Swimming Among Sharks

Token Insight: A look into SBF's allocation scheme

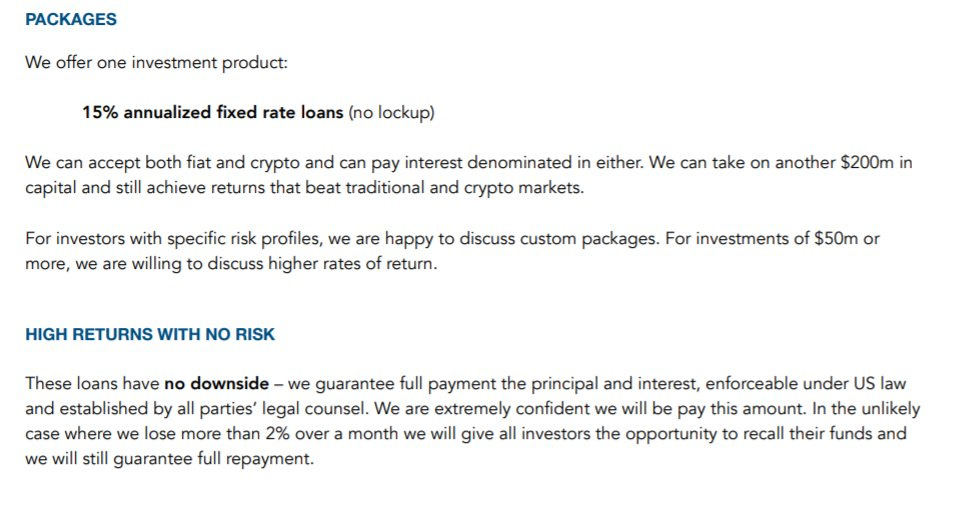

High returns with no risk.

15% return on investment guaranteed.

Even higher returns if you commit a mere $50 million or more.

No lockup. No downside.

This succulent offer was doing the rounds in the crypto-sphere in early 2019:

Sound good to you?

It sure did to investors of Alameda Research.

The offer raised some eyebrows, particularly of one Zhu Su, co-founder of the now-bankrupt hedge fund Three Arrows Capital (3AC).

In Telegram chats that have now come to light, Su questions the legitimacy of this offer and asks why anyone would be trying to raise funds with such generous conditions.

After being told that the firm is legit, and is the dominant market maker in crypto, Su becomes even more suspicious. Why would the dominant market maker in the industry be trying to raise money like this? They should’ve been swimming in cash.

Su ended the Telegram exchange by calling Alameda a “highbrow bitconnect with better social proof.”

We should remind our readers that Su went on to start a Ponzi of his own through his firm 3AC. I guess game recognizes game.

Come April 2019, Alameda was raising money for its new venture, the FTX derivatives exchange. It did so through an initial coin offering (ICO) of the newly minted token FTT.

FTX went on to become one of the most dominant exchanges in crypto.

It all unravelled last week, though, and FTT was at the centre of it.

The original sin

You see, scams in 2017 were rather simple:

- Step 1: Get famous.

- Step 2: Raise money through an ICO.

- Step 3: Dump token on retail.

- Step 4: Drive into the sunset in your brand-new Lambo.

Trouble is, if you are raising money for something that looks, sounds, and walks like a security and then you dump this security (sorry, token) on retail, regulators are not gonna be too happy.

Hell, they might even do their job for once and take you to court. If only.

Anyhow, aside from getting the attention of regulators, you cannot really get that much money off an ICO. Even if you launch a hot ICO and run with the funds, you might only get a few tens of millions of dollars. A couple hundred million if you are very lucky.

But a few tens of millions would never satisfy the needs of the poster boy of effective altruism that is going to lead us to the promised land. For that, it’s billions you’d need.

One way to become a billionaire is to come up with something people would want. Something that people want to use. Build it, iterate, create a successful company and build your wealth over time.

But like, that takes work, man.

Who wants to build tirelessly for years on the off-chance that you create the new Facebook or the new Ethereum?

It sounds much better to come up with ways of defrauding people. At least it does to some people.

And that takes us to the early days of Alameda and the FTT ICO.

