The November Cut

The market is currently pricing in no rate cut for September, which goes against what the odds say. Here's why.

I tried to unplug for a week.

And I came close.

I thought it would be easy. But like most things, theory and practice are nothing alike at times. Theory lures you in with the idea of simplicity and logic. Practice on the other hand, throws dirt in your face while storm force winds blow your logical plans off the face of this planet.

Beauty is the byproduct of unpredictable forces. And that's where I sit now.

I won't bore you with the details.

Just know, I've been traveling for a bit and was ready to come home. Before the last stretch I tried to remove myself from X.com, Telegram, charts, Bloomberg and other platforms that spoon feed me bite sized dopamine hits of emotional headlines.

What happened instead was a reflective period where I used paper and pencil to fill up pages of future plans. Those plans you'll see unravel in the coming weeks. To sum it up, J-AI is about to go into hyper drive.

What's interesting though, as I sit here after this unplugged week, is that I have a blank slate of what to expect at today's FOMC meeting.

So as I get going on my first day back on the desk, I figured I'd try to do some original analysis before the meeting. Then in the days that follow, write up some fresh analysis on what seems to have happened in the wake of his talk, and perhaps what to expect in the coming Jackson Hole Symposium - biggest central banker event of the year.

In the meantime, I'll stay away from what other macro analysts are saying...

I find this type of approach important to do as an analyst because owning your analysis gives you greater confidence in what is happening in the market, but also, a greater skepticism towards what others are saying - in a healthy way.

If you've never done it, I highly recommend it.

Now, before I get started, just some house cleaning items.

We are sad to see our favorite Jlabs Janitor leave. It's a bitter sweet departure. JJ has grown a lot with us over the years. He came in with a very unique and nontraditional skillset. While here, we got to watch him refine his craft while creating educational content for our readership. We are all excited to see him take a step up in his career. I'm guessing and hoping we'll see more of him again in the future. For now, we wish him the best, he will be missed.

In his wake, you will unfortunately be hearing more of me via Espresso.

So if that frightens you, I recommend you unsubscribe asap as you're about to be inundated with caffeinated alpha that will cause your heart to palpitate to a point you are so uncomfortable, you simply ask J-AI to take over so you can go touch all the grasses you can find within the confines of 24-hour days.

We're bringing back the old roast style of Espresso. No time like the present.

Let's go.

Pre-Powell

It's T-minus four hours until the man of Brrr walks up to the podium and delivers financial forward guidance like a dead fish handshake... A delivery that seeks confidence in confidence, and tries to minimize any threatening behavior.

A byproduct of what the market asks of him.

