the frontier of innovation.

It's not enough to simply know what new projects are launching. Nor is it enough to say you heard about some rumor that a new narrative will be hot soon.

To understand the industry means to embrace the bottlenecks. That's where you'll find opportunity.

As new avenues get paved and capital is able to flow more freely, the possibilities become new realities.

Given this view of how the industry moves in shifts instead of incremental daily progress, I thought I'd share something I wrote a few months ago on an emerging capital constraint in crypto.

This weekend seems appropriate given yesterday's livestream with the Jlabs Digital team is how we still view the market today. Nothing has changed since then. The market shows hesitation and a willingness to sit back and let price run into bids.

Once we see bids begin to chase price, then market strength will return. Until then, let's use this time to look at a current bottle neck in crypto...

The Need To Print ETH Out Of Thin Air

We could buy a Ferrari if you stopped drinking Diet Coke.

I was seven or eight years old at the time. Cassette tape Walkmans still had two ports for shared listening and Gameboys were still not much of thing.

This meant that a case of boredom while in the rear facing back seats of a station wagon, where seatbelts were merely a suggestion, meant resorting to math in the head.

Now, my Mother was known for having Diet Coke on hand like a millennial influencer holding an iPhone with their Instagram account opened throughout the day.

It was like an accessory of her personality.

As we slipped into the nearest drive through for the cup holder version of a sugary caffeinated IV bag to be filled up, I wondered how much our family spent on Diet Cokes.

Before long, the numbers were getting big enough to where I began to close in on the price tag of a Ferrari.

The math was mathing. Well, at least I thought.

The numbers were likely way off as I look back on it all now. I also shortsightedly assumed no other beverage would be substituted in its place… But when you’re that young, the effort is what matters, not the accuracy of analysis.

Right?

Regardless, at the time, it became clear I was starting to grasp a concept of money that I carry with me to this day.

Time and capital go hand in hand, or said different, the cost of money.

Making the decision to not spend today, meant more available to be spent tomorrow. But there was more to it…

What sparked this random math session was the gift I had just received – a U.S. Treasury bond. I had no clue what the piece of paper I received as a gift meant outside of it saying “Bond” on it. But my grandparents tried to tell me just how awesome it was.

I didn’t quite understand. After all, it sort of looked like dollars. It had some old looking dude on it with some numbers. Even the paper itself seemed fancy. Yet it wasn’t money I could use to buy Sour Skittles at the nearby corner store.

Anyways, this new concept of earning more than what was lent out – the number that was printed on the paper - started to blow my childhood mind the more I thought about it. Sure, the paper said $50, but in 10 years it was almost $100.

The fact that time created more money made me look at each dollar spent different. It was not just a dollar anymore; it was tomorrow’s dollar.

I began to pinch pennies.

And even though my Ferrari math was likely egregiously wrong, it’s in part why I’m so drawn to rate markets to this day.

The cost of money.

And when it comes to digital assets, public blockchain networks, and capital onchain, it’s no different. I’m drawn to the rate markets.

Anybody who’s followed me for the last several years knows that yields, rates, economics… That’s my homemade heirloom specialty jam being served up with uber bougie freshly roasted and burr grinded Espresso.

I’m also a big fan of breakfast if you couldn’t tell.

Now, the reason I’m talking about the cost of capital is because it has to do with why I’m so drawn to the Ethereum network… A lot of these rate market primitives have taken root over there. Watching their maturation is like watching an early financial system mature at the speed of light.

What took hundreds (if not thousands) of years for traditional finance to lay the foundation for, has taken only a few years to emerge in crypto.

And it’s the market that I’ve been glued to of late. Reason being, I see the biggest catalyst originating from it.

Tens of billions of dollars are starting to slosh around through it on the heels of its latest innovation. It’s a non-trivial amount. And it’s a catalyst that’s beginning to emerge on networks outside of Ethereum. Meaning your favorite layer-ones are likely getting started on this same trend. Which means you need to pay attention…

So no matter what network you pledge your allegiance to, let’s unpack what this massive opportunity is all about.