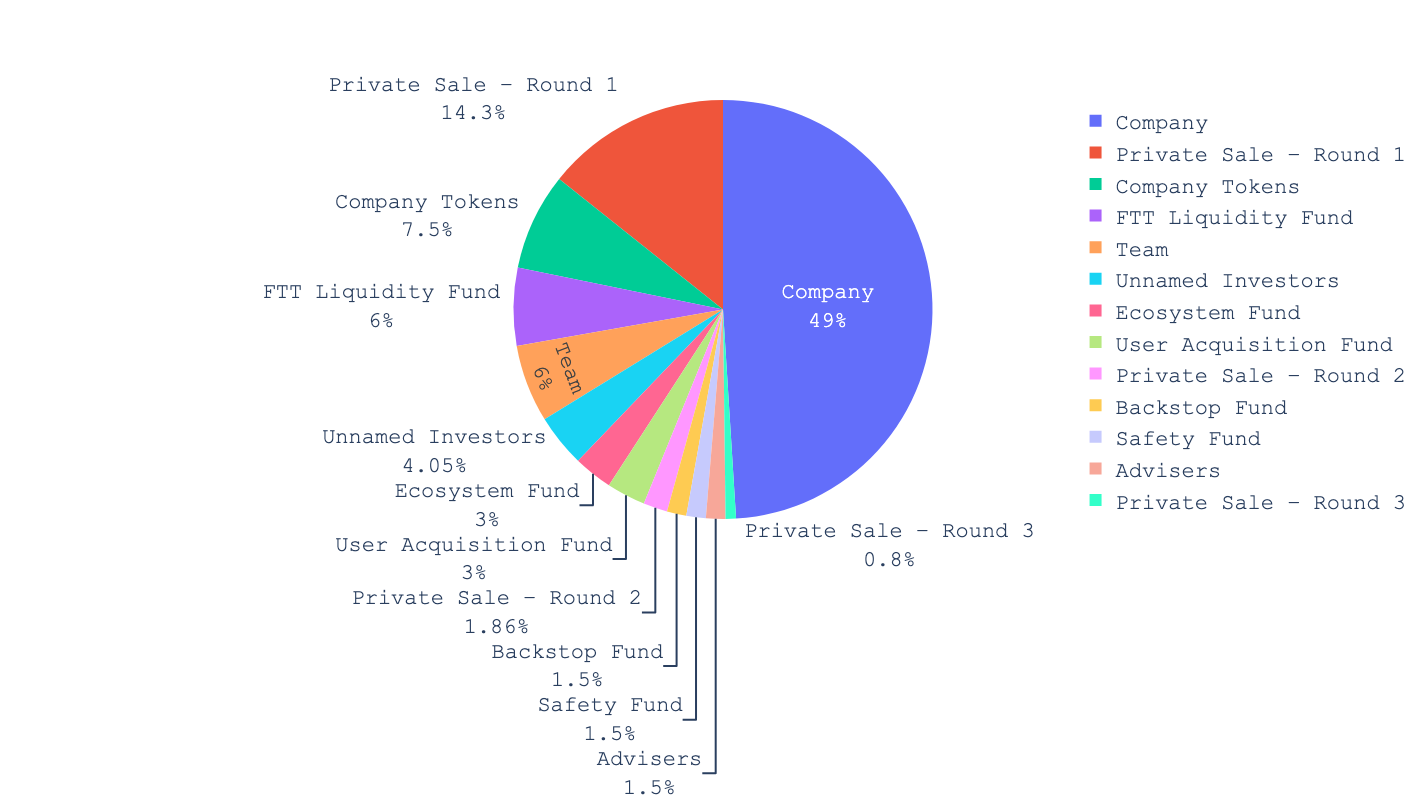

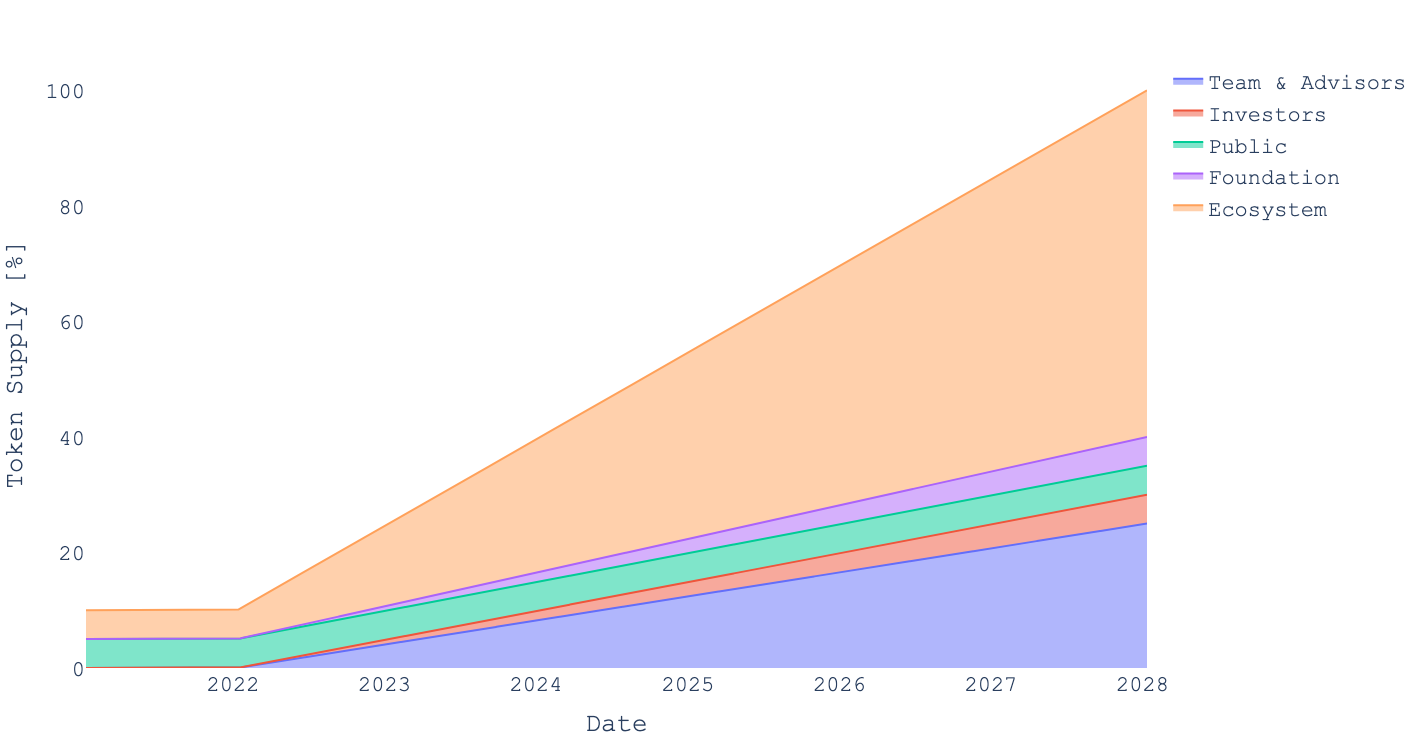

This is the FTT allocation according to FTX:

FTT allocation. Source: FTT Transparency Page, FTT Unlock Schedules

The allocation of FTT is quite muddled, probably on purpose. Most of the different entities above like the Backstop Fund or FTT Liquidity Fund are controlled by FTX at the end of the day. From what we can tell, Alameda and FTX controlled up to 80% of the supply. This seems to be corroborated by some funky transfers of FTT back in September.

This all begs the question, what was the purpose of FTT?

Well, FTT is similar to other exchange tokens. FTX users who stake FTT will see their fees reduced, receive airdrops, or increase their referral bonus rate. FTX also implemented a weekly burn of FTT funded from a percentage of the fees accrued by the exchange.

FTT’s main use case, however, was to be used by Alameda/FTX as collateral.

Alameda would take FTT, give it to a lender, and get certified, U.S. grass-fed dollars in return.

Imagine that.

You create a token out of thin air, a token that you control most of the supply of. You give someone else the made-up token. They give you actual money in return.

And it worked!

I know what you are thinking. If it worked once, why not do it again?

Well, that’s just what Alameda did.

The Name of the Game

At the start of the bull market in late 2020, Alameda led a series of investment rounds in a few Solana protocols. All these projects followed a similar pattern with their token economics, which featured:

- A high supply of tokens,

- A low initial float (float is the token’s circulating supply),

- A high percentage of tokens controlled by insiders,

- A short initial lock-up,

- High inflation after the lock-up ends

To top it off, FTX was often the only major exchange where you could trade these tokens. This made it very easy for SBF and his crew to inflate each token’s price.

Even at high prices, the actual market cap of these tokens would be rather low. This is because the initial float was very low. However, that’s only counting unlocked tokens.

