The Anomaly

Market Update: 8 Jan 2024

For six months, your thesis is crushing it.

It was crafted during the doldrums of crypto and served you well to date.

Literally, no reason to change course.

Yet, here we are… ETF fervor is in the air. A new tweet comes down your timeline saying SOL is your ticket to Valhalla. Your favorite Twitter account is stating ETH is buried underground and Bitcoin mining Maxis are unloading the Celsius estate’s ETH holdings to drive the token down that last few bit until its declared dead.

And suddenly you read some new tweet about DePINs unlocking new infrastructure paradigms of the future.

Welcome to the bullish crypto market. Noise is abundant.

Each tweet and media piece is vying for your attention. Five tokens to make you a trillion-billionaire. The rarest micro cap token that will turn $1,000 into a million bucks. And some new contract address that some guy in some other chat that has a cryptopunk avatar mentioned is the “next doge”.

When did you suddenly need to lean on everybody else?

You bought when everybody told you crypto was dead. The thesis you formed when the word Bitcoin was taboo during the holidays has netted you triple digit returns.

Why change your approach? It’s still early. Lots ahead… Trust yourself. Don’t let the excitement and fervor cause you to make the most common mistake in crypto…

Losing your money.

Heed this advice, please. The most common mistake I see crypto traders and investors make is not remaining disciplined. You have your game plan, stick to it.

I don’t tell many people this, but I challenged myself this cycle to do something seemingly simple. Put $250 in Bitcoin every week, for about six months. It’s a simple process that some retail investor could have done.

The stack has since grown. I stopped the weekly purchases after BTC rose above its 200-day moving average most recently. And my only move now is to change the amount to ETH when the time is right.

Then later on, I’ll move small amounts of the portfolio into smaller caps. I’m basically following the thesis I laid out in this video.

That’s it, that’s the plan. Sure, I have other accounts, but this is enjoyable to me since it truly distills my philosophy about crypto trading… Stay true to a process and thrives on making less, not more moves. It’s also about having a game plan that doesn’t change with the winds of crypto twitter.

Then finally, I have a tangible goal in mind. It’s not only a dollar amount, but a plan for those dollars.

And as soon as I have enough for my goal (+ taxes), I’ll shut that portfolio down. I say that because we should all set goals that we know we can attain by staying true to our own processes. It helps keep the mind focused and less distracted on all the nonsense that exists day-to-day that can sway your opinion.

I apologize for that little rant there, but seeing the amount of speculative discussion on an event with minimal historic precedent is getting hilarious. What will be even more amusing is a week after the ETF has been approved, everybody will be trying to push the next narrative.

This is crypto, and you can avoid some of this by focusing on data, metrics, and models that you believe in.

That’s sort of our way of thinking at Jlabs Digital. We don’t buy into the narrative, just look to find ways to apply data and metrics to such gut feelings… With the goal of being able to make a decision without having to buy into some thread we read.

It reduces stress and makes for a more confident approach to metrics. Many of these screeners will be coming to J-AI Platform in the coming months… So stay tuned for more on what we mean here.

In the meantime, let’s take a look at what’s taking place in the market during this ETF frenzy so I can add yet another mindless take on what is shaping up to be the week of the ETF.

