The April 9 Blend

Digital Gold Jewelry, April Fools’ Liquidity, and CBDCs

- How a single satoshi can be worth six figures

- The current DEX trend is not a price catalyst

- The global central bank network to host all CBDCs

Here at Espresso, we don’t have inflated opinions of our place in the crypto media ecosystem. We know you probably visit other sources that dive into crypto, macro, and token fundamentals, which is natural.

That’s why one of our core beliefs is to always try to provide unique analysis. And we can say we’ve been doing it since before the masses understood what a basis point is.

This has helped us work toward becoming your primary destination when getting an update on the nexus of crypto and the “normal world.”

But despite what you may read and hear on the internet, crypto is growing larger by the day.

We know you are busy and don’t scroll Crypto Twitter on an hourly basis like the rest of us. Nor do you have time to go deep into the weeds on niche topics to figure out what matters. So in an effort to serve you better, we want to continue to help you separate the signal from the noise.

We’re not going to bombard you with laundry lists of the news or the latest tweets that you missed. That’s not what we do. Another of our core beliefs is that more does not mean better… Better is better.

Instead, we focus hard on making our analysis easy to understand, conversational, and entertaining. This is our ethos. And in this way, we hope to get better at being better.

So today, we’re starting a new series that hits on trending topics in crypto. For now, we are calling it The Blend… An Espresso blend of topics.

We’ll continue providing our regular analysis in other essays. While this new series will focus on topical stories that you might not have time to do a one-hour deep dive into. That’s where we come in – by giving you the cliff notes on what matters.

As with most things, we will try to link it back to price as often as we can. Some of these stories will not have an immediate impact or relationship to price, but we think they will in due time.

Now, before we get started, I want to fill up the tip jar with a quick message to those who are helping keep the lights on at The Lab…

Ben Lilly here. As you know, we want to take Espresso to the next level. To do so, we’ve explored bringing sponsors into our newsletter, but in a way that first and foremost benefits you, our readers. To that end, we aim to share introductory offers that give you an opportunity to trial new services, tools, or exchanges.

We are excited to announce our first sponsor, the trading platform ByBit. For those who have been looking for a new exchange, consider checking them out.

They operate in 160 countries. They have more than 270 assets trading on spot and over 200 perpetual and quarterly futures contracts. They even offer options contracts and NFT trading.

Simply put, ByBit has a lot to offer any trader. And right now, they are offering a $10 welcome bonus if you open a new account and complete some introductory tasks. They also have additional ways for you to earn. So if you are looking for a new platform to trade on, consider ByBit today by clicking here. Also, if you simply want to support Espresso and the Jarvis Labs team, consider giving a click.

Bitcoin’s Newest Trend Has Inscribed One Million Satoshis

Bitcoin has never realized a positive shift in demand, until now.

Usually, upgrades to a network can help increase demand. And historically, projects like Lightning Network and SegWit have been major improvements to the Bitcoin network. Both of them made transactions more efficient for users by reducing fees.

However, this quickly reduced the demand for bitcoin overnight. Yes, I’m aware they were great for scalability concerns, but the fact is each transaction requires less fees now...and those fees are paid in bitcoin.

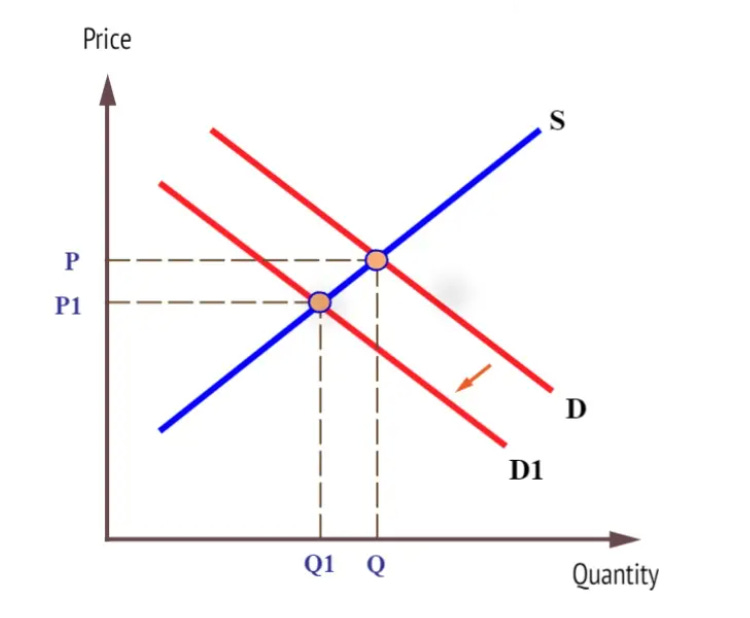

It would be like doubling every car’s fuel efficiency overnight. What would happen to the price of gas? Since less demand is in the market, a surplus of supply would build up. More supply means sellers need to cut prices to unload their inventory.

