The Dollar Is Hurting. Can Devs Do Something?

Filtered: July 17 – 21

Welcome to a new weekly issue we call, Filtered.

If you’ve been following Espresso regularly, you’ve likely noticed that we’re starting to ramp up our content on other platforms. So we thought we’d help our readers out by giving you some of the highlights.

You can consider this your weekly round-up of top insights from our analysts, filtered down to serve you better.

And if you’ve missed any of our content this week, whether it’s in essay, podcast, or video form, you can find links to it at the bottom.

Without further ado, let’s get into today’s Filtered.

The U.S. dollar has had a rough year.

Inflation, while slowing down, has proven difficult to tame. And we’re getting the first signs that it might be losing its status as the global reserve, as countries like China and Russia attempt to settle trade deals in other currencies.

You can imagine Jerome Powell pacing the halls of the Federal Reserve, talking to his subordinates:

Okay, okay, okay, I need inflation to go down. I can’t take this anymore. Everyday I’m checking the inflation and it’s rising. Everyday I check the prices, bad prices. I can’t take this anymore man. I have over-invested, by a lot. It is what it is but I need inflation to go down. Can devs do something?

Well, turns out devs did do something.

Welcome to FedNow.

FedNow is an instant payments service that launched yesterday. While it’s still not fully rolled out, the idea is that it will enable U.S. businesses and consumers to send and receive funds 24/7/365.

Gee, sounds familiar.

To be clear, FedNow does not use blockchain. And its stated purpose is for instant payments, not to fight inflation. But as I wrote in the Blend on Wednesday, that could become one of its use-cases:

...we should note [FedNow] fills the void of a unified, nationwide instant payment system.

It was being filled by private sector providers like Zelle and Venmo. Meaning this service will offer competition to those providers. But due to the ease of using those apps, I expect FedNow to work in the background of these apps and not necessarily replace them.

We’ll see. Details are still pretty scant, so we are left to our imaginations for the most part.

But what’s clear here is the U.S. central bank is one step closer to a central bank digital currency (CBDC). And with that, we are getting closer to the dollar becoming a CBDC that can be used on new technological platforms.

As you’ll see soon...these technological innovations are recipes for higher inflation and the dollar becoming less dominant as a reserve currency.

What’s funny is that the FedNow system will combat this concern, whether intentionally or not. Because it will create a more direct demand for dollars.

If you’re curious how FedNow could affect inflation, you can read the whole piece here. I also talk about Google’s latest insidious AI move...and I take a closer look at some interesting features of Uniswap’s upcoming v4 upgrade.

The U.S. isn’t the only government warming up to the industry. China recently did an about-face when it allowed retail trading of crypto in Hong Kong starting last month.

But our globetrotting analyst, TD, believes there’s more to this story than meets the eye. In fact, it may show just how desperate China is getting as it tries to fix its economy:

We can expect the Chinese government to print even more money and to keep on lowering the rates.

This combination of adding to the already overabundance of money supply and lowering interest rates equals a buildup of massive inflationary pressure.

This is most likely why Beijing decided to open up Hong Kong as a crypto trading hub.

Just as a pressure cooker lets steam off through a safety valve, China will need an exhaust valve for its potential domestic inflationary pressure should the [quantitative easing] and rate-cutting policy start to work.

TD explained how China may be trying to turn crypto into its own “inflation sink,” in his latest piece, “A Crypto Bull in the ‘China’ Shop.”

Meanwhile, the ruling in the SEC’s case against Ripple (XRP) still has crypto buzzing, so of course we had to weigh in on the latest episode of Alpha Bites.

You can catch the team’s thoughts by listening to the episode here. But I wanted to share a snippet of what I think is one of the most interesting implications:

...it was okay to programmatically sell XRP into the market. But essentially, what [the judge] said was when [Ripple Labs] went ahead and created the investment contract with, let's say, some sort of over-the-counter transaction or some sort of private investment round, that became a security.

Like I'm not a lawyer. This is not advice. Don't take it that way. Go ahead and spend the obscene amount of money to go ahead and get that advice from a lawyer.