Crypto Update

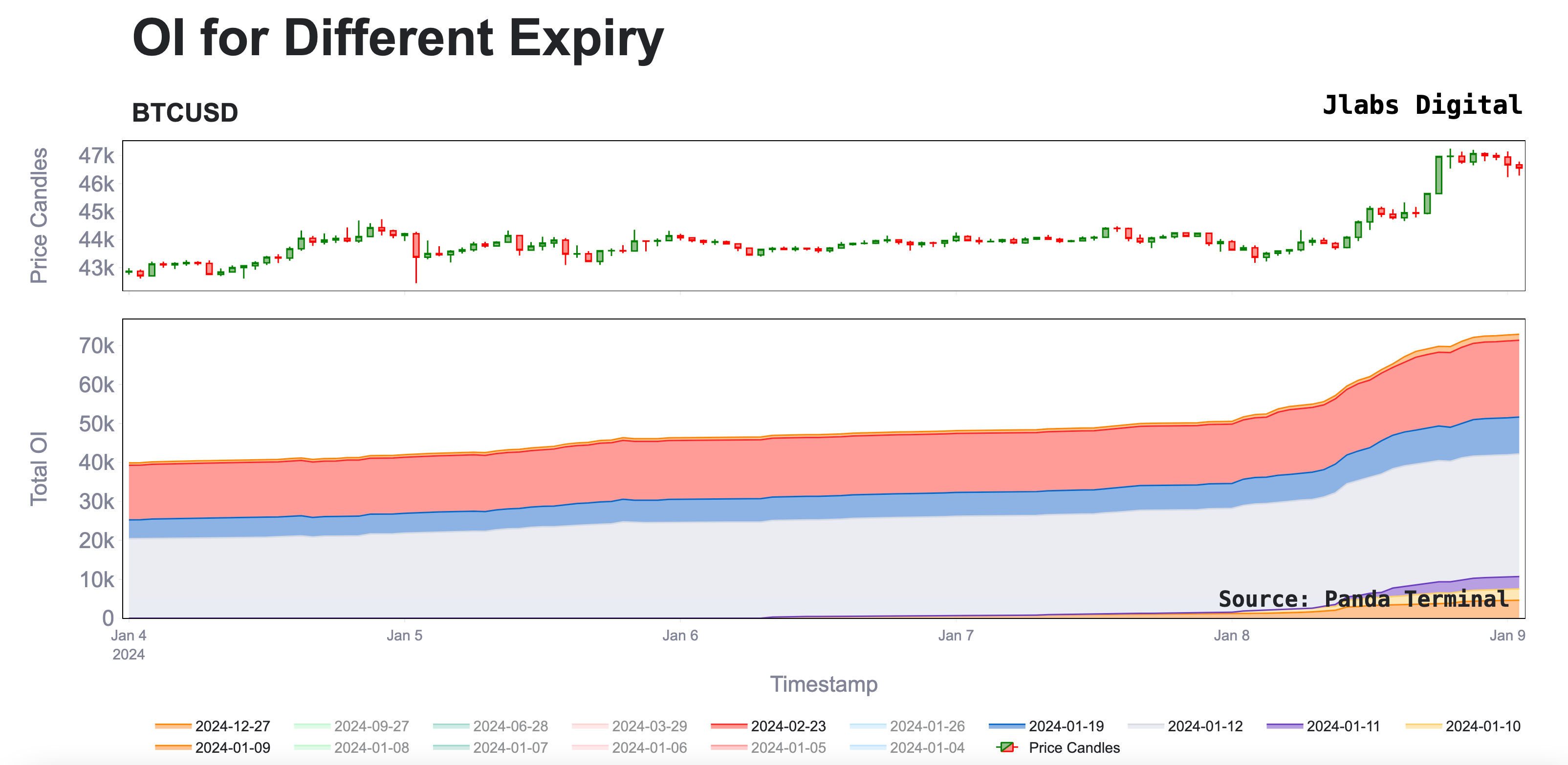

The last week of December saw about 150k worth of Bitcoin contracts expire. We said during that week we wanted to watch the market for when that open interest returned.

