SOL Is Having a Great Year, But Solana Is Still Struggling

How Well-Designed Tokens Can Fuel Solana’s Future (And Your Pockets)

Solana (SOL) has exploded upwards in the past few weeks, leaving many investors with a serious case of FOMO. Heck, even Arthur Hayes and Raoul Pal are getting a bag. If that does not mark a local top, I don’t know what will (judging from recent price action, it did mark a local top).

In any case, SOL’s performance year-to-date has been stunning. Up from $10 to $40 at the time of writing, trading as high as $47 for a brief period of time.

Bear market? Never heard of her.

Now, you’d think that with SOL’s price skyrocketing, its ecosystem would be thriving, right? Boy, do I got news for you.

For much of the history of Solana, you’d have been right. The price of SOL tracked almost 1:1 with the Total Value Locked (TVL) on Solana.

However, in this last run, the TVL of Solana has only doubled, while its token has gained 4x. Here’s a zoomed-in version of the chart so you can appreciate just how much the growth in the ecosystem has lagged that of SOL’s price.

What gives? Why has Solana’s ecosystem not yet come alive in 2023?

The answer is actually pretty simple. And it’s not all doom and gloom for the network. A new crop of projects is already driving new liquidity into the ecosystem and could address the issue holding Solana back.

The New Fruits of Solana

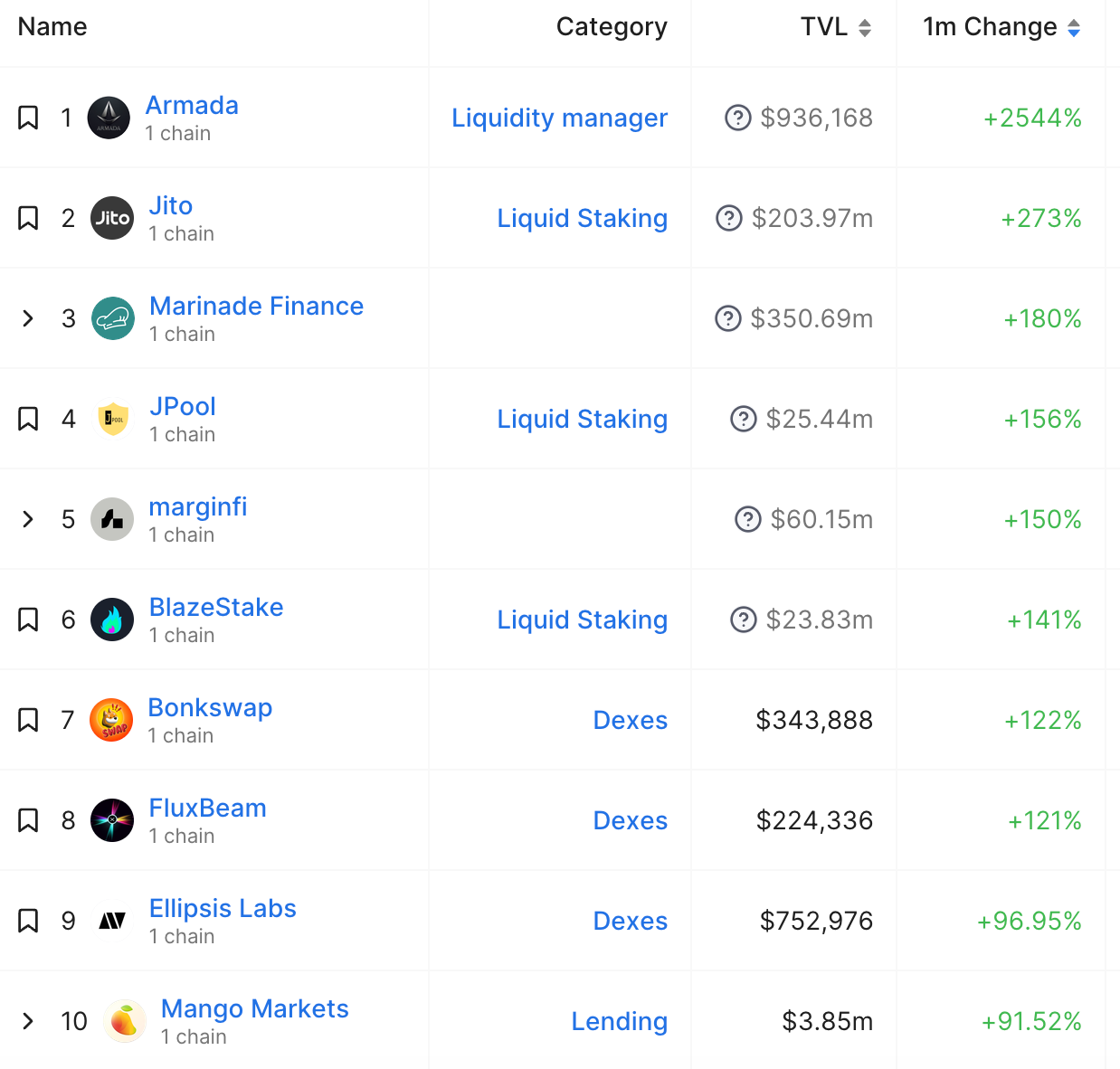

While there hasn’t been much growth on Solana this year, it’s encouraging to see that most of it has been driven largely by new protocols, rather than established ones. Of the top ten gainers in TVL over the past month, seven launched just within the last year.

And based on the categories above, it’s clear that these projects are helping to create a diverse ecosystem on Solana rather than all of them trying to do the same thing.

The most successful by TVL is Jito, a liquid staking provider that offers maximum extractable value (MEV) rewards on top of the staking yield (for a deeper explanation of MEV and how Jito captures those rewards, head to the Jito docs here).

Marginfi offers another liquid staking token (LST) based on jitoSOL (Jito’s LST), as well as a lending service focused on risk management.

