Squeezing Lemons

The market wants yield in the form of dollars. And through a certain trend, it's creating a market structure that cannot be ignored.

The low hum of mechanical certainty pulverizes the halved orange.

Its juice waterfalls down a funnel where it calmly fills my cup.

I feel the crusted salt loosen on my eyebrows as I smile at how easy it is to get freshly squeezed Florida orange juice.

It's in stark contrast to the unruly weather outside. I'd been fishing in the rough ocean all morning... Getting pounded by the waves and cooked by the sun to secure enough Pompano for dinner.

As I glance by some familiar locals entering the store, I can see the weather had started to turn. Afternoon thunderstorms were approaching and it was time to head home.

The juice tasted sweeter as I waited at the stop light, watching in awe over the spectacular fractals of lightning stretching across the dark sky.

It was a reminder that orange juice doesn't come from California. It comes from the drastic volatile weather conditions produced in the state of Florida. Weather conditions that make this home to the most lightning strikes, most annual rainfall, and 6 of the top 25 most humid cities in the country.

Ah, the Sunshine State. What an ironic tagline.

But the reality here is that nastiness produces some of the best juice in the world. Juice that I can bottle up with the flip of the switch.

Systematic squeezing of homegrown volatility... It's beautiful.

And when we look back on our crypto markets since 2017, we can see this systematic squeeze has been playing out before our very eyes. Its become so ubiquitous that we've essentially given every homegrown trader their own countertop juicer of volatility.

It's systematic. And the reality has meant it dominates the structure of markets.

To see how, we can go back to a simpler time...

Unadulterated Rawness

There was a simplistic beauty to Bitcoin in 2017.

I'm not referring to narratives, discussion of institutions, or its codebase. Not even the cypherpunk ethos that was still thriving.

It had to do with market immaturity.

The market in 2017 lacked sophistication. It lacked robust derivatives. The action was concentrated to spot.

The purity meant a dollar going in, produced upside movements well beyond a dollar in the market's price. (Love me some inelastic market price movement.)

That's because even if you placed a dollar into the market, there's no guarantee a willing seller sat there ready to accept.

It's what led to arguably one of the most iconic rallies of Bitcoin's history. The run from $1,000 to $20,000 in a span of months. Everybody was cheering on the rise and everybody was a genius. Even scam artists and rug pullers were a rarity.

Simpler times.

But on December 17, an industrial piece of machinery entered the market. The Chicago Mercantile Exchange launched Bitcoin futures... And on the same day, the high of Bitcoin was in.

As the Federal Reserve Bank of San Francisco wrote in regards to the introduction of CME Bitcoin futures, "The rapid run-up and subsequent fall in the price after the introduction of futures does not appear to be a coincidence."

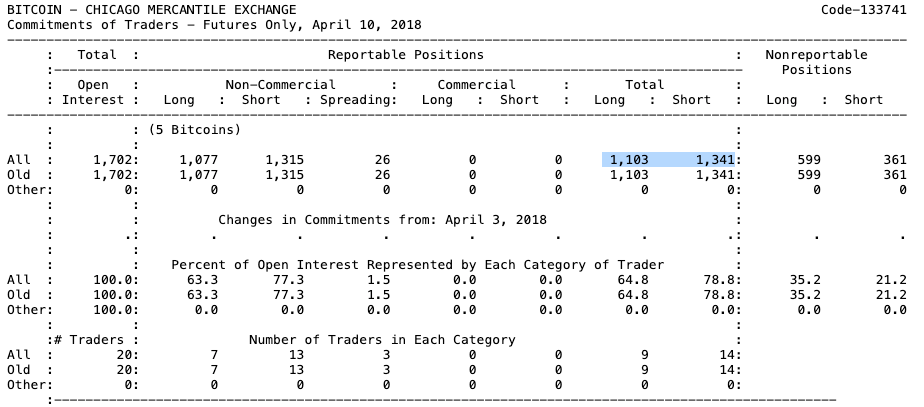

I wanted to look back at open interest at the time, but the furthest back I could go to see CFTC commitments of trader (COT) data began in April 20218. But what we can see is that the machine was juicing.

On April 10, 2018 Bitcoin was trading at $6,830. At the time 58% of open positions were short.