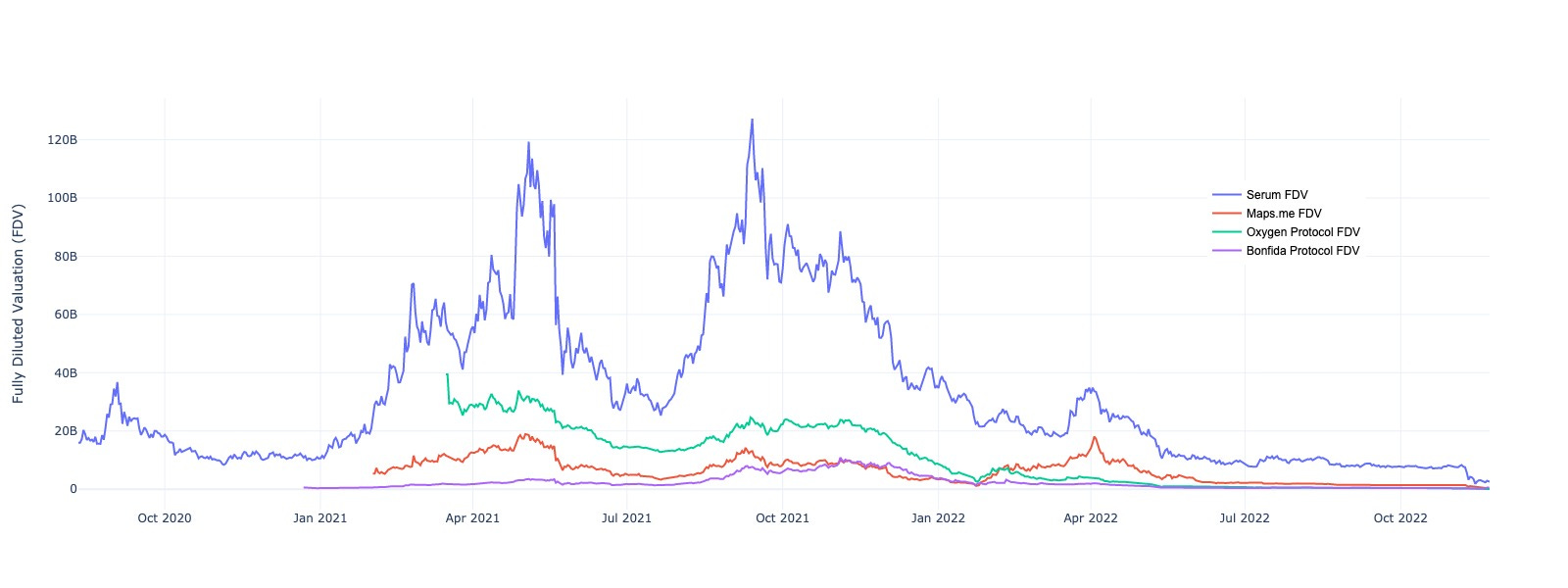

If one were to count both locked and unlocked tokens, the theoretical market cap would be huge. This theoretical market cap is known as the Fully Diluted Valuation (FDV).

FDVs in Solana land reached absurd numbers during the bull market. To illustrate, these are the FDVs of Serum, Bonfida, Maps.me, and Oxygen:

Fully Diluted Valuation (FDV) of Serum, Bonfida, Maps.me, and Oxygen. Source: Coingecko

Serum’s FDV hit a high of $120 billion. On a market cap of just $1.2 billion. Not too bad, considering that the market cap of Ethereum right now stands at just over $145 billion.

This inflated FDV is what permitted Alameda/FTX to borrow as much as they did. They would send locked tokens to lenders, mark them at the price of the unlocked tokens (which they had already inflated), and use them as collateral to get a loan in return.

Now, usually, lenders can liquidate their collateral if the borrower doesn’t pay back their money.

Thing is, locked tokens cannot be sold.

That is why this is all so preposterous.

Not only was Alameda marking them up as if they were liquid. But the lenders were agreeing to it, too!

Let’s walk through an example to further illustrate the point.

Anatomy of a scam

We at Jarvis Labs have been compiling token allocation data for some time. We went ahead and made the token allocations of the projects discussed in this article available for public consumption here.

Let’s take Maps.me, for instance. Maps.me is an alternative to Google Maps. The idea there was to integrate the app with a Solana mobile wallet to offer a “revamped maps experience.”

That most people use Maps.me offline rendering the whole crypto wallet thing useless seems to have escaped the bright minds of the peeps at Alameda.

