The Government Catalyst

Notes from The Lab: A lesson from the Vietnam era

This story begins before my favorite Grandpa was even born.

“Our family and others were all blamed for causing hardship to our country… For owning gold.”

The way in which he explains this memory is always so impactful. If I hadn’t heard the story several times already I could easily be mistaken that he felt ashamed for wronging some lifetime friend.

I can’t begin to imagine how his Papa felt. The working aged man trying to do what was best for his family when Franklin D. Roosevelt was President of the United States.

In his words…

“My Papa, your Great Grandfather, was wronged by the government due to its finances” Grandpa said “and instead of shouldering the blame, the finger was pointed at people like your Great Grandfather.”

He went on, “As the blame game and confusion of the moment unfolded, those running the country found a loophole. There was a statute left over from World War I that allowed FDR to create laws without needing the vote of the people.”

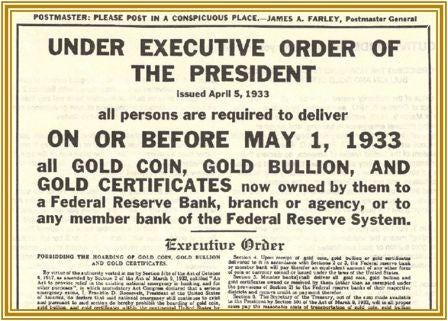

It was an Executive Order, and it looked to fix the harm being done by private ownership of gold. It did this by making gold illegal to own for all private citizens.

After flipping through historic newspapers on www.newspaper.com - a site that reminds me of the microfiche catalog my local library owns - I saw America was immediately required to exchange their gold at the bargain rate of $20.67 USD per ounce.

Those who did not comply with giving The Federal Reserve their wealth in gold in exchange for paper bank notes were punished with harsh fines and up to 10 years in federal prison.

I’m pretty sure this is what my Grandpa is referring to when he throws around the word “tyranny.”

I find it hard to imagine this type of thing taking place, but it did indeed happen in America.

But where his story always gets exciting is when he explains what happened next.

Grandpa’s Gold Rush

He always starts off the same.

“You know what the craziest part of it all was… about four decades later this law was repealed.”

“The economy was not anything to brag about, but I remember that time fondly as I just got back from Saigon.” he said.

“My next move was to start trading commodities. That was a fun time. A new job, an Indian Motorcycle with a sidecar for your Grandmother to ride in, Creedence Clearwater Revival was on vinyl, and my all-time favorite film, The Gambler starring Jimmy Caan, had just been released. Life was alright.”

I understand his nostalgia. I still use my thirty year old walkman while sweeping floors at Jarvis Labs.

Speaking of my time at The Lab, I hung around the building a bit later than normal last week to look into my Grandpa’s story.

Turns out in the early 70s the U.S. struggled with their war debts from Vietnam. Which was part of the reason President Nixon removed the dollar from the gold standard. Which means not only could people own gold again, but the U.S. dollar dropped its backing.

At the time, the FED had huge amounts of gold reserves. And thanks to removing the peg, the U.S. government was no longer required to hold on to those bars. The funny part was due to the original order by FDR decades earlier, they lacked buyers.

I told Grandpa recently that this next part is what the younger kids call the exit pump or rug.

That’s because on the final day of 1974, President Gerald Ford repealed the 30+ year ban on private gold ownership.

It was gold’s 0 to 1 moment.

I can hear him saying it again… “Inflation was sky high, rates were sky high. The tension and hyper focus on politics was thicker than New Jersey diner pancakes.”

Civil unrest and macro uncertainty was real, and Nixon’s impeachment was almost too much.

Then the combination of laws on gold made things simply chaotic.

“It was a madhouse back then, JJ. That golden bull run was almost as wild as the summer I spent touring with The Doobie Brothers.”

He must have been a lot of fun in his younger years.

