Washington D.C. is Engineering The Largest IPO in History

Here's the gameplan Bessent and Trump are running to create the biggest melt-up of our time. Will you run towards it?

Placing stablecoins under the purview of the U.S. regulatory system and Treasury was just the beginning.

If U.S. debt were to ever hold a public IPO moment, this is it.

But the U.S. is not stopping there. It looks to export even more to the globe. I like to think of it as a global IPO event for all U.S. based financial assets.

Let me lay it out for you.

In the next several years, U.S. Treasury Secretary Scott Bessent expects the stablecoin market to be $3.7 trillion in size.

If that sum represented short-term treasuries, it would be represent 64% of all U.S. short-term treasuries outstanding ($5.78 tr). That's in comparison to what we see now, which is just a bit more than 3% of supply.

Bessent's figure would completely distort the treasury yield market. It represent an insatiable appetite of debt stemming from stablecoins.

This positions the U.S. in a unique situation. Does it dole out a lot more short-term debt... Or, does it need to change the rules of the game.

Considering the administration has already expressed a desire to finance debt at longer terms, what rules would need to change?

Well, to get to that, let's build up a little backstory...

The Bank Run That Wasn't

In 2008, bank runs were getting a little out of control. Institutions like Washington Mutual saw about 10% of its deposits leave its bank in 16 days. Others saw similar levels of demand in similar time horizons.

These assets were being demanded by depositors in a span of weeks. The panic distorted various markets and caused banks to become insolvent.

The Fed ran to the rescue and bailed them out. The level of demand by depositors was just too much.

In contrast to this, crypto had its own bank run in 2022.

Tether saw 10% of its total of supply of stablecoins redeemed in the span of not weeks... but 48 hours.

It met all those redemptions without a bailout, throttling redemptions, or even pausing redemptions. They just processed them as they came, despite Sam Bankman-Fried attempting to trigger a widespread bank run on Tether.

They didn't need a bailout or some liquidity injection.

Which is almost odd to think... Tether's redemption process operated as intended.

But what's important here is this number: 10%. Even in widespread panic, depositors or stablecoin holders were not redeeming 100% of all the backing (unless Do Kwon is at the helm deploying everything of value to retain an algorithmic stablecoin).

This 10% figure means the snippet below is almost overkill. Stablecoins don't need to be backed 100% by short-term treasuries.

The reason for this backing is short-term treasuries are easier to redeem in the market. But in a scenario where the Fed needs to step in, these treasuries will be redeemed at par value.

Meaning the need for instant liquidity for the full 100% of reserves seems overkill.

And with the understanding that short-term treasuries will not be able to absorb a stablecoin market that looks ready to swell by 10-15x means some edits to this White House document will need to be made.

Specifically to "short-term".

That brings me to what I expect to happen in 2026. The requirement that stablecoins be back by cash and short-term treasuries will not remain. There will be a loosening of duration for this backing, meaning banks will be able to hold longer dated treasuries.

This makes sense. If demand is too high relative to supply, then make more supply available. And the easiest way to increase supply is just a quick click, drag, delete to the word "short-term".

The edited version will go like this: The GENIUS Act requires 100% reserve backing with liquid assets like U.S. dollar or Treasuries.

The benefit here cannot be understated, specifically for Treasury Secretary Scott Bessent.

This type of adjustment means he can point that demand wherever he wants to.

10-year treasury is too high, no problem. Let's aim that bazooka of demand there for the next quarter.

In all reality, this is a dream for Bessent.

It's Y– C – C , yield curve control. Which means the man of Brrr himself, Jerome Powell, will play second fiddle to Bessent - Perhaps that's why things are getting so hostile between the two lately?

Again, Bessent thinks rates are too high... No problem. Aim the gun of liquidity at the short end of the curve, drive the rate down.

He needs to dole out some long duration debt for a big bill coming down the pipeline, no worries President Trump, let me adjust the flow of liquidity for you.

Make no mistake. This is the reason why stablecoins have become such a massive priority for the administration.

Unlike the Eurodollar where the U.S. is unable to exert the amount of influence and control it wants, this new setup for Eurodollars 2.0 residing on blockchains instead of European banks, gives the control that's been desired for policy makers for decades.

