Slow Dancing in a Burning Room

Powell and the Market

I listened to the pundits talk for nearly two hours after Powell finished the question and answer portion of the press conference.

By the end my brain felt like a scrambled egg. My thinking felt clouded. It’s like I was being told 50% of something, and expected to form my own conclusions.

This is usually when I go for walk and clear the mind.

Unfortunately, it was raining. So I opted for a nap.

My goal was to let my subconscious form some connections that I wasn’t able to do initially. Basically to stop trying. Or think less.

Then once I have a spark, I’d start writing to form some takeaways.

Well, I woke up with a headache. Fail.

And as I went about the rest of the day nothing really came to mind.

Settling down with a glass of wine and some slow beats, the following lyrics came through my speakers…

We're going down

And you know that we're doomed

My dear

We're slow dancing in a burning room

John Mayer’s somber tune managed to spark some life to my aging synapses.

And it wasn’t an insight, but more of a reminder.

The Federal Reserve and the market are in a dance, one that is taking place amidst the backdrop of a financial system that is slowly burning down.

Now before I get into a few thoughts on the recent meeting, I should say my underlying assumption is the global financial leaders are combating and/or causing inflation, unprecedented growth in money supply around the world, unsustainable debt levels, debasement of currencies, issues that are a result of stagnant wages, and dozens of other issues.

I’d wager a guess that many of you are here reading Espresso for that very reason.

If so, good. Because my second assumption is many of you are familiar with these matters.

If you are not, please don’t hesitate to comment below. I’ll be more than happy to spill some ink on any of the topics mentioned above.

Now, getting to it… Reflecting on the events of the day, there were two topics that stood out… Bloomberg summed them up well in an article they published.

Fed Chair Jerome Powell told a press conference Wednesday that officials would begin a discussion about scaling back bond purchases used to support financial markets and the economy during the pandemic.

They also released forecasts that show they anticipate two interest-rate increases by the end of 2023 -- sooner than many thought