The short interest compared to long interest (the ratio) remained similar for much of 2018, the only difference is the total contracts grew. Meaning the amount of new shorts entering were more than longs for the year.

By the time Bitcoin lost support at $6 and submarined into $3k territory, there were more than 400 more short contracts than long, each contract representing 5 bitcoin.

These aren't crazy figures. But instead, it showcased a structural shift in the market. Traders were no longer just directional, they were harvesting the yield.

When we look back at 2018, the chart begins to make more sense when we view it from the perspective of this new market dynamic. Futures brought with it the ability to conduct a carry trade. Which is simply holding the underlying asset (Bitcoin) and holding a futures short position. The difference between the two created a yield on the position without carring what way the price of the asset went.

Once the market was out of bounces, the floor ran out. And in the next cycle of 2020 to 2021, this same systematic yield harvesting of Bitcoin went into overdrive.

We saw Grayscale's Trust, Genesis Lending, and several other main players that got too greedy on this trade get exposed in 2022. They were lending out Bitcoin, one use case was this exact trade as it helped facilitate the very yield many platforms were reliant upon.

Now, some investors and traders will say the open interest wasn't enough to dictate the market.

I'll quickly come back and say it was. This was a new mechanism introduced to the market that impacted the upper limit of Bitcoin. But don't just take my word for it...

The Bank of International Settlements did their own study on the cash and carry trade. Economists did some regression analysis and found that "a positive carry predicts both a decline in the spot as well as in futures price, albeit to different degrees."

To know how "different" they are talking about here and how significant, let's read on...

"Our estimates for 1-month BTC futures imply that a rise in absolute carry by one dollar predicts a five dollar decline in spot prices which is overcompensated by a six dollar decline in futures prices. These results indicate that a high carry predicts future crypto price crashes."

That's some serious numbers.

And is enough to make one laugh when reading the recent piece saying $1 into Bitcoin can result in up to $25 of upside. It's ignoring the reality of market derivatives.

And what we've seen since the emergence of industrial yield juicing is that tooling now exists further away from custodians and centralized exchanges. It's becoming commoditized.

You might recall a few months back I wrote an X post on the subject of how Ethena is suppressing ETH's upside.

1/ The cat @CL207 made the point that ETH is heavily "suppressed".

— Ben Lilly (@MrBenLilly) January 4, 2025

Comments below the tweet suggest it's Ethena.

Figured I'd drop some data to help visualize things a bit.. and perhaps offer some Leptokurtic midcurver thoughts. pic.twitter.com/dPM8qHv8Jt

Ethena figured out how to automate what was taking place via CME Bitcoin Futures, and wrap it in a synthetic stablecoin.

It was bottling up juice for easy consumption.

My X post was quickly discarded on Laura Shin's Unchained Podcast with guest Kain Warwick when she asked him if Ethena was suppressing ETH's price.

But the fact that CME Bitcoin Futures looked to play a pivotal role in capping the asset's upside... Why would billions of dollars flowing into Ethena's custodial system, and placing the same type of trades, not cap the upside of an asset?

It does.

And you don't have to like it, but you do need to accept reality for what it is. It's in part why once Ethena's portfolio shifted out of ETH as price tanked in February and March, ETH's bottom was in.

The juice was squeezed. The carcass was disposed. The preferred asset is an asset of lower volatility that squeezes the yield in the form of dollars from higher volatility assets.

To borrow from the Blockworks crew from their discussion of token transparency for a moment, this is a market of lemons right now.

And as I'll add, we're just making lemonade at an industrial scale to make more dollars.

Which brings me closer to the two points I'd like to hit on briefly.

Zesting The Rind

Onchain solutions are rolling out that are very good at funding rate arbitrage (warning, momentary and shameless Jlabs Digital shill incoming).

Look no further than our own deploy.finance where you can spin up an agent to run delta neutral positions on HyperLiquid in quite literally a few clicks and minutes. Users who've deployed have been arbing funding rates on HYPE are generating twice what USDe is producing.

The reason the yield is higher is because funding rates outside of centralized exchanges are much higher. It's an added bonus that it can be done in a fully self custodial manner.

And yea, if those positions qualify for a future HYPE drop that's a bonus. But it's not advertised and not the main intent behind the juicer.

But the reality here is that dozens of vaults are running similar operations across crypto. The user wants USDC and they are fine to juice any lemon they can to extract more yield.

