The Day I Almost Got Rekt

Token Insight: How USDC’s De-Peg Created a Synthetic Dollar

Let's do things a little differently this time around. Today, I’m going to tell you about my USDC depeg horror story.

On a recent Saturday morning, a sleepy Kodi woke up to the warm embrace of the morning sun, as the first rays of sun peeked through the open window and birds chirped cheerfully outside. I kid you not, it was like a fairytale.

But, as I reached for my phone to check on messages and Twitter, a cold shudder ran through me.

My girlfriend stirred beside me, roused from her slumber by this sudden movement.

“Is everything okay?”

“Everything's fine, love. Go back to sleep.”

Narrator: Everything wasn't fine.

As you might know by now, Silicon Valley Bank (SVB) endured a bank run and was declared insolvent on Friday, March 10.

The reason that set off alarm bells in my head was that I held a good amount of USDC, the second-biggest stablecoin. And I knew Circle, the issuer of USDC, just so happened to have entrusted SVB with $3.3 billion of the $40 billion of USDC collateral.

A sum that is well above the $250,000 limit that the FDIC insures at any bank. If you trust a bank with more than that, and they go under, you just might not get all your money back. Now, Circle and all other SVB users (and me) were looking at catastrophic losses if the government didn't come in to save the day.

Sure enough, it seemed like the market had realized overnight that Circle might have a gaping hole on its balance sheet come Monday morning. And USDC started to slip off its peg to the dollar.

So there I was, on that beautiful Saturday morning, sitting at my desk and staring at a chart that told me USDC was now trading at $0.87 cents on the dollar. This was not how I envisioned my day off, I tell you that. After having survived Luna and FTX unscathed, frigging USDC was gonna do me off. F*** me sideways.

To top it off, I was meeting my parents for lunch. There’s nothing better than describing to your parents what new way you have found to lose money.

I had to explain to them how a bunch of luminaries at SVB had decided to place a significant amount of their deposits in long-duration bonds at historically low interest rates.

As I explained, I couldn't help but notice my mum nodding with a knowing look. See, she was a bank teller in the ’90s, and the bank she was working at had the same genius idea. When interest rates eventually rose, the bank faced liquidity issues the same way SVB did.

How is it that a retired bank teller from an undisclosed European country (hint: we like siestas) knows exactly how this story plays out, but all the PhDs and "world-class C-suites" at these top banks drive head-on into insolvency? To be honest, most of it is just greed, with a healthy dose of incompetence.

The USDC story has a happy ending, for now at least. The high priests at the Federal Reserve and FDIC decided that all SVB depositors would be made whole, regardless of how much money they had stored in the bank. By Monday, USDC had all but regained its peg.

It could have as easily gone the other way, though. Truth is, we got lucky this time around.

After this latest scare, coming on the heels of the FTX and Luna debacles, I've just about had it with centralized actors having this much sway over our financial lives.

If it wasn't clear by now, entrusting our financial futures to the whims of a select few is not the way to go. It's high time we do away with these incompetent fools and embrace the potential of decentralized solutions. And it feels like the market agrees with me.

You see, as USDC broke its peg that weekend and people lost faith in it, a few market participants decided they'd had enough, too, and they were gonna create a stable of their own. Today, we are going to explore what this "stable" is, what its shortcomings are, and what the future might hold.

But before we do that, let me explain why stables, despite their many flaws, aren’t going anywhere anytime soon.

