Reports of Cardano’s Death Have Been Greatly Exaggerated

Token Insight: ADA Has Been Quietly Building Itself Into a Competitive L1

Let’s start with a pop quiz.

Below are the returns for Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA) during the last bull market, from the COVID-19 March 2020 bottom to their respective tops in the 2021 bull market. Can you guess which is which?

- 17,469%

- 5,560%

- 1,724%

It might surprise you to learn that ADA actually had by far the largest gain out of all three.

Yes, that’s right: ADA more than tripled ETH’s performance in the last cycle. And it outperformed BTC by a factor of 10.

Not too shabby for a blockchain that for much of the crypto community was (and still is) seen as a laughing stock.

To be fair to its critics, they kinda had a point. During most of the last bull run, Cardano was a barebones L1, allowing you to do little more than transfer or stake ADA, its native token. The chain had no other tokens. And the promised smart contract functionalities were always a far-off mirage, perpetually pushed back to a later date.

Add in the fact that Cardano was slow compared to other L1s, and that the cult surrounding its founder, Charles Hoskinson, raised questions about how decentralized it was.

Over a year and a half into this bear market, with ADA 90% down from its peak at the top of the bull market, many have all but forgotten about Cardano. Yet another L1 that didn’t quite make it.

However, the winds are starting to change. For one thing, it actually has smart contracts now. And it’s starting to address its other issues, with encouraging results so far.

But is it enough for ADA to outperform yet again in the next bull run? Let’s take a look.

Cardano’s Speed Woes

If you want to be a competitive L1 in DeFi, speed is essential. Users don’t wanna swap tokens and have to set a reminder to check if their transaction has gone through or not 20 minutes later.

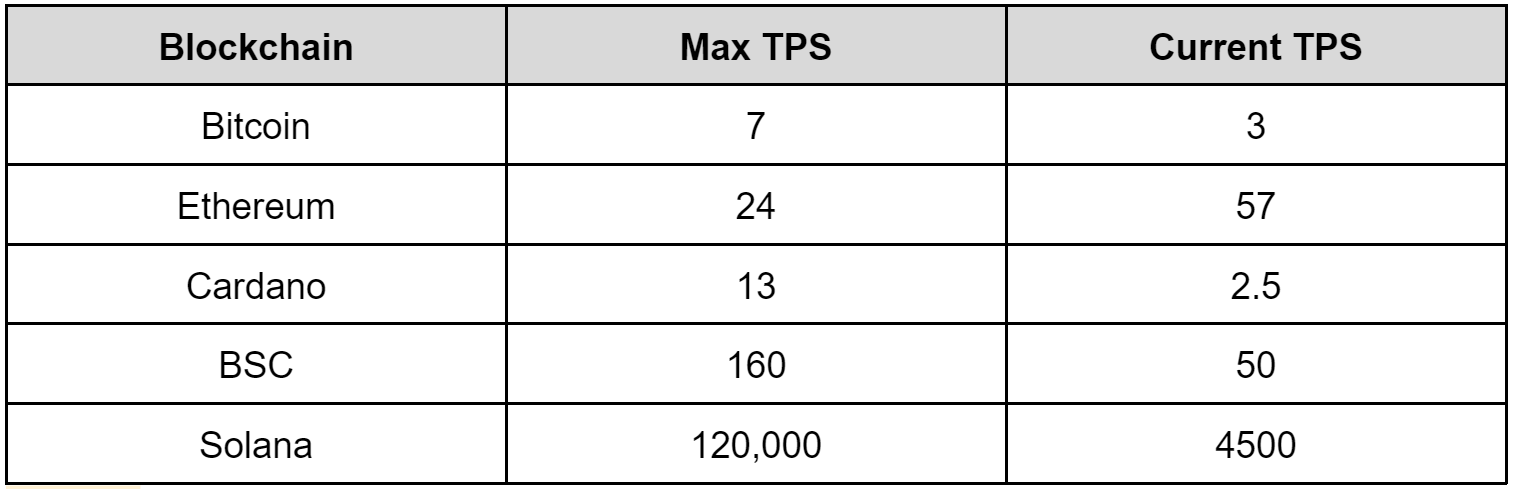

When it comes to how fast a blockchain is, there are a couple of ways to measure it. You probably have heard about transactions per second or TPS. Think of it as how many tasks (a swap, an NFT mint, a transfer) a chain can do in a second.