But it opens the door up to essentially attract capital and sell native tokens in a different fashion and in a new way. And I'm not necessarily sure how the market's gonna respond to this, but I've seen that chatter. So I look forward to seeing this approach taken in the months to come, because I think it will be.

I think it actually puts VCs in a harder position now, because now the incentive is to not open up early investment rounds, and instead sell them into the open market.

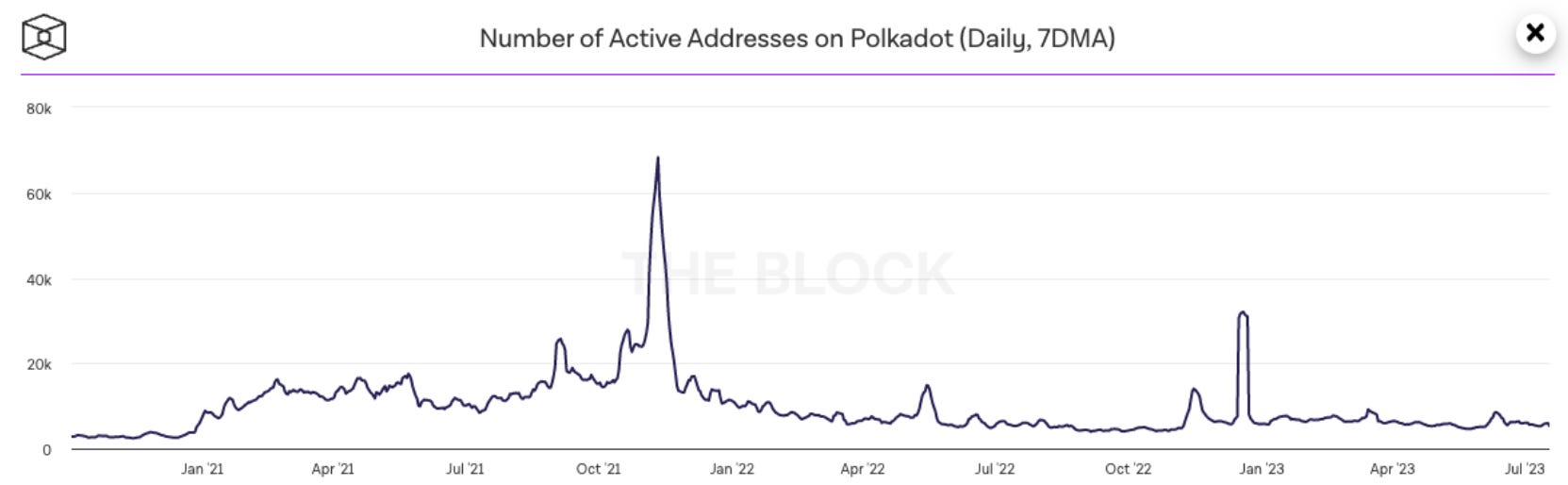

However, the Ripple ruling was far from the biggest debate on this week’s episode. The team had a deep discussion on Polkadot (DOT) and the troubles it’s had in growing its ecosystem. Here’s a chart of active addresses on the network:

But as our token analyst, Kodi, explains below, it’s making key changes to its token economics to address its problems:

One of the biggest issues they had is that for anyone to launch an application in the Polkadot network, they had to win an auction.... And for that, they had to gather a lot of DOT and basically win a bidding auction….

So basically if you're an application, before, you had to deploy a full chain and win an auction. Now, or in the future when they enable these changes, you will be able to deploy your application similarly to how you deploy a smart contract in Ethereum and pay for the block space that you intend to use.

And I think that's a change that was a long time coming. People don't use blockchains because they have the infrastructure. It doesn't matter if you have the best infrastructure that there will ever be. If there's no applications there, no one will show up, which is what Polkadot was seeing.

Kodi wasn’t as optimistic as I was on Polkadot’s chances (and I’m still a bit skeptical myself), but if you want to hear the full debate, be sure to listen to the latest episode here. You can also listen on Apple Podcasts and Spotify.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. We’ll see you again on Monday. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso:

Alpha Bites:

Tweet of the Week: