The Divine One-Two

The setup we see today looks eerily similar to the one in 1996. Here's how to play it...

Its been two weeks and I'm still speechless.

During this time I've had a wave of nostalgia flood over me. Flashbacks of watching low view count YouTube presentations on blockchain, Bitcoin, and smart contracts were among the many memories that flooded my mind.

Over a decade ago I took the plunge into crypto.

It started with a search to find new asset classes and investment opportunities to get involved with. I spent a couple years trying to get involved with private equity and credit opportunities.

The deal flow I had access to painted me as exit liquidity. And the 7-10% apy I made on highly leverage real-estate loans was echoing a similar sentiment.

My search made it clear that it would take 5-10 years of networking in order to get access to the best deals.

I was deflated thinking that I might as well just buy some stock indexes... Keep grinding away at the day job, earn the 7%, compound it over decades, and enjoy some financial freedom in the brief window left at the end of life.

It was a Bogglehead way of life.

But that didn't sit well with me...

It was March 2014 and like any good ole economist, I was reading my weekly issue of The Economist on a flight.

That week had another story of Bitcoin being briefly covered, tucked away in the sections most tend to flip past. It wasn't the first time I saw Bitcoin covered in the magazine, but for some reason my curiosity spiked this time.

I don't recall the exact article, but there was something in those lines that hinted at value. It led to a rabbit hole where the next three days was a sleep deprived binge on blockchain technology. I was hooked. And felt like I was early to a new asset class.

"Be first, be smarter, or cheat" is the saying.. I didn't feel first, but I definitely felt early.

Then smart contracts and all they offered was all over Bitcoin forums. And in those early days the hopium was high and a fresh sleep deprived binge ensued.

Running on little sleep and dopamine hits of imagining a new financial frontier running on blockchains loaded me with naive thoughts.

Finance needs blockchains. Even your cat's litter box needed blockchain. I was pilled... Suzie's lemonade stand would be issuing $SUZILEMONS in no time.

Years later the hopium would erode and reality took hold on how lofty this grand vision was given the current system.

In the time that followed I would be reminded of those early days whenever reading somebody new to crypto preach to the choir about how great crypto will be. And each time I would say to myself, oh how exciting it would be to discover crypto again.

Trump made things very exciting again. And reading daily posts on the world running on public blockchains elicited a "that's cute" response in my cynical mind.

For the fear of Wall Street taking over crypto always gave the impression that a Grim Reaper stood in the background waiting to strike when most convenient.

Then July 31 happened...

The SEC Chairman gave a speech that left me at a loss for words. He sounded like a fresh crypto convert waxing poetic on the virtues of crypto and how it'll take over the global financial system.

But this isn't somebody in the forum boards, telegram chat, or crypto twitter. It's the freaking top dog of the SEC saying it!

I was floored listening to him speak. I kid you not, I checked my watch to see if I was in a dream...

In case you don't know, if you're having a vivid dream, you'll instantly know it's a dream because your watch looks like an AI generated image of the time.

My watch was saying the time without issue.

The speech was incredible.

SEC Chairman Paul Atkins was talking about not just giving the green light to crypto assets and investing in them... He was laying out the gameplan on how to bring the U.S. financial system onchain.

This wasn't about giving clarity to crypto or allowing crypto to be an investable asset... No, he was talking about bringing the existing system to it.

You're not bullish enough my friend.

The words we all uttered in the months that followed our foray into crypto are being echoed by the rule makers themselves. Our financial system will be powered by the blockchains we interact with on a daily basis.

Which brings me to the main point of today's piece... Or actually, a similar thread to what was in the previous Espresso: Washington D.C. is Engineering The Largest IPO in History.

The previous essay broke down how Washington D.C. is about to unload financial assets to the world. It was enough to cause many of you to reach out and ask "how to play" this trend.

Today I plan to unpack the setup of today... Not in the sense of how these assets will come onchain or how stablecoins will act as a massive reservoir of dry powder that will plow into these assets getting tokenized... We already touched on that.

But instead via a much stronger analogy. One that touches on the similarities playing out from both a regulatory and macro view.

And then, most importantly, a tool you can use to find the best entries on what will likely feel like a cowboy riding a bucking bull for the next 6-12 months.

Looking Back

August 9, 1995 was a day that is etched in history for financial markets.