The result of the shift in treasury operation and management means the world is about to get inundated by U.S. debt, delivered in the form of a stablecoins.

By the end of Act One, the globe will be armed and ready for what comes next.

Act Two

If you've heard ChainLink's Sergey Nazarov present literally anything in the last three months, you'll note he has a well rehearsed sales pitch for his product.

It has to do with a system that not only provides providence, custody, and disclosers for real world assets on chain...

But his speech includes a great breakdown on what is the most valuable commodity the U.S. has to offer to the world - its financial markets.

He does an incredible job driving into some key points around legal precedents, property laws, disclosure documents, and clear shareholder rights. I'm not a Link Marine, but you must respect game when you see it.

Because what he does next is smooth as silk.

After he hits on all these structural strengths of the U.S. market, he stresses it as the reason the U.S. is a capital hub.

In other words, he's saying the U.S. has some of the most pristine collateral in the globe. If legal disagreements need to unfold, the judicial system operates as expected. It protects the investor.

This is what attracts such large swathes of capital - quality assets.

With the audience now armed with this understanding, Sergey delivers the bottom line...

The U.S. has an opportunity to make its financial markets more accessible to the globe. He's pitching a global IPO event.

This is the tokenization trend that Wall Street is already salivating over. Look no further than BlackRock, JP Morgan, and even Robinhood.

It's no wonder Robinhood CEO Tenev cleaned up his look for the GENIUS Act being signed into law.

These titans of finance understand their user base is becoming the global.

What's more... That potential user is now armed and ready with a stablecoin in their wallet.

There's no need to exchange currencies, pay premiums on a foreign brokerage site, or purchase a proxy or derivative instrument of the asset. It's a direct exchange for a tokenized share that's viewed as a pristine asset.

If this seems like a nothing burger to you, go ahead and start asking around some financial forums of smaller countries. You'll quickly see there's a sizable margin to squeeze.

Which gets me to the point of all this...

The U.S. is preparing to shove stablecoins into the phone of every person across the globe.

Once armed, they'll export their financial system in the form of tokenized assets.

It's as if the administration and Wall Street are working towards a global IPO event of the financial system.

The liquidity machine is gearing up. And if Wall Street moves fast enough, we're getting ready to make the Dot-com bubble look like a speck on the chart.

But there's one last catalyst...

The Melt-up

Bessent will bring rates down.

