Taking the Bait

Guest essay from @tempting_beef

My cats hate being brushed.

It’s mostly my fault. I didn’t brush them as kittens. So they never got used to the process.

And for one of them it’s a necessary endeavor with her long fur that easily mattes.

But its no easy task.

To do it requires some subtle coaxing to where Sansa wasn’t aware of what was happening until it was too late. Its a point when I strengthened my grip and Mrs. Lady Beef grabbed the brush.

But after going through this dance several times now, she’s developed a sixth sense for when it’s about to happen.

So we have to be a bit more sneaky…

Often I’ll grab a tub of treats and lure her over. Subtly shaking it to draw her near. Then after Sansa enjoys a couple of treats, I’ll scoop her up.

The sneaky part is while I’m luring her in with delicious snacks, Lady Beef fetches the brush. We keep it out of sight and out of mind until the last moment.

Then once underway, we move swiftly and gently.

After… she gets a reward.

And after the first few days after the drop in bitcoin, I’m starting to feel this way about the market. I’m suspicious of being lured in with delicious bullish price action.

But what I’ll show you today is on-chain tells a different story...

Hello everyone, @tempting_beef here. I’m back at it again with some more prime on-chain cuts.

Today I’m focussing on bitcoin, and right now it’s important to be laser focused on where the overall market is headed.

After such an aggressive sell off and bullish structure that’s still yet to be confirmed, we need to stay on our toes.

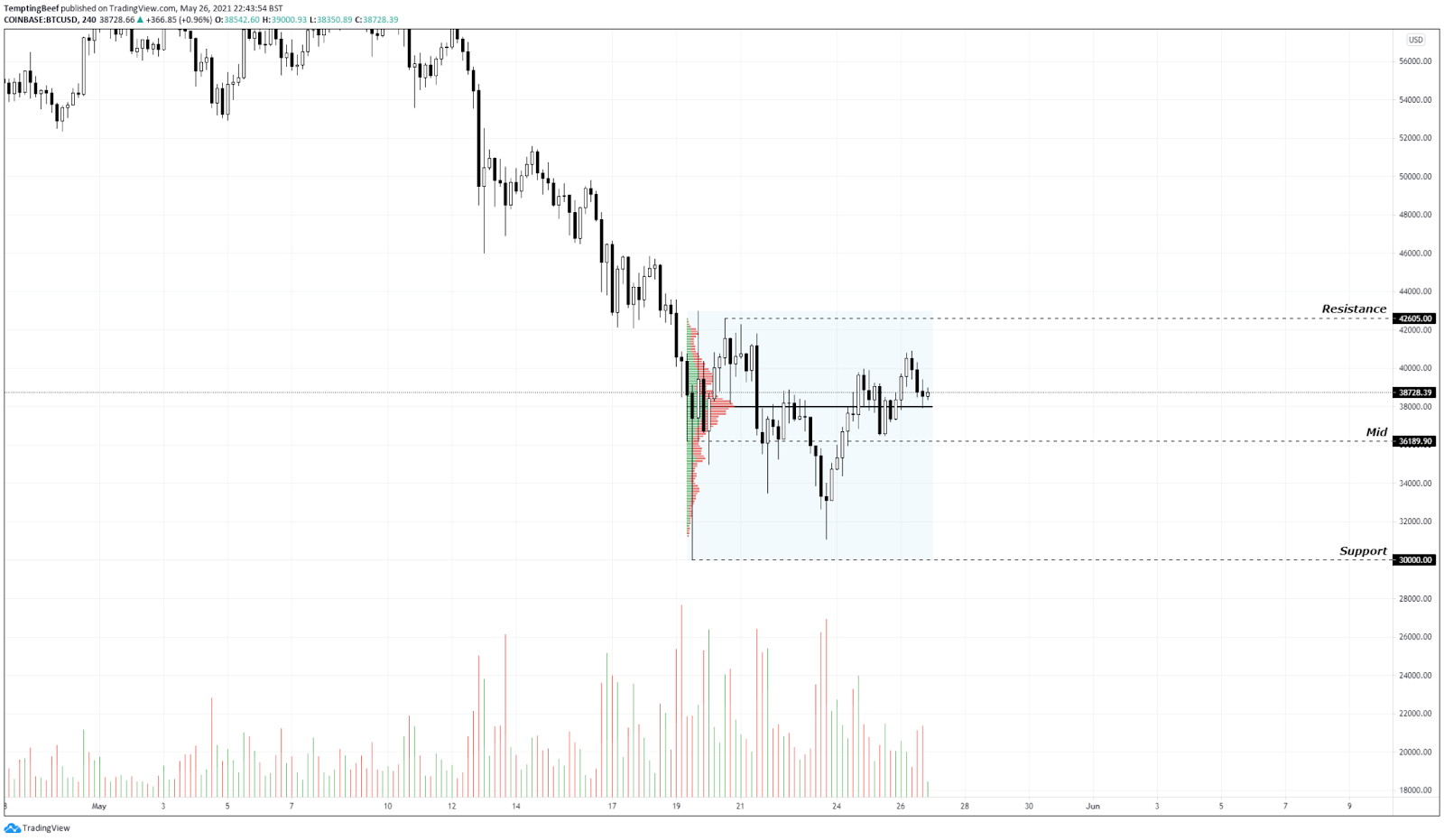

As you can see below, BTC is currently in this trading range from 30k to around 42k. It is comfortably hanging out in the upper part of the trading range for now.