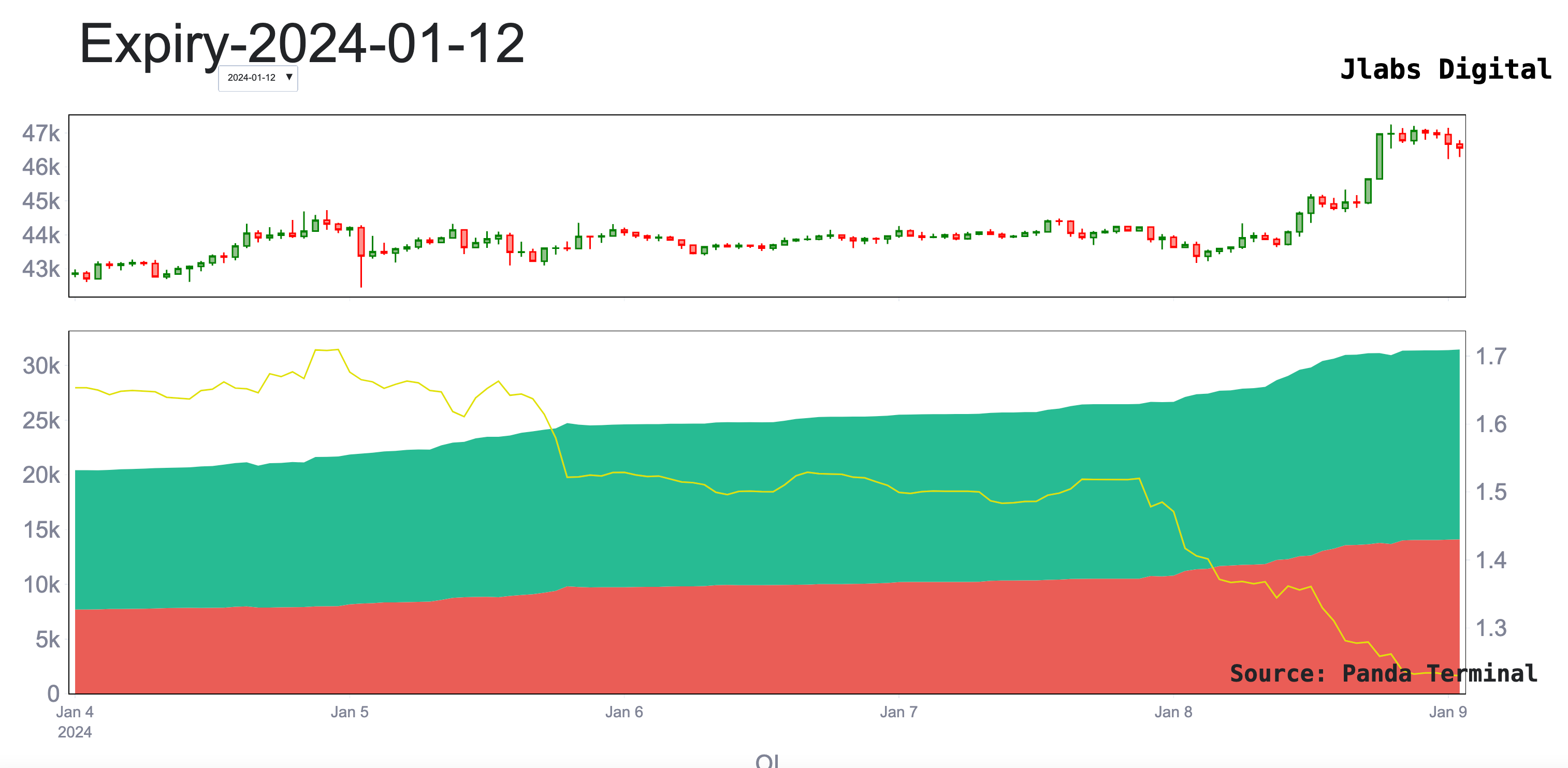

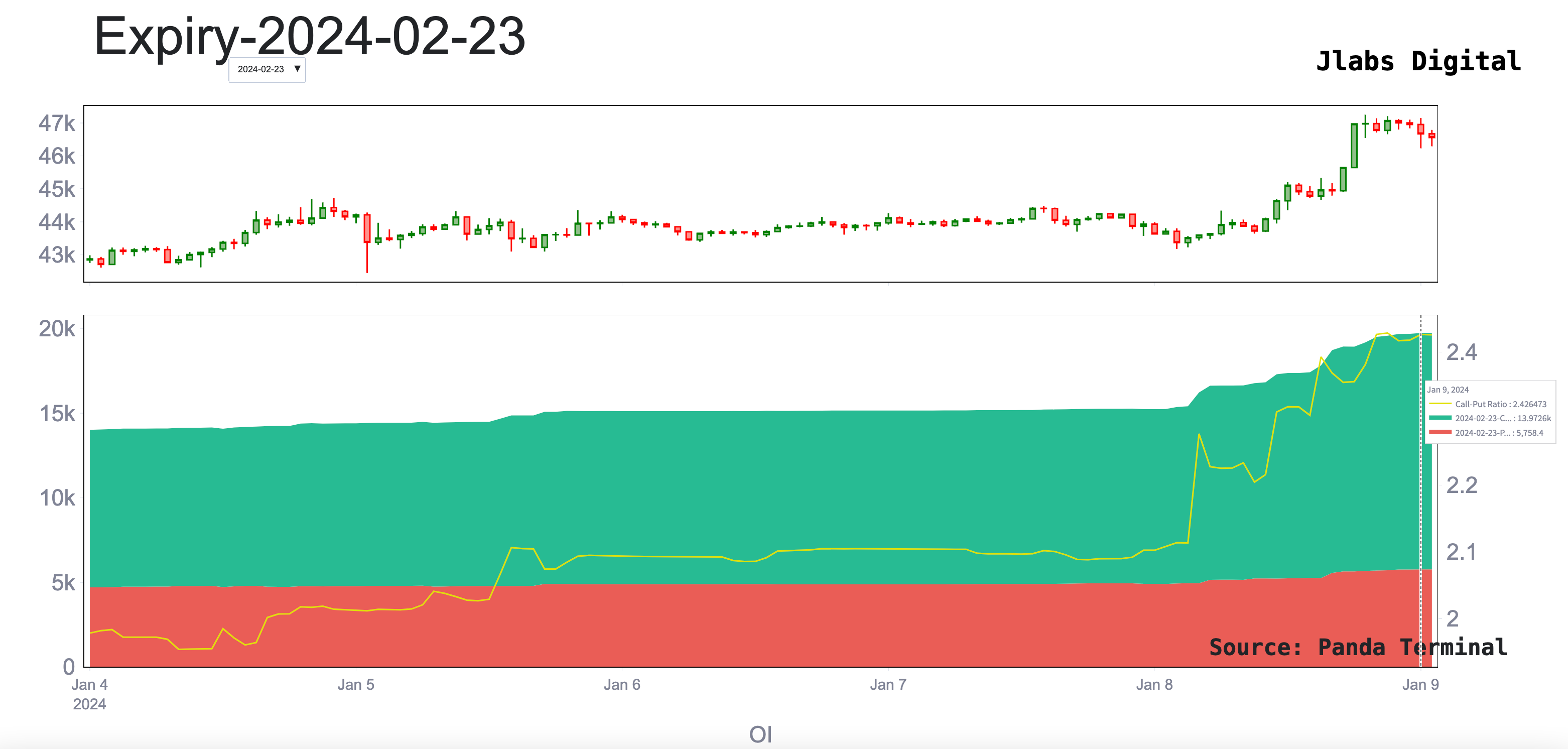

Well, it hasn’t necessarily returned. However, there were some contracts that realized some noticeable uptick in open interest as shown below. These are the January 12, 19… February 23… And December 27. The January 12 was the big move during the last 24hrs.

January contracts showed a noticeable change in the yellow line, which is the call to put ratio. As it trends down while open interest rises, it means more put contracts opened up.

