Reset the Fomo

This flush is good

Since Monday open, we have seen a large correction happen across the crypto markets. Speculations remain on who was the cause of the big dip in price from 54k to 48k. Exchanges became inaccessible. API went down. Chaos at its best, yet a few whales managed to fill their orders. Classic day in crypto.

Now, lets talk about why this flush was good.

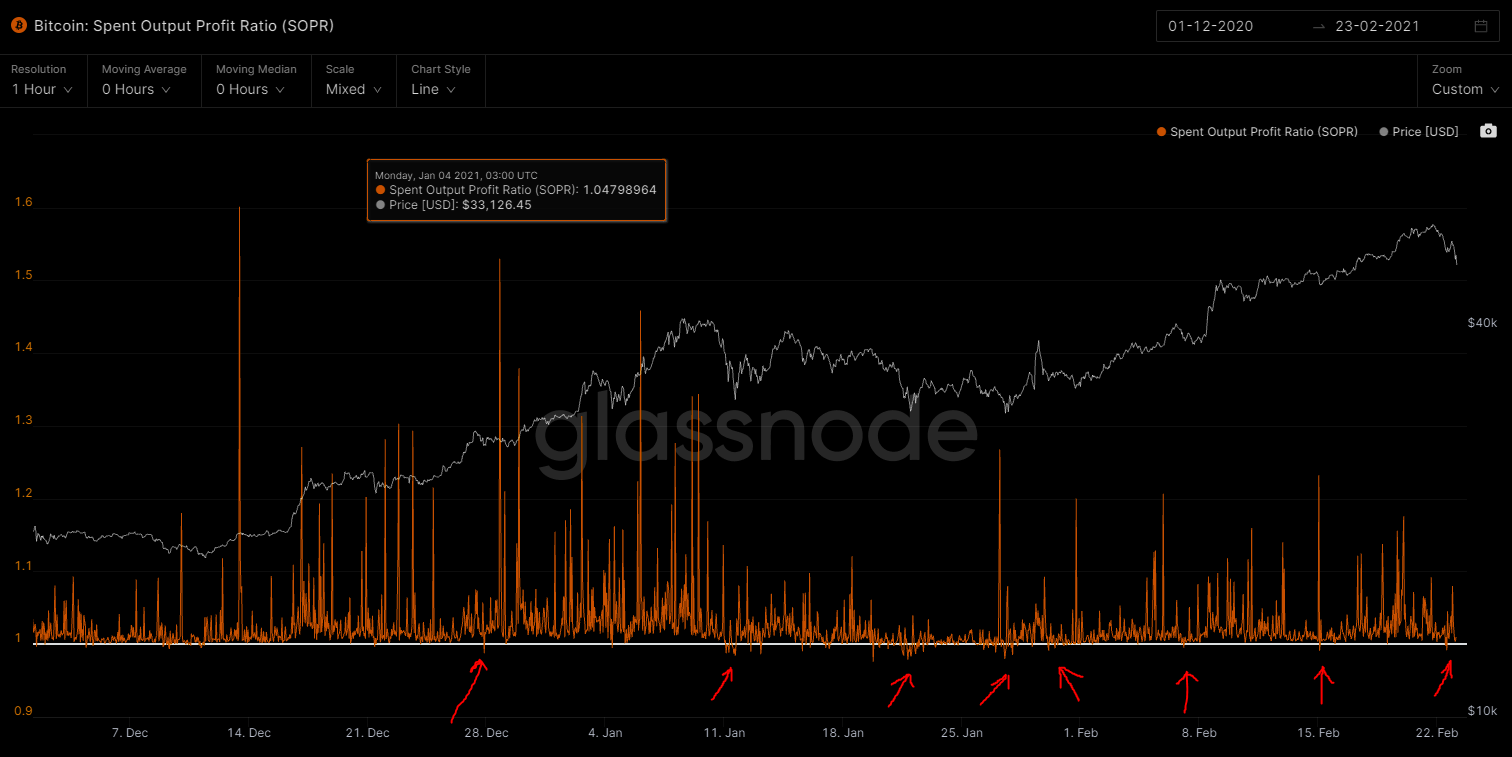

From the onchain metrics point of view, we had the SOPR reset on lower timeframes, which is great news as this has historically led to buying bots to get activated. SOPR - Spent Output Profit ratio is nothing but price sold divided by price paid.