The People Want Stables

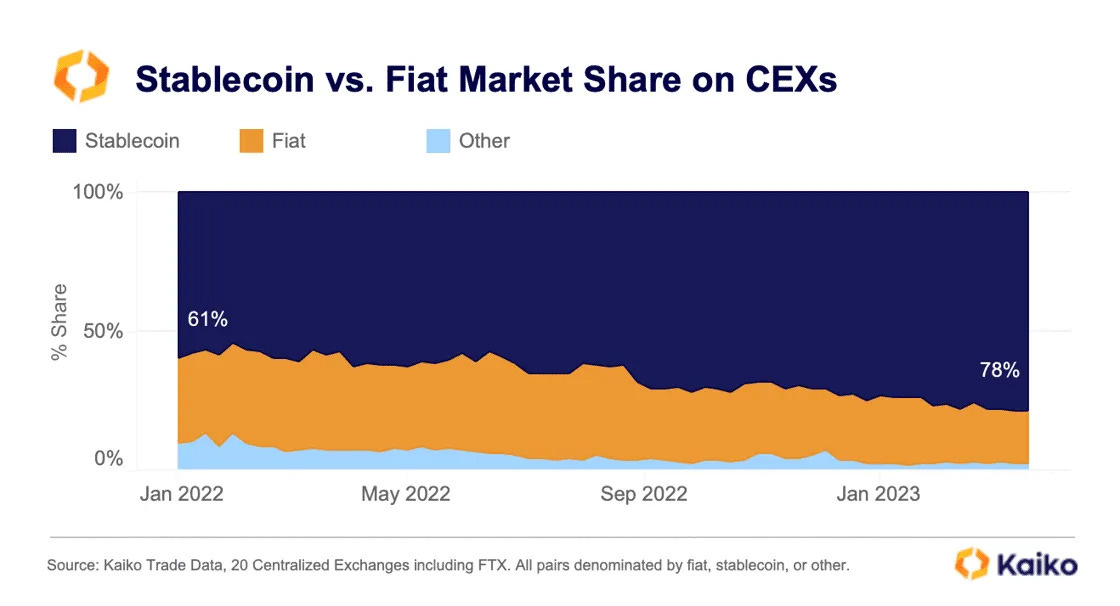

Crypto-natives like stables. A lot. Gone are the days when BTC pairs were the name of the game. Take a look at the share of trades denominated in stables, fiat, and other cryptocurrencies (BTC, ETH, etc.).

78% of all trades on centralized exchanges are denominated in stables. Only 19% are in fiat, while just a measly 3% are in other cryptocurrencies.

But it’s not traders who stand to benefit most from wider stablecoin adoption.