These are the higher lows that act as the tempting snacks I was talking about. It’s making a lot of people very excited about the re-ignition of the bull market… but I’m suspicious.

I’m suspicious because we already know that big players offloaded in huge quantities on the recent sell off. And they need more time to re-accumulate.

Any rally right now would be too soon, and it would quickly be met with heavy resistance.

Let me show you what resistances I’m referring to using on-chain data.

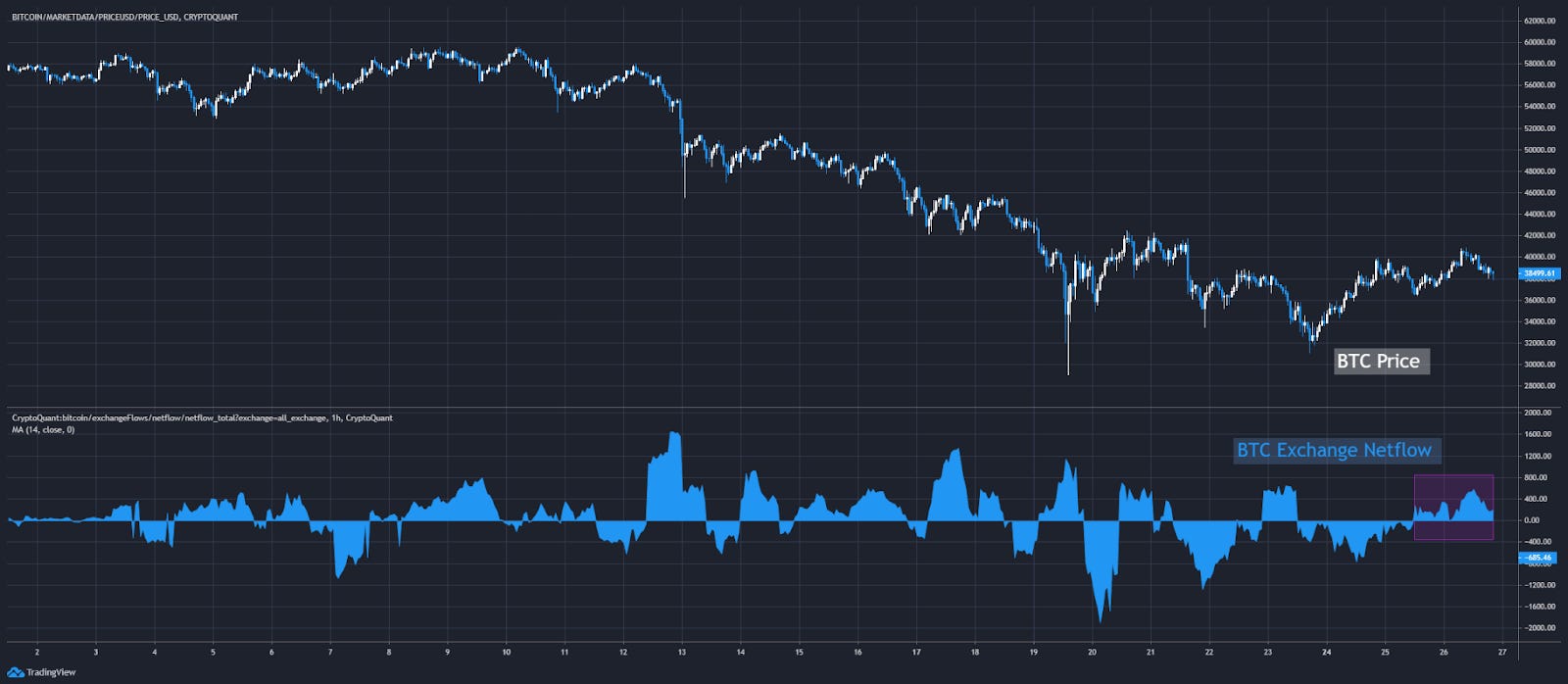

During the sell off we saw huge amounts of BTC enter exchanges. The bottom half of the chart below shows BTC exchange inflows mean. Its a way to view the amount of bitcoin entering exchanges. And we saw a lot of large spikes as price cascaded lower.

