Oil Turmoil

Macro Update: The Inflation the Fed Can’t Fix

“How would you like to pay for your gasoline/petroleum today? We take cash, card, your right arm, your left leg, your kidneys, or your firstborn…”

Soon, this will be the de facto greeting from the gas station attendant every time someone pulls up to fill their tank.

The world is facing the worst energy crisis ever.

Disrupted supply chains.

Skyrocketing prices.

Geopolitical instability.

Reduction of production capacity due to green energy movements and mandates.

The average price of a gallon (3.785 liters) of gasoline in California is $5.25 USD. There just does not seem to be any relief in sight.

And energy costs are also one of the major contributors to today’s high inflation (reaching 7.7% in October), which the Federal Reserve (FED) is trying to rein in.

That’s why Federal Reserve Chairman Jerome Powell said earlier this month that they won’t be letting up in their fight against inflation. Sure enough, the FED raised its interest rate by another 75 basis points as expected. Powell also said there won’t be any pausing of rate hikes anytime soon.

In “The Divine Dichotomy,” we mentioned the difference between temporary inflation and sticky inflation. Unfortunately, the ongoing high energy cost falls into the category of sticky inflation. This is because it stems from structural inefficiencies caused by government policies.

As a result, this cost-push energy inflation that we are seeing now will require quite a bit of effort to untie. But not just from the FED.

Continuing with the thesis from last month’s update that the FED is not the only one responsible for inflation, the U.S. Congress shoulders the same blame and the same burden to solve it as well.

The FED and its monetary policies alone cannot resolve the energy crisis and the inflation it’s causing. The government and its fiscal policies will have to do the heavy lifting on this one.

Let’s see what kind of heavy lifting is required.

The Conundrum

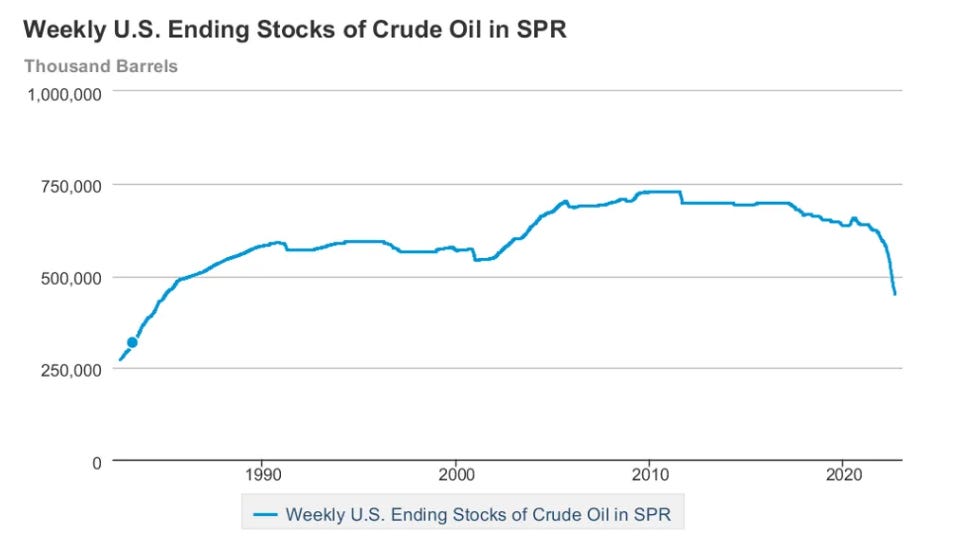

The Biden administration has been trying everything to bring energy costs down. Its latest move was to release millions of barrels of petroleum from the Strategic Petroleum Reserve (SPR). Yet even though this brought the SPR to its lowest level since 1984, the talk of high energy costs is still making headlines.

And now, the finger pointing starts, with accusations that the oil companies are profiteering off of a geopolitical crisis. Or that the refineries are posting all-time high earnings while people are paying all-time high prices at the gas pump.

Claims like these occupy the headlines on news sites and TV. So the blame of high gasoline costs now rests squarely on the shoulders of the oil companies and refineries.