You can’t escape it: Less demand leads to lower prices, as the chart below shows.

Lightning Network and SegWit ultimately made transactions quite literally more fuel-efficient.

That’s what I mean when I say Bitcoin has never realized a positive shift in its demand curve. But that just changed.

Ordinals, Stamps, and BRC-20 tokens are creating an uptick in demand on the network by giving it a new use case.

For example, Ordinals represent a way to give a single satoshi essentially a barcode (a satoshi is the smallest unit of bitcoin). This lets you inscribe each satoshi with text, images, or even audio files (Stamps and BRC-20 tokens work similarly).

It would be like taking a piece of gold, inscribing it with something, and now being able to sell it for more than it was originally worth. It’s why one gold coin can be worth $1,900, while another of the same quantity can be worth millions.

Or said another way… it’s why an ugly piece of art can be worth millions as alluded to in this old tweet.

For anybody saying Bitcoin's inscriptions / ordinals / digital artifacts are ugly...

— Ben Lilly (@MrBenLilly) 6:25 PM ∙ Mar 10, 2023

(Seems I'm talking myself into believing what is happening right now is digital gold jewelry if it's 'art') https://t.co/7g6Hxc3POl

This era of digital gold jewelry is here. And it’s causing the amount of demand on the bitcoin network to grow.

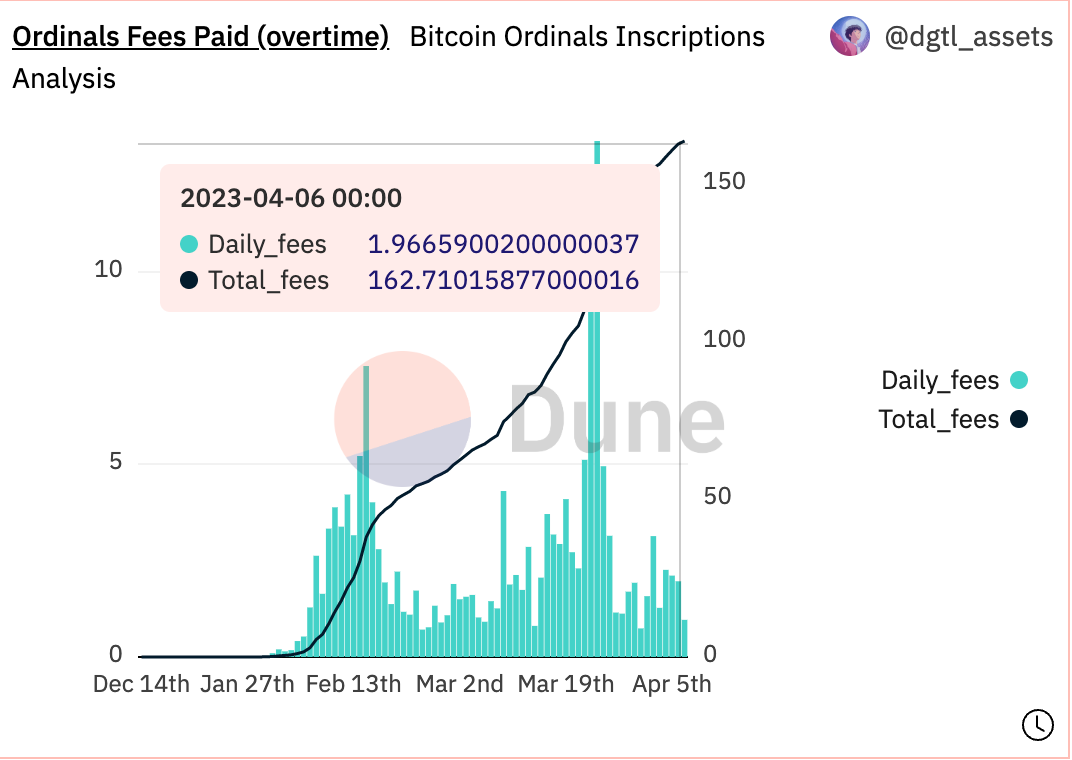

Here is a quick snapshot showing over 160 bitcoin has been paid in two months for these inscriptions.

The use cases are only growing.

In fact, some users are trying to mint mini collections of tokens. You can see a list of these shitcoins here. And overall, there are now over one million inscriptions as of a few days ago.

