The First Victim of the New Stablecoin War

Token Insight: FTX Was a Casualty of Binance's Quest for Dominance

On October 23, Sam Bankman-Fried (SBF), then-CEO of crypto exchange FTX, declared the start of the “Second Great Stablecoin War.”

I guess SBF didn’t think he was going to be the first victim of this war just a few weeks later.

A quick recap for those that live under a rock or have a life outside of crypto (boy, how do I envy you).

On November 6, Binance CEO Changpeng Zhao (CZ) announced that his exchange would liquidate all FTT it held. FTT is FTX’s token, issued in early 2019 in an ICO to raise money to launch the exchange.

Binance made this decision after learning that locked, illiquid FTT made up about 40% of the balance sheet of Alameda Research, SBF’s trading firm.

FTX and Alameda were supposed to be different, independent operations. Guess it wasn’t so.

Soon after this news, rumors started flying about FTX’s insolvency. A bank run ensued.

By November 8, FTX could not service withdrawals.

By November 11, FTX and Alameda Research filed for bankruptcy under U.S. law.

While more information keeps coming out, I could not help but ask: What could have triggered CZ to turn the heat on SBF? Did he suddenly feel threatened? And if so, why?

It might just be that this was the first battle of the “Second Great Stablecoin War.”

The first war occurred in 2018-19, when USDT and USDC established their dominance over TUSD, GUSD and USDP. Now, a new conflict is flaring up, with CZ and Binance firing the first shots.

In our previous article, we looked at the decentralized protocols that were battling for the stablecoin crown. Today, we’ll take a look at their centralized counterparts, and how an announcement by SBF might have pushed CZ to finally pull the trigger on FTX.

Battle for the Sundae

Last month, SBF announced that FTX was developing its own stablecoin.

This is nothing out of the ordinary for a crypto exchange. A few already have their own stable: Binance has BUSD, Huobi has HUSD, Gemini has GUSD. You get the drill.

Stablecoin issuers can bring in revenue in a few ways. They can lend their collateral short-term, much like banks do with their reserves. They can also earn a yield on the U.S. Treasuries they hold as collateral.

Plus, they can make fees from users issuing or redeeming stables. Oh, and being able to mint stables against assets in their balance sheet, and then sell those stables to their exchange users for even more assets. Fantastic, isn’t it?

But that’s just the cherry on top.

The sundae is about using your stablecoin to become the portal to all things crypto. If you have the most widely used stablecoin, that enables you to become the most dominant exchange. Game. Over.

So, with FTX’s collapse killing any chance of launching its own stablecoin, what are the centralized stables that could compete with Binance and BUSD?

The Contenders

Let’s take a quick tour through the most important centralized stablecoin issuers:

- Tether (USDT) launched in 2014, becoming the first USD-pegged on-chain asset to achieve product-market fit. It’s closely tied to the Bitfinex exchange, and both are owned by the Hong Kong-based company iFinex. Tether was not always transparent with what exactly was backing its stablecoin. However, it now publishes a quarterly independent audit of its reserves. These include cash, treasury bills, commercial paper, bonds, loans, and investments in cryptocurrencies (the last two might raise some eyebrows). USDT remains the biggest and most liquid stable to date.

- USD Coin (USDC), the Dr. Jekyll to Tether’s Mr. Hyde. USDC is issued by Circle, a regulated U.S. entity which has positioned itself as the do-gooder in the stablecoin arena. It ensures USDC is backed only by cash and U.S. Treasury bills. It is the second-largest stablecoin by market cap. It's the on-chain stable of choice for many institutions and traders in DeFi, and it’s even used as collateral for decentralized stablecoins such as FRAX or DAI.

- Binance USD (BUSD), Binance’s stablecoin released in collaboration with Paxos. BUSD has long been one of the biggest stables by market cap. However, it seems like Binance decided a few months ago to do everything in its power to make it number one.

- Pax Dollar (USDP), issued by Paxos. Although Paxos has its own stablecoin, it will likely find more success in its “stablecoins as-a-service” offering. Paxos offers other companies the ability to create their own stablecoin using Paxos’ infrastructure. Plus, Paxos is regulated by the New York Department of Financial Services, and its stablecoins are backed by either cash at insured U.S. banks or U.S. Treasury bills protected by New York banking laws.