These indicate large swaths of bitcoin getting sent to the exchanges.

And yet, we’ve seen only a few spikes in outflows.

Clearly there was some dip buying, but not much since those lows per the chart below.

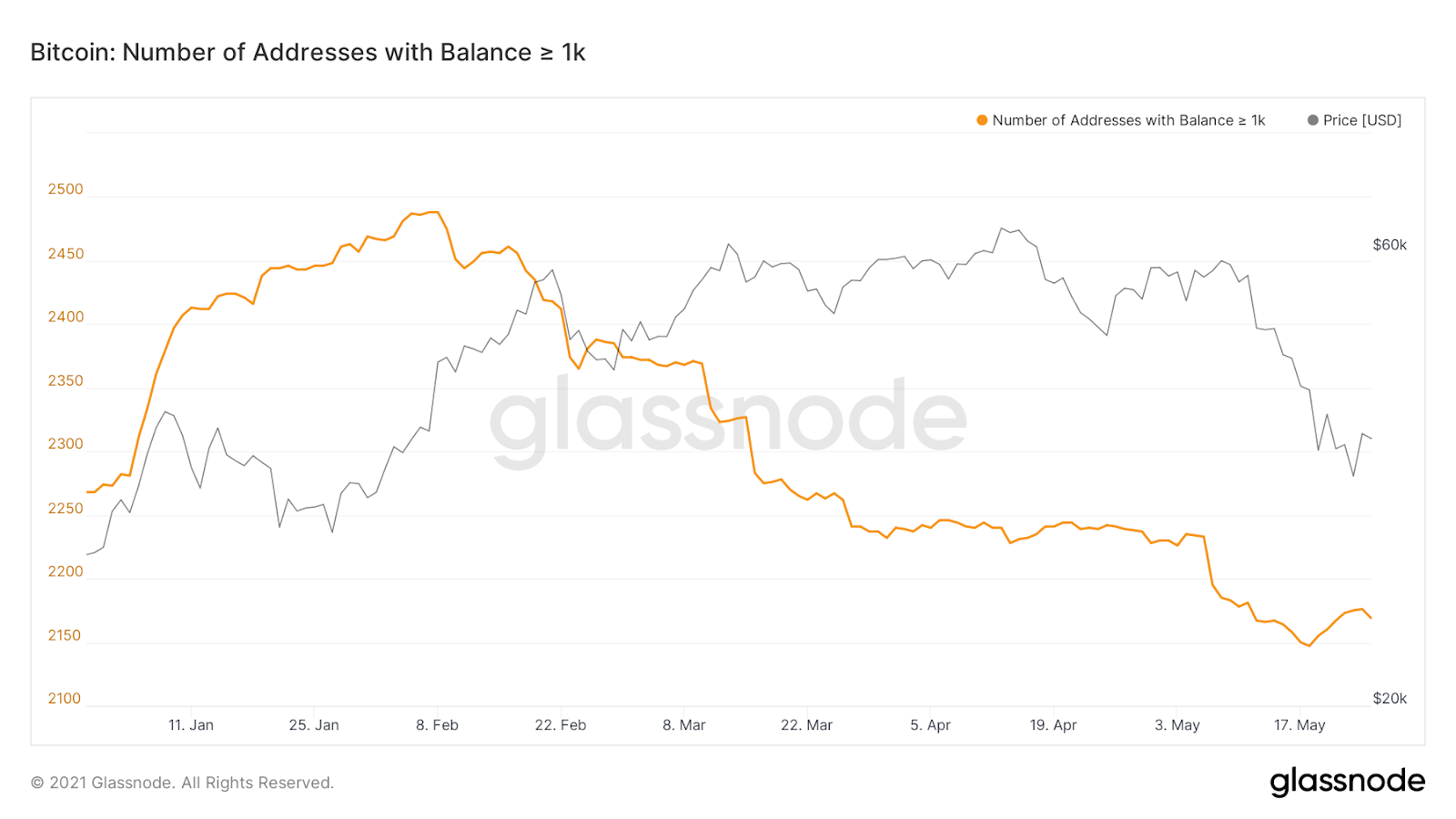

Furthermore, when we track the number of addresses with Balance > 1k, we see a limited increase in whale accumulation wallets.

Why?

Likely because they need more time and want to buy at lower prices. Whales aren’t looking to buy at the top half of the trading range.