If you want to get more math-y, TPS is usually defined as the number of transactions in a block divided by the block time of the chain. Maybe it helps to visualize it in a pseudo-equation like so:

TPS = (number of tx in a block)/(block time in seconds)

So, the more TPS, the better. Here’s how Cardano stacks up against other chains:1

As you can see, Cardano’s numbers just aren’t great.

But here's the kicker: a high TPS does not mean that a chain will be or feel fast.

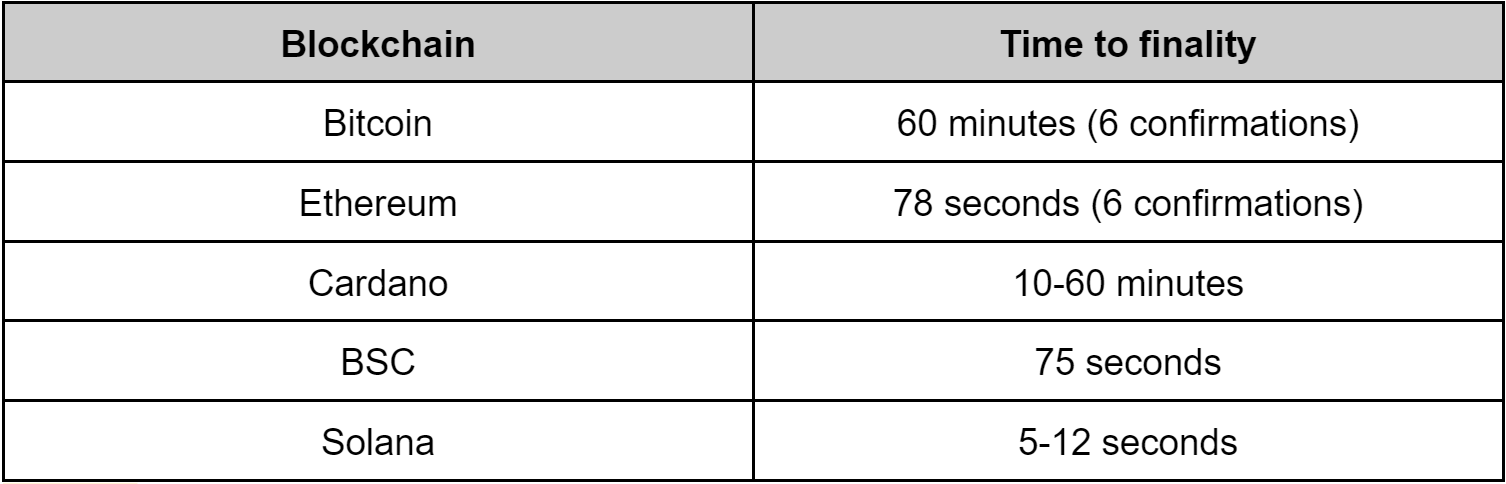

For a transaction to be final, the various nodes of a blockchain need to agree on what the truth for the chain is. If they don’t agree, you won’t be credited the NFT you just bought, or receive the token that someone just sent you.

Or, in one of those quirks of this fantastic technology called blockchain, the whole chain can be rolled back much as you would rewind a film, and all transactions with it.

The time needed to finalize a transaction and guarantee that it won’t be rolled back is known as “time to finality” (TTF).

Let’s again compare Cardano to some other L1s:2

Again, Cardano’s numbers disappoint. Time to finality for Cardano is similar to that of Bitcoin, a chain that does not have smart contracts. Chains with smart contracts built in mind to enable DeFi, gaming, social apps, etc., have a much lower TTF of 1 minute or less.

Cardano’s real TPS of around 2-4 and a TTF of up to 60 minutes made it a suboptimal choice for DeFi, social, or any somewhat complex applications.

It is not a surprise then, that for much of 2022, activity in Cardano stagnated. But a much-awaited solution to Cardano’s speed woes is finally here.

Hail Hydra.

No, I am not talking about the Nazi terrorist organization from The Avengers. I am talking about the scalability solution that promises to be the cure for Cardano’s slow speed that ADA stans have long been waiting for.

Hydra is what’s known as a state channel, a scalability solution that allows two or more parties to conduct multiple transactions off-chain, without the need for each transaction to be broadcast to the entire network; only the initial and final details are recorded on the chain.

The bulk of the transaction takes place in a Hydra “head,” a sort of private blockchain between users. Each Hydra head can theoretically handle as much as 1,000 TPS, and its time to finality is negligible.

I know what some of you might be thinking. Does this mean that Cardano, by deploying thousands of Hydra heads, can scale to millions of TPS and instantaneous finality?

