Relief Rally or Resume the Trend - Part 1

Friday Update

“Traders who become emotionally distraught over missed trades have two choices: --Learn to adapt -/-Quit trading.“

First of all, apologies for not publishing the past couple of weeks. We have been absolutely busy with a lot of backlogs as we have a lot of products, metrics, new ventures, and partnerships under development releasing in September. So Ben Lilly has been unavailable to continue writing every day. He will resume soon next month once he is back.

Bitcoin and Ethereum have rallied nearly 12% and 30% since August open. Combining with the latest upgrade in Ethereum (EIP 1559) where a portion of ETH is being burned from the supply as a result of every transaction has left users in a frenzy to buy and accumulate more ETH as they forecast new all-time highs for ETH.

We will be covering the updates in multiple parts, starting with BTC today.

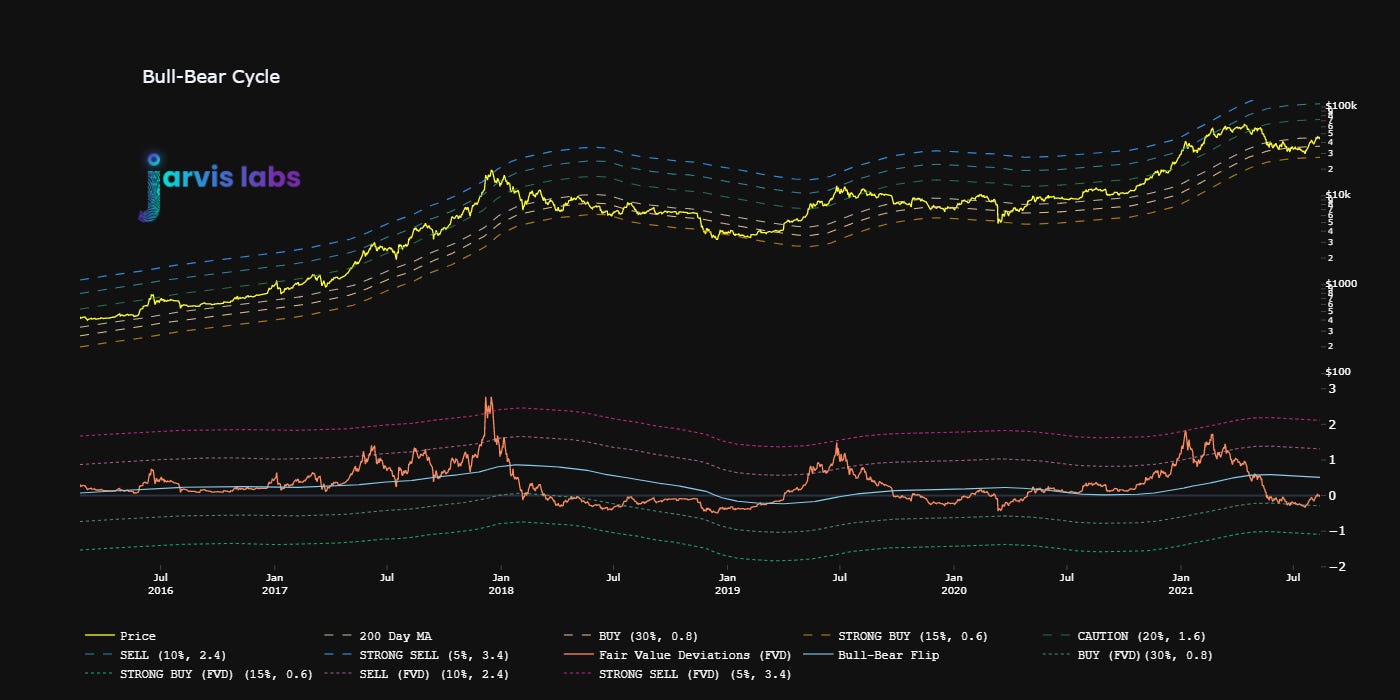

Let’s take a look at where we are at the Bull-Bear cycle.

The bull-bear cycle is a metric constructed out of an estimation of where the fair value of bitcoin is at a period. In this cycle, price (yellow line) bounced the lower price band while at the same time the Fair-Value Deviations (FVD - orange line) metric bounced at its bottom band as well.

Now, the FVD is rebounding and likely to test the Bull-Bear flip (blue line) threshold which will tell us further if this is a relief rally or the trend has turned to give us new all-time highs. In the event that the line is flipped, we have a primary confirmation of the change in trend and prepare for a massive bull run ahead. In past cycles too, flipping the bull-bear flip line after a consolidation period not only provided massive gains of more than 300% but also gave the perfect confirmation that price is back to trending mode.