Sure, they like warrant-like "points" in the form of tokens for additional flavor...

But the mechanical juicer is fully industrialized to the point where everybody can make their own juice in a matter of minutes from the comfort of their kitchen.

But here's the takeaway of it all, and the second point...

Once those funding rates drop, arb opportunities come down, and money markets dry up, that capital unwinds.

This is signal.

It's in part why negative funding rates lead to bounces in the market. We saw most assets on HyperLiquid for instance turn negative shortly after Bitcoin touched $99k... Which was the price point we said in our last post I'm Back that was worth keeping an eye on.

Positions unwound across crypto as these arb opportunities were no longer present.

These are the resets we often talk about in markets. Capital will flow to various opportunities. And as those opportunities begin to trend to nothing, capital will shift to the next opportunity. Once most opportunities dry up, the next move is directional bias.

Now, I don't think the market is quite ready yet for directional bias. Many larger cap assets returned to positive funding rates and many assets on HyperLiquid and other exchanges roared back to life.

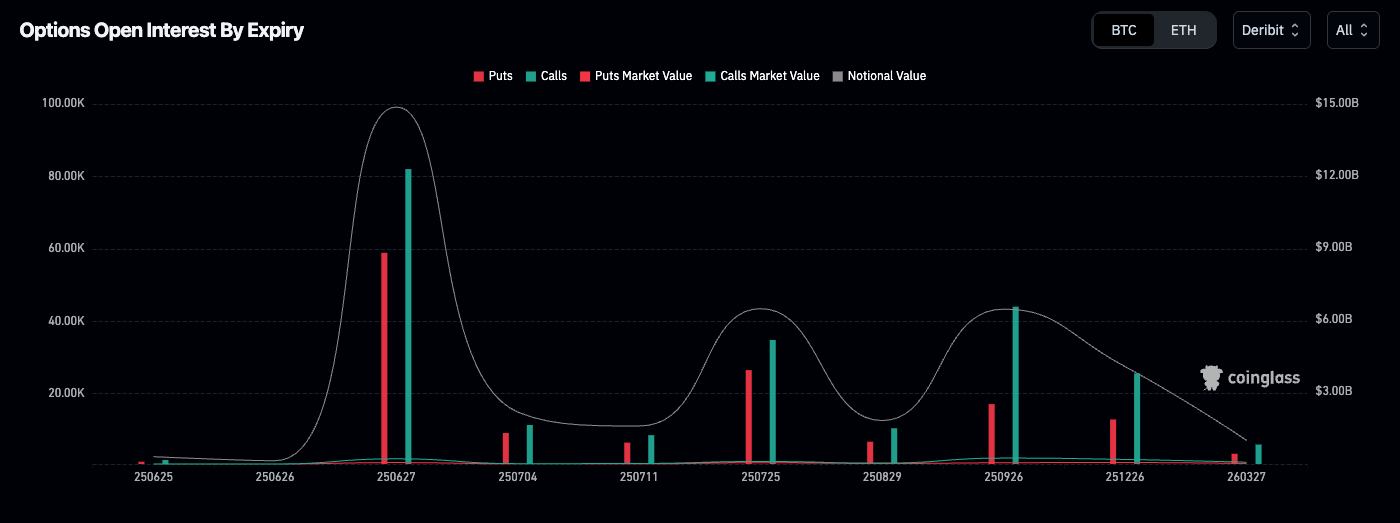

There's also nearly $15 billion of notional options interest getting ready to expire on June 27 - old school juicer.

This is all to say that a lot of capital is getting ready to be dry powder in the coming week once this bounce cools and the options expiration date passes.

I'm leaning towards the idea that directional bias will be one of the opportunities that will present itself in the weeks to come.

