The Grayscale (GBTC) Effect

Part Three: 3AC, Grayscale, Genesis, and DCG

As we wrap up 2022, the Espresso team is taking this week off to spend some time with loved ones. We hope you’re doing the same.

We’ll be back to delivering fresh insights to you next week.

In the meantime, this week we wanted to share a couple of our favorite pieces of the year.

Today, we’re reupping this piece in which I dive deep into the “Grayscale Effect.”

We hope you enjoy it. And we’ll see you in the New Year.

We dusted off a two year old story.

One from 2020 we call The Grayscale Effect.

As we look back through the pages we find the beginnings of the 2020-2021 bull run. It was an account of a meteoric rise. But hidden in those early days are clues that led to the carnage of 2022.

Carnage that has yet to subside.

If anything, crypto onlookers across Twitter and the media are currently reciting ashes to ashes, dust to dust as the Digital Currency Group empire sorts itself out… An empire that houses the now infamous Grayscale Bitcoin Trust… The central scene to that two year old story.

And what those early day clues are showing us is that we are coming full circle. The various catalysts that were are now unwinding. Leaving us with a story of a double edge sword cutting two ways.

So today, let’s dive into some of the recent rubble to make more sense of what is happening today.

Soapboxing

Now, before we begin, I would like to touch on one thing.

I mentioned we are coming full circle. Before anybody suggests all the progress from two and a half years ago has now vanished, I’d like to quickly dispel such cancerous thoughts.

We are not where we were two-and-a-half years ago. And this year is not setting the industry back three to four years.

To think in such a manner alludes to the origin of one’s beliefs. A belief system likely stemming from the behavior of speculation. A behavior I would argue is mostly unproductive for the community at large. A behavior we will shortly see results in much of the horror stories the rest of us hear day-to-day.

So while the room’s mood is somber and reflective, let’s not lose sight of the breakthroughs in technology that are happening each and every week at a ferocious pace… This innovation is the truth. And it’s the intrinsic force of an industry that will not be pushed back on the order of years.

If anything, the energy rising within githubs, forums, and eager teams is like a volcano preparing to erupt. And anything getting in its path will be unable to slow its progression. And once this energy is released into the world, the most fertile ground will exist to enable what will become a brighter future.

This industry’s innovation and developments are the most liberating force at work across any sector. It is one baked in freedom, truth, and self-sovereignty. These are truths that don’t simply lose ground… And they are truths that the headliner failures of today did not embody nor hold paramount.

So if the “end and object of conquest is to avoid doing the same things as the conquered”… Let’s take a look back at what was in the hopes to help us move forward and not allow the mistakes from the past haunt us tomorrow. Ground is not lost. Only the perception of distance is realized.

Act One - It Works

OK. The story…

It began in the thick of DeFi summer in 2020. Every crypto user that was deep down the rabbit hole of transacting onchain began to learn about yield farming, vaults, liquidity aggregation, synthetic tokens, yield bearing tokens and more.

Amidst a cacophony of food tokens and 1,000%+ shortlived yield offerings, our internal trading and alert AI system was honed in on the abnormal demand taking place on Bitcoin’s spot market.

It was a major alert for us as spot demand drives prices to new ranges. Derivatives move us to range highs and lows. For anybody that recalls 2020, the fear of March 2020 lows was branded in the minds of traders making this activity a welcome.

What we find somewhat ironic as we look back is that the emergence of a new species swimming into the waters of blockchain in the form of yield tokens allowed the biggest whales in the ecosystem to travel about unnoticed…

These whales were what sparked an 18-month bull run.

And today, as price retraces closer to where the market sat 18 months ago, we realize all the leverage that started it all, is exiting the stage. This is the double edge sword we mentioned earlier.

The players who started the cycle are the same ones gracing the headlines.

So who and what am I referring to here?

Let’s pull up a tweet that caught our interest during the summer of 2020. It stuck out to us more than any other at the time only because this type of bullish mentality is likely linked to what the AI was picking up.

It’s a now deleted tweet from the front man of Three Arrows Capital (3AC).

Look at those long call options.

This was a snippet of 3AC’s book - one that was likely hedged to some capacity - that reflected positioning to the upside. Based upon the image it seemed Zhu’s screenshot reflected contracts costing him about 2340 ETH. Totaling up to an amount just shy of $1 million at the time.

To a multi-billion hedge fund, this is likely a very small position. But 3AC at the time was not a billion dollar hedge fund.

To run a quote from this story by New York Magazine that cites 3AC’s annual report, “Three Arrows’ main fund posted a return of more than 5,900 percent, according to its annual report. By the end of that year, it was overseeing more than $2.6 billion in assets and $1.9 billion in liabilities.”

Meaning 3AC was about $700 million in the black… Which also means at more than 5,900% gains, the duo was managing around $11.5 million at some point in 2020.

This makes that screenshot more reflective of an outsized bet built on a conviction.