It's when the browser Netscape went public. The first day of trading sent the stock from $28 per share to $75 before the close.

And that was after the stock was repriced from $14 to $28 at the last moment.

We look back on that day with greater understanding that it marked the beginning of what led to one of the most incredible 4.5 years for publicly traded markets - the dot-com boom.

It was a period of hot money looking to gain exposure to a future that would exist on the internet.

But what often gets overlooked is the two key traits of that time period that look to be happening now.

The first was the regulatory environment. The second is the macro setup. We'll go over both before diving into the similarities we see today.

Let's dive into the regulatory landscape at the time...

Two pieces of legislations helped kick start the investing frenzy.

The first was the Telecommunications Act of 1996. It began its path through Congress in 1994 with hearings and several drafts making the rounds.

In 1994 with a Democrat in the White House and Congress flipping to a Republican majority during the mid-term elections, there was a lack of bipartism support to get big bills through.

Attempting to overhaul the tech industry with an ambitious bill was like pushing a boulder up Mt. Everest.

To make things even more difficult was the extensive lobbying efforts amongst industry giants like AT&T, Regional Bell Operating Company, and cable companies. It was an economic turf war.

But in 1996, with elections coming up, there was finally political interest to pass major legislation that promoted economic progress. Everybody wanted a key bill passed to attach their campaign to.

The bill finally got signed into law in February 1996 after its introduction almost a year earlier.

Now the bill was critical for the development of the internet as it helped foster innovation. It wasn't so much about creating hubs of innovation, but more about letting the private market begin to compete with itself.

It did this by deregulating the communications industry. The Act allowed companies to begin offer more services across the country. The end goal was to reduce the prices paid by the consumer while also encouraging better services to be spun up.

With the U.S. open for business, a second act that is often overlooked became another catalyst for the market frenzy that ensued...

That catalyst was the National Securities Markets Improvement Act of 1996 (NSMIA).

I know, feels like you're reading a history book here, but it's worth getting a feel for the era by knowing what was taking place on the regulatory front to be able to grasp just how historic today's moment truly is...

The NSMIA helped new companies with capital formation and reduced regulatory costs associated with becoming a public company.

Capital formation was major. New ventures were able to more easily attract capital as they could file for state exempt offerings. No longer were companies burden with state filings, which in turn helped cut regulatory costs.

The NSMIA exemptions also extended to public companies that traded nationally. National markets being the major hubs like the Nasdaq or NYSE.

This further reduced compliance and regulatory costs, and fueled companies to move to public companies fast.

In 1996 there were 572 IPOs... That's quite the uptick compared to the 89 IPOs in 1990.

It's in part why the Netscape IPO was such a turning point for the market. Not only did it showcase the market wanted exposure to this new investing theme, but regulation was altered shortly after to help accommodate this appetite.

We had a new technology seeing greater adoption paired with improved regulatory clarity. It was a one-two punch scenario.

