The Stablecoin Arms Race

Token Insights: Blockchain central banks are coming

There is a progression in crypto.

One that Kodi wanted to draw attention to today since it is something our token design team has begun to look into of late. For those that don’t know, Kodi spends his time in our token design department. He is a whiz kid that can truly find ways to bolster any economy. He is our newest writer and looks to discuss these economies at a more fundamental level.

His piece today touches on what looks to be a stablecoin arms race that has only just begun. Be sure to read up on it below.

Afterwards, we can quickly touch on what our team believes is about to unfold… The next chapter in financial innovation and experimentation.

With that, we will speak shortly. For now, I’ll hand it off to Kodi.

Enjoy,

Ben

You’ve probably heard of Do Kwon, the infamous founder of the UST stablecoin.

On March 23, he sent out the above tweet. He was promising that UST would eventually destroy its main competitor, another prominent stablecoin called DAI.

Spoiler: it did not.

We at Jarvis Labs were reminded of Do Kwon’s fateful promise recently while listening to Do’s interview with Laura Shin.

Much ink has been spilled recounting the demise of UST and the broader Luna ecosystem it was a part of. It is a story of poorly designed mechanisms and misaligned incentives. A story of human fallibility and hubris.

It ended the only way things can end when we dare to fly too close to the sun: an uncompromising, tremendous defeat.

UST is now trading at mere cents, the Luna ecosystem died an ignominious death, and Do Kwon is playing Schrödinger's cat with his fugitive status (either on the run or not, nobody seems to know).

Meanwhile, DAI is still alive and kicking.

And now other projects look to launch their own stablecoins. Aave for instance just released the technical paper for its own stable (GHO) recently.

The part that seems to be flying under the radar is it may have a hidden motive…

A New Player in the Stablecoin Market

As you probably know, Aave is one of the top lending protocols in crypto.

And now, it’s expanding into the stablecoin market.

Called GHO, it will first be an overcollateralized stablecoin. That makes it similar to MakerDAO’s DAI.

The way it works is a user can borrow (or mint) GHO by supplying excess collateral to the Aave protocol. This collateral will take the form of various cryptocurrencies. And Aave remains solvent by liquidating the borrower’s collateral if its value falls to a certain level.

During the course of the loan, users pay an interest which goes to the protocol’s treasury. And the borrowing rates are set by AAVE holders.