While doing so, I’ll also introduce you to a certain hinderance in markets that might help you decide where current bottlenecks sit. But before do, let’s quickly get into just why this rate market exists in the first place.

You Don’t Own Your Car

You have $5,000 and want to borrow $20,000 to purchase a used car. The bank says ok, and generates some paperwork that basically says if you don’t make payments, they own the car.

The car is probably worth less than $20,000 to the bank since they will likely wholesale it at auction, quickly. They are not in the business of finding the highest bidder in the market like a retail car dealership.

This means the bank is giving a loan for likely less than the value of the car since they also asked for the $5,000. Not a bad deal. And the rate is probably around 10% at today’s numbers.

From where Mr. Powell has set rates at, this is not bad. Sure, for those that bought a car a few years ago, this seems like highway robbery, but I assure you it’s not. The cost of capital has risen.

Now, what’s even more impressive here is that money is quite literally being printed out of thin air by the bank. They don’t necessarily have the $20,000 on hand. They simply place the car on their balance sheet as an asset. Money is then created on the bank’s ledger to give to the borrower, who then passes it on to the dealership where you purchased the car from. Then you pay the bank back all $20,000, plus another $5,500 in interest before the bank gives you the title (aka ownership) of the car.

$5,500 to the bank after five years. Not bad considering the bank’s risk is relatively low.

Sure, the bank might lose more than expected at auction if the borrower defaults on their payment or they lose on some other types of risk like economic recessions... But the returns spread out over many loans helps to mitigate some risks.

Understanding this process in how money can be created, and how more money gets created at a faster pace when Powell sets rates lower can help us better grasp this concept of why the cost of capital matters.

The $5,500 the bank makes at 10%, is much more than what they make at 3-5%. But also, the bank is likely writing up more loans at 3-5%.

Now, let’s take some of these first principal concepts about the cost of money and how it’s created, and pivot over to crypto to see what makes it so different and unique. Not to mention, why some of the best returns elsewhere in crypto will create a boogeyman for lending and borrowing protocols.

The Adam Cochran Loan

There’s a term you hear frequently in crypto as one makes their way down the DeFi rabbit hole…

Capital inefficient.

And when it comes to lending and borrowing, it’s easy to see.

Borrowing stablecoins onchain, we need to lock up more value than what is being borrowed.

It’s essentially having the money you need on hand, but using that money to unlock a little more.

Or to use values, it’s locking up $100,000 to borrow $50,000. It’s like giving a friend your $1,000 watch to borrow $20 while you’re at some store.

Granted… If they are your friend, they likely don’t want to hold your watch. They just ask to be paid back later. But let’s assume for a moment they are Adam Cochran-like and whip up a 47-tweet thread that details the loan agreement while you two finish up the purchase.

When you return the $20 the next day, Adam gives you your watch back. He then fires off another 10-tweet thread on the loan coming to an end.

Now, there are a few notable differences here compared to our car example earlier – outside of the tweet threads.

First, no money was created. You couldn’t use the item being purchased at the store with Adam as the collateral for the loan in the same way the car being purchased was used as collateral.

Adam had $20 and you had a watch. Nothing “minted”.

If this hypothetical onchain transaction happened at the car dealership, we would need to lock up $40,000 to borrow $20,000 in order to buy the used car.

That would seem a bit odd since we have more than enough cash on hand to purchase the car.

But what this quickly shows us is how we don’t tie an onchain asset to the original loan.

Technically, we could imagine ways to make such things more possible in crypto. A smart contract owns the right to specific coins, tokens, or assets purchased using the borrowed collateral. This way a stablecoin, in some ways like DAI, can be minted out of thin air like the bank example above.

Then as a borrower, you make payments on the loan to avoid default, and in time take ownership of the tokens purchased using the borrowed funds.

This would be more capital efficient and would require strict procedures on how asset ownership is owned, transferred, and liquidated in various scenarios.