If you go beyond the top 10 growing protocols, you’ll find plenty of quality projects excelling in their niches, like Phoenix and Jupiter, two decentralized exchanges.

Phoenix (a project from Ellipsis Labs) is a fully on-chain limit order book that seems to want to fill the void left by Serum and serve as the liquidity hub for the entire Solana ecosystem. Jupiter is a swap and bridge aggregator that just launched a perpetual protocol on top. (I don’t want to shill Jupiter too hard, but for a while now, it’s the only place I make my swaps on when using Solana. Gud effing product.)

And there are plenty of other types of projects as well. Tensor is Solana’s answer to Blur, a marketplace for NFT traders. And finally, Squads is a multi-sig protocol that most Solana projects use, securing over $500 million of funds.

Do you know what these protocols all have in common?

None have a token. Not yet, at least.

That’s why Solana’s TVL has been lagging despite its token price soaring. Before, most of the tokens locked on Solana were either SOL or altcoins related to it. But despite these protocols succeeding this year, they’ve limited the ecosystem’s growth because they’re reluctant to launch tokens of their own.

Why is that so?

Let’s take a trip down memory lane.

Why Is Solana So Token-Shy?

It’s 2021, SBF is still the wunderkind who can do no wrong, and FTX is en route to becoming the crypto super-app.

SBF’s blockchain of choice is none other than Solana, where he deployed a lot of (misappropriated) funds.

Solana was rather barren before SBF took an interest, and FTX/Alameda backed a lot of projects in the ecosystem, particularly early on.

Their backing came at a price, though. Not only did they award themselves and other insiders a rather high supply of tokens, but they also dictated the token economics of every project. And they all shared the same blueprint.

This blueprint and its predatory nature have been discussed at length, including by us here.

The tl;dr is that these projects would launch with a low initial float (aka few tradeable tokens). Since the float was so low, these tokens were primarily traded on FTX, so it was easy for Alameda to manipulate them and keep them at high prices…

…prices that would command a very high valuation if all the coins were unlocked – but they weren’t. The majority of these projects’ token supplies were locked for many years.