With hindsight being 20/20, and knowledge surfacing that 3AC was not interested in hedging, this ETH position is an indicator of what 3AC was up to. And we don’t even know what the BTC call options looked like - which was a more liquid option market. (Perhaps somebody else kept a screenshot of this?)

I’d argue his BTC option market was much larger as anybody who traded Deribit at the time can likely attest to the massive spreads that existed. For anyone building a position north of seven figures it takes considerable time to get filled, especially on illiquid ETH options contracts.

It’s why we also see such an array of contracts and expiries in the snippet above.

OK, so diving into this position a bit more, we also know a few more things that took place before the time of that tweet.

First up, 3AC purchased over 21 million shares in the Grayscale Bitcoin Trust (GBTC). We know this thanks to a June 2, 2020 SEC filing (Gensler, take note how disclosures such as this are helpful).

For those that need a quick background on how GBTC operates, here is a snippet from the 2020 essay we wrote. I’ll box it out so that if you know how the Trust works, you can easily skip it. Also note, I kept the language the same without updating any of the figures so we can better understand what made the offering so compelling at the time.

Grayscale is an entity of the Digital Currency Group that has cornered the market, accumulating a total of 536k BTC to date.

Their unique structure is what makes it possible. It’s essentially structured to hoard Bitcoin. BTC and USD (which is then used to purchase BTC) flow in and nothing comes out.

The way Grayscale achieves this one-way flow is in the way they distribute shares. Accredited investors or 'wealthy individuals' can sign up for Private Placements to receive shares.

These accredited investors can then give BTC or USD to Grayscale. In exchange, Grayscale gives them an equal value of shares. If each share equals 0.001 BTC (In reality it’s 0.00095085) then for every BTC handed over to Grayscale, the accredited investor receives 1000 GBTC shares (minus a small fee).

The catch is the private investor must wait six months before selling the shares on the market. That's where the non-accredited retail investor comes in. Aka the not so wealthy buyer.

It might seem fair, the exchange of shares for BTC, but in reality, it's anything but fair. That’s because GBTC almost always trades at a premium. non-accredited or retail investors looking for a pure-play into BTC within the stock market are paying anything but fair value.

Here's what I mean... Recently GBTC closed at $28.25. Bitcoin according to the BraveNewCoin Liquid Index closed at $22,830. According to the Grayscale website each GBTC share equals 0.00095085 BTC. Meaning fair value for GBTC is $21.71. The current price represents a 30% premium just because the buyer isn’t wealthy. And that’s a 30% premium going straight to the accredited investor who handed over their BTC.

This strategy is how Grayscale created a Trust where Bitcoins essentially flow one way, into the trust. What accredited investor who owns Bitcoin is not interested in growing their balance in terms of Bitcoin? It doesn't matter if the price is $5,000 or $20,000. The value in terms of BTC grows as long as there is a premium.

It's an almost risk free 30% return in six months. In a year, 69% if each 6 month period is a 30% return.

The 30% return is pretty impressive, and natural economic pressures should bring this premium down to 0%. Yet, for some reason we just haven't seen that happen yet.

This means 3AC likely purchased Bitcoin ahead of the June 2 filing. We can base the period shown below off of the approximately 30 days it took Zhu to make a tweet on December 5, 2020 and file his next disclosure on December 31, 2020. The period below is just over 30 days.

But remember, Zhu held some July call options on ETH. They had a 240 strike price and cost him 0.0246 ETH per contract.

If buying these contracts 1.5 months or more ahead of time, this means for that contract to be in the money, price would need to rise 20 to more than 40% (estimates).

Perhaps we can look at the tape as we might we have options data reaching that far back (FM, Yash?)… Or perhaps somebody reading this can unpack when these purchases likely happened…

For now, we can make an assumption that these positions were entered in this time frame.

Takeaway here is 3AC most likely entered call options before purchasing their BTC on spot prior to sending the coins over to Grayscale, and filling out the SEC paperwork. This seems logical as you can capture profits on your spot purchases as 21 million shares (~1,000 GBTC shares = 1 BTC) was about 21,000 Bitcoin.

That many Bitcoin at the time was between $150 and $200 million, which means based on 3AC’s assets and liabilities, it was a borrowed amount (from lender Genesis).