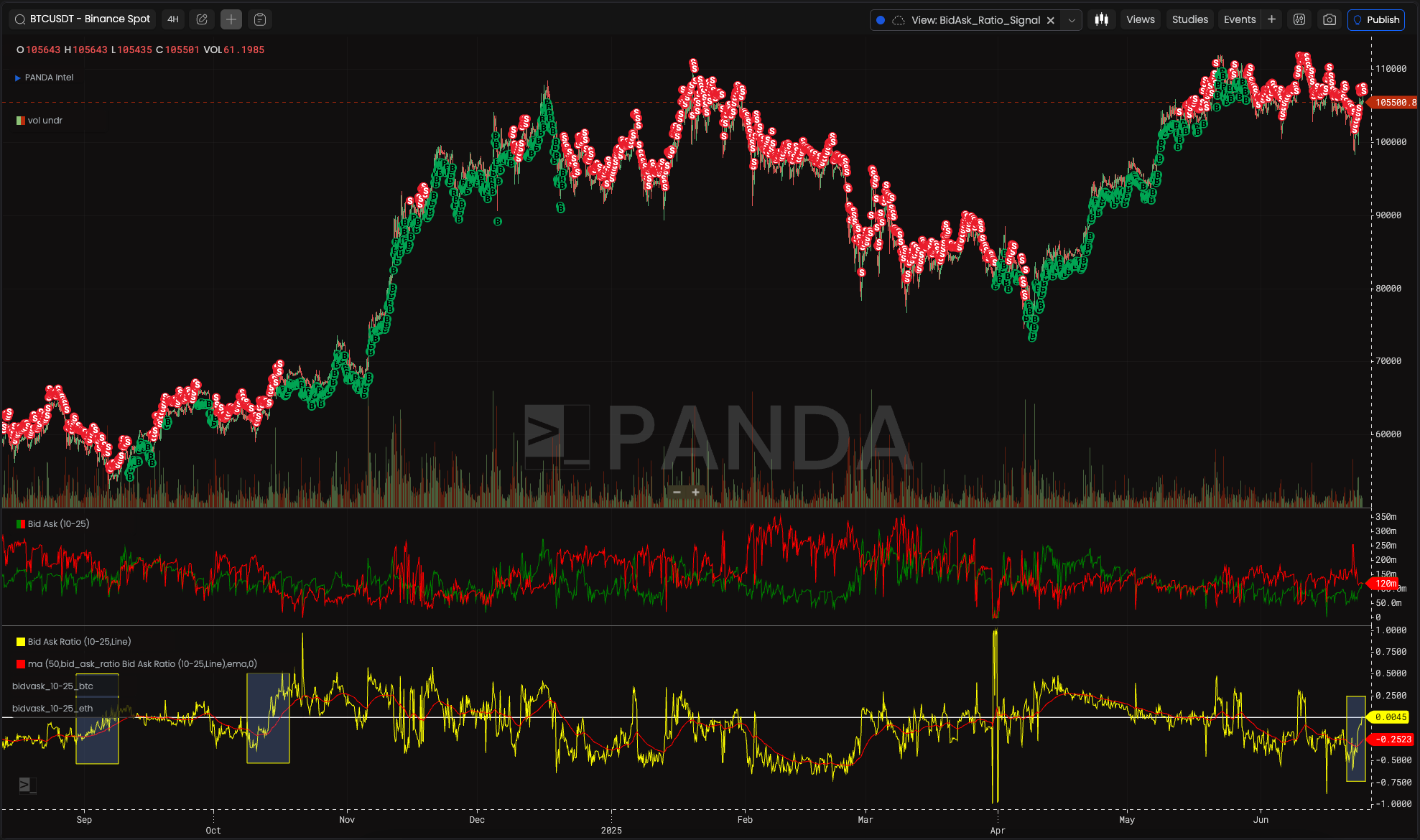

That's why this chart in particular will be one to watch next week. On the recent bounce order books began to shift towards the bid side. That's highlighted in the yellow box in the bottom right.

It's still not enough to be overly optimistic, but it's encouraging. And if the bids continue to grow, the regime could shift.