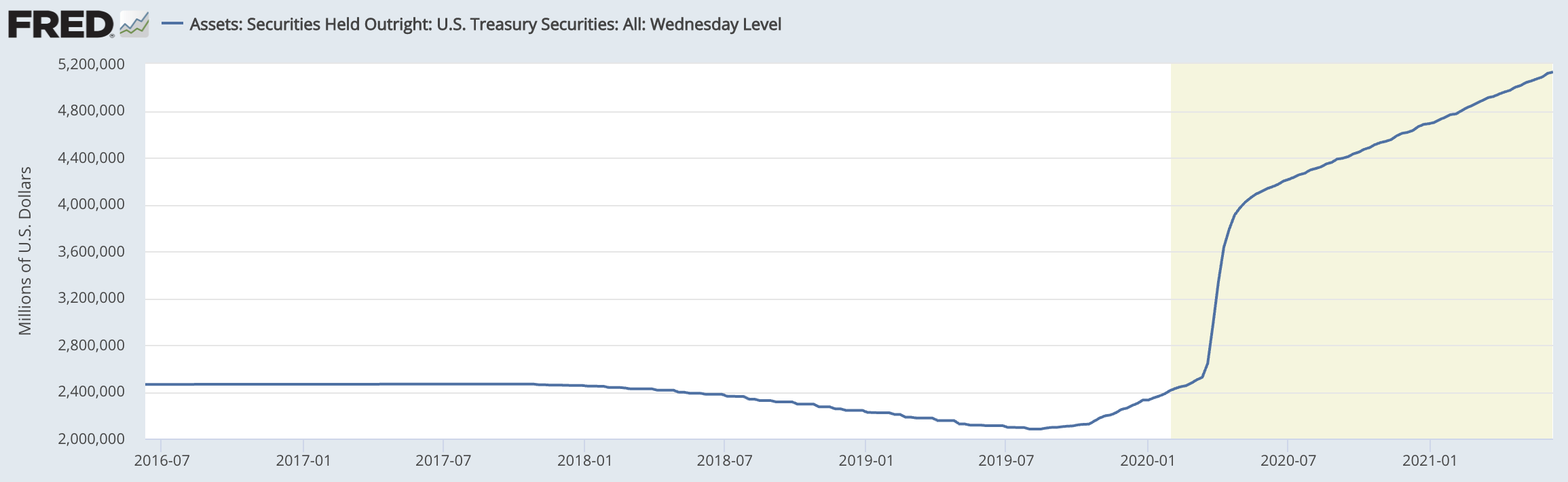

The first point can be best understood with a chart from a Federal Reserve Economic Data chart. It’s the amount of Treasuries being held by the FED.

As you can see below, the amount of purchasing shows no signs of slowing.

Looking at the last 12 months this figure comes to approximately one trillion dollars.

This is what keeps yields from going parabolic.

Recall, treasuries are debt being sold by the US Government. If nobody is buying their debt, then the treasuries drop in price to find a buyer.

The drop in price results in a higher yield for the bond.

So if the FED is not stepping up to buy treasuries, yields would be much higher than what we see today.

And the FED doesn’t want to sit there and be forced to absorb billions of dollars worth of treasuries each month. Which is why they are trying to get itself out of this role.

What’s interesting here is the current US administration is looking to spend trillions of dollars in the coming year. Meaning more debt that needs to be soaked up by the global financial system.

Meanwhile, the double dose of suppressed rates and excess liquidity is helping equity valuations to hit record highs. It’s like everybody is in on the fun.

And the FED is merely there catering to everyone else…

Big spending bill, go ahead the FED will pay for it.

Market dropped a bit, FED will insure we reverse.

Yields are overheating, no chance the FED lets that continue.

The punch bowl is out of booze? The FED will buy some more.

Which brings us to the second point… The FED is trying to find a way to create some breathing room. Their most recent attempt was seen via their chart that signals future interest rates.

This told the market to expect some rate hikes. The funny part here is they didn’t say it was next year. It was in 2023, and only half a percent in total for the year.

This is up from the quarter of a percent they had before.

These little dots on a chart are their way to find breathing room. Powell is trying to see how far he can go before he makes the market uncomfortable.

And the fact this mild ‘threat’ is more than 18 months away is almost hilarious. Everything can change in 18 months. So the market isn’t likely to price too much into this announcement.

It’s simply a way for the FED to say, “Hey guys, we are beginning to think about it. Take us seriously. We’re serious, we swear. Cut back on the booze.”

We’ll see.

Meanwhile, while we wait 18 months for the rather hot air threat, I think we need to start considering how the FED might respond to market forces already beginning to percolate.