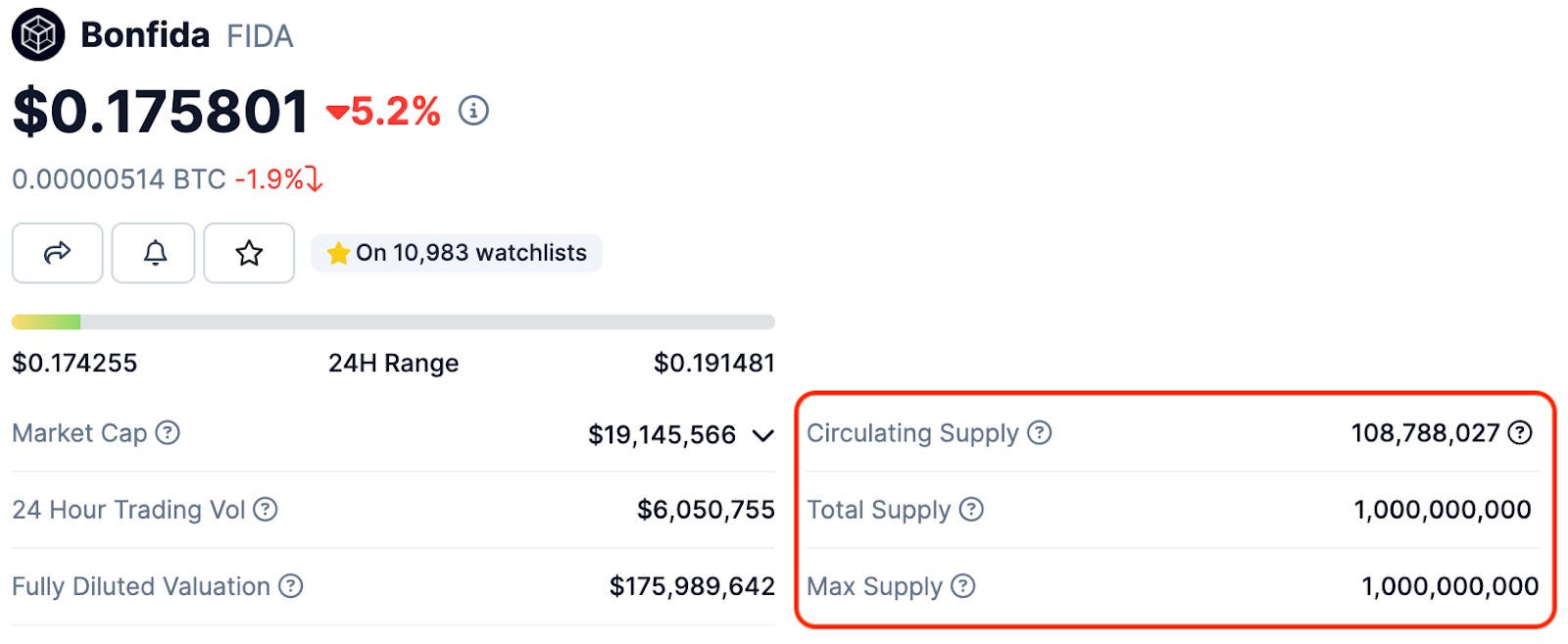

Compare for instance the circulating supply (tokens that are tradeable right now) with the total supply of Bonfida (FIDA), one of the earliest “Sam coins.” It’s been three years since the token launched, and only 10% of the total supply is unlocked.

Of course, that didn’t stop FTX/Alameda from valuing these projects as if all the tokens were unlocked anyway.

FTX/Alameda would then use the tokens they controlled (surprise surprise, the majority of tokens always went to insiders) as collateral. They would stuff unsuspecting lenders with high-priced tokens that were actually worthless and get dollars in return.