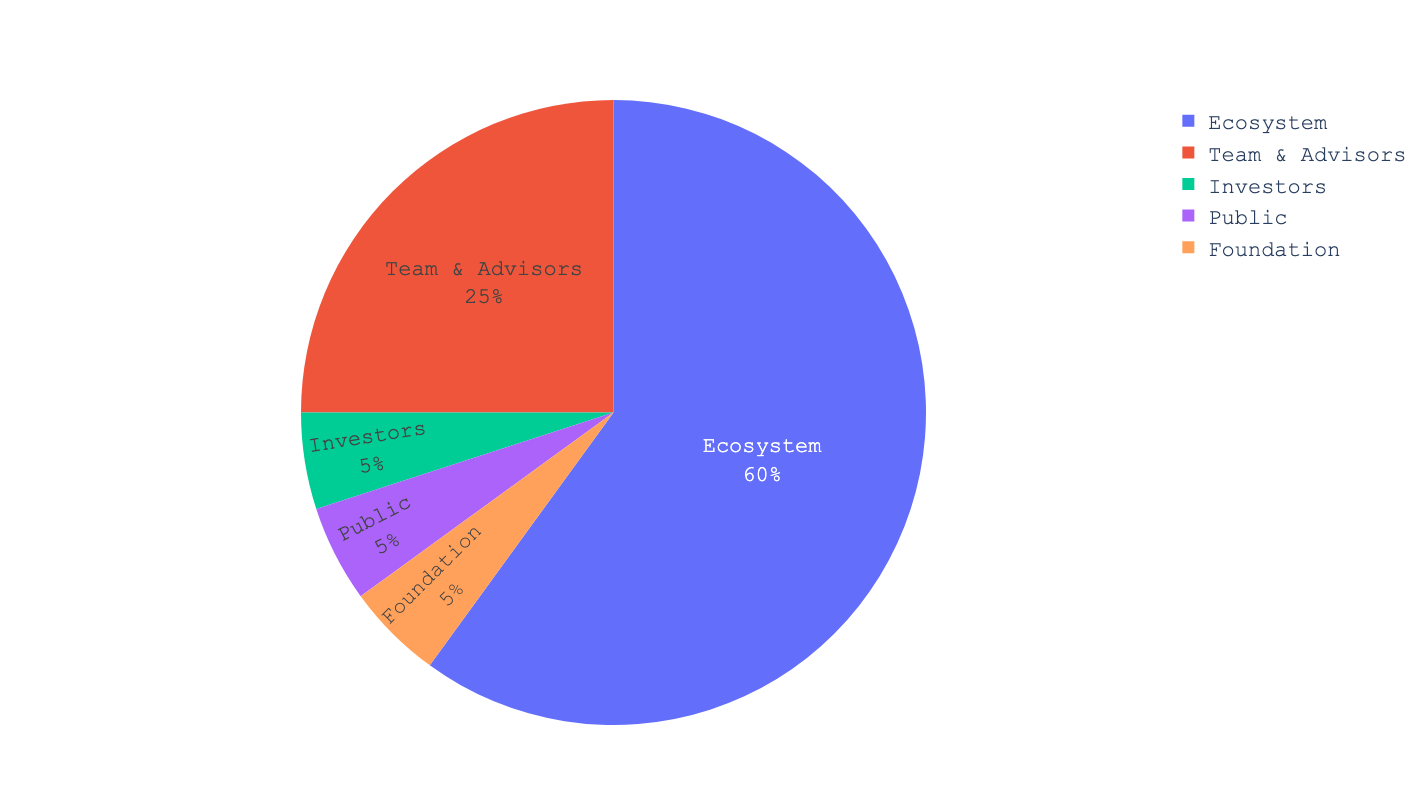

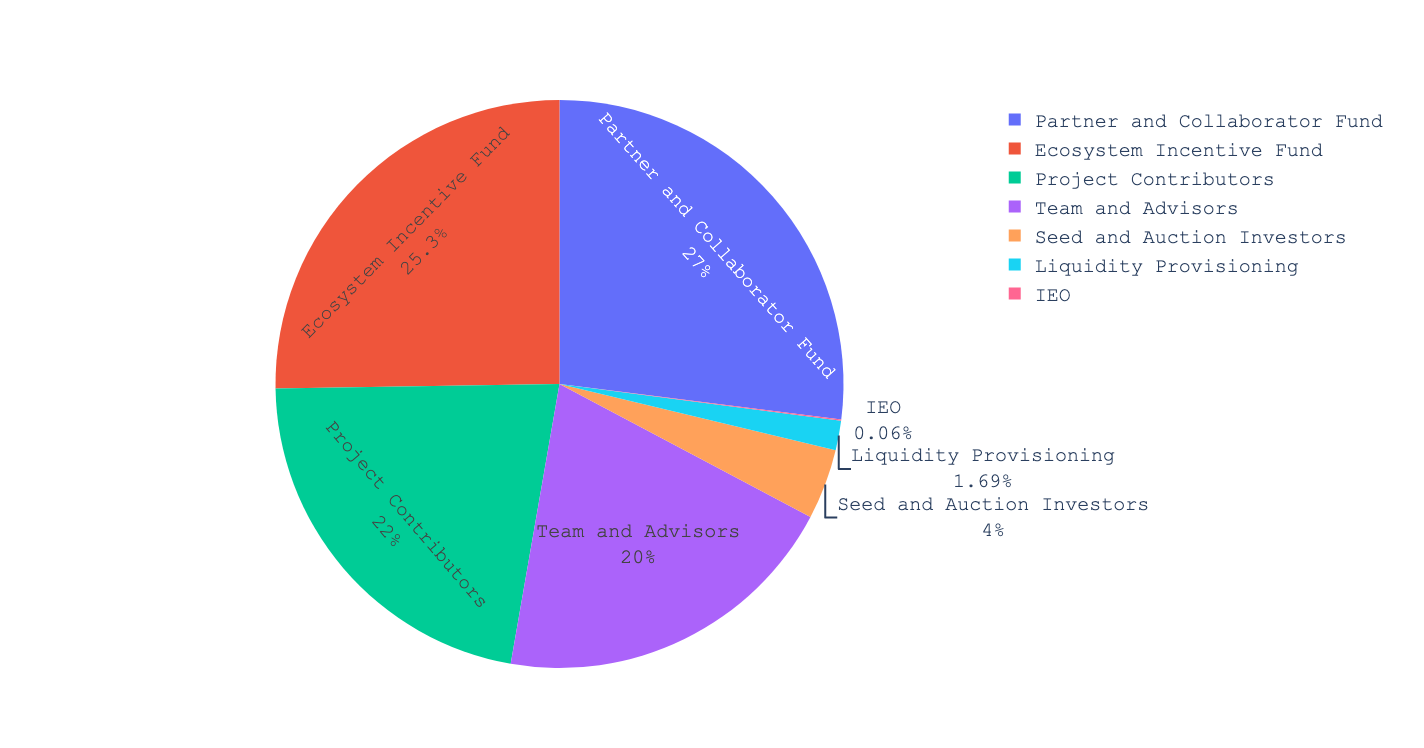

In any case, this is the MAPS token allocation:

MAPS allocation. Source: Maps.me whitepaper

The foundation, the public, and investors each received only 5% of the supply. Team members and advisors received a whopping 25%; the “ecosystem” 60%. And in this case, the ecosystem allocation was just rewards to other protocols backed by Alameda, when not Alameda itself. Suboptimal if you ask me.

The token distribution through time looked like this:

MAPS allocation distribution through time. Source: Maps.me whitepaper

Only 10% of the supply would be unlocked the first year. Then, there would be daily linear unlocks over the next six years for the rest of the tokens. This was quite common in projects that Alameda backed; Serum, Bonfida, and Oxy had very similar distributions.

Now, what does the chart of a project with such supply schedules look like?

MAPS price history. Source: Coingecko

If I were wearing my conspiracy hat, I’d say that those price spikes probably matched times when Alameda was short on liquidity and wanted to get a loan using MAPS as collateral. Alas, I am not, so I’ll just say that is not what a healthy token looks like.

The fraud must go on

Another “neat” little trick Alameda had up their sleeve was to use locked tokens for staking. Why would you, a smart little fraudster, let your locked tokens just sit there doing nothing? Much better to use them to earn yourself rewards or even new, unlocked tokens. So crafty.