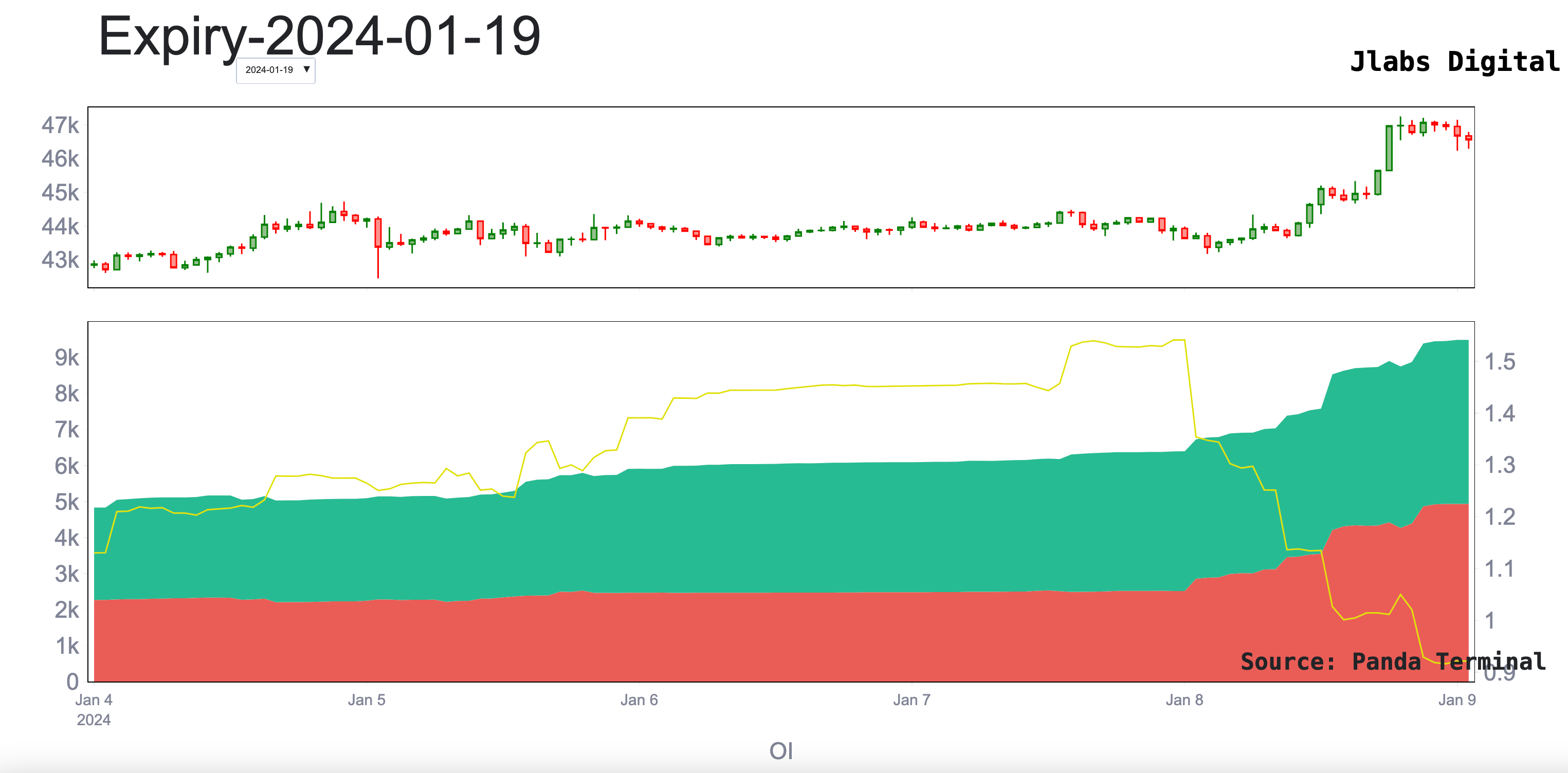

The January 19 contract had the same, just not a lot of open interest in general relative to the January 12 contracts.

But check this out…

February had an uptick in calls.

And December the same.