The takeaway here is that because of the variety of possibilities, inscriptions are not going away.

And that’s great, because they represent new, organic demand that is not based upon hopes of institutions arriving. It’s important this distinction is made as in 2020 and 2021, the institutions many thought were arriving were in fact just speculators.

Ordinals and others represent actual demand for storage space on what is viewed as the most secure decentralized form of storage for bytes. The cost per byte is now rising. It would be unwise to dismiss the trend.

The issue at the moment is these projects lack a good user interface. Sure, Stamps recently upticked the original ordinals use due to how their data cannot be pruned away by nodes.. But the fact is, no matter the method chosen to inscribe, the ability to view them is poor. UniSat Wallet proves this if you go take a look. It is hard for people to look at an Ordinal, let alone trade them at scale like an NFT on OpenSea. Eventually, developers will get there.

For now, we are excited to be involved with Sigle.io. It’s a user interface that has already begun to incorporate ordinals into its own stack. In fact, you can view our own ordinal here: It’s #392347 and one of the first 100 ordinals to use the news (blog) standard.

V3 is NOT for everyone

A recent event on April Fools’ Day, enabled decentralized exchanges (DEXs) to take the next leap forward. And it’s creating quite the frenzy..

At the start of this month, the license for Uniswap’s v3 code expired.

Uniswap’s v3 released in 2021, representing a significant upgrade in how DEXs work.

Before, Uniswap’s v2 design relied on a method called constant product AMM. It’s an equation where the product of all the tokens in a pool remains constant. Here’s a quick example of how it works…

If a pool has 100 ABC tokens and 50 XYZ tokens, the product of the pool is 5,000. And that product will remain constant as users swap tokens in or out of the pool.

Meaning if somebody deposits 10 XYZ tokens into the pool and receives the proportional number of ABC tokens, the equation will rebalance the pool so that the product will still equal 5,000.