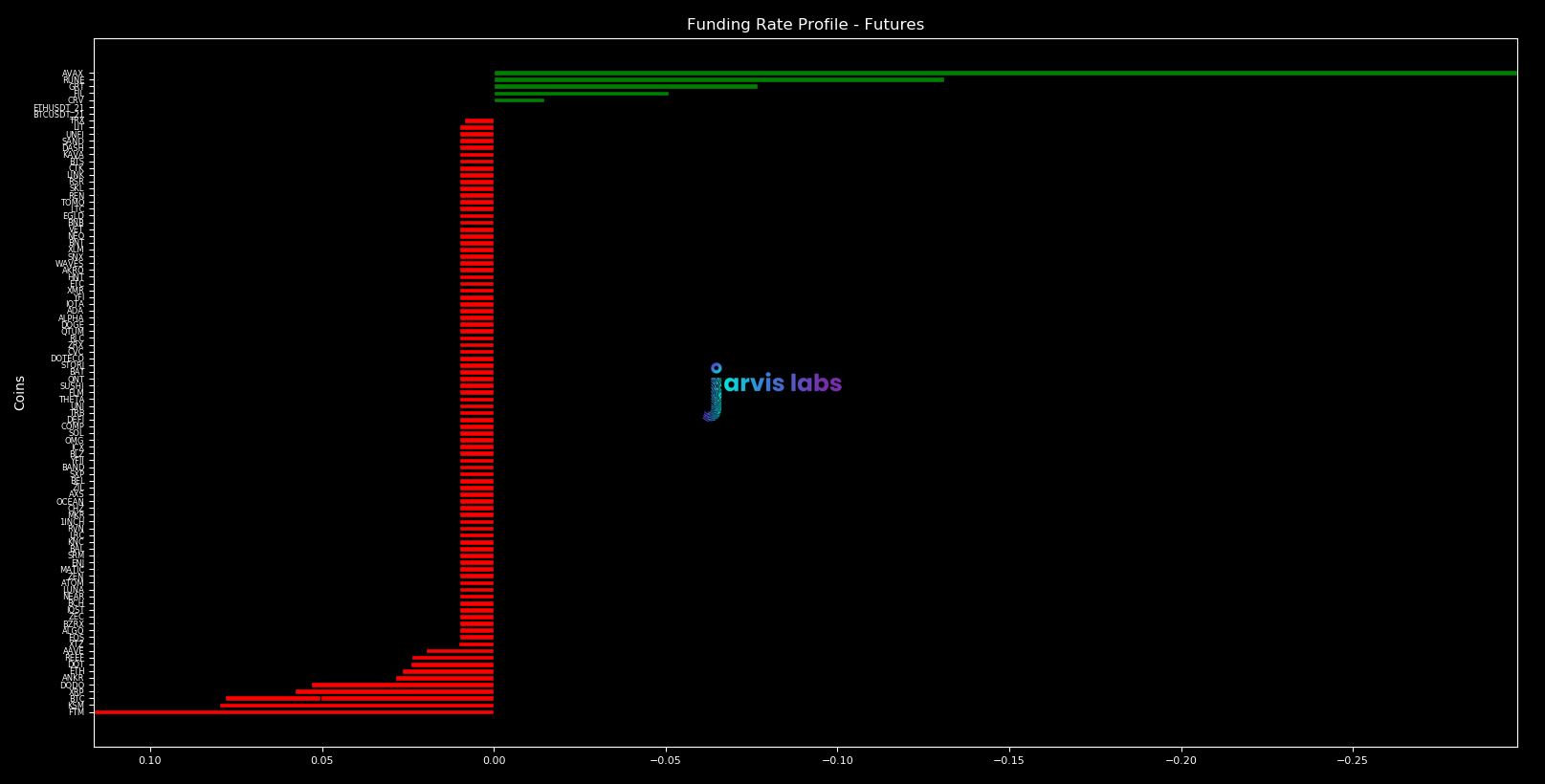

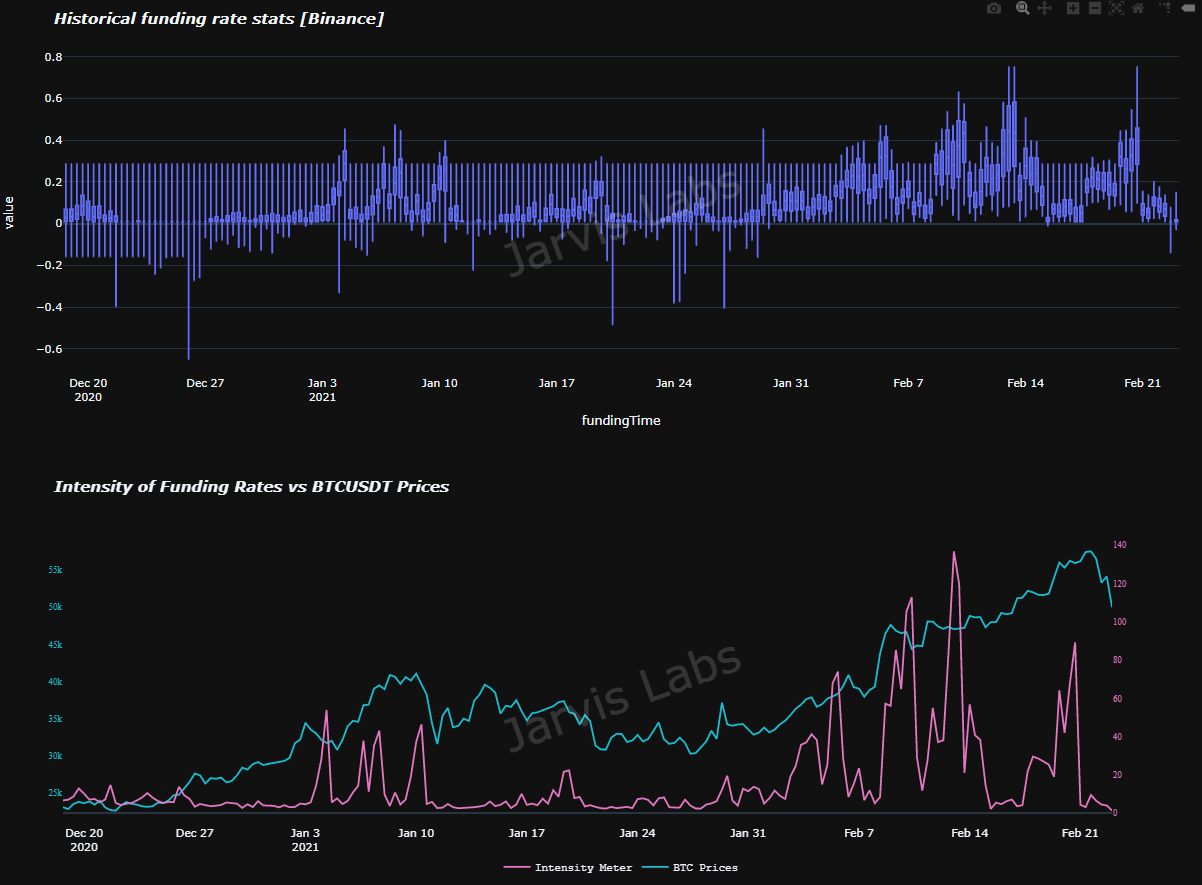

Funding rates on altcoins in Binance futures saw a total reset. They have been running high for a few weeks now. This flush makes it possible for swing positions to enter back in the game.

We are seeing the box plot showing that the candle is inclined towards negative values. This is good news again, coz buy the dip season is coming soon.

Intensity indicator is flatlining, reflective of the crazy fomo in the market cooling off a bit.

Correction is common in bull markets is an absolute necessity, nothing to panic about.

Its rather time to plan your investments and look closely for opportunities, especially on altcoins.