Now, if we take this just one step further, we can line up the timing even more…

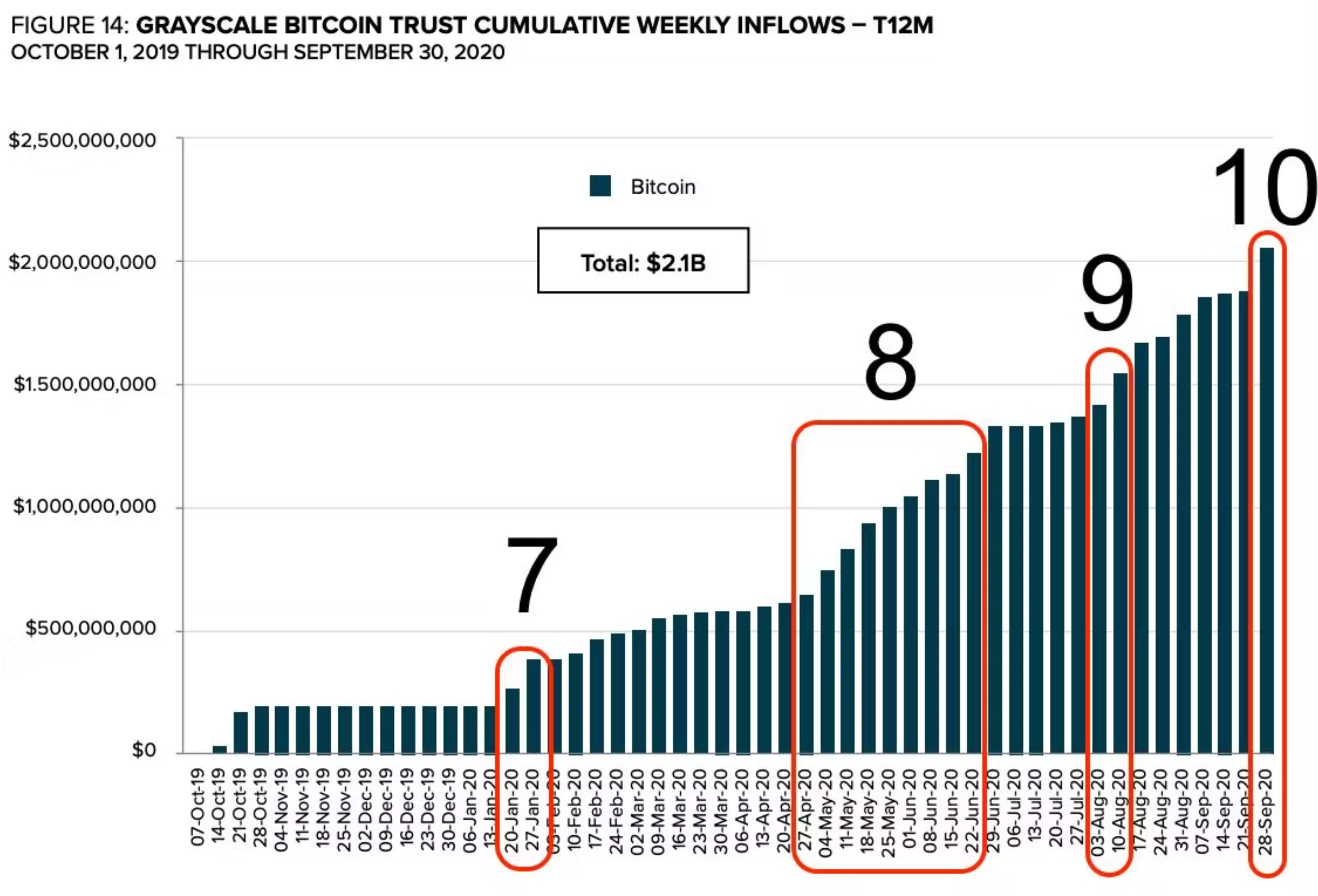

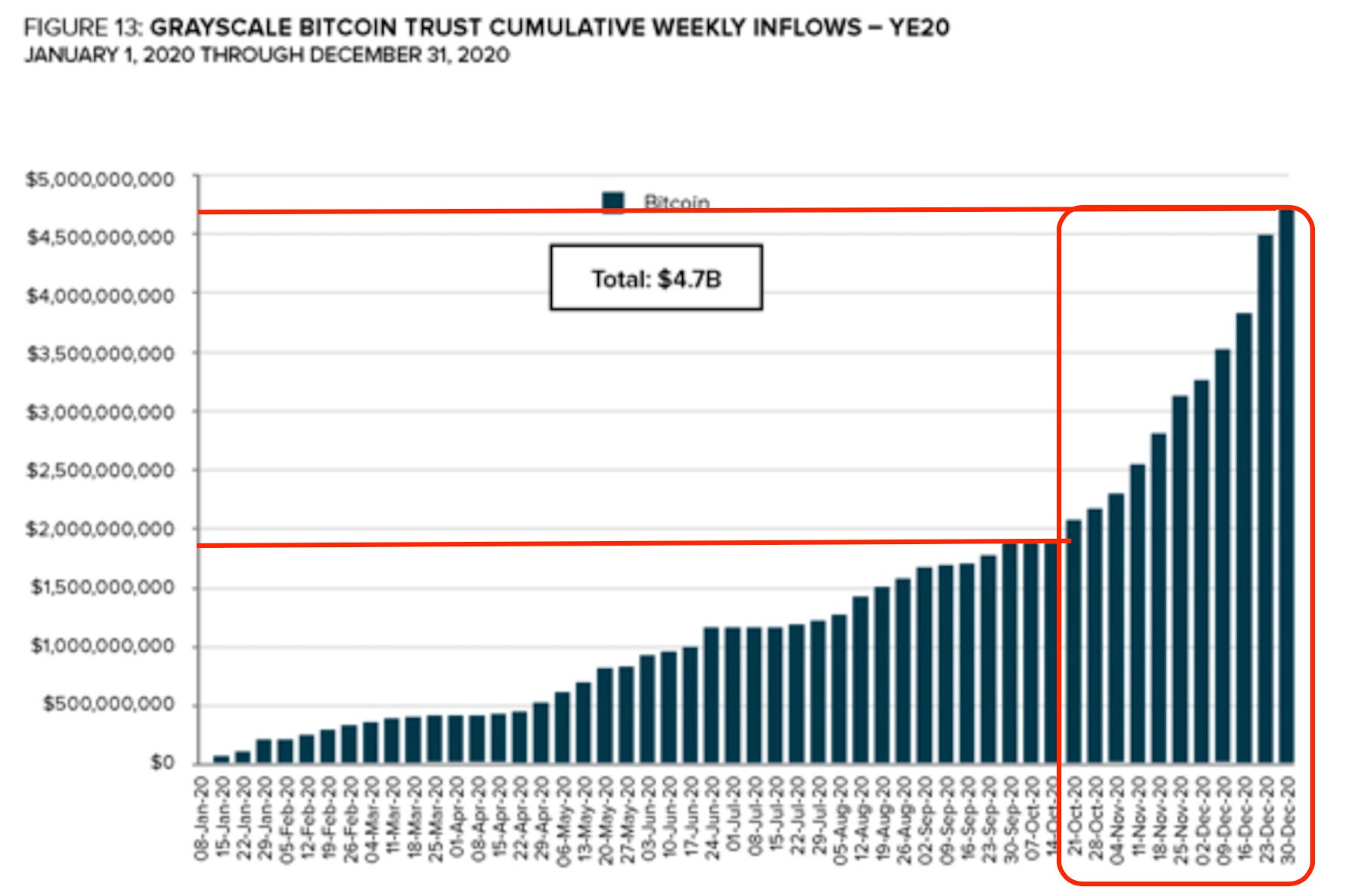

Here are snippets from Grayscale’s cumulative weekly inflow charts. Remember, we are talking $150 million or more of Bitcoin. 3AC filed on June 2, which falls in what I call “Tranche 8” in the original write up of the Grayscale Effect.

This tells us the inflows likely began the week of May 11th at the earliest. This puts us at the start of those two accumulation boxes in the candlestick charts from earlier. And simply adds more support for the big move in late-April and early-May as stemming from the 3AC <> Grayscale dynamic.

This portion essentially sums up Zhu’s first act.

But what is interesting is during the first act, we can see Zhu’s character showing fear in the directional bet. He wanted to lock in the GBTC premium and worried it would disappear.

Here he is making a plea to SBF at FTX to create an instrument around Grayscale’s GBTC Trust. We can only assume it was so 3AC could exit a position in the Trust without waiting six months before their position became unlocked.