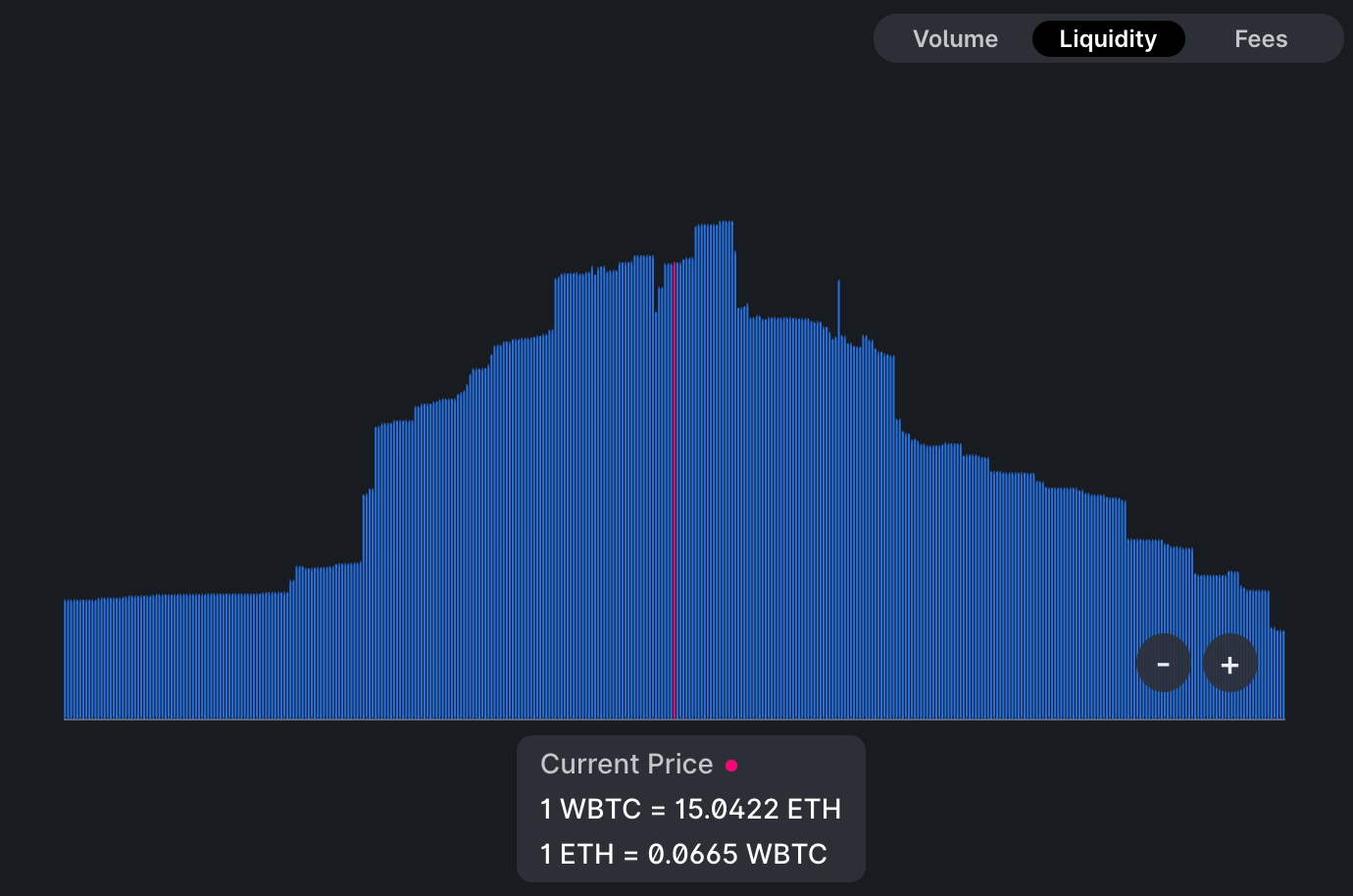

But the upgrade to v3 changed this model to enable what is referred to as concentrated liquidity. Essentially, a provider of liquidity can set a range in which their capital is used as liquidity.

This change in design resulted in liquidity to be a bit more “bumpy.” You can see this in a very popular wBTC/ETH pool in v3 below. In v2, this liquidity profile looks more like a symmetrical distribution curve.

The upgrade is a leap forward in DEX pool designs. And when Uniswap’s license expired, projects started to fork the code for their own purposes.

Since the expiration, we have already witnessed projects like SushiSwap and Trader Joe release their designs based upon Uniswap’s v3. Many in the industry knew this would unfold in the weeks to follow the license expiration. It’s in part why some believe Trader Joe’s native JOE token enjoyed a strong end to March realizing a 215% gain.

But the truth here is that the license being dropped on April Fool’s day will only fool traders on price action related to this event. Protocols will be in a race to add this new swap design to their suite of offerings. But overall, I’m not hopefully this will cause a major uptick in volume across the board. Which is why any price action based on this news may only be short lived.

The other reality which some of our token design researchers mention to teams we work with is that v3 is not for every project. Most projects are better off with v2 designs, especially when launching a token. The concentrated liquidity is for more advanced markets. It really requires more liquidity to thrive. Not to mention, most liquidity providers are not knowledgeable enough to set good bands for their liquidity. As a result, they don’t benefit.

All of this to say, v2 is not to be overlooked yet.

FedNow is only the start, Nexus is the endgame

The global payment network looks to make banking apps like Venmo and Zelle obsolete. That’s essentially what a developer just said of Nexus.

The reason for why we should take note is that Nexus is a project of the Bank for International Settlements (BIS). The BIS is essentially a consortium of central banks. And Nexus is its non-blockchain-based solution to enable cross-border payments while staying true to KYC/AML rules.

I won’t get into great detail here on how the system works, as I haven’t spent enough time myself diving into the technical details. What I do know is its testing has already begun.

In 2022, the European Central Bank, the Central Bank of Malaysia, and the Monetary Authority of Singapore were testing Nexus. The next phase of this collaboration will also add the central banks of Indonesia, the Philippines, and Thailand.

It’s a pretty major push by the BIS. And in a recent podcast by the BIS, one of Nexus’ developers made an off-the-cuff remark that it will render banking apps (like Venmo and Zelle) obsolete.

This type of push for new, retail-facing payment systems is happening at multiple levels. For instance, in July, FedNow will be introduced to the public. It’s a way for the Federal Reserve to now offer its own innovation when it comes to payment tools.

For those that are following along, you know I see the FedNow release as the primary reason for so much regulator crypto hate mail of late. It’s understandable when you realize FedNow is several years in the making. And those that are pushing its launch want to maximize its success.

But with Nexus, we see these central banks are not just connecting with their own base, but gaining interoperability with other central banks globally thanks to BIS.

Which is really me reaffirming that the regulatory hate mail is not likely to cease soon. The best response that we can see is elected officials pushing back on CBDCs in the hope to get a competitive market on payment solutions.

That’s it for the first issue of Espresso: The Blend. Please drop some feedback below or hit the like button if you enjoyed it. And for those that celebrate, Happy Easter.

Your Pulse on Crypto,

Ben Lilly

This newsletter is sponsored by Bybit. Be sure to try out the exchange here, and take advantage of all they have to offer today.