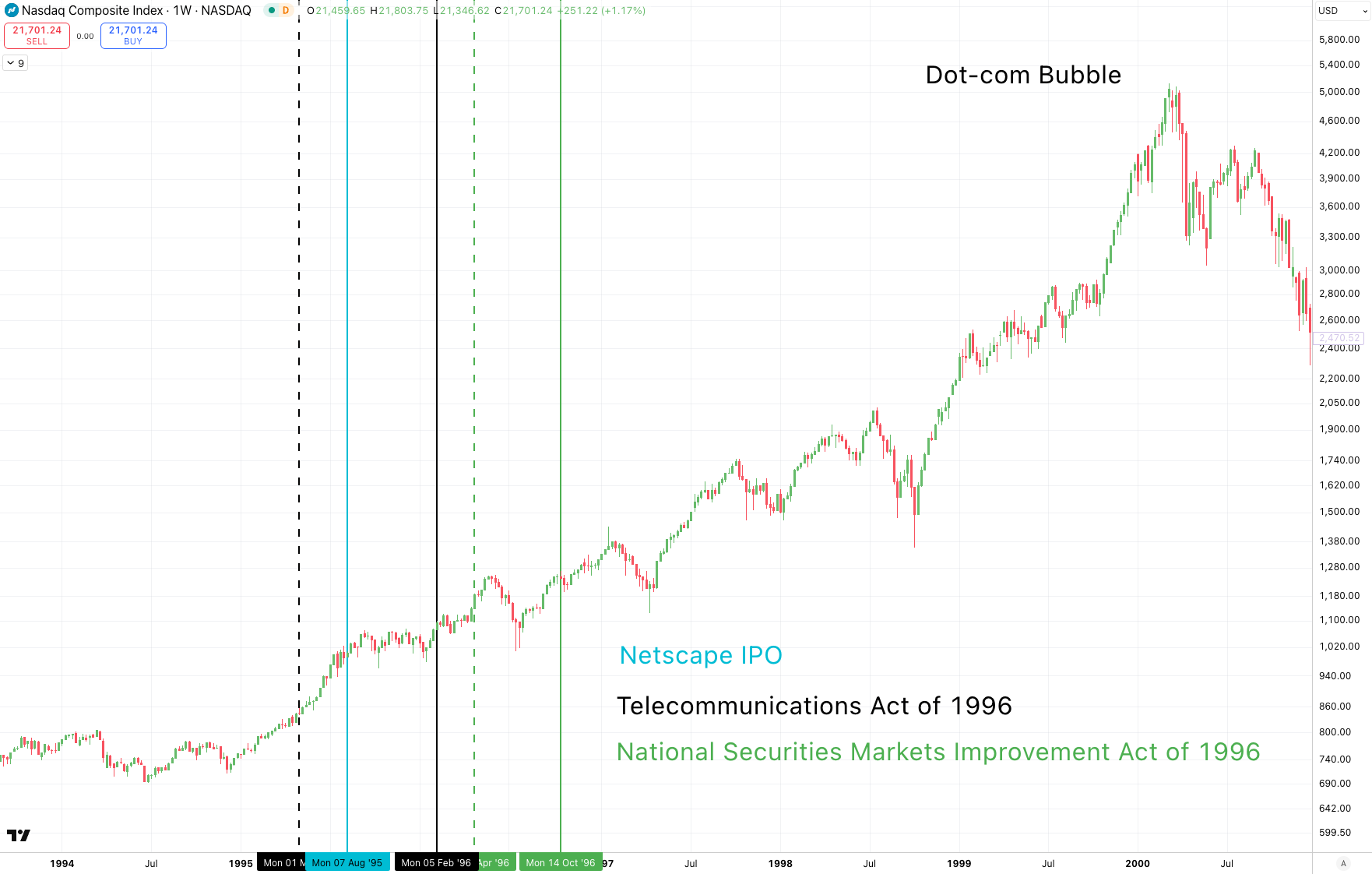

We shouldn't need to look at a chart to know what happened next... But when we draw these three key moments - Netscape IPO, Telecommunications Act, and NSMIA on a chart, it helps us to understand how they acted as a catalyst for the market. The dotted lines represent when the respective Acts were originally introduced in Congress

Greater adoption paired with regulatory clarity...

So what's the pivotal IPO moment this time around?

The Analogy

The Circle IPO took place on June 5.

It was arguably one of the purest plays to stablecoins for traditional markets. The stock listed at $31 per share, and by June 23 reached $299.

The appetite for exposure was insatiable, much like the Netscape IPO moment in the 1990s.

And similar to that Netscape IPO moment, legislation was already making progress in the halls of Congress.

The GENIUS Act had been introduced on May 1, over a month prior to the IPO. The Act was laying the framework for how digital asset companies could compete in offering stablecoins.

Instead of AT&T and RBOC being the industry incumbents... Banks and the monetary system were the Goliaths.

The passage of the bill opens up the door to innovation and competition.

The analogy isn't a perfect fit, but we can see similarities to how the Telecommunications Act wrote the rules of competition much like we see happening with GENIUS Act and this next one...

The CLARITY Act was introduced about a week prior to the Circle IPO. The Act differs from the stablecoin bill since it acts as a framework for how digital assets will be regulated.

CLARITY is the deregulation event similar to how NSMIA helped capital formation and companies operate in public markets.

We're about to see tokens become equity, equity become tokens, and all sorts of markets open up. It's deregulation on steroids that reduces compliance and regulatory costs that have been a major obstacle for crypto startups.

It's in part why we even see Uniswap now setting up a Wyoming entity in order for its DAO to operate with greater impact.