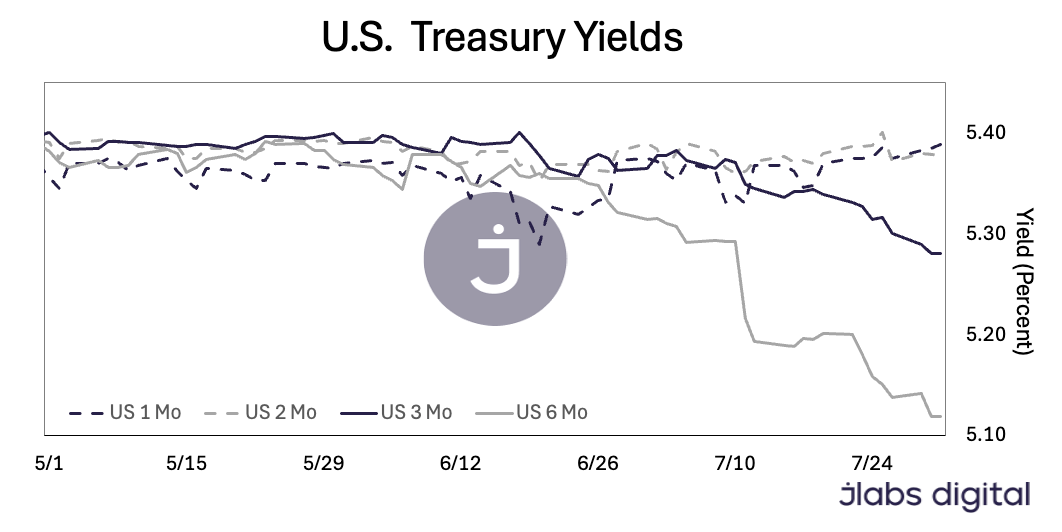

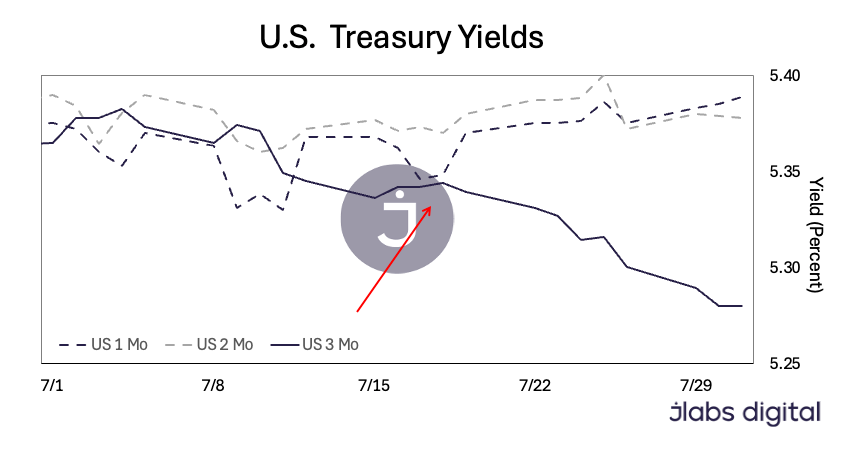

In the run up to him being mic'd up, let's take a look at current U.S. Treasury yields. This is helpful because yields tend to reflect rate expectations.

If the market expects Jerome and Company to maintain a 5.25-5.50% target rate for another 30 days, then the current rates for 1 month treasuries should be a little higher than the federal funds rate (or SOFR's 5.33% for those a little more familiar with rates).

This has to do with the cost of capital. Rates "begin" at this federal funds rate since this is the most secure source of financing. Everything else is a byproduct of this rate.

What I mean by this can be explained by looking at market yields for various U.S. Treasuries. Here is a snippet of some shorter duration treasuries over the last three months.

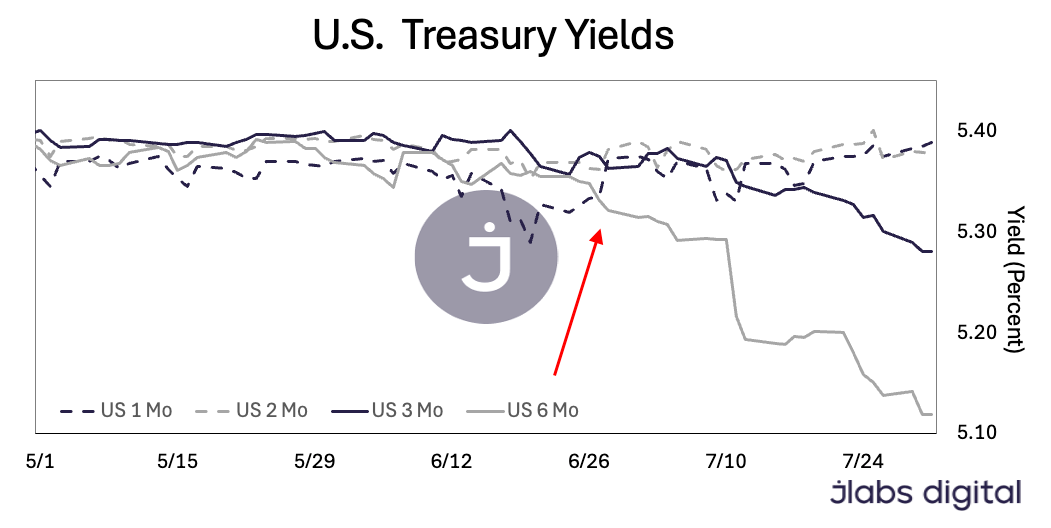

Note the deviation of the six month treasury (gray solid line), as seen below, and the three month treasury (darker solid line).

This happens due to the expectation of what that federal funds rate will be in the future.

For example, if you and I were to negotiate a contract for a six month borrowing rate, I might say 5.5% is a good rate since it's slightly higher than the federal funds rate. But you might come back to me and say, yea, but in September, that rate might be less because you believe Jerome Powell will cut rates then.

So we go back and forth and agree that in either September or November, rates will be less. We then settle on November... And agree that August, September, October should be 5.5% while the last three months should be 5.25%. Which is to say... We write the contract up at 5.375% for six months.

That's essentially what we see happening in the charts above. The market is pricing the change in rates, already.

The second chart highlights in late June that at some point within the next six months, rates will come down. That's what the red arrow is point to above.

Then in July, the three month treasury started to drop. But the 1-month and 2-month treasuries show no budge. Which is to say the market does not appear to be pricing in a rate cut within the next two months, but perhaps in month three.