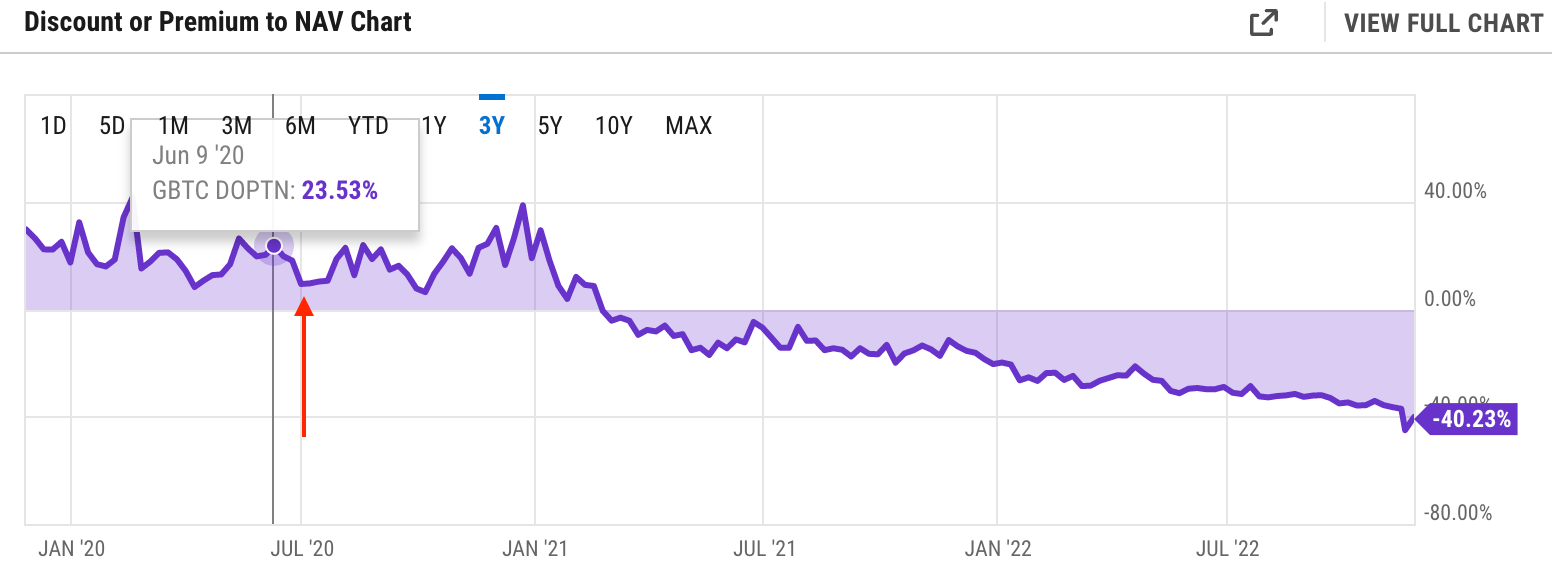

The tweet shows the appearance of uneasiness due to its timing. 3AC filed with the SEC on June 2nd, and their potential profit on the premium dropped from about 23% to single digits during the month of June.

While the premium remained… It foreshadowed the ending.

Act Two - Levering Up

My initial theory was that 3AC held their GBTC for six months at a minimum, then sold.

This would mean in December, 21 million GBTC would hit the market.

But thanks to some great digging from Data Finnovation in this piece, it appears my initial take was wrong. When we look at the GBTC chart and volume, this looks to line up as well… The volume for 21 million shares does not seem to be there. And to dump 21 million shares after Grayscale’s parent company’s lending subsidiary, Genesis, loans the Bitcoin… I highly doubt they would be ok in creating such volatility.

Instead…

Why it seems 3AC did the opposite by leveraging up. After all, Bitcoin has gone up, the premium is rising… So here, take more cash. We already heard stories of how lenders would not even run due diligence on 3AC.