Whether oil companies and refineries are profiteering off of a crisis is up for debate. But even if so, what is certain is that oil companies and refineries are not the only ones to blame.

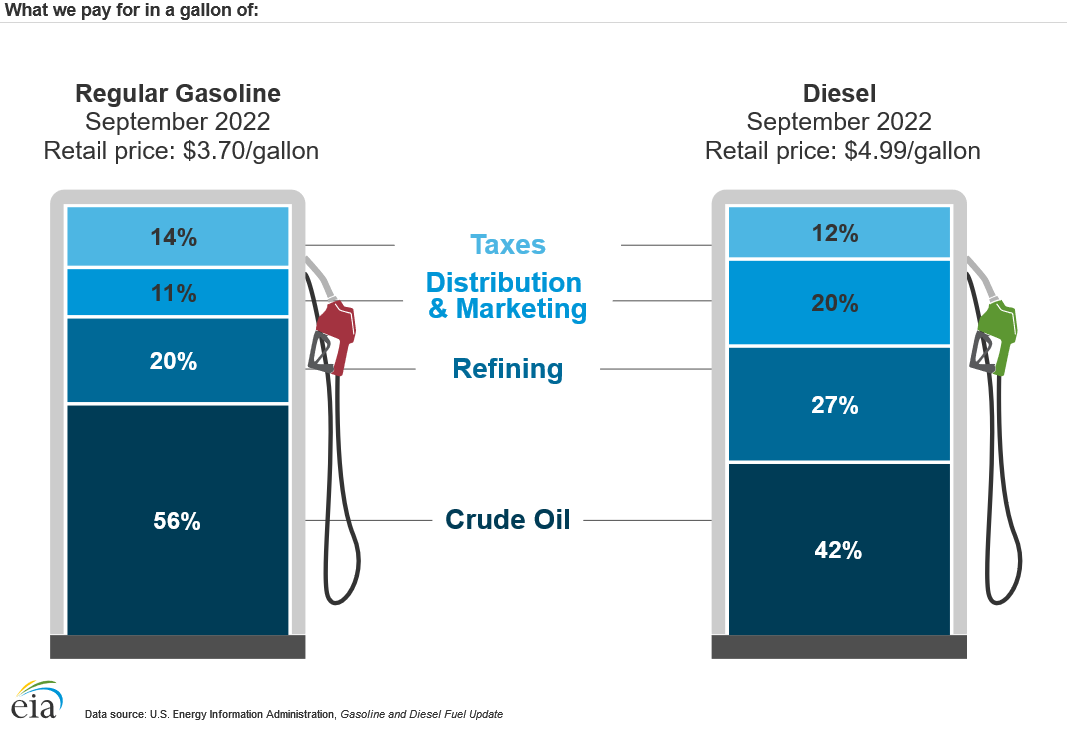

Below is a chart that breaks down the cost components for gasoline and diesel.

Crude oil price and the refining cost are the top two price components at a combined hefty 77%. So let’s focus on these two.

The Crude Crunch

Crude oil is currently hovering at the $80 to $100 USD range after its 2022 high of $130 USD per barrel.

That price level will hold for now for several reasons.

In early October, the Organization of the Petroleum Exporting Countries (OPEC) decided to reduce its production of oil, which equals a 2% cut in the current global supply.

Strike one.

The US also imported 8% of the oil supply from Russia in 2021. This supplier won’t be coming back online anytime soon.

Strike two.

The Biden administration tried to spin up talks with Venezuela for its oil supply, and it’s considering easing sanctions on the country in return. But so far, that hasn’t gone anywhere. President Biden also visited Saudi Arabia to negotiate for an output increase, but he was met with a soft rejection because the Saudis proclaimed that they are at maximum production capacity.

Strike three.

So it does not look like the crude oil supply will increase in the U.S. in the short term.