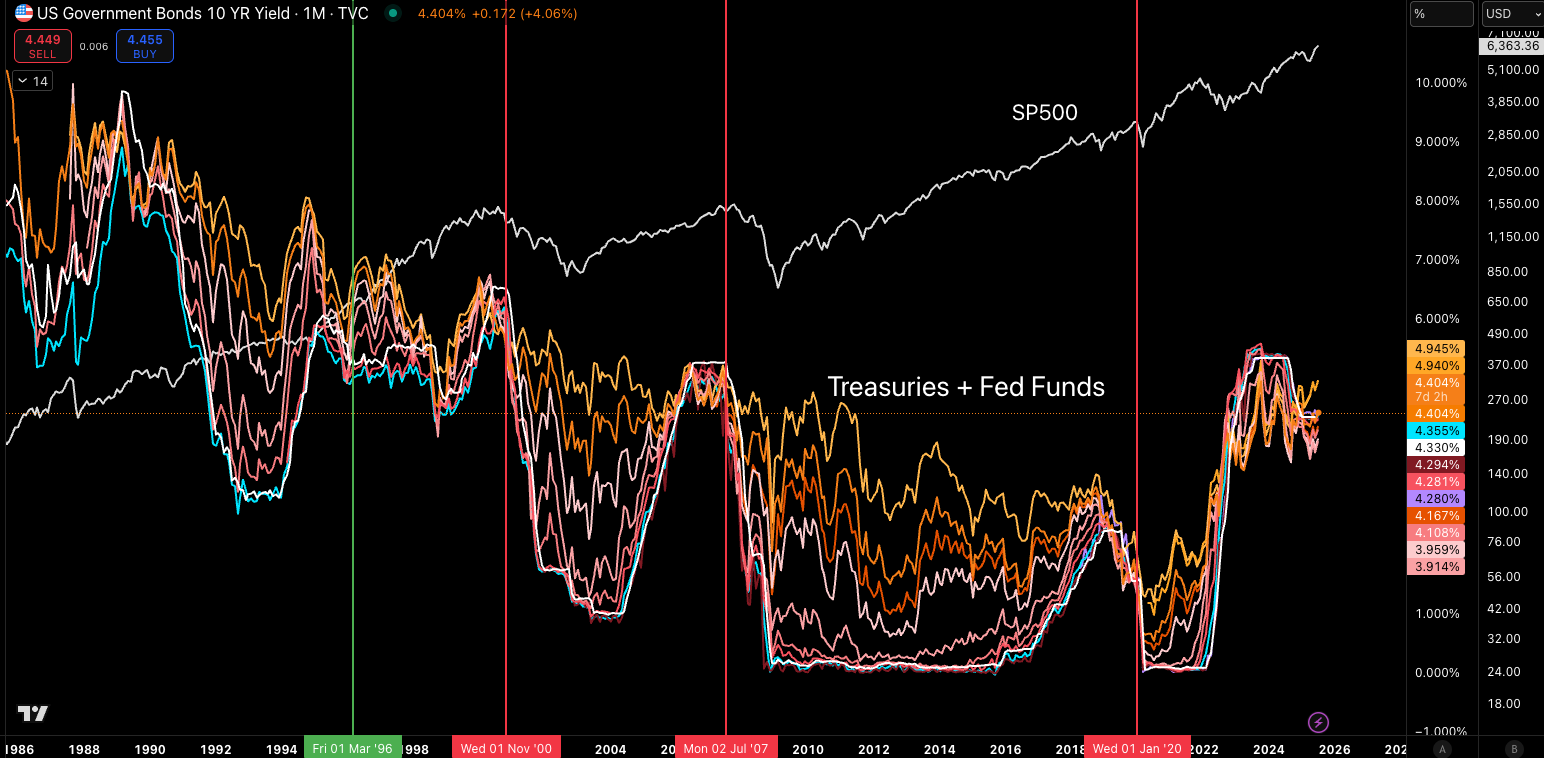

Historically, when rates begin to fall, financial markets tend to collapse. This is mostly due to financial markets forming cracks that are beyond immediate repair.

Rates in turn drop to near zero with the hopes that our debt fueled system won't liquidate itself.

But take another look at the chart above, especially at that green vertical line.

Rates (white line) didn't fall like a rock. They dropped a touch lower and formed a new plateau for several years. Meanwhile, the S&P 500 went on a tear.

It's worth noting this because President Trump isn't looking for lower rates because the financial system is showing cracks. Nor is he looking to drop them to the floor.

He wants 100bps. And if he gets it, we have a setup similar to the late-1990's.

New technology coming online, more investable companies, and a wave of dry powder ready to be unleashed.

It's a similar setup.

Now combine that with more debt getting printed and lower rates... driving the dollar's value lower - which in turn drives financial asset prices higher.

It's quite the setup.

With that in mind, what happens when the U.S. coordinates and unleashes a global IPO/tokenization event of its financial markets into an ocean of digital dry powder...

I'd argue we're about to see the biggest melt-up of our time.

The bubble is forming, are you brave enough to race towards it?

Your Pulse on Crypto,

Ben Lilly

P.S. - Deploy.finance users are earning an annualized yield of more than 25% over the last seven days. A figure that was over 30% the week before. They are doing it without having to make a trade, watch the charts, or manage a position.

That's because deploy.finance's agent does it for you in just a few clicks. Set it, and forget it. The agent manages a delta neutral strategy for you on HyperLiquid 24/7.

If you don't believe me, come and ask the more than 100 deployers yourself here. What are you waiting for, Deploy is literally head and shoulders above the competition, deploy today.

10 funding rate trade strategies you should know about 🧵 pic.twitter.com/6aZOWFX6JO

— Deploy.Finance (@DeployFinance) July 23, 2025