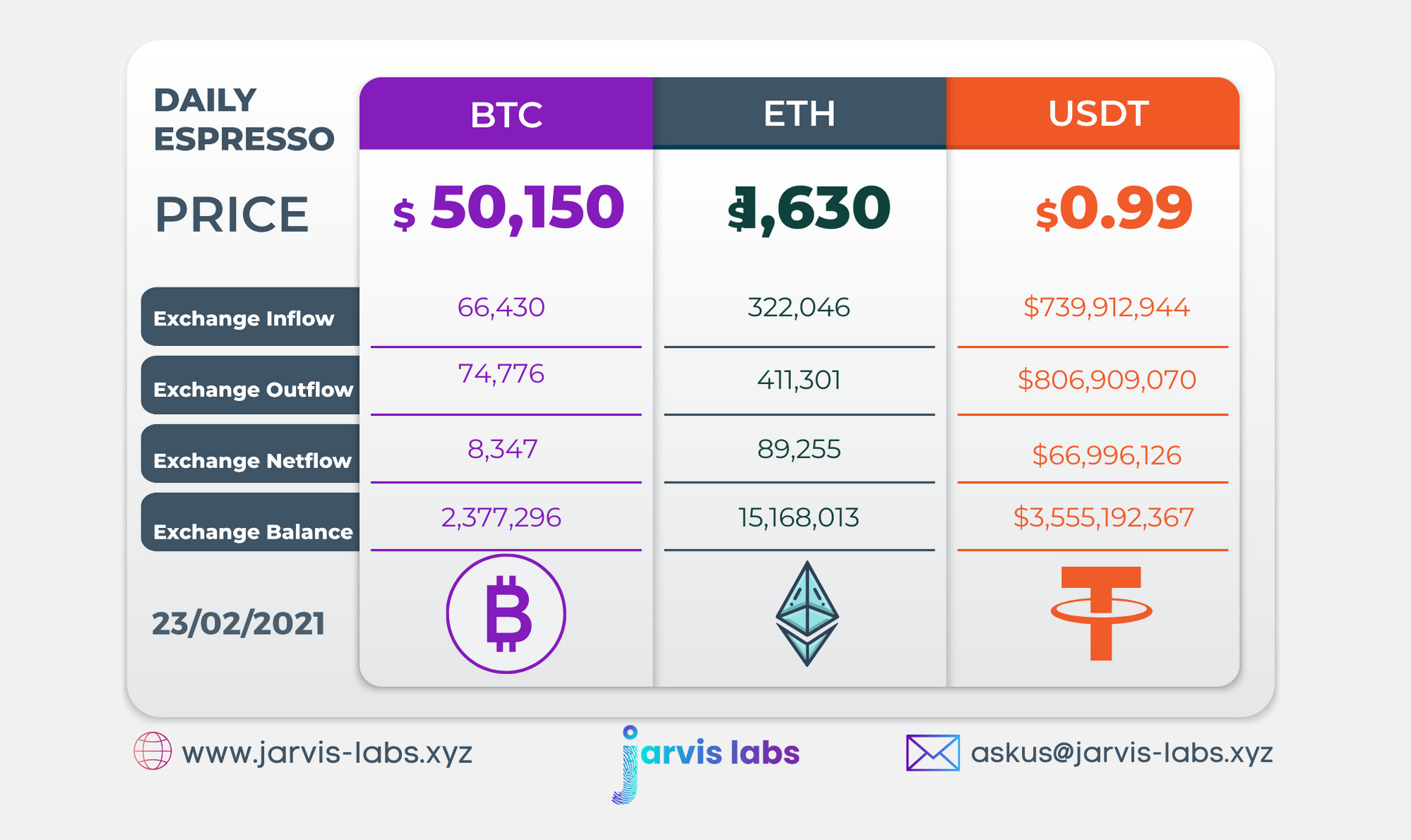

A tether print would go a long way in cementing investor confidence and I think it is coming soon.

Reset is good. Cheer up.

Yours

Benjamin

Below is our daily exchange flow data. This is a great gauge for understanding if BTC, ETH and USDT are flowing into exchange or leaving. If BTC and ETH are entering exchanges it can generally be viewed as bearish. The opposite scenario is bullish.

When USDT is flowing into exchanges it’s typically viewed as bullish. The opposite scenario is bearish.

This should only be used as a general gauge. Tagging the exact wallets these flows move into or out of helps improve the reliability of this data, which is what we do at Jarvis Labs. To date we have over 800 market mover wallets and 16 million wallets tagged all together. Consider us your on-chain trackers.

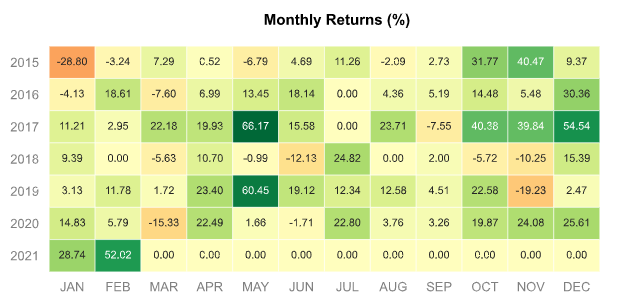

P.S: A sneak peek into monthly returns on a new BTC algorithm to be added to Jarvis into Q1 upgrade. Exciting year ahead!