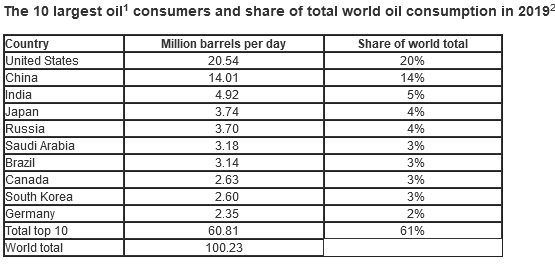

And the U.S. is the largest oil consumer in the world.

But we have a couple of surprises up our sleeve.

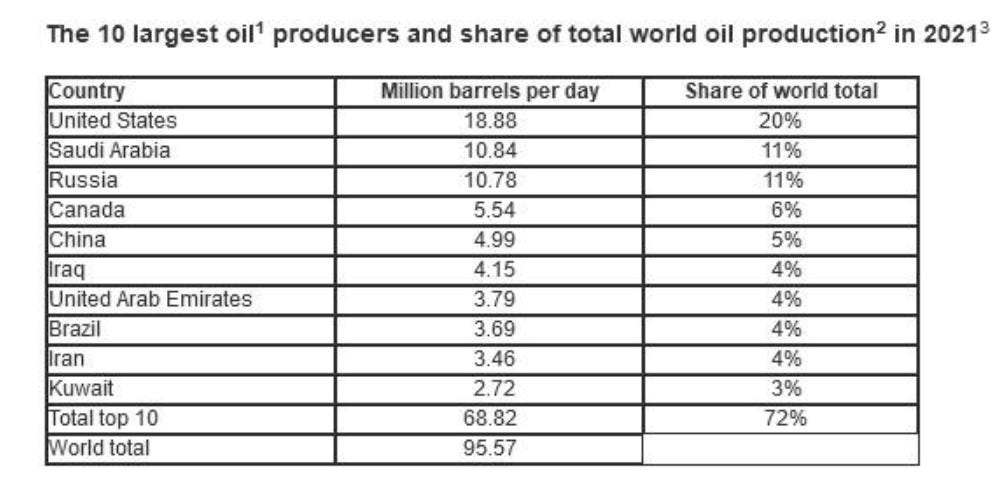

While the U.S. is the largest consumer of oil in the world, it is also the largest oil producer in the world.

The United States has the ability to produce enough oil to meet its domestic demand without importing from other countries.

The second surprise is that back in 2019, the U.S. became the largest oil exporter in the world.

That happened because the Trump administration’s energy policies were quite friendly to drilling and fracking, due to Trump’s goal of making the U.S. energy independent.

But the Biden administration favors a clean energy policy. The first thing that President Biden did when he took office in 2021 was to cancel the permit for the construction of Phase Four of the Keystone XL Pipeline. With the completion of Phase Four, the U.S. would have been able to deliver 510,000 additional barrels per day and increase its total capacity to 1.1 million barrels per day.

Another key initiative of the Biden administration’s energy policy was to freeze the federal land lease for new fracking and drilling sites, which further tightened oil production.

Per Jamie Dimon, CEO of JPMorgan, the U.S. is the swing producer of crude oil in the world, not Saudi Arabia. The U.S. can produce more oil, and it has the capacity to export it.

Jamie is right.

But all that depends on governmental policy (such as renewing the Keystone permit) and foreign policy (such as easing the sanctions on Venezuela) falling in line to support the oil industry.

Rogue Refineries?