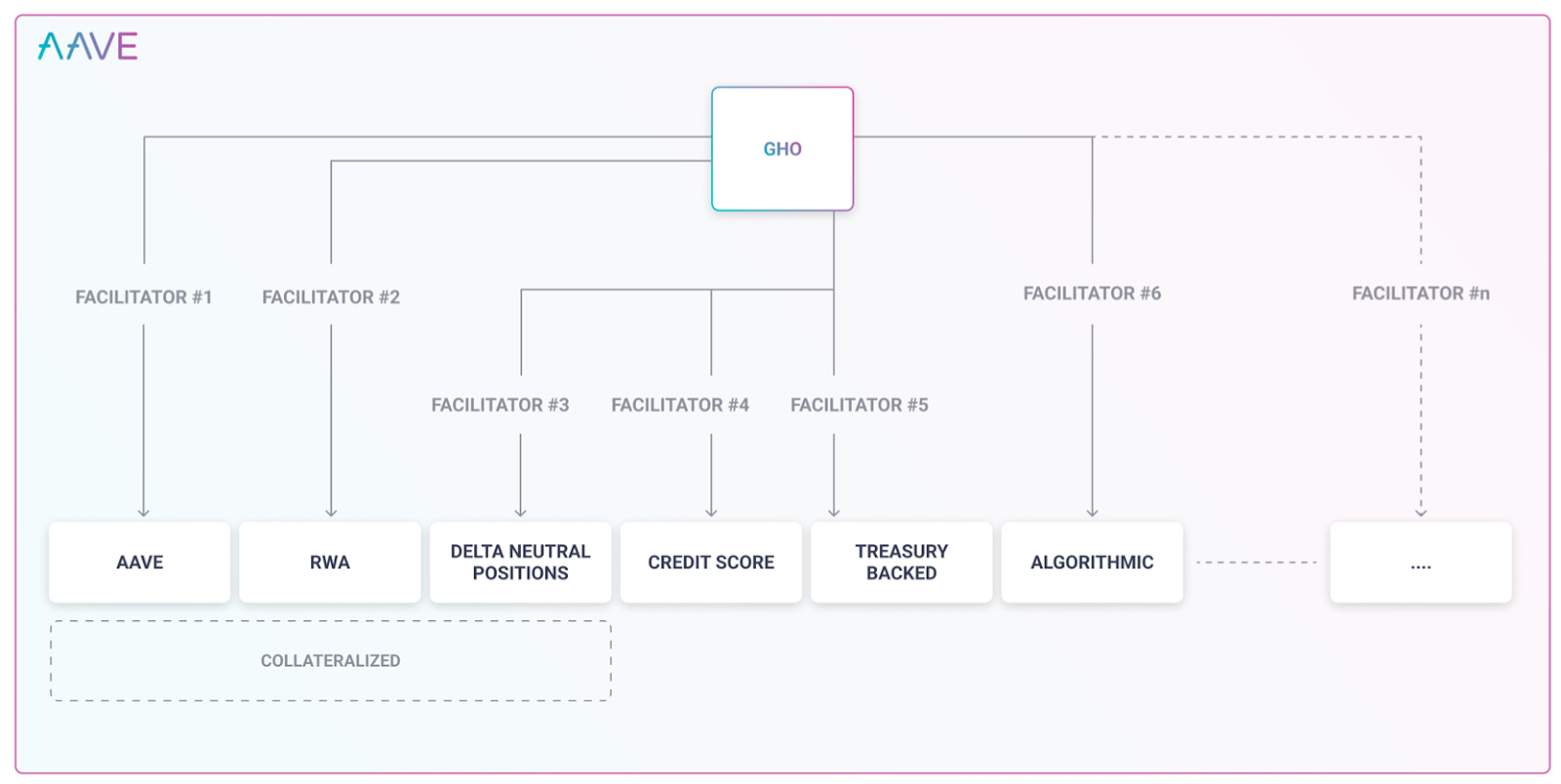

However, this is just the initial plan. In the future, GHO will be mintable through various strategies called Facilitators. These strategies include:

- over-collateralized debt, including real-world assets (RWA) and Treasuries as collateral

- delta neutral positions

- algorithmic strategies

- credit score (potentially using Aave’s social network Lens we wonder?)

- yet to be named

Possible future strategies (called Facilitators) to mint Aave’s GHO stablecoin. Source: GHO’s technical paper

It’s unclear exactly when GHO would launch. It’s currently up for debate on Aave’s governance forum. Nonetheless, unless faced with major opposition, the design should proceed to testnet soon.

I can see some of you scratching your heads. I thought Aave was a lending protocol. Why would they launch a stablecoin?

Because they’re the latest protocol to start chasing after the “Holy Trinity” of DeFi.

The Holy Trinity

Back in January, Andrew Kang released his thesis on Frax, one of the leading stablecoin protocols. In it, he stated that Frax was pursuing the “Holy Trinity”, three verticals that when combined under one umbrella would make for DeFi’s killer app.

The three verticals are:

- A stablecoin with sizable liquidity and usage (velocity) across DeFi

- An automated market maker (AMM) with deep liquidity and sizable volume

- A lending market with adjustable interest rates

Any protocol that offered these three verticals simultaneously would soon become the most important protocol in DeFi.

Frax is one such protocol looking to attain the Holy Trinity. Its been building out these three verticals for a while according to its founder, Sam Kazemian. As Sam statedf:

We’re building towards this trifecta slowly and methodically. If we achieve it imo it is game over.

The minute this idea surfaced, an arms race began across DeFi. The signal to other protocols was clear: build the trifecta yourself or step aside and see your protocol die.

And that’s why Aave is throwing its hat into the ring with GHO. It needs its own stablecoin to achieve the Holy Trinity.

So who would be the likeliest contenders in this battle to become DeFi’s ultimate protocol?

Well, the most obvious are protocols that have achieved success in one of the three DeFi primitives (AMMs, lending markets, or stablecoins).

These would include protocols such as Aave, Compound, Curve, Frax, Maker, or Uniswap. These are also the ones that stand to lose the most if any other protocol can achieve the “Holy Trinity” before they do.

For now, the protocols that have taken up the gauntlet are:

- Aave: arguably Ethereum’s biggest lender, and the protocol with the highest total value locked (TVL) in DeFi. As covered above, Aave is set to introduce its stable GHO on testnet shortly.

- Curve: the biggest stablecoin decentralized exchange (DEX), which puts it at a distinct advantage against other protocols. Curve announced its own stable crvUSD a few months back. However, aside from some teasing comments on Telegram, the details are scarce.

- Frax: the first partially algorithmic stablecoin, and the second-highest market cap of any decentralized stablecoin. It was the first protocol to announce it was gunning for the trifecta, but its solutions for lending and AMM have not found much success yet.