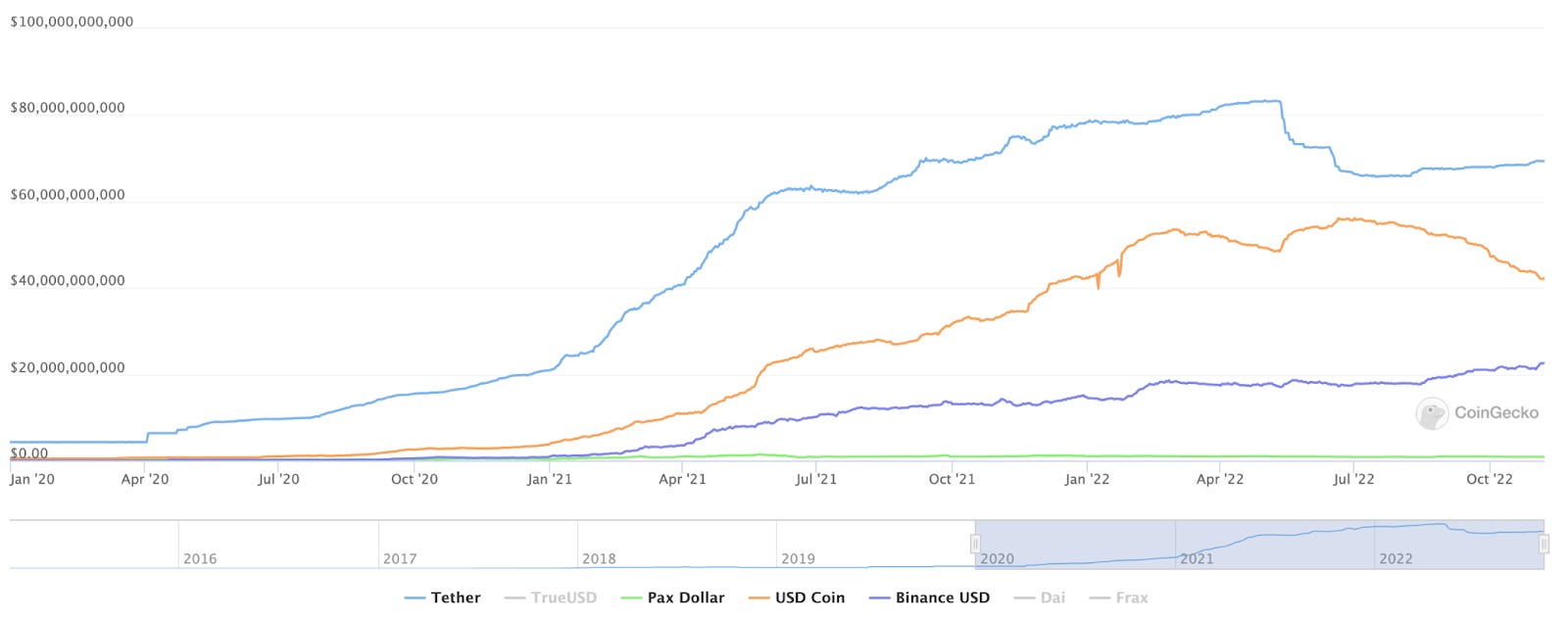

You can see how they’re all faring in the chart below, which tracks their market caps since the start of 2020.

It is clear that USDT (light blue) was the first stable to rise to prominence and dominated the market until May 2022. However, the LUNA depeg and the forced liquidation event in June seem to have triggered a flight to safer (or at least more trustworthy) alternatives.

USDC (orange) looked like the biggest beneficiary, at least until Binance started marketing BUSD (purple) in earnest.

In late September, Binance announced that it would automatically convert any non-USDT stablecoin on its platform to BUSD. Binance has also phased out perpetuals and futures markets denominated in USDC or any other stables aside from BUSD or USDT. To boot, Binance offers lower fees when trading using BUSD, and has even waived fees on certain markets like spot BTC/BUSD.

Now, USDC is on the decline, seemingly bearing the brunt of Binance’s new policies to increase the usage of BUSD.

Binance is trying to become the portal to the crypto ecosystem. The success of BUSD is at the heart of it.

I guess CZ must not have been too happy when his biggest competitor, FTX, announced it would launch a stable of its own.

Bear with me for a second as I put my conspiracy hat on.

In December 2019, Binance invested an undisclosed amount in FTX, in what was dubbed a “strategic partnership.” Keep your friends close and all that jazz.

One benefit of being an early investor is gaining access to non-public information. CZ likely saw a little more behind the curtain than most.

And when he cashed out his stake, he received one of FTX's most important forms of collateral, FTT tokens.

Even if CZ was not aware of the magnitude of the fraud, he likely had his suspicions. Maybe he didn’t want to kill FTX. Maybe he just wanted to hurt their reputation at a time when FTX was trying to raise money and launch a stablecoin.

If FTX had launched a stablecoin, it could have posed a real threat to Binance’s dominance. Something that no one has been able to do in years.

It is not too crazy to think that CZ might have wanted to nip FTX’s plans in the bud.

Truth is, we don’t really know. And it’s possible that we will never get the full picture.

What we do know is CZ’s greatest foe is out of the game. And the “Second Great Stablecoin War” has only just begun.

Keep it fun,

Kodi