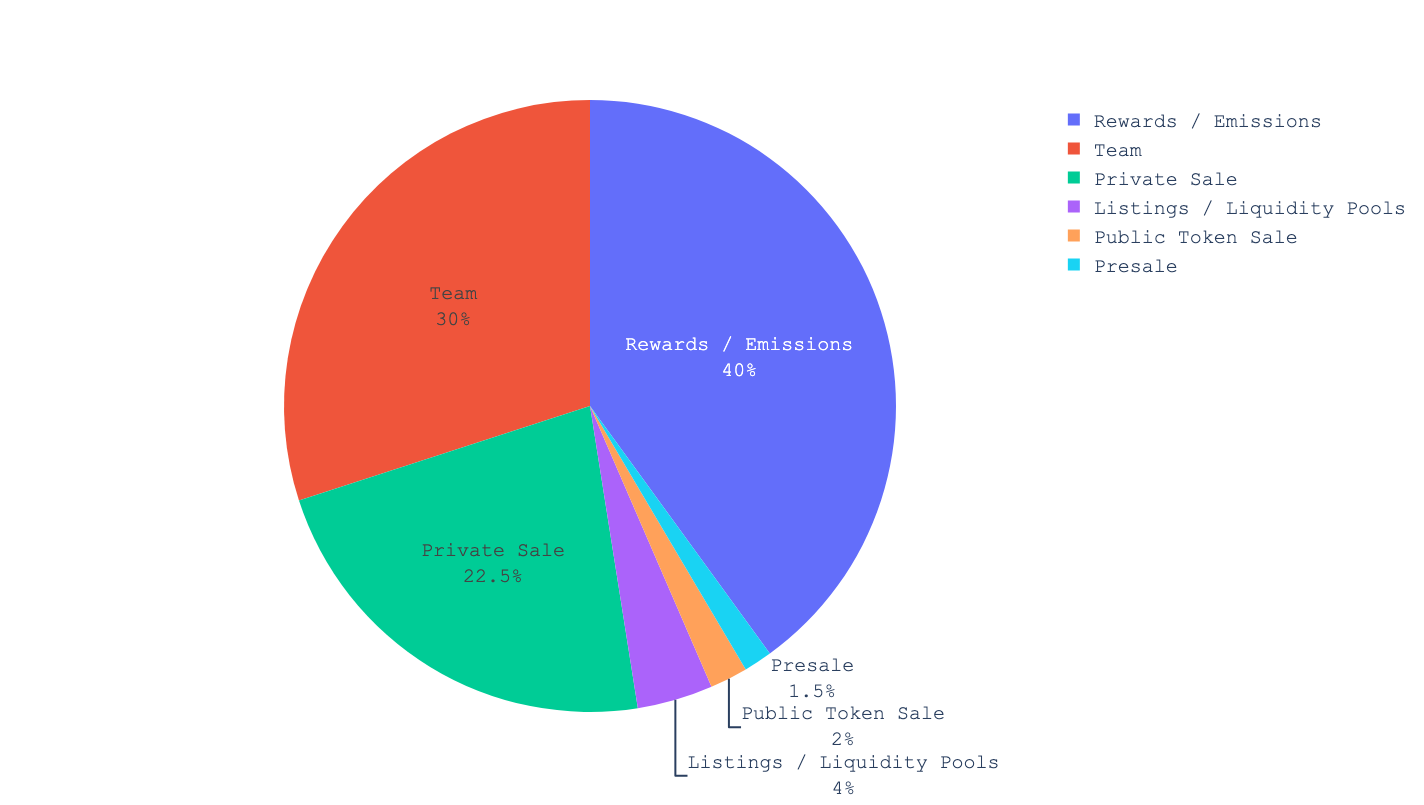

An example of this is the project we mentioned above, Serum. It’s a decentralized exchange (DEX) on Solana that focuses on derivatives. Its governance token, SRM, had the following allocation:

SRM allocation. Source: Serum website

Now, all the tokens belonging to the team, partners and collaborators were locked for a full year. However, they could stake those tokens and receive rewards based on the trading fees that Serum accrued. Since they controlled most of the supply, the lion’s share of the rewards would go to them.

All these shenanigans got rather popular in the Solana ecosystem. Even protocols that had nothing to do with FTX/Alameda implemented them.

It appears they were not in on the scam that the only reason to do the “low float, high FDV” strategy was to use the tokens as collateral.

What they did catch onto was the bit about staking locked tokens and receiving unlocked rewards.

An example of this would be Star Atlas, a play-to-earn game. Here’s its allocation:

Allocation of Star Atlas governance token (POLIS). Source: Star Atlas economic whitepaper

In Star Atlas, the team and the private investors had a two-year vesting period. However, they could stake their POLIS tokens from day 1 and receive unlocked tokens. The team and the investors controlled 54% of the total supply (including tokens acquired from the presale) and 90% of the initial supply that could be staked.

It doesn’t take a genius to see that they would receive the vast majority of the rewards, and either become even bigger whales or sell POLIS day in, day out. Looking at the POLIS chart, it’s likely that this is what they did.

And this is a pity. It is obvious from the whitepaper of Star Atlas that someone had put a lot of thought and care into the governance and economy of the game. Alas, the economy of a protocol with a poorly designed token is destined to fail eventually.

If you are trying to build a healthy token economy and/or protocol, there are much better ways to do it. You can get in contact with us to discuss how. In truth, seeing such damaging designs are in part why we set up shop. We knew these designs were going to set the industry back.

Buyer Beware

Much like 3AC, FTX decided to scale up its venture investments in the months leading up to its bankruptcy.

My guess is, SBF needed to up his collateral with FTX and Alameda’s various lenders. This is because the market was experiencing a bit of a continuous, year-long bloodbath. Thus, the price and FDV of the tokens FTX and Alameda had dropped precipitously, and they needed new tokens with lofty valuations they could use as collateral to keep the Ponzi going.

With FTX out, it’s likely that no one will use these new tokens as collateral for new loans. At least you’d expect lenders not to accept them if offered.