When we pair this up with investors wanting exposure to this asset class... It's easier to see why public companies are hoarding tokens and acting as proxy vehicles for investors to gain upside exposure to an asset class that is still waiting on CLARITY Act.

The appetite is likely bigger than us crypto natives can fathom. And all this legal clarity helps projects offer the market with better assets.

Uniswap for instance, through this new entity, will look to enable its often joked about fee switch. It's a move that instantly makes the token more desired and other projects look to follow suite.

Digital assets are about to become better.

But we're not here to discuss the legal nuance, we're looking at the analogy. So here it is drawn out on a chart. Notice the timeframe of the candles/data points are days versus the prior chart being weeks.

The feedback loop is compressed and accelerated this time around.

The one-two catalyst of new technology paired up with regulatory change is turning every chart green.

The similarity to 1995-1996 is strong.

But it doesn't stop there...

Macro Backdrop

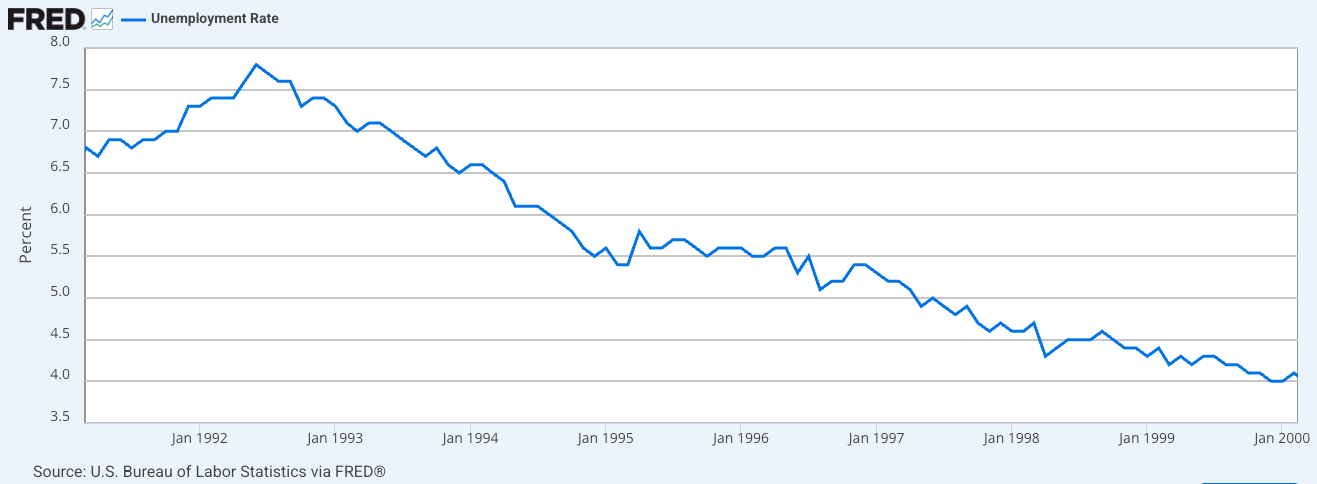

From December 1993 to early 1995, the federal funds rate rose from 3% to 6%.

The U.S. economy was fearful of inflation and successfully acted before it became an issue. It also managed to do this without harming the unemployment rate.

Then in 1995, the Federal Reserve reversed course on its rates.

It first began to drop rates about half way through the year, and by 1996, the rate went from 6% down to 5.25%.

And by 1999, rates were around 4.75%.

The rate cuts were not due to some exogenous shock or financial system turmoil. It was more about minor adjustments that focused on price stability and maximum employment.

Rate cuts are seen below.

This is the macro view that has similarities to what we see today.

I know some will argue the minor points on what I'll say because that's the typical response from macro oriented analysts... So I encourage us to stay at a high level here...

But from the end of 2021 to early 2023, the federal funds rate rose from near 0% to more than 5%.

Rates have started to come down, and not due to an economic shock. Instead it's more of a typical policy response to get rates at an ideal level.

In fact, when we point this out on our Nasdaq chart, we can get a better reference to the similarity here.

There are concerns about inflation... And yes, the armchair economists will debate at length about data gathering and what not... Then even poke holes in the employment levels...