There are some projects starting to experiment with undercollateralized loans, and the answer tends to hone in on creditworthiness. While I disagree in how many of these projects go about defining creditworthiness and setting rates, there does need to be some manner to help define loan risk… But I digress a bit here from our main discussion on how onchain loans are different from a bank loan…

The point of this hypothetical scenario and mental gymnastics is that no new money is truly being generated out of thin air like a bank. Capital, via credit, is not truly being created.

The second and third differences between the bank and onchain loans is term and supply.

Term is simple. Banks can lend from days to decades. This is simply thanks to stability in the financial system. Onchain lacks this stability to date, so writing up a multi-year loan agreement is a bit of an anomaly at this point.

It’ll take time before terms get lengthier.

Supply is the more interesting topic of the last two points as it hints at a major issue that might be coming to a head for DeFi – the area of DeFi we can avoid unless we see innovation around capital constraints.

We Want Better Rates

If no money is being printed from thin air, the question exists of, “Where does the supply come from”?

For projects like Aave and Compound, it comes from lenders like you and me. It’s from liquidity providers that earn some return on making their capital available for loans. When demand for loans rise, the returns get better since rates rise as well. That’s of course no bad debt is incurred by the protocol.

This is in stark contrast to the overly simplified bank example from earlier where there was no liquidity provider. The asset being purchased by the borrower was used as collateral to produce dollars – to increase the money supply.

Which means the rates set by the “Man of Brrr”, Jerome Powell, is what influences borrowing rates and demand in general. That’s because the return on money needs to be higher than what capital can receive by short-term treasuries… Which is a direct result of how the Federal Reserve sets rate.

Meaning as a bank, I won’t lend money out at 4% if I can get 5% from a Treasury. I’ll lend it out at more than 5% to make a bit more spread, while adjusting the rate for risk.

The point here is that a central bank influences the cost of money across the economy.

Hopefully this contrast is making sense. If not, let’s come back to onchain borrowing a bit to drive home another difference…

Rates in crypto are predominately influenced by the amount of capital being locked up by liquidity providers and how much that capital is in demand.

Which means when the market gets overheated, the cost to borrow skyrockets. Like a hockey stick, up to the right, 40% rates in minutes type of skyrocket.

We don’t like stable things in crypto to say the least.

Now, this type of lending and borrowing acts more like funding rates that happen in perpetual markets than it does a brick-and-mortar bank.

And while these high rates help the market cooldown and nudge borrowers to start unwinding their loans… Is that really what the Ethereum economy or other public blockchain networks should be subject to? Speculative finance? (To borrow a ‘Minsky Moment’ phrase.)

If Ethereum is to be an economy, then it should be subject to network wide rates similar in spirit to what the Federal Reserve sets – not because the price of Nvidia is going parabolic.

Because Ethereum (and other L1s!) do not set rates in a similar spirit to a central bank, I find it odd. Mostly due to the fact ETH does have a cost of capital. It’s about 3.1% at this second. That’s the expected yield for ETH being staked to the beacon chain, and we can use tools like CoinFund’s CESR index (nod to Christopher Perkins there) to track this over time.

The reason we can use it as a proxy for the cost of capital is simply because a staker expects to earn 3.1% apy right now. But that’s not a true cost of capital for a year. That’s because activity might come back to Ethereum again, causing yields to rise again.