But their predatory economic design might continue to haunt us.

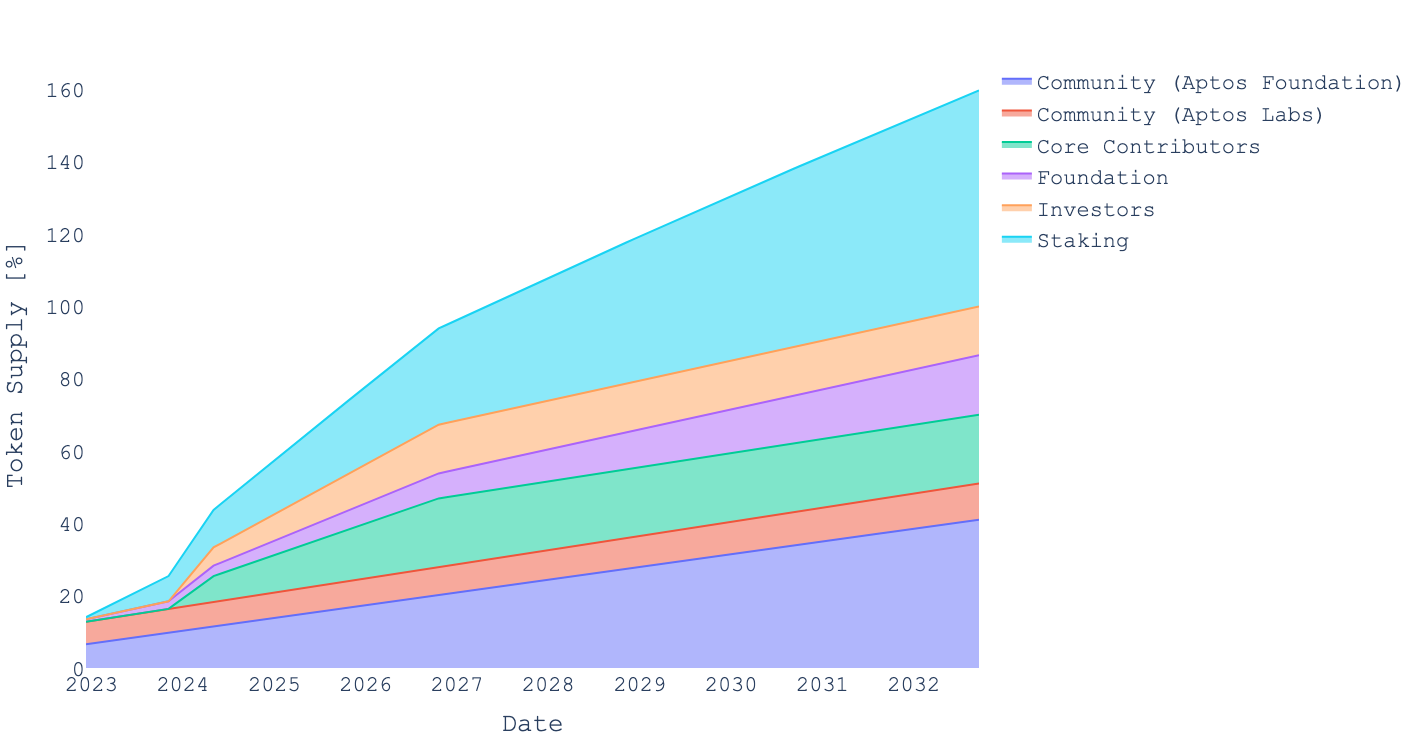

Take a look for instance at the token distribution for Aptos Labs, the hot new L1 on the block.

APTOS allocation through time. Source: Aptos docs

The first red flag is that the tokens awarded to the “Community” are controlled either by Aptos Labs (which is just the company that created Aptos), or the Aptos Foundation, both run by insiders. The foundation also gets an allocation of its own.

However, the more predatory mechanism is yet again being able to stake locked tokens. In this case, you get awarded shiny new APTOS tokens that you can then sell on the open market. Just grand, isn’t it?

The day APTOS schedules dropped, the Jarvis Labs team immediately asked why not just come out and be honest? Tell the community you want to control all the tokens. Sure, you’ll need to register with the SEC, but potential investors will take you seriously.

As the burning mess of FTX continues, we wanted to encourage everybody to rethink how we use tokens to power economies. These are not stocks. These are not free chips. These really are economies that can lead to a decentralized society.

Web3 deserves better token designs. And we look forward to setting a new standard when it comes to token design.

Keep it fun,

Kodi