Well, as Mum likes to say, if it sounds too good to be true, it probably is.

The truth is, each Hydra head still needs to post transactions to Cardano Mainnet, and Hydra does nothing to improve the TPS and TTF of the main chain. So, while Hydra is a very useful solution, it is not a panacea.

Still, it’s already produced encouraging results.

Blue Skies on the Horizon

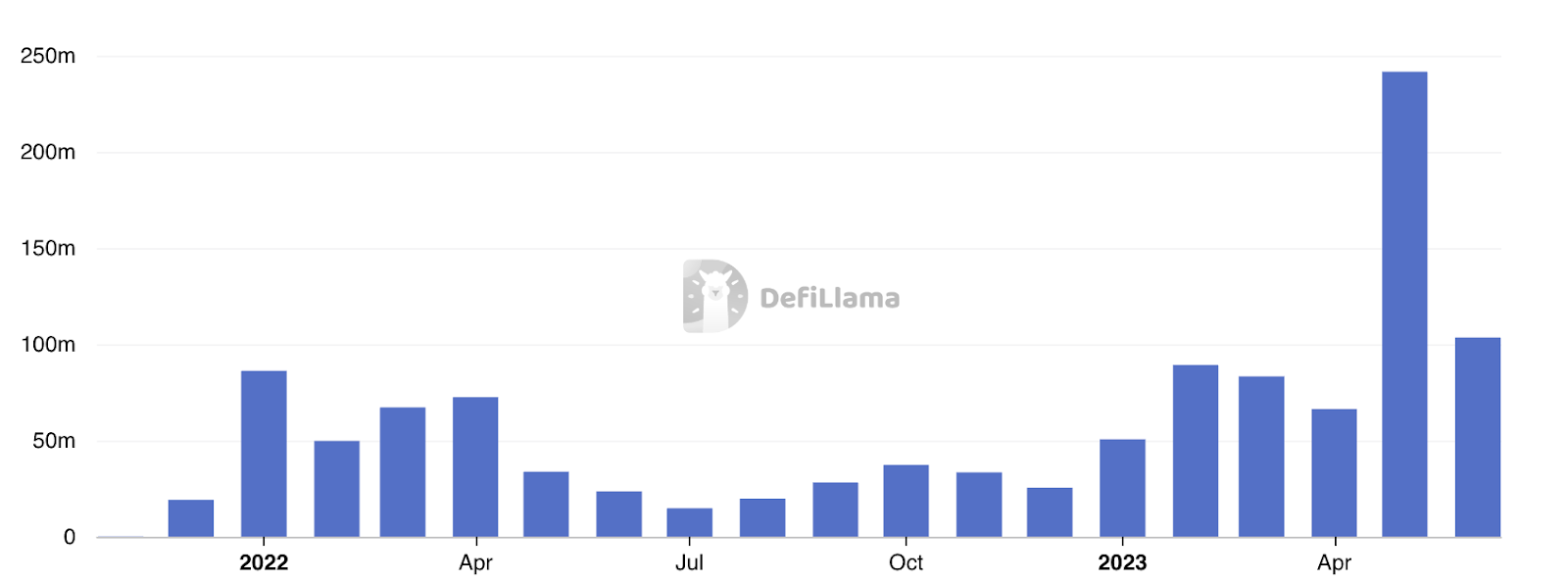

Hydra went into effect on May 12, and it had an immediate impact.

Decentralized exchange (DEX) volumes for Cardano increased from around $60-$90 million in the months prior to almost $250 million in May. According to DefiLlama, the May weekly volumes of its leading DEX, Minswap, were 5-10 times those of prior weeks. Heck, Cardano even had its own memecoin season.

But this had long been in the making. Cardano’s total value locked (TVL) had been rising steadily since the start of the year, after peaking in April 2022. Cardano’s TVL in USD terms is now over 50% of what it was at the peak, despite ADA's price being a fifth of what it was back then.