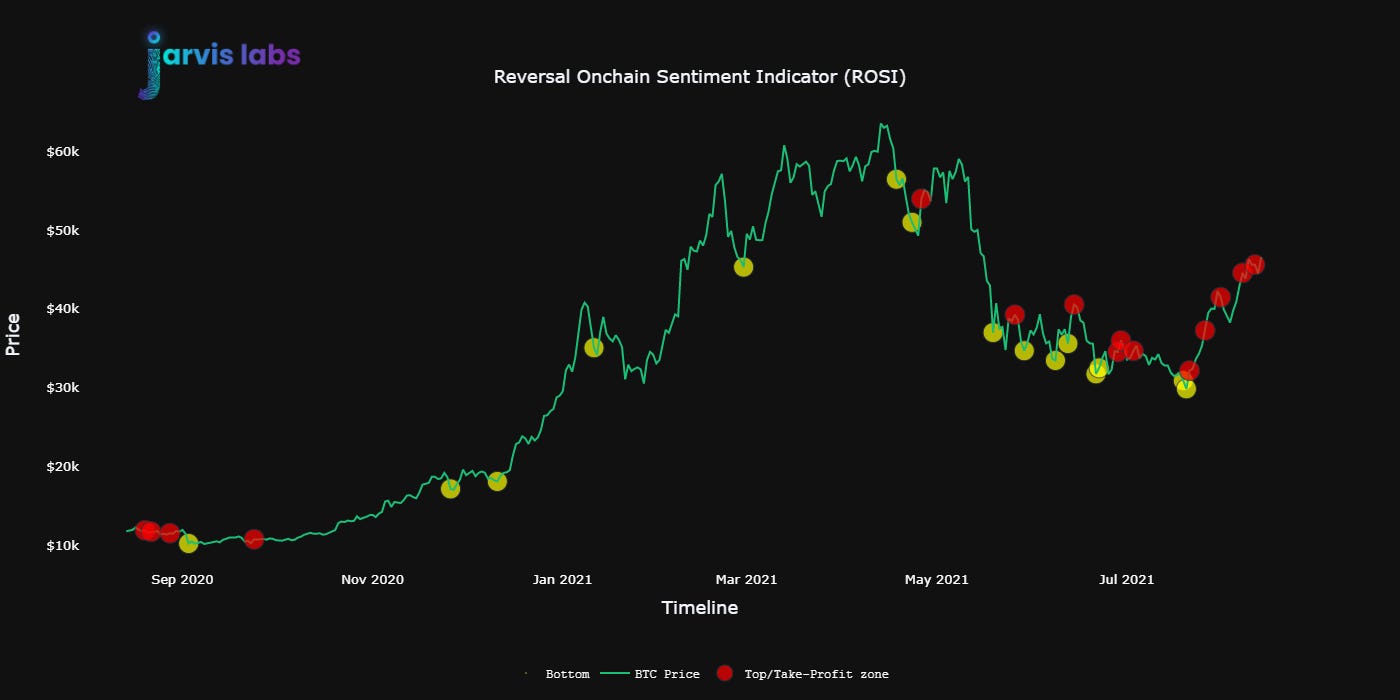

Let’s take a look at ROSI, our short term onchain sentiment metric.

ROSI perfectly signalled the bottom (yellow circles) at $29,500 however started signalling local tops/take-profit spots earlier than expected. This is primarily because of a mini-euphoric sentiment forming across the market, there are a few large players silently unloading their bags. There is a high likelihood of a short term correction inbound.

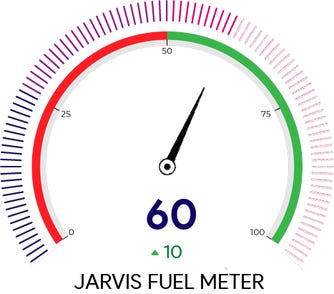

Risk meter is at 70 which is a bit high while Fuel meter is fairly neutral. Indicating we could have another leg up before the correction.