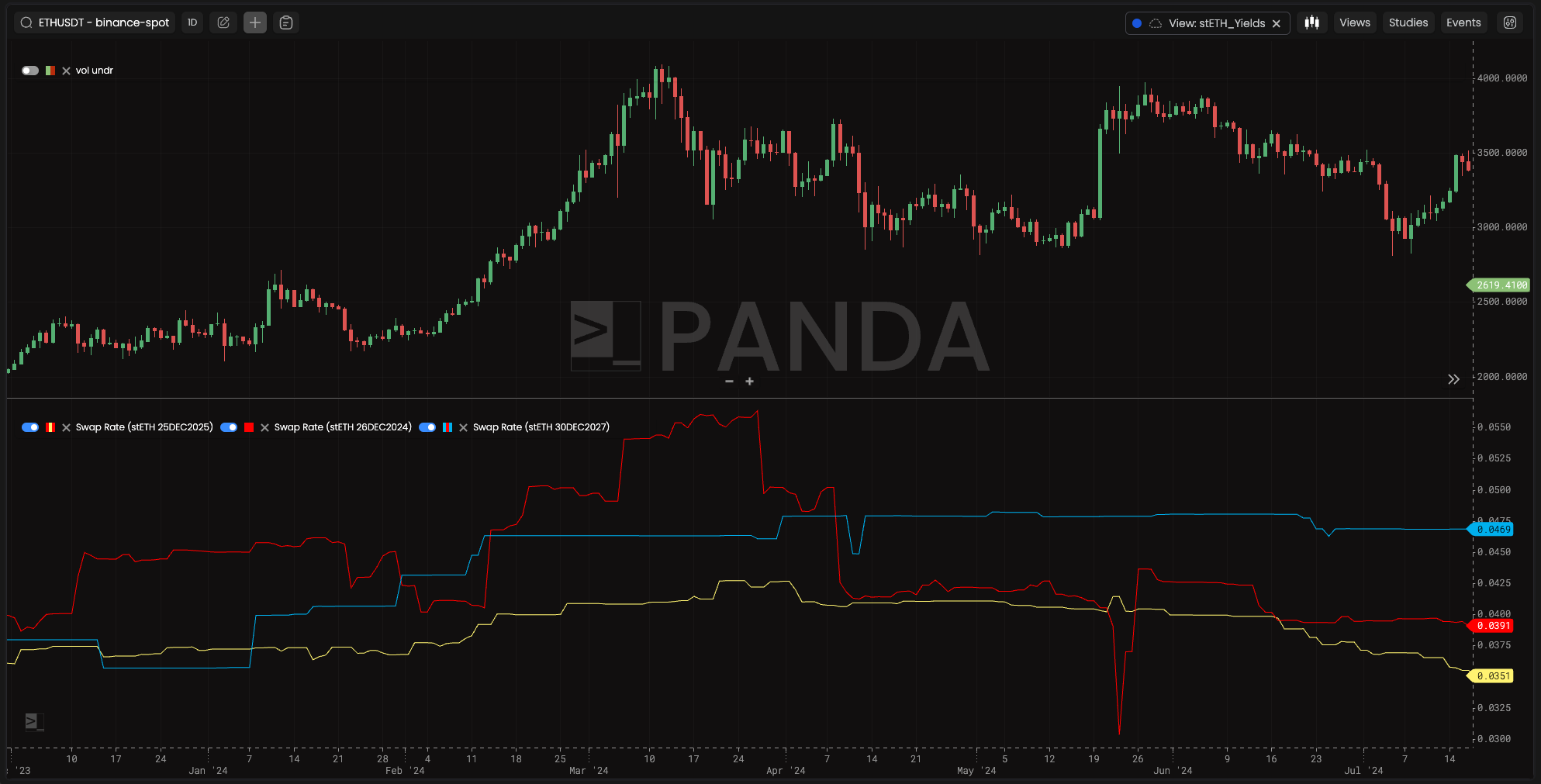

If we want to use a different proxy for the cost of capital, we can lean on Pendle.finance markets to arrive at numbers like 3.9% for a better expectation for yields over the next year. We can see that in swap rates in the image which shows Pendle rate swap markets over time.

That’s more than the current 3.1% stakers are earning today.

If we bring this rate back to our lending/borrowing examples, when Ethereum’s economy heats up, staking rates rise (all else equal). This same logic seems to hold with fiat economies… When economic activity heats up, central bankers tend to slowly raise rates.

In both instances, it signals a rising cost of capital in the economy… Which is more removed from speculative finance with 40%+ rates via current onchain borrowing solutions.