- Maker: the protocol with the most successful decentralized stablecoin to date, DAI. However, its overreliance on USDC for collateral and a lot of in-fighting inside MakerDAO mean DAI could not remain king for long.

What’s clear is that UST’s collapse hasn’t scared protocols away from attempting to develop their own stablecoin and achieve the Holy Trinity. With Aave on the cusp of launching GHO, it’s clear this arms race is just starting to heat up.

And to take a few steps back on discussing what this all means for crypto, let’s turn it over to Ben.

Keep it fun,

Kodi

The FED of Blockchains

Thanks, Kodi. That was a great primer on a major trend unfolding for DeFi protocols.

Now, the reason we want to pay attention to this arms race of protocols building stablecoin, AMM, and lending/borrowing components is that they are trending towards something quite revolutionary.

They may soon have functionality similar to central banks.

To explain, I’d like to touch on a few points about banks.

Lending and borrowing are foundational to most banks. And to better understand this basic function, let’s look at the mortgage process.

Banks write a loan to a customer buying a new home. When the customer signs the loan documents and makes a down payment, the bank sends money to the seller. This money is a liability that must be paid back by the buyer.

What is interesting here is the money is created by punching numbers on a computer. The bank creates money. Not physical dollars, but electronic dollars.

This is possible because the bank puts the home the buyer purchased on its balance sheet. For the crypto natives among us, this should sound similar to what takes place with MakerDAO and its DAI stablecoin.

MakerDAO takes in ETH as collateral, then prints DAI to the borrower. This process is what we are expecting to now see with Aave.

And in both the commercial bank and MakerDAO example, in both instances the assets get sold into the marketplace if the borrower defaults. This helps keep both entities solvent.

The parallels between the two entities I find interesting. On the one hand commercial banks mint dollars while DeFi protocols mint stablecoins.

What traditional banks don’t need to do is have AMMs between various assets. Reason being is their minted dollars do not sit on a shared blockchain with coded contracts that can cause incompatibility (interoperability) issues. DeFi protocols for now do have this concern and require an AMM for this exact reason.

Which is why if a DeFi protocol can achieve the Holy Trinity Kodi mentioned, they are a force in the industry to take seriously. It would be the potential Citi, Goldman, BNY Mellon, JP Morgan of tomorrow… Just with only a small fraction of employees.

To say it differently, the current banking industry’s margin is DeFi’s opportunity. This is likely known by most as it is likely why you all are reading a crypto newsletter in the middle of a brutal bear market.

The irony here is that the regulation being discussed by regulators, specifically for stablecoins, is likely to put a damper on this Trinity due to onerous rules on software and code.

If hindering regulation materializes, I expect a cat and mouse game to begin. One that actually unlocks the potential of these protocols in an unexpected way.

If regulators don’t want DeFi protocols to issue stablecoins just like traditional banks do, then DeFi protocols should listen. For those following the current discussions by Rune from MakerDAO, you might know where I’m going…

Unpeg DAI. Unpeg stablecoins. In doing so, the assets minted by DeFi protocols would put them on a level above banks in general, and closer to central banks.

These protocols would create their own currency.

So instead of trying to keep the minted currency stable to a U.S. dollar, the goal would be to create mandates similar to the Federal Reserve - Price Stability, maximum ‘usage’.

This is a potential outcome the team at Jarvis Labs has started to research and model just in case. In our preliminary work of unpegging MakerDAO’s DAI token, our team began to realize the supply and demand influences that would emerge on DAI would draw similarities to what takes place with the U.S. dollar. And not just the U.S. dollar, but sovereign currencies in general.

That is quite interesting and potentially very powerful.

By following regulatory guidance and not issuing a stablecoin, DeFi protocols could be trending towards similar practices as central banks (p.s. - MakerDAO swap lines already exist).

It is an exciting proposal for DeFi. And its what our token design team sees as the future. Which is why we are beginning to model out how to best prepare for this chapter. Specifically, how can a protocol create an asset that maintains price stability. It is such a fascinating topic to dive into. And understanding why users seek a stablecoin in general opens up many realizations of what properties a minted asset that seeks stability would need to have. Stability, liquidity via AMM, assurances, and more.

And while all of these questions are fun to dive into. The real question of the day is…

What DeFi protocol will be the first to take the next step? Who will start the trend of blockchain based crypto banks with seigniorage?

The one thing I do know is financial experimentation has only begun.

Embrace the innovation as it accelerates.

Your Pulse on Crypto,

Ben Lilly