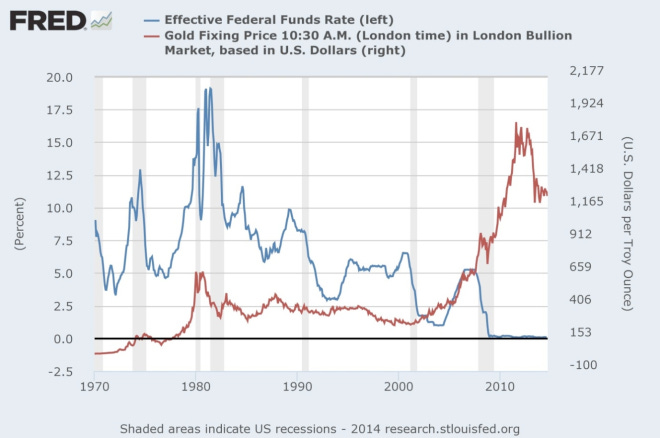

But back to the gold story, to showcase this run I pulled up the chart below. In it we see how this chaos sent gold from under $100 per ounce in 1974 to over $700 an ounce by 1980… All while rates were rising along with it.

It’s as if the combination caused a momentary shock to the price of U.S. dollars to gold. The part I tend to believe even more is that the government was successful in luring in new buyers - the general public. The everyday worker was finally getting their turn to load up on gold coins again… In fact, at the end of 1974 gold futures started up again to aid this process.

The Flat Circle of Time

“What you kids have going on with these computer coins don’t look so different to me compared to what happened to gold back in the 1970’s.” Grandpa said.

“We’ve got high debt levels, high inflation, high rates, and tons of macro uncertainty. What you and your internet friends need now is a 0 to 1 moment for those digital beans of yours’.”

I can see what Grandpa is getting at. And the reason I bring up this story is because of the topic Mr. Lilly and I were discussing over coffee last week. He had listened to a Congress hearing earlier and mentioned out it seemed regulators are getting close to bringing in more buyers to crypto.

Here is the CFTC news in Mr. Lilly’s words in a Twitter thread. He’s referring to bill #4760:

1/ While Gensler throws a temper tantrum and the White House is publishing 'kicking the can down the road' commentary, there is a bill (below) flying below the radar that might be a regarded as...

— Ben Lilly (@MrBenLilly) 1:47 AM ∙ Sep 22, 2022

Crypto's 0 to 1 moment.

Why?

congress.gov/bill/117th-con…

The truth is, while crypto isn’t illegal in the US (not yet at least), it is certainly restrictive to institutional funds who wish to gain exposure.

A passage of this bill would remove these restrictions by granting the CFTC official jurisdiction over crypto markets.

This is important because they’re currently in a legal grey area which keeps large flows of money out and unable to enter due to regulatory mandates.

In other words having the government stamp of approval on these prices may not seem like a big deal to most, but to institutional money it’s everything.

For example, Ken Griffin’s Citadel (over $50 billion in assets under management) has already stated publicly that they will be enter crypto if it receives CFTC guidance and regulation. And in Lilly’s thread he talks about a Citadel representative that was present in the hearing saying the bill would help move them off the sideline.

Which means it is unlikely they’re the only legacy behemoths sidelined, and the effects this sort of large monetary flow could have is hard to overstate.

In order for crypto to ever de-correlate from the broader financial system, it will first have to find a way to absorb the trillions of dollars currently trapped behind tradfi walls.

If such a feat happens, don’t be surprised to see a 1970s combination of events… One that has high inflation, high rates, gold and even crypto all rising in tandem.

What the break room all agreed on is while this is counterintuitive, it is something to note as a possibility.

As Grandpa likes to say,

“Time is a flat circle. Everything we have done or will do we will do over and over and over again—forever.”

What do you guys think? Be sure to leave a comment here or on Twitter @JLabsJanitor.

Thanks,

JJ

P.S. - On a personal note, I am starting to time up my coffee breaks with the rest of the team. The conversations are incredible. Part of me thinks these guys have data feeds entering their brains. One of the analysts began to draw out a price chart with indicators on the back of some trashed box. I went home to check if it was true, and he drew it perfectly. It was like a superpower, I was so impressed. OK, enough out of me. Time to rest. Hope to talk again soon.