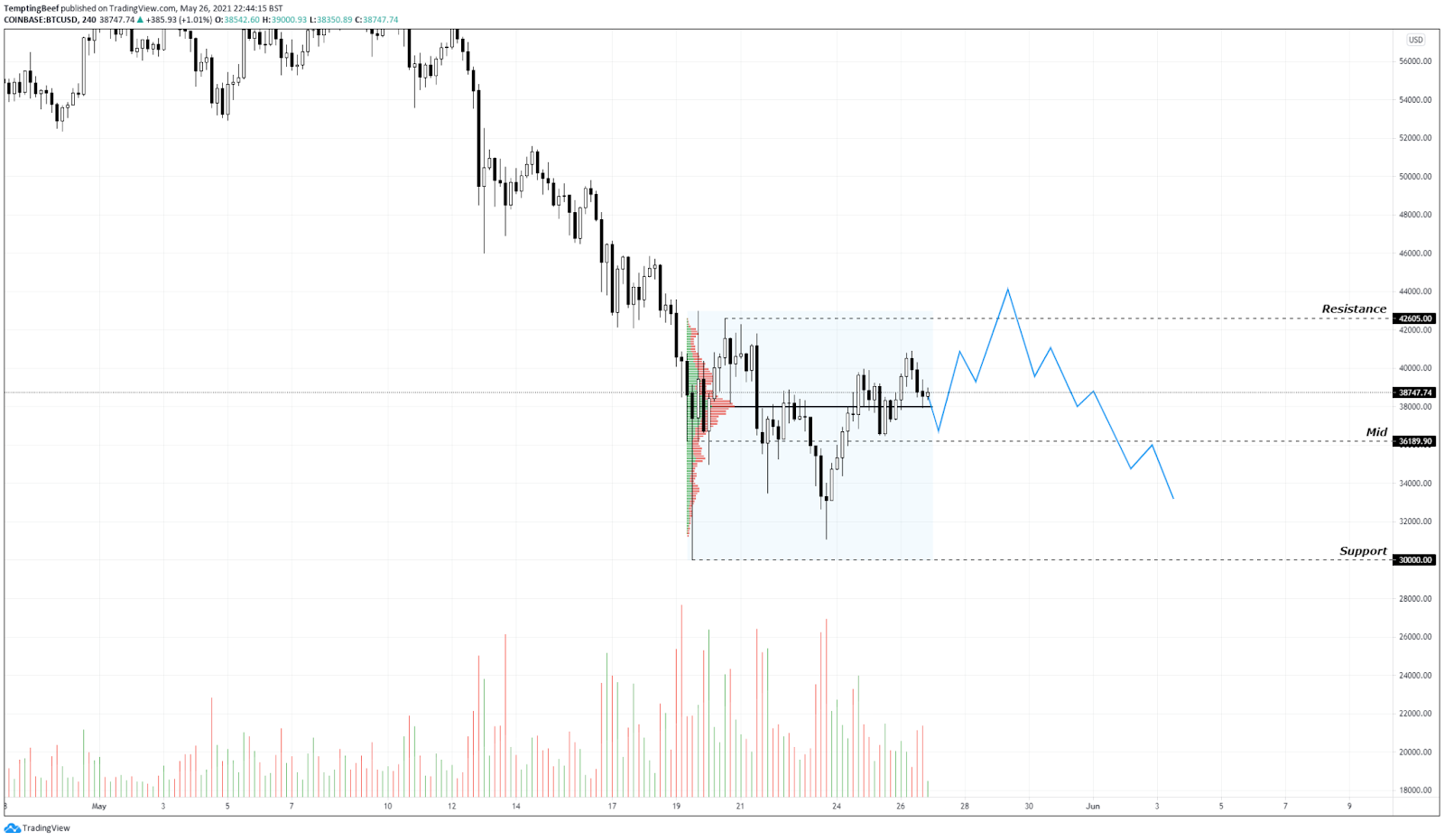

It’s why I wouldn’t be surprised to see some sort of upthrust that pokes its head out the top of the range and get rejected.

This is exactly the sort of thing that would trap a lot of retail traders at pretty high prices followed by some aggressive selling to the downside that would trip stop losses, creating more selling pressure and panic.

And better prices for accumulation.

I’ve layered on a volume profile just to highlight that the majority of the volume so far has occurred in the top part of the trading range. Which means there is more distribution going on than accumulation as we progress through this range.

We’re also still getting some fairly significant spikes in inflow mean with overall net flows leaning positive right now per the chart below.

Which tells me patience remains critical here.

If you are able to do so I believe you’ll be rewarded with a better entry.

Don’t be lured in with the promise of a tasty snack now, only to be followed up by a rough brushing.

Serving up on-chain cuts

@tempting_beef

P.S. - Ben Lilly here. I hope you enjoyed @tempting_beef’s essay. I always look forward to his weekly essays he sends in.

I wanted to drop in real quick to mention to everybody that if you think you can write as well as @tempting_beef OR you think you have analysis that the world needs to read, please send it over. Espresso is a place to share ideas so we can all improve our decision making. We encourage guests posts just like this!