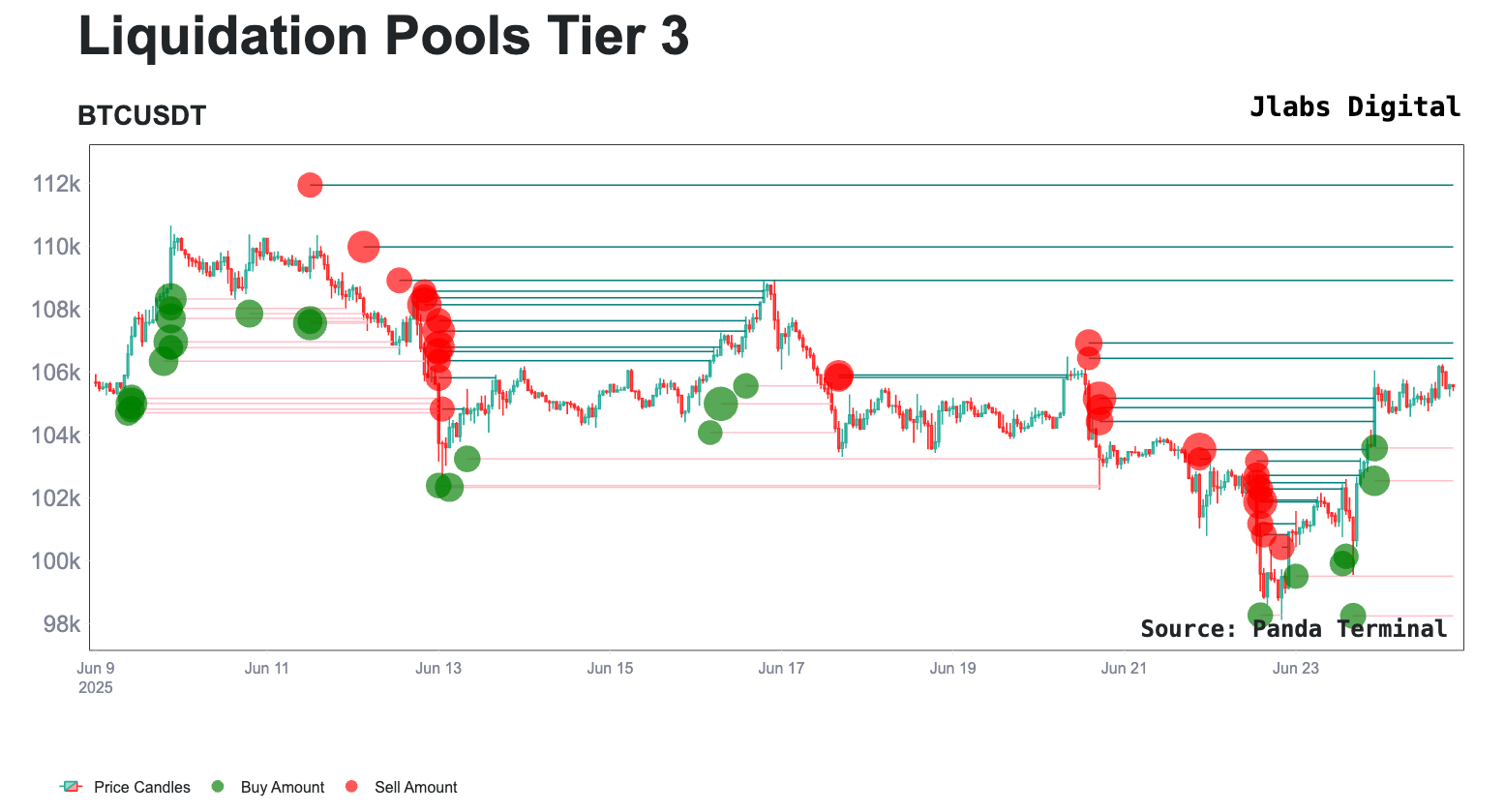

Until then, it's hard to ignore visiting some of the recent liquidity pools that formed on the bounce ($102.5k-$103.5k and $98.2k-$99.5k) for Bitcoin.

There's also the fact that if we don't get a bounce the next time we revisit some of these lows... And orderbooks don't improve, we might see some lower lows here.

We need to stay open minded to this route and simply watch the books to tell us the way.

Until then, the market will keep squeezing lemons and perhaps start zesting the rinds... extracting what they can.

Your Pulse on Crypto,

Ben Lilly

P.S. - Deploy.finance is a project I encourage you to try if you want to earn income from funding rates. It currently lets users deploy an agent from a self custodial wallet. If you have any questions, you can ask on the app or come ask the team directly in the Telegram "Another Boring Chat".

We're constantly listening to feedback, answering questions, and also talking markets. So if you want to be a part, come and join. Feel free to share some of your own alpha or even ask some follow up questions you might have from reading today's Espresso.

Thanks for taking the time to read!