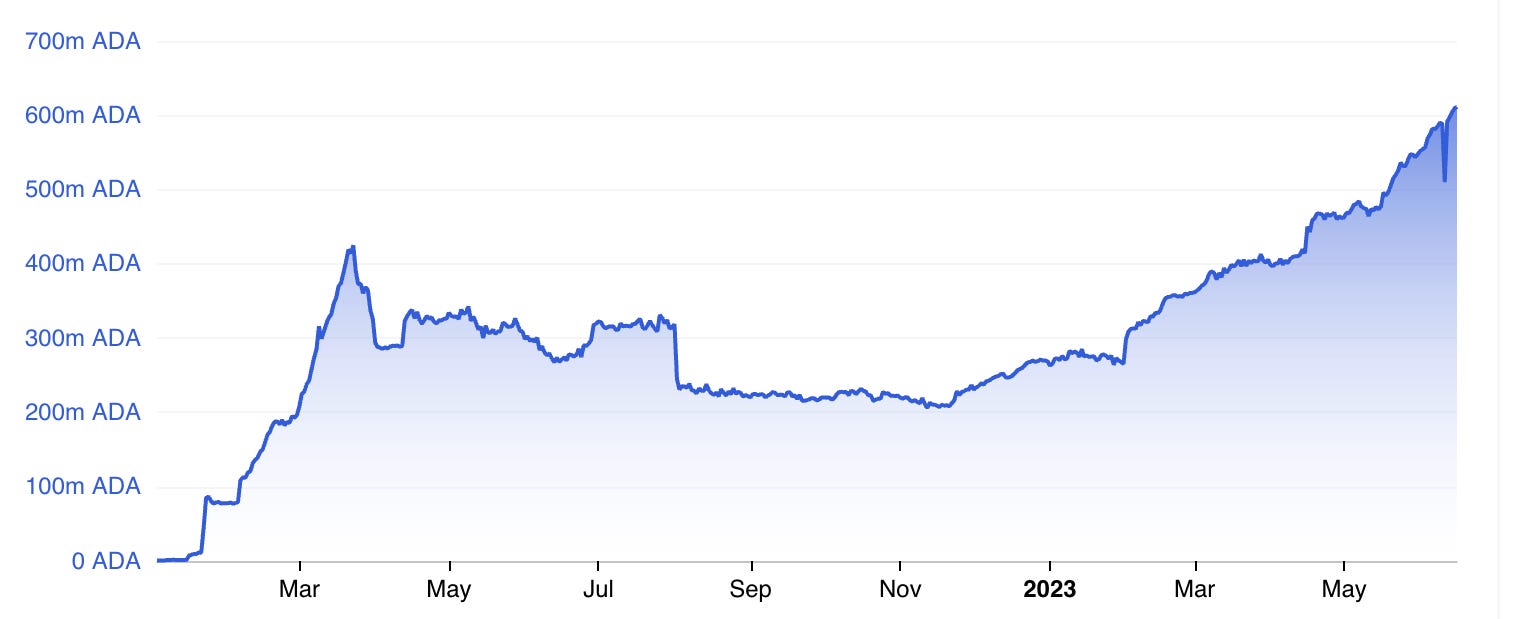

If we gauge Cardano’s TVL in ADA terms, the DeFi boom in Cardano becomes evident.

TVL in ADA terms has tripled since the bottom at the turn of the year and is over 50% higher than at the peak in April 2021.