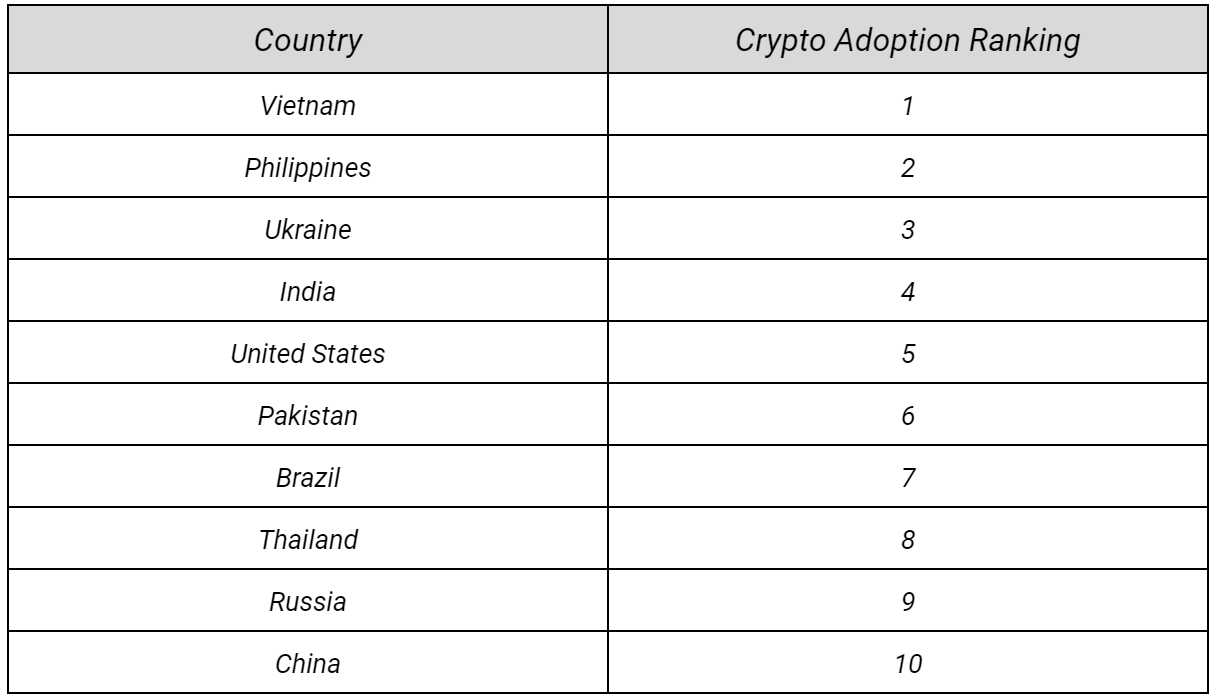

Take a look at the top countries by crypto adoption, according to Chainalysis:

It surely isn't the wealthiest or most stable countries up there, hey. Aside from the U.S., all other top countries by adoption suffer from inflation, instability, war, inequality, and all kinds of financial repression. You could even make the argument that large swaths of the U.S. population also suffer from financial repression.

And it is not just Bitcoin that people in unstable countries turn to. More and more, they turn to stablecoins.

Take the Ukraine conflict, for instance. Not only is crypto widely used in Ukraine, but also in Russia. This is the share of transaction volumes in Russian crypto services, divided among BTC, ETH, stablecoins, and other altcoins.

What did Russians turn to after the Ukraine invasion in January and the subsequent cut-off from the western financial system? That's right, stables.

Or take Latin America, a region fraught with failing national currencies, price controls, and skyrocketing inflation. A recent study indicates that over one-third of Latin American consumers already use stablecoins for everyday transactions.

And in Argentina and Venezuela, where inflation stands at 114% and 79%, respectively, stablecoins make up 31% and 34% of transaction volume, respectively, among small retail investors.

Stablecoins are much more than just a bridge between centralized and decentralized finance. They’re a great medium of exchange, unit of account, and store of value. And they’re a better currency than Bitcoin ever was and will likely ever be.

Ensuring they are decentralized and exist independently of the traditional financial system will safeguard the economic freedom of people the world over, particularly those facing economic challenges.

But that’s easier said than done.

Balancing Act

Thing is, stablecoins are hard to get right. Very hard. Because nobody has perfected the Holy Trinity1:

- Peg Stability: You want your stable to track the value of the asset it tracks. Easy said, not so much done. Any long-lasting or deep deviation will erode confidence in your stablecoin, and if that happens, you are done for. So, stablecoin issuers use price stabilization measures so that any deviations from peg are minimal and short-lived. Newsflash: These sometimes don’t work.

- Scalability: For a stablecoin to be useful, it needs to provide enough supply and liquidity to service the needs of the crypto economy. In case you hadn’t noticed, the needs and size of the crypto economy change fast. So, stablecoins need to be able to respond quickly to changes in market demand and conditions. Being capital-efficient helps here.

- Decentralized: He who holds the keys to the minting and redeeming of a stable makes the rules. Do you really want to have come all this way only for Jamie Dimon and the luminaries at the Fed to have ultimate control of your money? Heck no.

Now, it’s no trick for a stablecoin to achieve the Holy Trinity. The hard part is maintaining it. All stablecoins thus far are just performing a balancing act among these three criteria, with varying success.

Now, there’s a lot, and I mean A LOT of stables out there. It’d be a bit tedious, both for you and for me, to review them all here. Maybe we publish a report in the future, who knows?