Regardless, these cuts are not due the foundation of finance buckling below our feet.

It's taking place when we are at the cusp of a one-two moment in time. A moment where new technology and regulatory clarity are taking place in unison.

This is the setup for a major melt-up. One that will bring incredible swings and gains for those willing to see this moment as opportunity and not one of worry.

For God's sake, the top dog of the SEC is detailing a plan to bring finance onchain. What more do you want? Are you not entertained?

Financial assets will be issued more easily... Liquidity will be more plentiful... Markets will open up everywhere.

These are the facts, not some forum board hopium post. You are not bullish enough.

The Shill

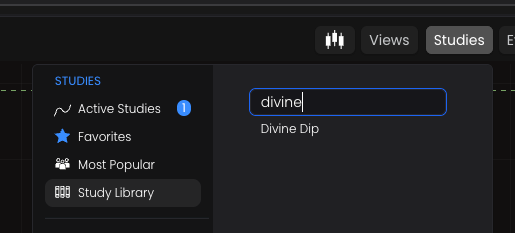

Now, for the bravest of you all that wish to follow along on this melt-up experience, join us here at Another Boring Chat. We're about to unveil a way for you to gain access to one of our newest alert systems we call Divine Dip (edit: I made it directly accessible for FREE in the P.S. below... I'm sure my team is going to give me hell for making it free).

The Divine Dip is signal that looks for moments of capitulation for assets. Traders and investors have enjoyed it so much that we now created an alert system that will tell you when those moments happen in real-time for various assets.

It's literally spoon feeding you opportunity.

Why do this?

The reason is simple... When assets start hitting new all-time highs and you're either on the sideline realizing ridiculous FOMO, you'll likely be a future top blaster. Meaning you will buy at the exact moment the market turns against you.

It's happened to all of us...

If you've never experienced this, then I'd argue you've never traded before.

So Divine Dip is an incredibly useful signal (and now FREE alert tool) to help you traverse this historic melt-up with confidence.

But for now, read through the P.S. below if you'd like to learn more and gain access to the free alert tool today.

Until next time, will you run towards the bubble or shy away?