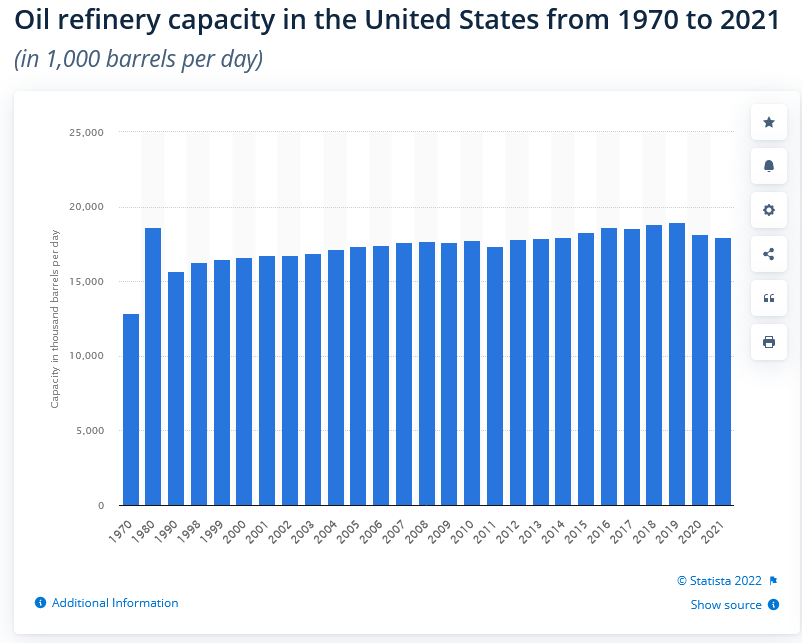

Refinery capacity in the U.S. has dropped significantly since 2020, due to weak demand as a result of the COVID-19 pandemic.

Over the past two years, U.S. refineries reduced their output by 1.1 million barrels per day. During the same stretch, the world’s total refinery output saw a reduction of 3.3 million barrels per day. So the U.S. alone accounted for 1/3 of the output loss globally.

The most concerning aspect here, however, is that refinery capacity peaked in 1980.

This is alarming because while the global and U.S. economies have expanded since 1980, refinery capacity in the U.S. remained roughly the same level from 1990 to 2021. There were no new refineries built, and the upgrades to the refineries were kept to a minimum.

And during the pandemic, more refineries were closed because of weak demand.

In 2022, with a lower number of refineries and a rise in demand, it is no secret that the refineries are making record profits.

Mark Wirth, CEO of Chevron, stated with the rise in refining margin courtesy of the lack of refining facilities, the change in oil prices have less influence on the prices paid at the pump. And this is why even with the release of the SPR, the price at the pump did not budge much.

In his opinion, the U.S. most likely won't ever build another refinery. And he is not the only one with that sentiment.

Because of the U.S. government’s focus on green energy policies, refineries have no incentive to build new facilities or even upgrade existing ones.

A major oil refinery hasn’t been built in the U.S. since 1977. That was 45 years ago.

There are numerous obstacles to building new refineries. It’s capital-intensive and takes years, often over a decade, in fact.

Also, this can be a risky proposition for investors and shareholders because of the current environment, which favors environmental, social, and governance (ESG) and green energy initiatives over fossil fuel projects such as a new refinery.

Not to mention the shift to electric vehicles (EVs). California just announced it’s banning the sale of new internal combustion engine (ICE) cars starting in 2035. All new automobiles for sale in California after 2034 have to be either electric, hydrogen-powered, or a plug-in hybrid.

Simply put: The current political environment is not conducive for refineries to invest in capacity expansion.

Meanwhile, all the old facilities that got shut down are either getting torn down or transitioning into renewable energy facilities.

Unless something changes, the refining capacity here in the U.S. will continue to dwindle.

Policymakers should start gearing toward providing incentives and simpler processes for existing refineries to increase production. Simultaneously, they should ease up on making the green energy transition until these technologies become more mature, reliable, and cost-efficient.

It Is Not Just the FED

Next time when the topic of inflation comes up, please bear in mind that the FED is not alone in bearing the responsibility.

The loose monetary policy from the FED in the past two decades is partly to blame for the highly inflationary world we are in today.

But energy policy, environmental policy, and foreign policy from the government are also major contributors.

Protecting the environment is indeed a top priority.

However, it’s irresponsible to push for abandoning the traditional mode of energy (fossil fuels) while forcing adoption of unreliable new technology (renewable energy).

Especially without a well-thought-out transition plan.

To quote Jamie Dimon: “Investors don’t give a s*** about ESG.”

If inflation continues to fly high, the populace might be feeling the same way – if it doesn’t already.

Yours truly,

TD