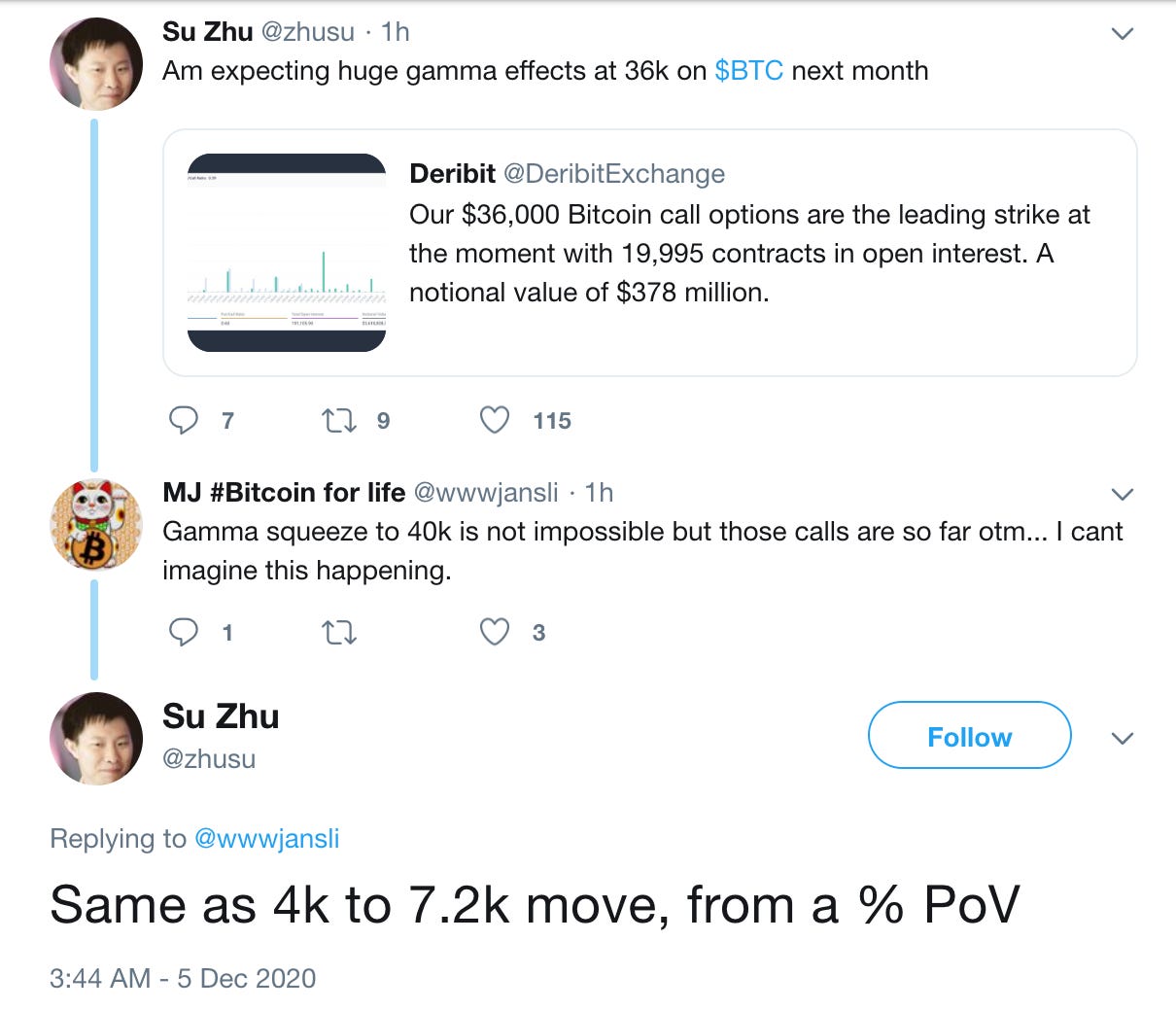

So if 3AC were to leverage up, the conversation likely took place in late November or early December. Reason being is we can see Zhu’s growing confidence in what is about to transpire.

Here is a deleted tweet below showing his belief in a Gamma squeeze preparing to happen at the end of the month. Remember, Zhu was holding call options.

And the fact Zhu had call options with this much foresight might indicate the late November or early December phone call that gave the go ahead for 3AC to leverage up even more may have actually taken place during the summer of 2020.

So backing up for a moment…

Zhu is confident on December 5, 2020, stating he expects a Gamma squeeze to push BTC past $36k. Price was $18.6k at the time, meaning this would require a 100% return in a span of about four weeks. Meanwhile BTC had yet to experience a new all-time highs, making this once again a tall order.

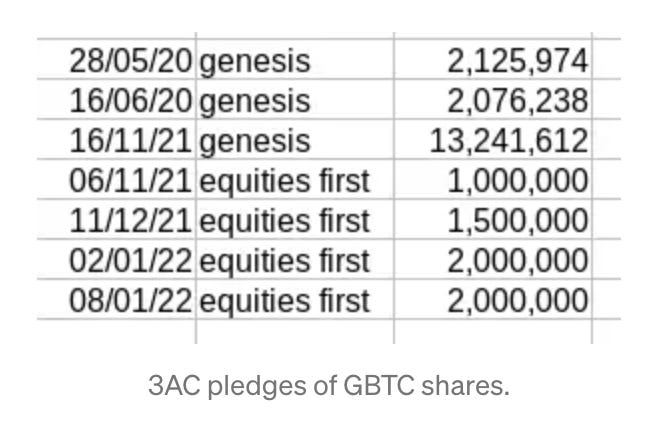

The confidence coincides with a December 31, 2020 filing with the SEC stating 3AC held 38,888,888 shares of GBTC at the time.

Which means from June 2 to December 31, 2020 3AC added 17.8 million shares.

The six month moving average at the time of the filing was just under $14k. This would be just under $250 million. The average across the prior 60 days was $19.5k, meaning the recent slug would be around $350 million.