Your Pulse on Crypto,

Ben Lilly

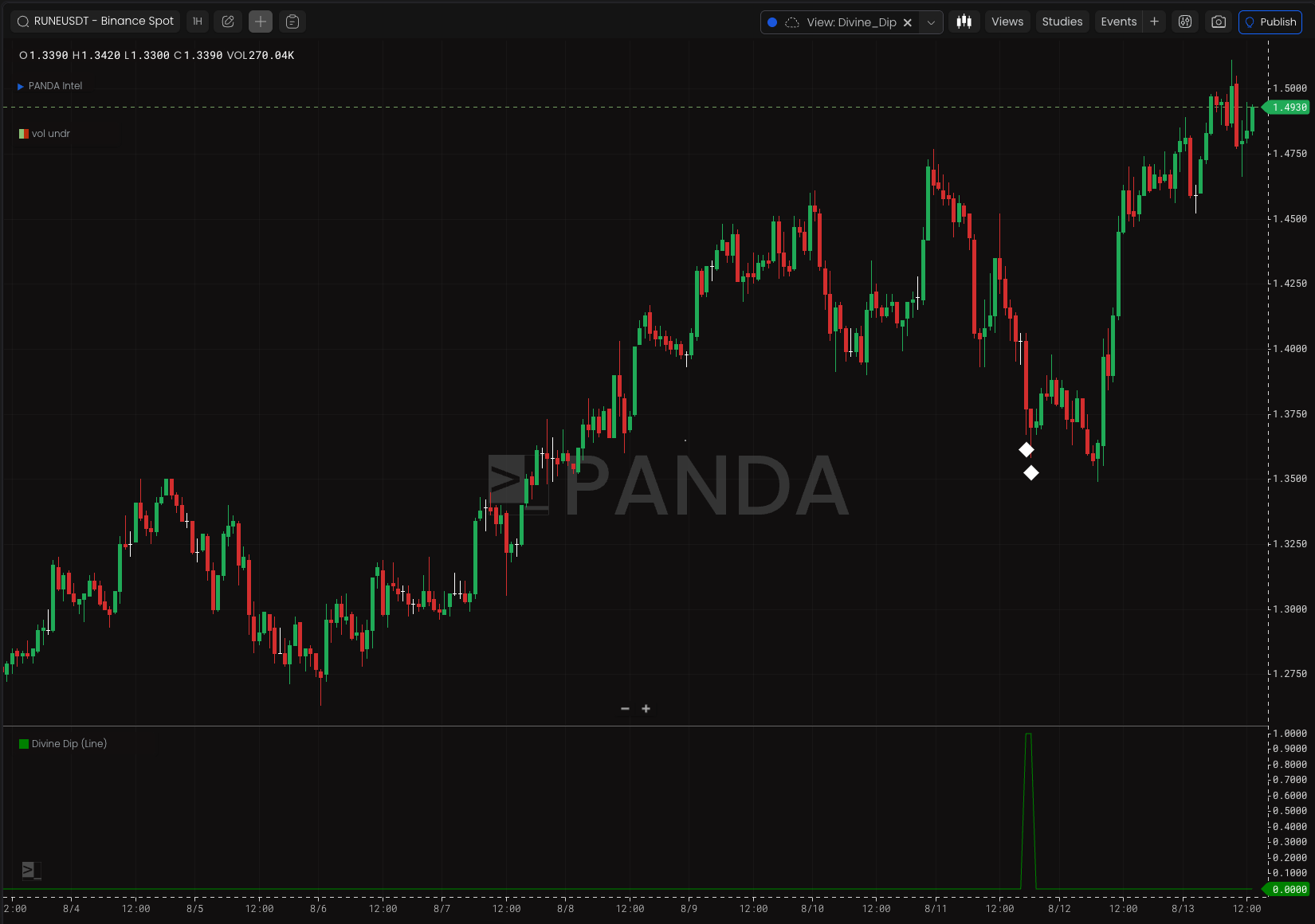

P.S. - Divine Dip combines various metrics and data points like volume and liquidity to predict the end of a selloff.

This means it's a simple yes or no alert that tells you when to consider opening a position. It's available in PANDA Terminal. Just sign in, click "studies" and type in "divine". You'll see the study there in the Terminal.

You can go ahead and type in whatever ticker you want in the upper-left corner of the Terminal and see how Divine Dip looks on whatever asset you want to study.

Below is one of the two dozen triggers from Monday. Literally just pulled the first thing I saw... Go ahead, you can click the image to be brought directly to the chart so you can copy/paste it for yourself and then change the ticker (remember to come back here because I'm showing you how to gain access to the alert system below...)

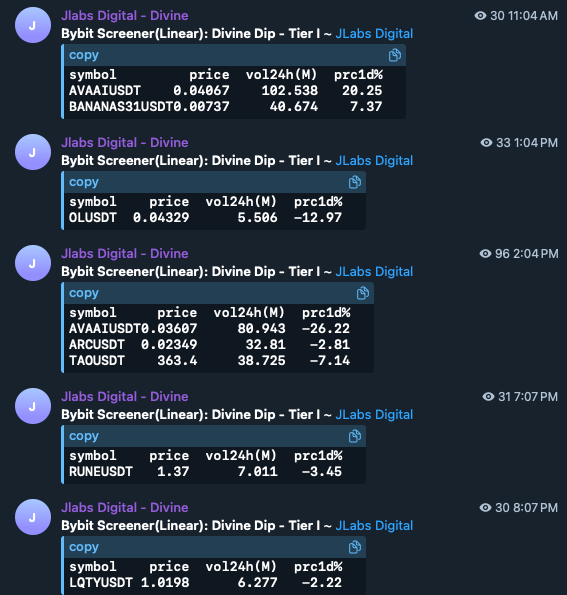

Like I said, this was one of dozens of alerts on Monday. Here are a few more from Monday if you want to run through them yourself to see how they look:

So how to gain access to this free alert system?

Go to telegram and message @DivineDip_Invite_Bot

It's a bot that will ask you for your email.

Note: We will regularly comb through the email list and purge users who give us a one-time use email, so be sure to use one you actually check.

We have some upcoming releases we want you to be aware of - and a future event. So if you're not wanting to receive an email from us, well, you can't use the free alert system... Fair enough trade, right?

In the meantime, here's a short tutorial about Divine Dip for the readers among us that like YouTube shorts... Hope to see you in the chat!