Now, these yields from staking will likely top out around 8% or so if the coming bull market brings about major upticks in fees. Assuming the chain does heat up, 8% is a much more realistic borrowing rate.

But that’s ignoring the bigger issue that needs to be addressed.

There is a trend shaping up to make ETH and other collateral even more scarce. That’s Liquid Restaking Tokens (LRTs). It’s where ETH holders can earn even higher yields… Higher yield than what they would earn on lending and borrowing protocols – granted, more risk (hello future rating systems).

Sure, these lending and borrowing protocols will allow these new LRTs to be used as collateral, but that’s not enough. There will be liquidity issues that impact how some of the protocols operate when it’s time to liquidate a loan. The plumbing. And a bigger question here is can they even attract these new forms of collateral to begin with.

Right now, a user makes a few percentage points to lend out their ETH. I have to imagine the lenders are heavily subsidized to do this or the capital is simply stale, and never leaving.

The reason being is DeFi already offers fixed rates much much higher for a similar amount of risk.

Which tells me, I don’t foresee lending/borrowing protocols being very competitive here. They must innovate.

Here’s one idea…

Print Money From Thin Air

Currently, borrowers pledge collateral in one currency like ETH, and then borrow in a second asset like DAI, USDT, or USDC.

This multi-currency transaction is in my opinion, part of the reason why the market hasn’t innovated to the point of using ETH staking rates as the cornerstone of lending and borrowing markets.

If a protocol were able to allow a user to borrow ETH to purchase something, while the user puts a downpayment of ETH on the loan… Meanwhile, the smart contract is able to take ownership of the purchased asset (which is priced in ETH terms)… Then the possibility for the creation of credit exists.

Sure, it’d require another derivative token of lent ETH (let’s call it lETH for short), but the possibility exists. Especially for fully onchain assets like NFTs.

There would also need to be fully liquid markets to aid in lETH being used throughout the ecosystem. Once we sort of look past some of those basic primitives for a successful derivative asset to be adopted and usable, the smart contract can lend capital out with some relationship to staking rates.

To better get this idea across, let’s draw an example out…

A user wants to go out and make the wise decision to purchase a cryptodickbutt. This user thinks it represents a vulgar insult to traditional finance BlackRock-ians as they begin to solicit Ethereum to their family office clients using high gloss pitch decks. And have this detached from reality belief that the NFT will rise in value for this reason alone.

I make no judgement…

This user acts on this thesis and pledges a downpayment, let’s say 0.25 ETH. The NFT costs 0.75 ETH. The smart contract looks at floor prices, market liquidity, etc. and defines some risk. It even looks at the wallet’s prior purchase of tokens, PnL on trading, and recent flow of capital in/out of the wallet to better assess credit worthiness.

The contract then moves the downpayment to staking or some rate swap market to lock in 3.1% returns. It then mints lETH to the user (or it swaps – liquidity assumption - it to another form of ETH to make payment of the NFT).

The NFT is now owned by the user with some caveats (ie – user doesn’t make payment for 90 days, NFT loses 50% of value or 30% of value in a certain period). In the event one of the caveats happen, the NFT is liquidated.

If all payments are made on the loan, the user will hold their very own cryptodickbutt. Bravo.

This is overly simplified, but hopefully raises an interesting thought of how to create capital onchain using an asset.

If we were to start overcomplicating things, then we can assume there is a portfolio of smart contracts from this hypothetical protocol minting lETH for loans. The protocol will need to diversify its loan book and perhaps hedge itself on rates to make more profits.

Nonetheless, the point remains that rates SHOULD be directly tied to the network economy. The cost of capital should not be highly volatile and rest solely on the shoulders of speculative finance.

And in an ecosystem where tokens are likely to be even more scarce in time and access to credit will be even more difficult and costly, there needs to be some fresh thinking.

If we can see this bottleneck open up, it'll be flush with opportunities.

All puns intended.

OK, that’s enough out of me, enjoy your weekend everyone.

Talk soon.

Your Pulse on Crypto,

Ben Lilly