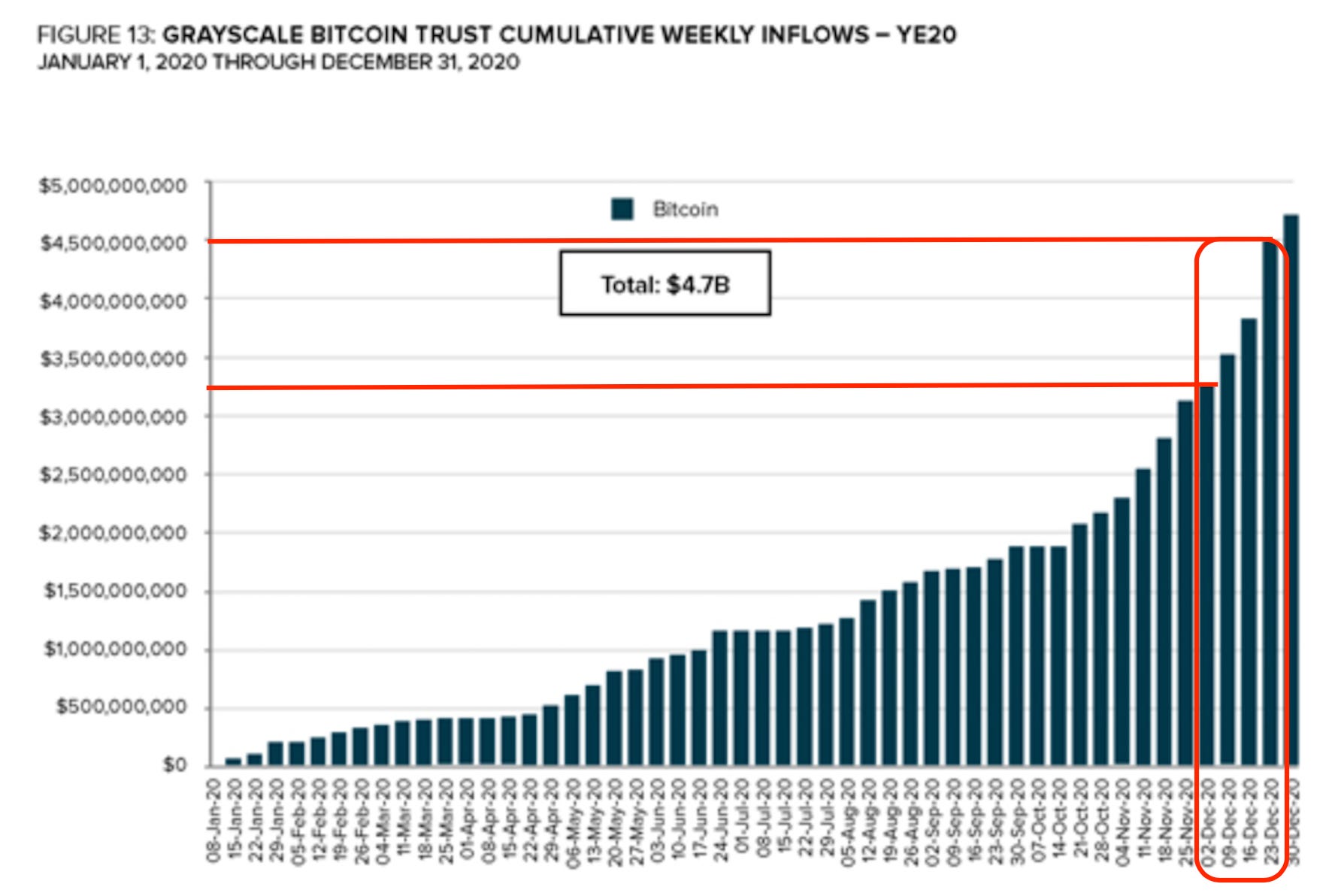

Here are the inflows into the Trust, there is plenty of room for 3AC and others. And the biggest uptick in inflows happened just as the market was on fire. If I had to guess (would be nice to see an exchange come forward and confirm the timing here) the largest uptick was when 3AC made its move to attempt the Gamma squeeze it alluded to on December 5.

And in all honestly, I would not be surprised if this story of a Bitcoin options trader turning $638k to $4 million in five weeks is 3AC. The timing would once again be too much of a coincidence to ignore.

So it’s the end of 2020. To bring back a line from earlier… 3AC had $2.6 billion in assets and $1.9 billion in liabilities. With 38.8 million GBTC shares at around $32 per share we get about $1.25 billion dollars, nearly half their book.

And with $700 million or so in profit, originating on approximately $11.5 million earlier in the year, we can assume 3AC made it’s entire living off the Grayscale Effect. It was rising the entire market. And making a 60x+ return off non-hedging plays was fulled baked into this trade that accounted for half of 3AC’s book.

What’s more…

We know this thanks to work by Data Finnovation’s piece (linked here) who dug into some filings that 3AC was borrowing from Genesis. Here are GBTC shares used as collateral.

With 3AC on the books for $1.9 billion in liabilities, we can assume they were also borrowing BTC to conduct the Grayscale trade we’ve been touching on so far.

Again… borrowing money from one DCG subsidiary to help the other subsidiary make income on hefty management fees.

It’s like allowing a lender to set up shop for homebuyers of an up and coming neighborhood. None of these homebuyers actually want to live there. And so a bank gives them money to buy the home… And the new homeowners wait six months for the home to be built.

Meanwhile, the home builders are making several percent on all the homes.

The key here is that no other homebuilders exist in the area… Or said another way, no other forms of buying Bitcoin exist in this trendy area.

So to recap, the lender is making about 10% on the loan. The homebuilder is making 2-3% on each home. And no homebuyer plans to actually live in the home.

Which means for the plan to work, new buyers must enter the market that cannot purchase from the original homebuilder.

How does one do such a thing?