For now, we will review the main categories of stables out there:

- Fiat-backed

- Crypto-collateralized

- Algorithmic

Let’s go through all three and evaluate them using the Holy Trinity test.

Fiat-Backed

The name pretty much says it all. These stables are backed by an equivalent quantity of fiat, sitting at any of our respected and very safe traditional finance institutions out there.

They are quite stable, scalable, and capital-efficient, yes. But everything about them, from the minting and redeeming to the custody, is in the hands of a centralized third party. Why be in crypto for this?

Some examples are USDC, USDT, BUSD, and TUSD. The last one you may not have heard of, but it seems to be Binance’s last stable of choice.

So, how do they stack up against the trilemma? Are fiat-backed stablecoins:

- Decentralized? Lol.

- Scalable? Very much so, especially if you are somewhat vague with what exactly backs your stables.

- Peg-stable? Quite so, until the bank where you hold your reserves goes under. Surely this won’t happen again…right?

Crypto-Collateralized

These are stablecoins backed by other cryptocurrencies. Since crypto tends to be volatile, these stables are often over-collateralized. That is, the value of the cryptocurrencies that act as backing is higher than the value of stables that is created. The higher the over-collateralization, the safer the stable.

Most crypto-collateralized stables have an identical model: users borrow stablecoins in exchange for collateral; once they return the stable plus interest, they are given back the collateral.

Protocols usually add incentives to keep the peg stable in times of volatility and have a system in place to liquidate a user’s collateral if the value goes below a certain threshold.

Are these stables:

- Decentralized? Quite so, unless your collateral is just a centralized stable. Regretfully, many protocols are just USDC in a fancy dress (looking at you, DAI and FRAX).

- Scalable? Not really. Overcollateralization is capital-inefficient, and protocols restrict the number of cryptocurrencies they accept as collateral. Protocols can always choose to accept riskier kinds of collateral, as MIM did, but this usually comes at the price of losing peg stability and ramping up Ponzification.

- Peg-stable? Surprisingly so, and better by the day as the incentives to keep the peg and liquidation processes have improved greatly over the past few years.

Algorithmic

Algo-stables rely on an on-chain code (an algorithm) regulating the supply and demand of the stablecoin. The most infamous was Terra’s UST, which relied on a seigniorage model2.

Let’s keep with Terra’s example to explain how this works.

Terra, and all seigniorage stables, have a two-coin system. One coin is used as the stable (UST) and the other is used to “absorb” market volatility (LUNA). That is, if the value of UST goes over $1, a LUNA holder can exchange $1 of LUNA for UST and sell for a profit. Likewise, if the price of UST falls below $1, UST holders can exchange 1 UST for $1 worth of LUNA and again sell for a profit.

Seigniorage models thus rely on arbitrageurs to keep the peg stable.

The thing with seigniorage models is, the second coin is not backed by anything. LUNA’s “value” was whatever the market deemed it to be at any time. Zero, infinity, or anything in between.

Terra is a prime example of the Greater Fool Theory. The only reason it worked for a bit was because the market expected it to keep growing. When that illusion shattered and people rushed to the doors, the whole thing came crashing down.

It should be clear by now that the seigniorage model is doomed to fail. Basis Cash, Dynamic Set Dollar, Empty Set Dollar, Terra – all relegated to the dustbin of history. One would think we have learnt the lesson. I am not too optimistic.

So, are seigniorage stables:

- Decentralized? Yup.

- Scalable? Very much so. They are creating “value” out of thin air, so yes they are quite scalable. Capital-efficient too in a sense, as nothing is backing them.

- Peg-stable? Don’t make me laugh.

Seigniorage stables are not the only kind of algorithmic stables, though. Any stable that relies completely or partially on codified algorithms to keep the peg can be classified as an algorithmic stable.

FRAX, for instance, was until very recently a combination of a crypto-collateralized and algorithmic stablecoin.