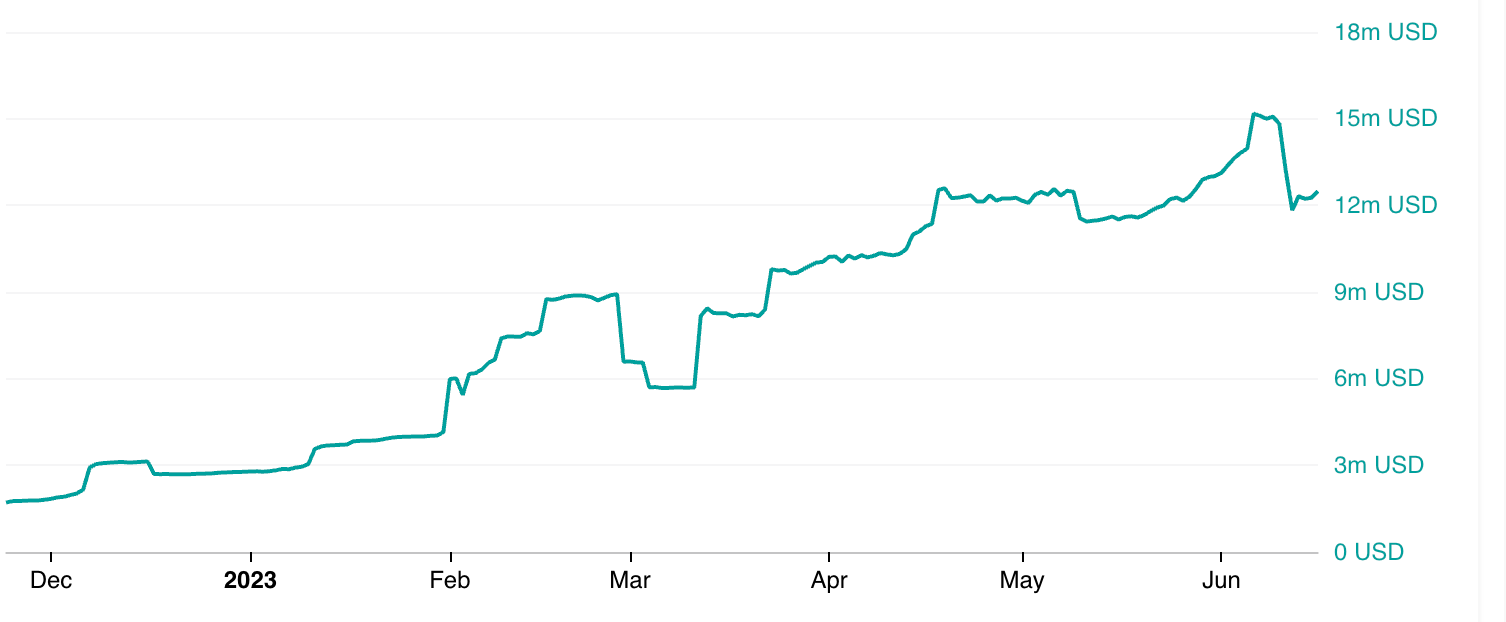

Stablecoins are another area where Cardano had been historically deficient. It is difficult for a blockchain to have a vibrant DeFi ecosystem without stablecoins and, thus far, none of the big boys (USDT, USDC, DAI, etc.) have any presence on Cardano.

However, some native solutions, spearheaded by Indigo’s iUSD, are turning things around.

Since the start of the year, stablecoin supply has gone from $3 million to $15 million at its peak and around $12 million currently. Baby steps, yes, but another major development for Cardano.

So, Cardano is getting its act together regarding scalability. But what about its decentralization?

A Chain for the People

For better or worse, people like to follow leaders. Some of the greatest stories in the past bull market were in ecosystems with a “cult leader”: SBF and Solana, Do Kwon and Terra, Daniele Sesta and Frog Nation.

Even Vitalik can’t escape from this personality cult, much to his chagrin, and people still look to him for guidance in the Ethereum ecosystem.

Many critics of Cardano despise the fact that its founder, Charles Hoskinson, is such a prominent figure in Cardano-land. And, to be fair with you guys, I am not Hoskinson’s biggest fan either.

But you gotta give it to him: The man is eloquent. This is a snippet of what he had to say after the SEC filed charges against Binance:

It does seem like this event is a perfect opportunity for the entire industry to set aside it's [sic] fragmented nature and unite for a common sense set of rules and guidelines that can prevent the United States from slipping into a dystopia that would make 1984 look like a vacation. I'll have more to say later, but will close with we are going to be fine. Everything's alright and the future is bright for the industry.

The man also has a large following. Over 2 million Twitter users saw the post above. Charles himself has over 1 million followers and is undoubtedly the figurehead of Cardano.

But despite Charles Hoskinson's central role in Cardano, the chain itself is one of the most decentralized L1s out there.