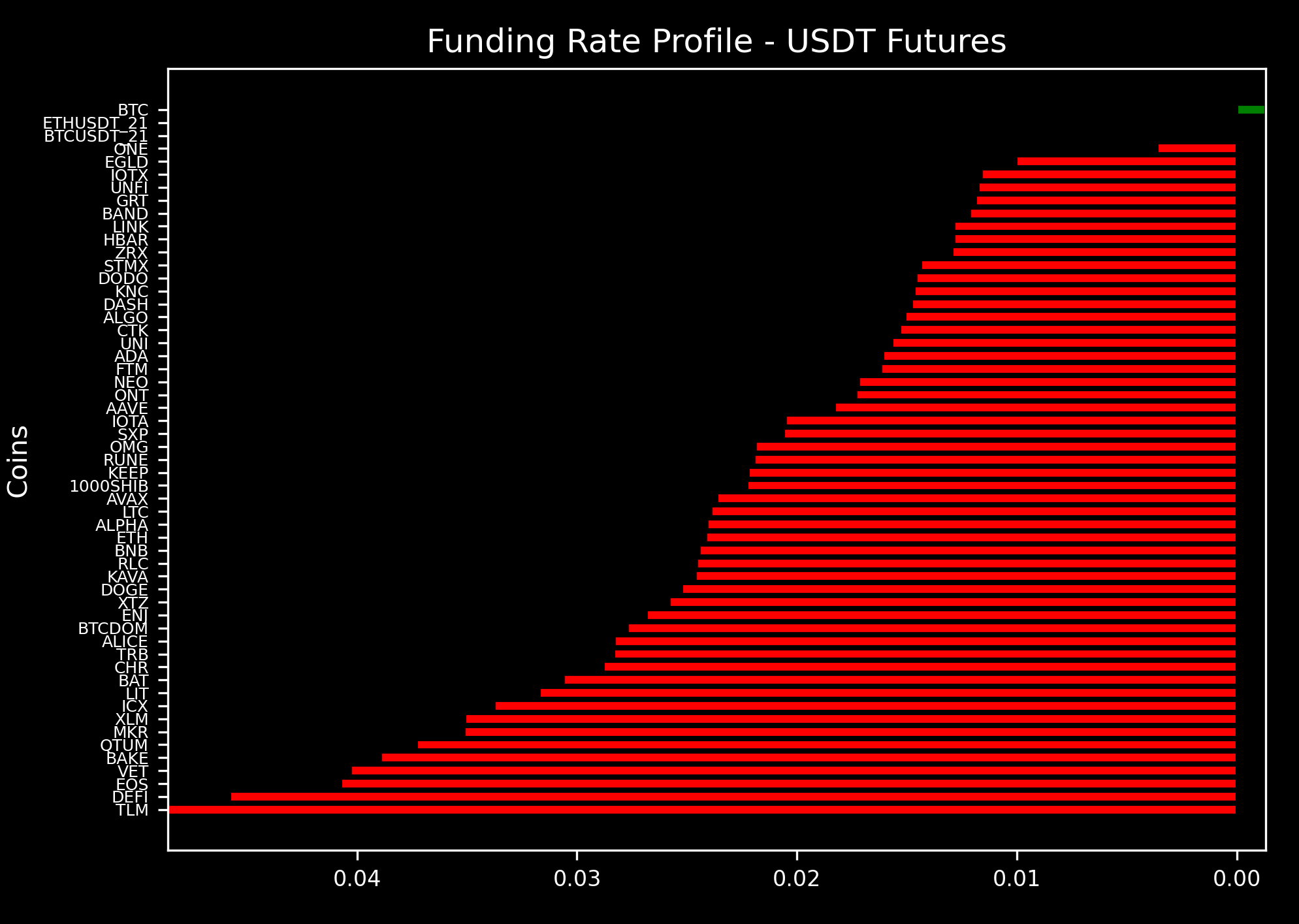

Funding rates are on the rise and no longer neutral on most pairs in Binance Futures. If this keeps rising, we could have a stronger correction on them.

Since the break of $37k, Jarvis has been constantly scalping long positions across BTC, ETH, LINK, and a few other pairs. Although we have seen Pablo alerts in the past two weeks periodically, amounting up to more than 20k BTC in deposits into exchanges, the impact has been bare minimum given the strength of the rally. This is in fact a positive sign but it is still possible that the funds could be used to dump later coupled with times of weakness. We also have a CME futures gap near $49-50k that might get tapped before a correction.

In the past three weeks, if you have missed out on trades, try to reflect on why it was the case, work on sharpening your tools. Find out what went wrong. Fix the gaps, make a plan, stick with it. Do not compromise your risk management for greed.

More about BTC on-chain, ETH & altcoins to be covered early next week. Stay tuned.

Until then have a peaceful weekend

Yours

Benjamin