FEI was another hybrid collateralized-algorithmic stable that implemented various innovations to keep its peg, including penalties for traders who sold the FEI stable below $1. It got off to a bit of a rocky start:

Another very interesting stable is Aave’s upcoming GHO, which we discussed in our piece “The Stablecoin Arms Race.”

This is where most innovation is happening, and where the solution to the stablecoin puzzle will come from.

Arthur Hayes, co-founder of the crypto exchange BitMEX, probably agrees, as he just proposed a new algorithmic stablecoin design in a recent piece.

The Prettiest Stable on the Block?

The Satoshi Nakamoto Dollar (NUSD), aka NakaDollar, would be a USD equivalent created using a combination of Bitcoin and a short position in a Bitcoin/USD inverse perpetual swap.

The inverse perpetual swap is a type of futures contract that does not expire and allows one to speculate on the value of the BTC/USD rate. The collateral and payout are all in BTC. If you open a short position that equals the same value of the BTC collateral, congrats, you just created a synthetic dollar position that cannot be liquidated.

Whether BTC goes up or down, your position would stay flat, because if the value of Bitcoin falls, the swap value in Bitcoin terms approaches infinity, while if the value of Bitcoin rises, the swap value in Bitcoin terms approaches 0. Thus, one can create a synthetic USD without using actual dollars or stablecoins.

And this synthetic USD is what traders resorted to that weekend when it seemed like USDC might be going the way of the dodo.