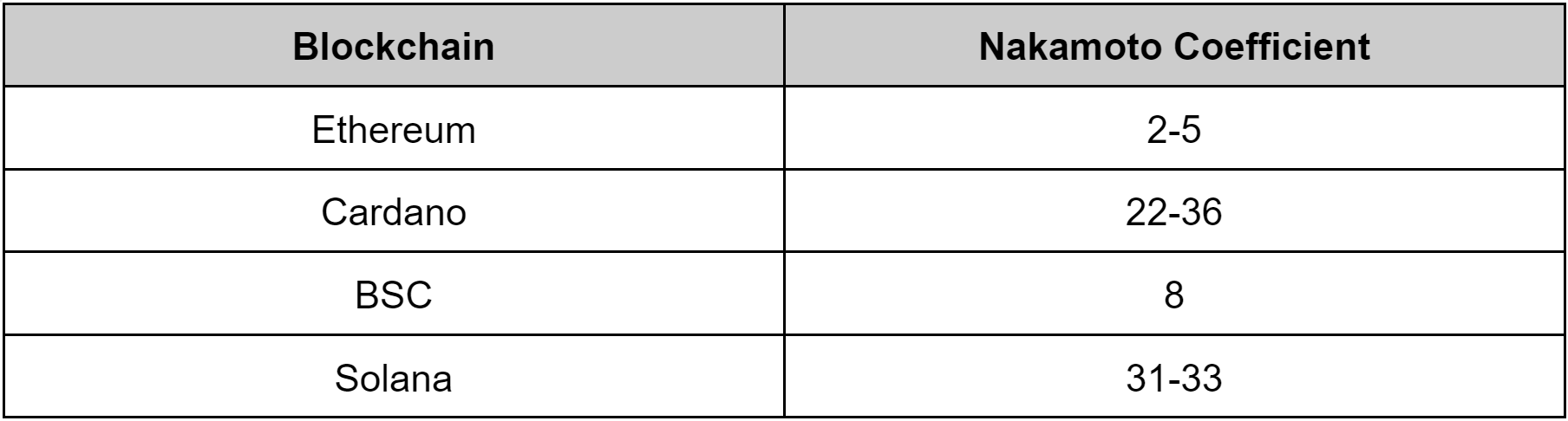

One of the more popular ways of quantifying how decentralized a network is is something called the Nakamoto Coefficient. It measures the minimum number of entities that would need to collude to compromise a blockchain.

For proof-of-stake (POS) chains like Cardano, Ethereum, or Solana, it would be the minimum number of entities that collectively control 33.33% of all coins staked in the network.

The higher its Nakamoto Coefficient, the more a network is decentralized.3 Below are the coefficients of some of the major chains:4

With a Nakamoto Coefficient of 22-36 depending on the source, Cardano is one of the most decentralized chains out there in terms of staking distribution. Among the major chains, only Solana (33) compares.

That’s in part due to the fact that there’s no minimum number of tokens you need to stake. In Ethereum, validators (the nodes that participate in consensus on a chain and validate transactions) need to stake at least 32 ETH. At current prices, that’s around $50,000.

Not a trivial amount by any means, and out of reach for most people out there. Most other chains have similar requirements.

Staking derivatives and delegated staking help here, but it does not take away from the fact that staking directly will always be a privilege of the very few.

In contrast, Cardano staking is for the people. With no minimum requirements for staking and only a 2 ADA ($0.50) fee to do so, anyone that wants to stake ADA can stake it.

No wonder then that a whopping 60% of all ADA is staked. To put things into perspective, Polygon has a staking ratio of 38%, and Ethereum fans are getting all excited as it’s just passed 20%.