That would place us in October... After the September meeting.

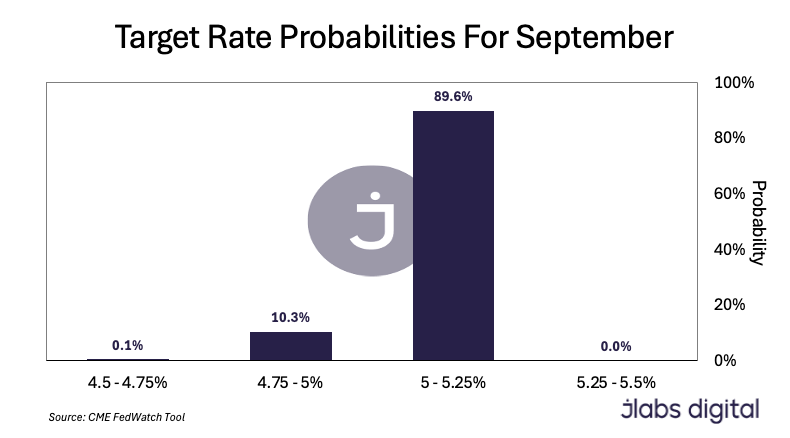

Which is in contrast to the CME FedWatch Tool, which shows that for September, there is a 90% chance that we see at least one cut, and a 10% probability for two cuts.

This is a significant difference.

Let's dive into why that is...

The Divergence

For some background, the target rates are determined by federal funds futures contracts.

Which means this can be used as a hedging tool. And perhaps what we see happening is the market's desire for insurance in the event the U.S. Federal Reserve needs to cut rates in response to some financial crisis.

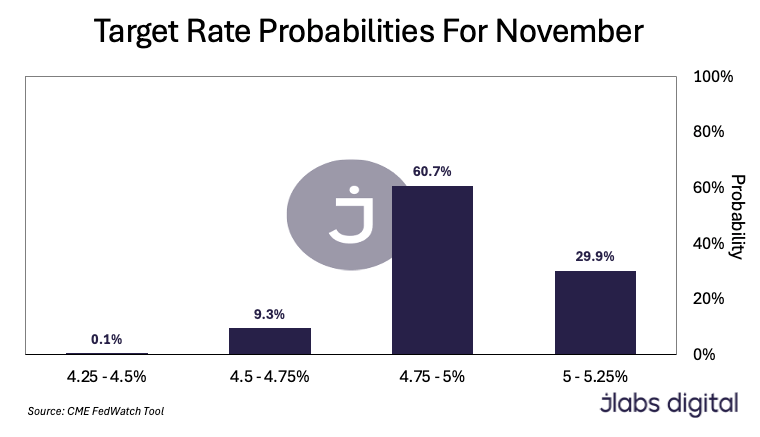

This difference gets highlighted even further as we look at the probabilities for rates at the November meeting. We see the chance for a full 100bps rate cut (aka setting the rate at 4.25-4.5%) by the November meeting.

That's not very logical.

Which tells me that this table is more of an expression of downside rate hedging.

Think of it like this...

Federal Reserve members believe rates will be somewhere between 4-4.5% in 2025.

Yet, the CME shows a market rate of 3.75% in one year's time (current "ZQ" contract prices in one year).

The difference I say is due to rate hedging.

If a major financial crisis were to cause the Federal Reserve to drop rates to near 0% again, or let's say 2%, many market participants would be impacted with this rate change.

This is similar to "skew" in the options market, where many funds keep purchasing downside insurance.

I bring this up because we should place greater focus on U.S. Treasury yields to better predict when rate cuts are happening. Not these CME futures contracts.

If anything, these CME probability charts are causing the market to have overinflated expectations for a September cut.

And if we instead focus in on the fact that 2-month treasury yield - before Powell speaks - is not budging below the current target rate, and the 3-month treasury did start to move over the last ten days...

Then three months from when that happened (ten days ago) places us in late-October. Which is closer to the November 7 meeting.

Based on this, my current expectation before I listen to what Powell has to say today, is for a rate cut in November, not September.

Now, I don't expect this write-up to go out before Jerome talks, so take what I have here and apply your own thoughts to the matter.

I'll do the same in the coming days to help tee-up the Jackson Hole Symposium and possible first rate cut... Arguably, one of the biggest catalysts to risk assets in the coming months - assuming these cuts don't happen for black swan reasons.

But for now, it appears November is in the crosshairs until I we hear what Powell has to say.

Enough out of me today. Talk more shortly.

Your Pulse on Crypto,

Ben Lilly