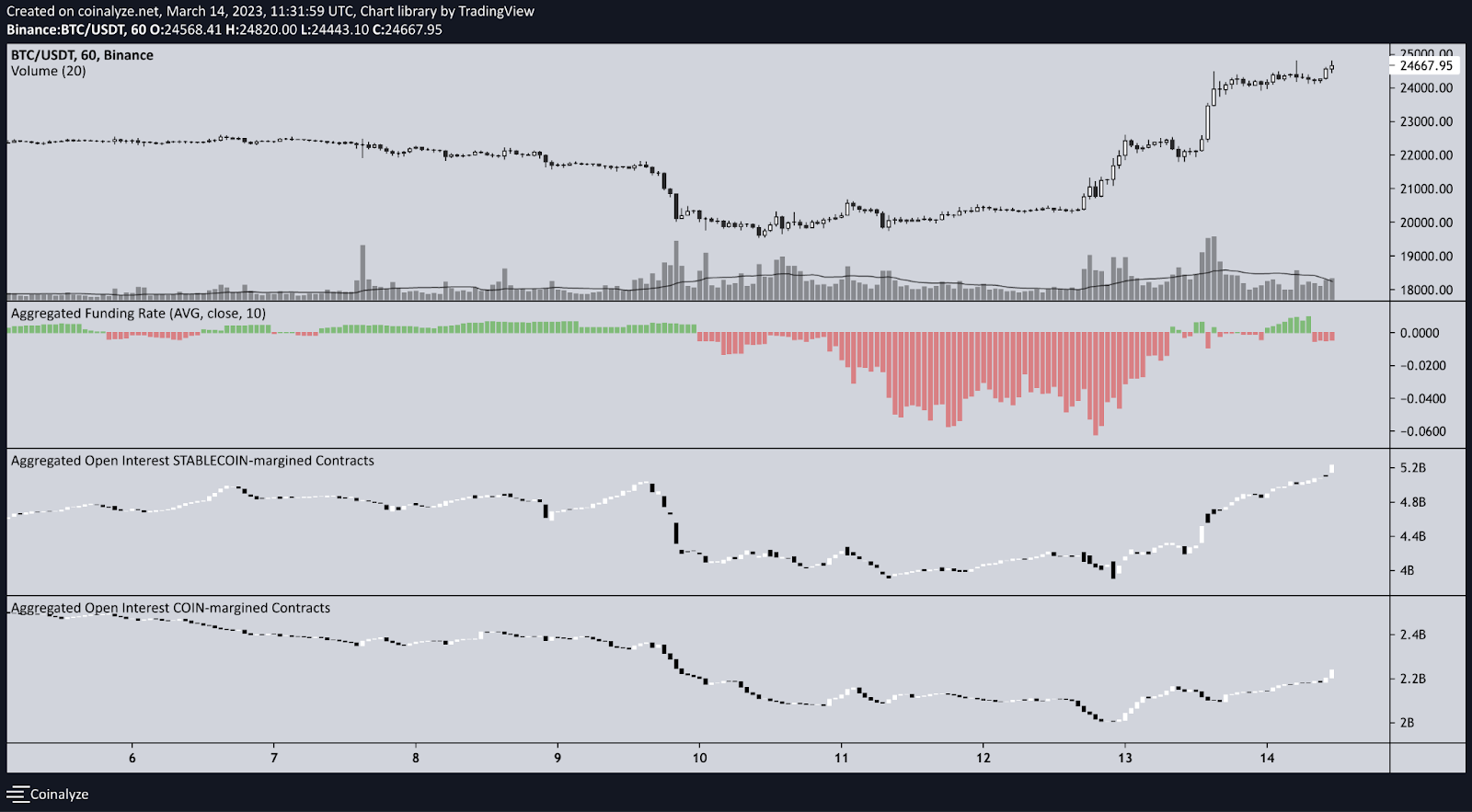

Just as BTC fell and USDC de-pegged, traders opened short positions against their spot BTC on coin-margined pairs. Funding rates on BTC-margined futures went deeply negative.

Meanwhile, USD-margined perpetual contracts remained stable. If traders were genuinely expecting a market breakdown and wanted to express their bearish bias, they would typically choose to short using USD-margined pairs.

The funding rate disparity between BTC-margined and USD-margined pairs suggests that the short positions were primarily a response to USDC’s deviation from its $1 peg rather than broader bearish market sentiment.

So, how does the NakaDollar stack against the Holy Trinity? Is it:

- Decentralized? Nope. You would need to trust centralized exchanges to launch any stable that resembles the NakaDollar. Judging by the events of recent months, that might not be the greatest idea. In the future, it is possible that the NakaDollar could be created fully on-chain, but right now, there are no protocols with enough liquidity to pull it off.

- Scalable? Well, it is quite capital-efficient. But there are no on-chain protocols with enough liquidity and only a handful of CEXs. C-minus at best.

- Peg-stable? That it would be.

It is great that the market can resort to this synthetic USD. But Arthur’s design, while great, still falls short. This is because Mr. Hayes and I have very different opinions on what a stablecoin is and how it should be used.

Thank you for reading Espresso. This post is public so feel free to share it.

The Revolution Will Not Be Centralized

You see, in Hayes’ view, stablecoins need not be decentralized. They needn't be a store of value, either. Or a means of exchanging value outside the fiat system.

Their purpose is, and I quote Hayes here, "to allow traders to quickly move between fiat and crypto." For everything else, there's Bitcoin.

If only.

Bitcoin might be a good store of value. It is definitely a great trading product. What it definitely isn't is a means of payment. Or a currency. Its high volatility makes it wholly unsuitable for daily transactions.

Stablecoins on the other hand… fulfill that need nicely.

But even if stablecoins are great money, what good are they if they can be tracked and censored? If you forfeit all control and privacy upon using them?

Decentralization is hard, and stablecoins doubly so. And Arthur Hayes’ synthetic USD, while a great solution, still falls short.

And yet, recent events have only strengthened my conviction that crypto will always find a way. Crypto is akin to the mythical Hydra, in that if one protocol or solution fails, we devise and create another to take its place. In the words of the one and only Jeff Goldblum, “Life, uh, finds a way.”

Be it in one year, five, or ten, the ingenuity within the crypto community will yield a solution to the stablecoin dilemma. And we at JLabs will join in those efforts.

Keep it fun,

Kodi