Act Three - The Narrative

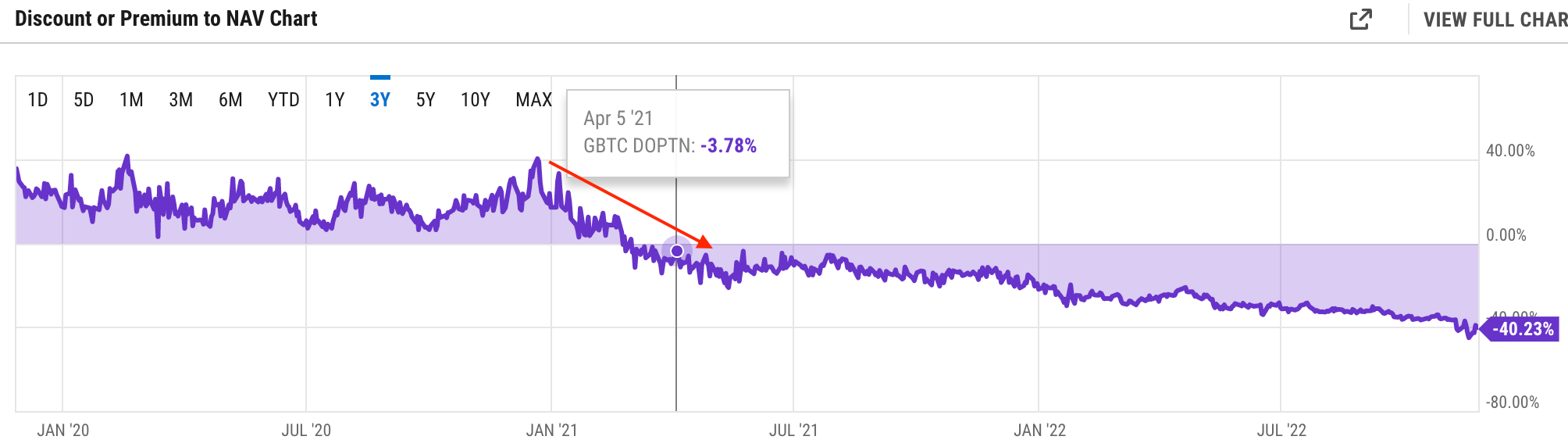

Q1 2021 we began to see the narrative shift. In a need to keep Grayscale’s premium from turning negative and ruining the momentum this trio had created… more buyers were needed.

This translates as a need to reach the masses. The secret here is the individuals could not buy a home from the homebuilder (aka buying shares from Grayscale directly). They needed to buy GBTC from the market.

This was mass retail (non-accredited buyers).

And they couldn’t appeal to users who would be willing to traverse a learning curve by using an exchange like Coinbase, Kraken, or Gemini.

This is the beauty of the “Drop Gold” campaign. It originally launched in May of 2019 and is the exact demographic Grayscale needed to lure in. What’s more, if you do some searching on the internet, you’ll see that at the end of 2020 and start of 2021 is when users outside of crypto picked up on the commercial.

Then to stack a narrative on top of a narrative, Zhu in Q1 began his supercycle narrative, which alluded to people needing to pay a high price for crypto as it will only go up.

The hype train was running full steam ahead.

Yet, it wasn’t enough. Grayscale did more than $2.5 billion worth of inflows in the last 10 weeks of 2020.

This was preparing to come to market as soon as mid-April. Those 10 weeks witnessed more capital than the entire seven years prior. Read that last line again… Those 10 weeks saw more capital enter the Trust than the seven years prior.

This time period was happening just as the Trust’s Net Asset Value (NAV) was turning negative. The inflows from August were causing shares to drop lower than what could be redeemed from the Trust - if the Trust allowed redemptions.

This was not just trouble… It was the literal start of what would be the slaughtering. How could Grayscale salvage the negative NAV just as $2.5+ billion GBTC was getting ready to enter the market?

Act Four - Time for Slaughter

On April 5th, Grayscale went ahead and declared its intention to convert the Trust to an ETF. If successful, the NAV would return to par.

To return the Trust to par would require Grayscale to sell BTC into the market until NAV returned. Meaning if somebody purchased GBTC at a discount to NAV, they would stand to gain.

It was a last ditch effort to fortify the damn before the first batch of more than $2.5 billion of Q4 2020 inflows began to hit public markets.

It was the beginning of the end for the Trust. The NAV almost returned when Bitcoin rallied in Q3 of 2021… But since NAV never flipped positive again, it was clear that the Trust was becoming toxic.

Grayscale, DCG, Genesis, and 3AC all were hogs at the trough. And if life taught me one lesson, pigs get fat, hogs get slaughtered… Never be the hog.

And that’s exactly what happened when the market began to turn in 2022. What started the bull run of 2020, began to unwind in what we’ve constantly called The Contagion.

I officially hate writing, hearing, and saying that word.

Regardless, this is why we are now watching Grayscale, Genesis, and DCG squirm in distress. Barry Silbert is at the helm. And he has done a lot of good in the space.

But he and his massive entity got greedy. If we look hard enough, we might see Grayscale/DCG roots attached to nearly every blow up in crypto if we look hard enough. The industry is truly that small.

What may have started off for good, looks to have become toxic. Do not fear its demise. I would not be surprised if we are to find out that 3AC <> Grayscale <> DCG <> Genesis (and even BlockFi) were more involved than what I allude to here.

However this current Act ends, it’ll mark the end to the current cycle. And perhaps move us one step closer to the next.

Your Pulse on Crypto,

Ben Lilly