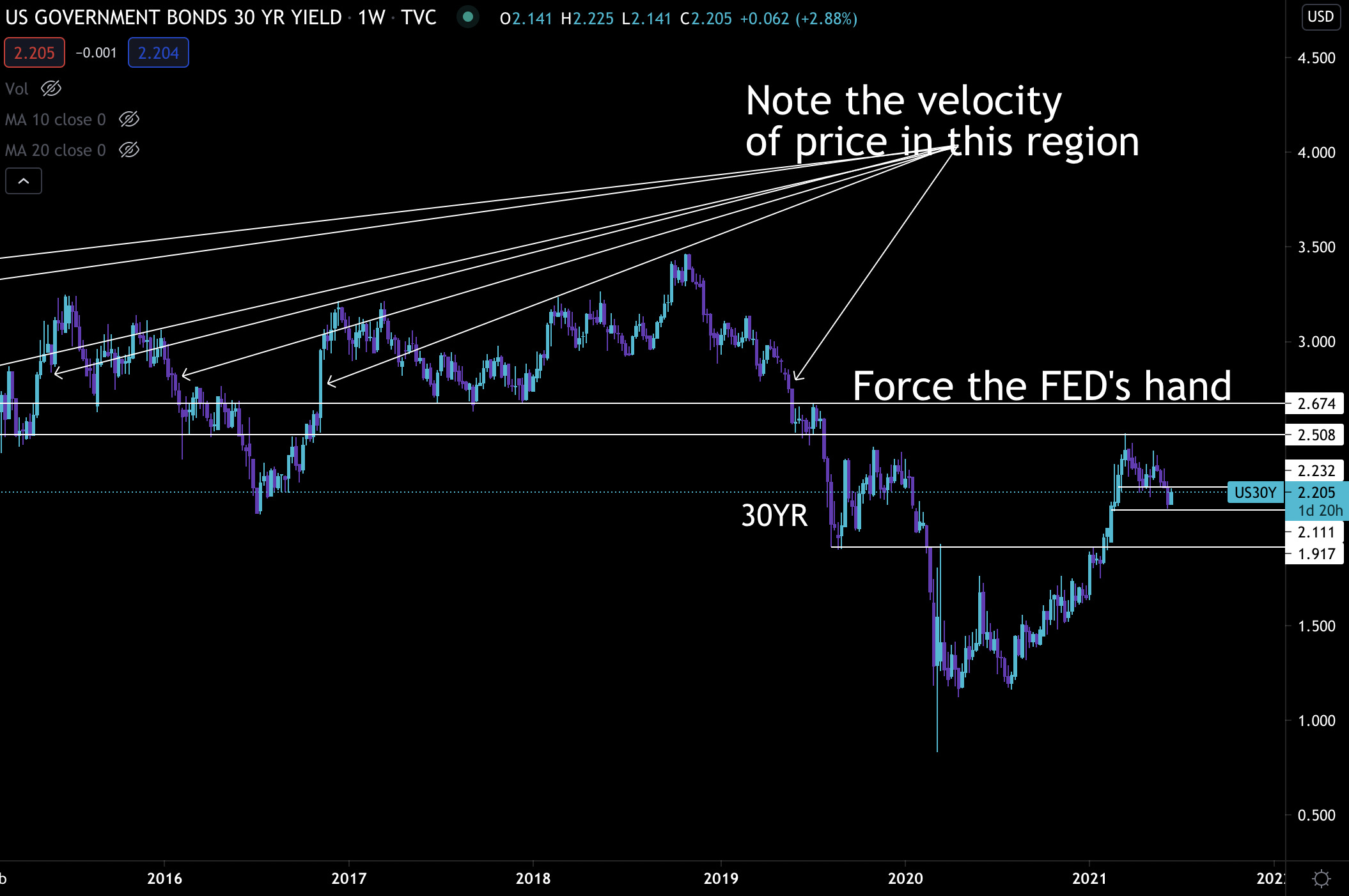

I know everybody likes to look at treasuries in countless different ways. 2 and 10 charts, 5 and 10, 2Yr, 5Yr, 10Yr… I like the 30Yr because the patterns are clearer.

Here’s an old chart I’ve used before. The pattern in yields are creeping back up and consolidating in a similar range as late-2019.

If it gains strength like we are starting to see in the middle part of the curve (ie - 5Yr, 10Yr) then I believe everything starts to get out of whack.

This means not only is debt expensive to service in shorter time horizons, but longer as well. Meaning debt is running out of areas to be stuffed. More importantly this long duration debt is the type the FED probably wishes to avoid.

If they want to get government debt off their books as quickly as possible, then this is the least attractable bond.

So let’s continue to keep an eye on these yields as they consolidate. If they start to creep above 2.5% and more importantly 2.7%, I believe we’ll see some reactionary measures take place from the FED.

I anticipate we see this happen before their dot plot comes to fruition in 2023. In fact, I wouldn’t be surprised to see this happen before the year is over.

The way in which they are most likely to respond is through more treasury purchases.

Another round of booze for the party goers while they load up on tech and crypto.

Your Pulse on Crypto - And the burning room,

Ben Lilly

P.S. - Onchain is very quiet still. We’ve been getting some bearish alerts over the last few days from market movers. It’s in part why we continue to sound bearish on Twitter and Telegram. If we don’t see these alert materialize by the weekly close, then we will consider them null. This remains our stance until we see things change onchain.