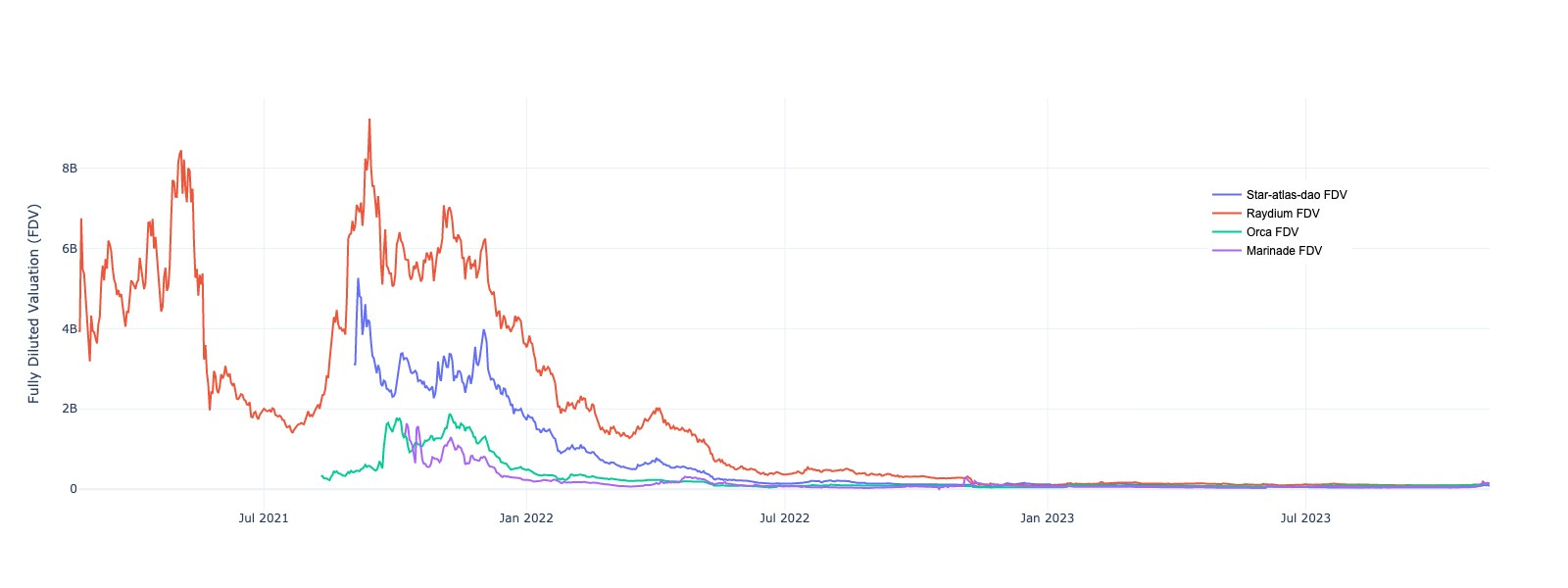

After FTX went belly-up, the whole jig was up. These tokens now trade at fractions of what they used to.

In May and again in October 2021, Serum was trading at $120 billion in Fully Diluted Value (FDV), a project’s value if all of its coins were in circulation. Now, it trades at $40 million. That’s a 99.97% drop. Even for crypto standards, that’s impressive.

But it was not only the Sam coins that suffered. All of the Solana ecosystem was badly hurt when FTX/Alameda went under, and most tokens’ prices have barely recovered.

This all has left a sour taste in the mouths of Solana developers, who are now shying away from tokens entirely.

But here's the thing: tokens aren't the bad guys here.

Make Tokens Great Again

When done right, tokens can be very useful. And line the pockets of founders, investors, and users alike. They can also fuel the growth of a whole ecosystem.

Just look at Ethereum and ETH, which have kickstarted an entire token economy and funded the development of the Ethereum ecosystem.

The incentives are clear. Most of the Solana projects I mentioned above will launch a token. And this will be good for Solana as a whole.

In fact, I kinda lied before. One of the projects, Jupiter, just announced a token at the Solana Breakpoint conference in Amsterdam last week. Another project, Pyth (the main oracle on Solana), also recently announced it was launching a token.

And guess what? They are both doing airdrops and allocating a significant share of tokens to past users.

That’s right, if you've been using the protocols, you might just find a bunch of tokens waiting for you one day. If not, it might be time to dust off that old Solana wallet and try these protocols out. Organically and from only one wallet, of course.

But let's not forget the lessons of the past. Protocols should aim to launch sustainable tokens, not just any tokens.

A sustainable token design would involve a fair distribution, a reasonable supply, and a clear use case. It's not just about creating a token; it's about creating a token that adds value to the ecosystem.

The blueprint for good token design has not been written yet, but we do know a thing or two. For starters, forget the high-FDV, low-float scammy blueprint from FTX.

If you won’t share yield to tokenholders for (justified) fear of being labeled a security, try to figure out some other ways in which the token can be useful in the economy of your protocol. But try to leave a door open to enable giving revenue back to tokenholders in the future, as the way the winds are blowing, we are likely to get regulatory clarity sooner rather than later.

So, to all the Solana protocols out there: let's make tokens great again. Let's create tokens that are more than just a quick cash grab, tokens that contribute to the growth and sustainability of the ecosystem.

Keep it fun,

Kodi