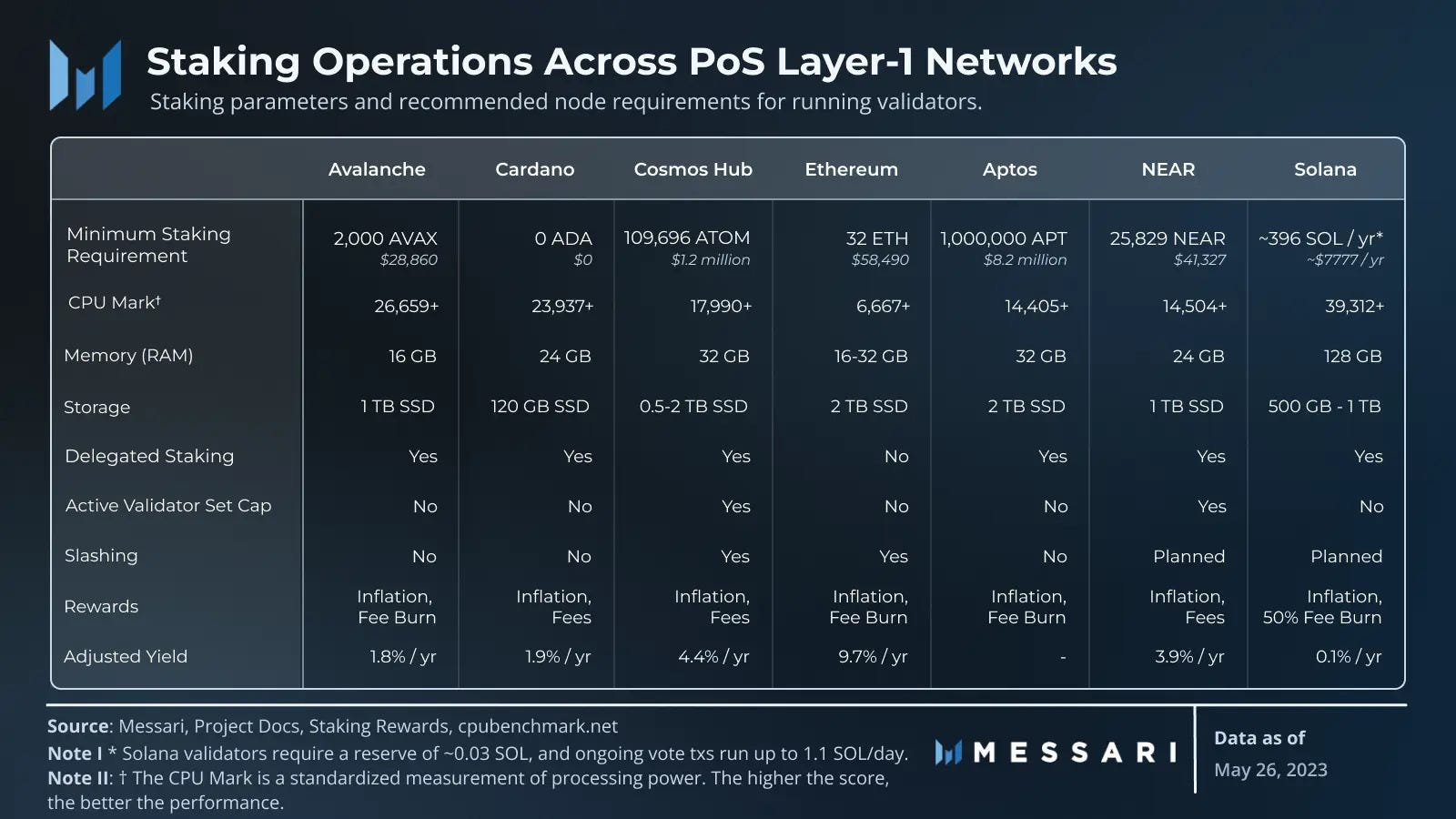

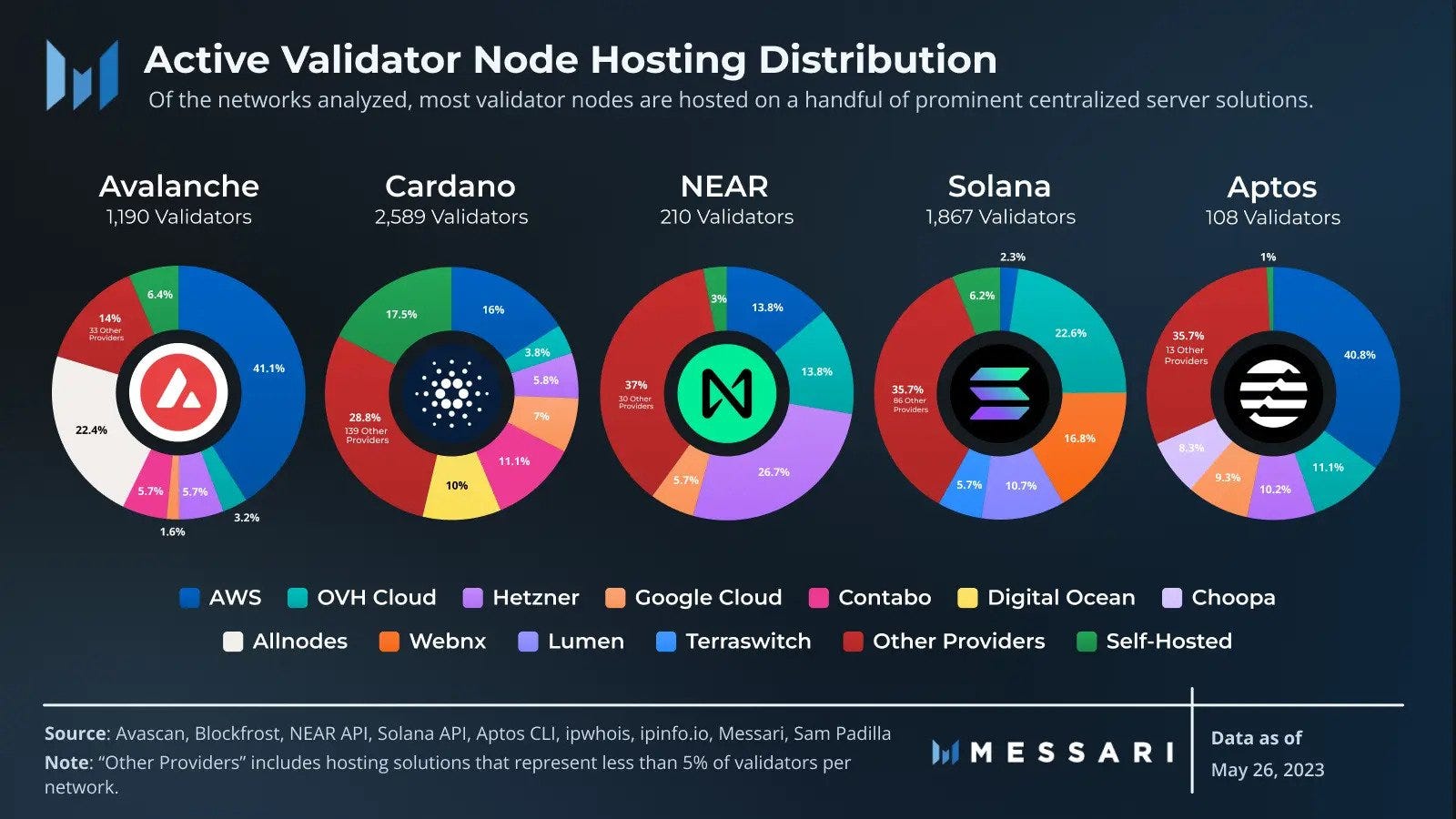

To top it all off, Cardano’s hardware requirements for validators are the lowest among the big L1s. This table from Messari lays out how Cardano’s parameters compare to other L1s.

This has led to Cardano being the least reliant on hosted server solutions like Amazon Web Services (AWS), another boost to its decentralization.

Running validators on hosted servers and relying on a few providers can be convenient, but it’s not smart. The blockchain becomes dependent on the whims of a few corporations and governments, who could ban them.

The network also becomes more homogeneous, so any kind of bug with a cloud provider will likely impact more validators.

Over 17% of Cardano’s validators choose to self-host, better than other L1s like Avalanche and Solana.

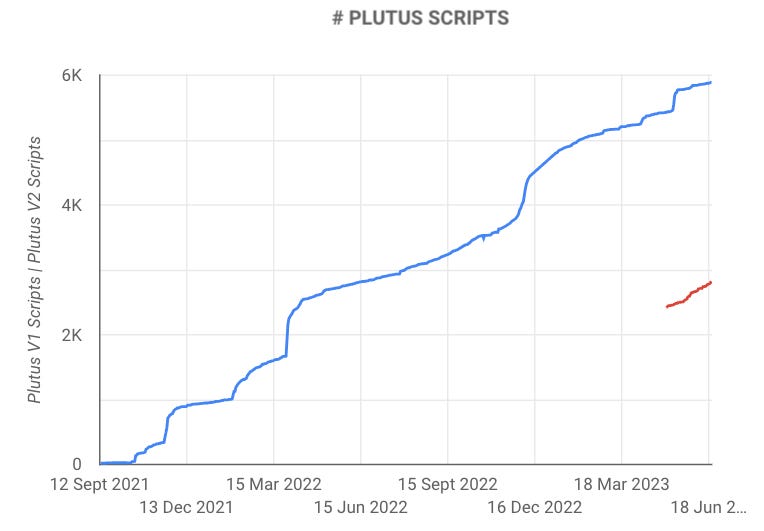

One data point that speaks to the resilience and tenacity of the people working on Cardano is the number of smart contracts (known as Plutus scripts in Cardano) deployed through time.

So there you have it: Cardano’s not dead, but very much alive, kicking, and ready to throw down in the next bull run.

Though I cannot predict how well ADA will fare in the future, or how much activity Cardano will attract, anyone writing them off is doing so at their own risk.

Keep it fun,

Kodi

Sources: https://cexplorer.io/tps, https://explorer.solana.com/, https://ethtps.info/, https://pontem.medium.com/a-detailed-guide-to-blockchain-speed-tps-vs-80c1d52402d0 ↩

Sources: https://twitter.com/CryptoSeq/status/1433420657291763714, https://cexplorer.io/article/finality-of-cardano-transactions, https://pontem.medium.com/a-detailed-guide-to-blockchain-speed-tps-vs-80c1d52402d0 ↩

Do note that there is no established method to calculate the Nakamoto coefficient of a chain and the numbers will vary greatly from source to source. ↩

Sources: https://solana.com/news/validator-health-report-march-2023, https://cexplorer.io/nakamoto, https://nakaflow.io/ ↩