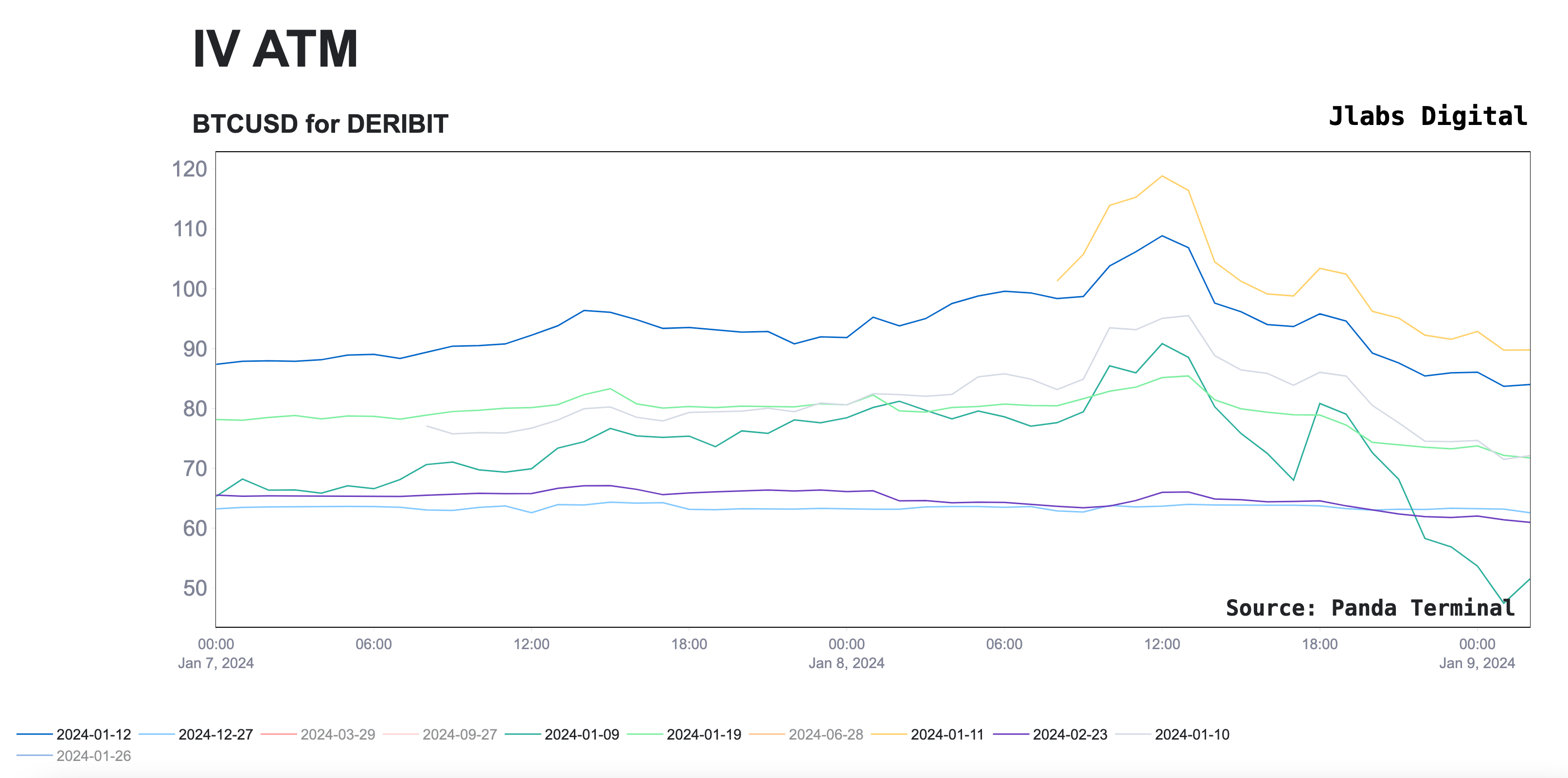

For more on the why, we can look at options pricing. For options, the main factor we care about is IV or implied volatility. It’s essentially the premium that exists on various contracts. And it’s a way we can tell how the market is positioning itself.

Here is that same timeframe for IV for the contracts of interest. We can see that IV rose slowly, then spiked before getting smashed down… As open interest climbed. That’s the key there… IV was dropping as open interest climbed.

To see what I mean, here is the price chart to better see when IV spiked compared to price… I placed a white vertical line where IV spiked.

Volatility then went on to explode, but IV did not move after that. It might seem minor, but it’s notable. As for the red lines, I’ll get to that in just a moment.

For now, keep in mind that a rise in options market IV preceded a rise in true volatility in price. And now, the market is positioning for the downside in the near term with the rise in put contracts opened up.

Now, that’s what the options market is showing. But what we saw on our end outside of the options market was something a bit similar.

In fact, with our CARI indicator - an alert that tells us volatility is imminent - flashed prior to the recent move. It’s a great tool for options traders.

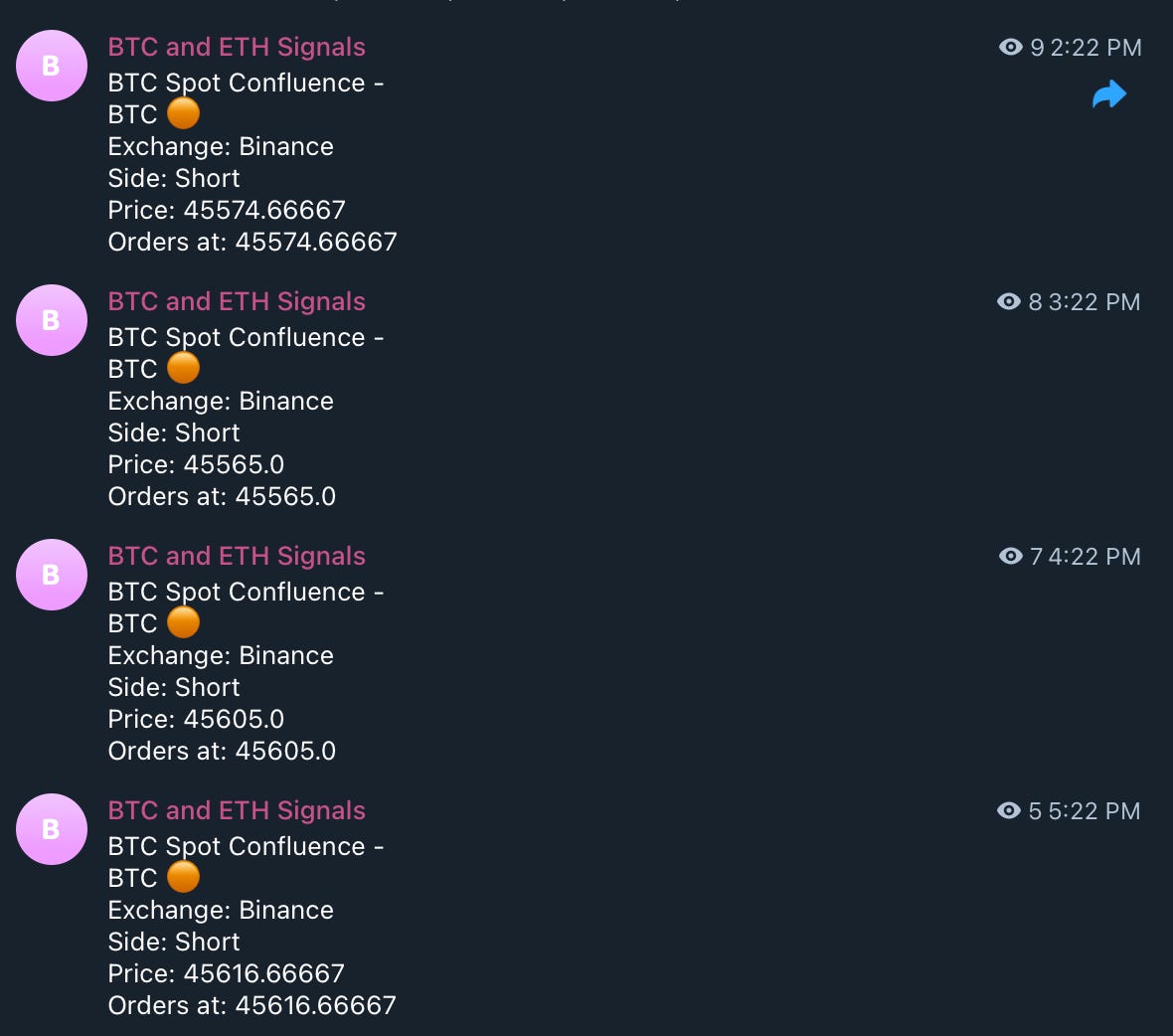

What also happened was J-AI, our autonomous trading software, begin to exhibit a short bias. This was based predominately on the orderflow data taking place after the big move higher. Meaning the price rise was not realizing a follow up on the trades hitting the tape.

Here is the bias showing itself in one of our alert systems. I drew those red lines in the price chart from earlier based upon these alerts below so you can see it a bit more easily (New York timezone, Jan 8).

So what does this all mean… Options IV is dropping after the pump… J-AI leaned bearish after the pump…

It’s hard to get too excited in the near term on the ETF news. I wouldn’t even be surprised if we see the early warning signs of a delay surfacing in the market over the next 24hrs.

The market structure is beginning to allude to a correction coming.

But instead of being swayed from yet another market opinion, it’s important to stay true to your earliest beliefs in the market. Those beliefs formed months ago… And then read the data… Assess what the data says, and compare it to your thesis.

We truly don’t know what to expect. The inflows might not be priced in, and such things would become apparent on spot quickly. But if it’s a fast paced wick higher into the $50k region with minimal follow up on spot or orderflow… Then recall how the market structure changed this week before the news.

It’s exciting times and we are living it. Glad to be here with you all.

Until the approval/delay news…

Your Pulse on Crypto,

Ben Lilly