Peace, Love, and Bulls

Market Update

We are a bear in a pasture of bulls.

And as hard as we try to blend in, we can’t.

I chalk it up to operating on too short-term of a time scale. Our team’s vision begins to get blurry when we try to focus on where we might be in a few weeks.

The bread and butter for our squad is in where the market will likely be over the coming week. This is our happy place.

And while we are working on correcting our near-sightedness through novel methods of analyzing the market, the fact is these tools are not quite polished.

So while onchain analysts using halving or four-year timeframes can publish bullishness, we are not so lucky.

The way we look at it…

We are not your drug dealer of onchain analysis.

Bullishness gets people excited. And people tend to gravitate towards it. Dreams, hopefulness, and thoughts on how their life will change when bitcoin hits $250k by the end of the year… this is literal dopamine to the brain.

And many analysts operate on this halving timeframe. Which is a great type of analysis. So don’t think this is a jab at them or anything of the sort. If anything, we know our limitations. Two weeks and sooner is our wheelhouse.

Anything further out and the reliability of the alpha we serve gets diluted away.

Now, the halving analysts operate on yearly timeframes. And that’s very needed in a young industry like this. It keeps our sanity levels in check when things get ugly. They remind us of why we pay so close attention to crypto, the change that is upon us, and what types of price levels the big of idea of bitcoin and crypto warrant.

So be thankful.

The way I look at it, each one of us have a role to play on this small ship. We are in open and stormy waters setting sail for the new promise land. We might not all get along and agree with one another during the journey, but at the end of the day we are brothers and sisters of crypto. Once we finally step foot in a new crypto-centric land, we will realize each one of us are family.

And each one of us served a purpose to make. Which reminds me of this quote…

“Scornful people inflame a city, but those who are wise turn away wrath.”

Crypto is too young for the scornful. Instead its more about gathering the wise for the battles that lay ahead. So even though we might not agree with one another all the time. We all tend to agree on one thing.

This is the way.

So with all the peace, love, and bull talk out of the way, it’s time to tell you what the Jarvis Labs crew is thinking...

It would not surprise us to see $30k break before August.

Further… If it happened before Monday the 19th, it wouldn’t surprise us either.

Demand is simply far too weak.

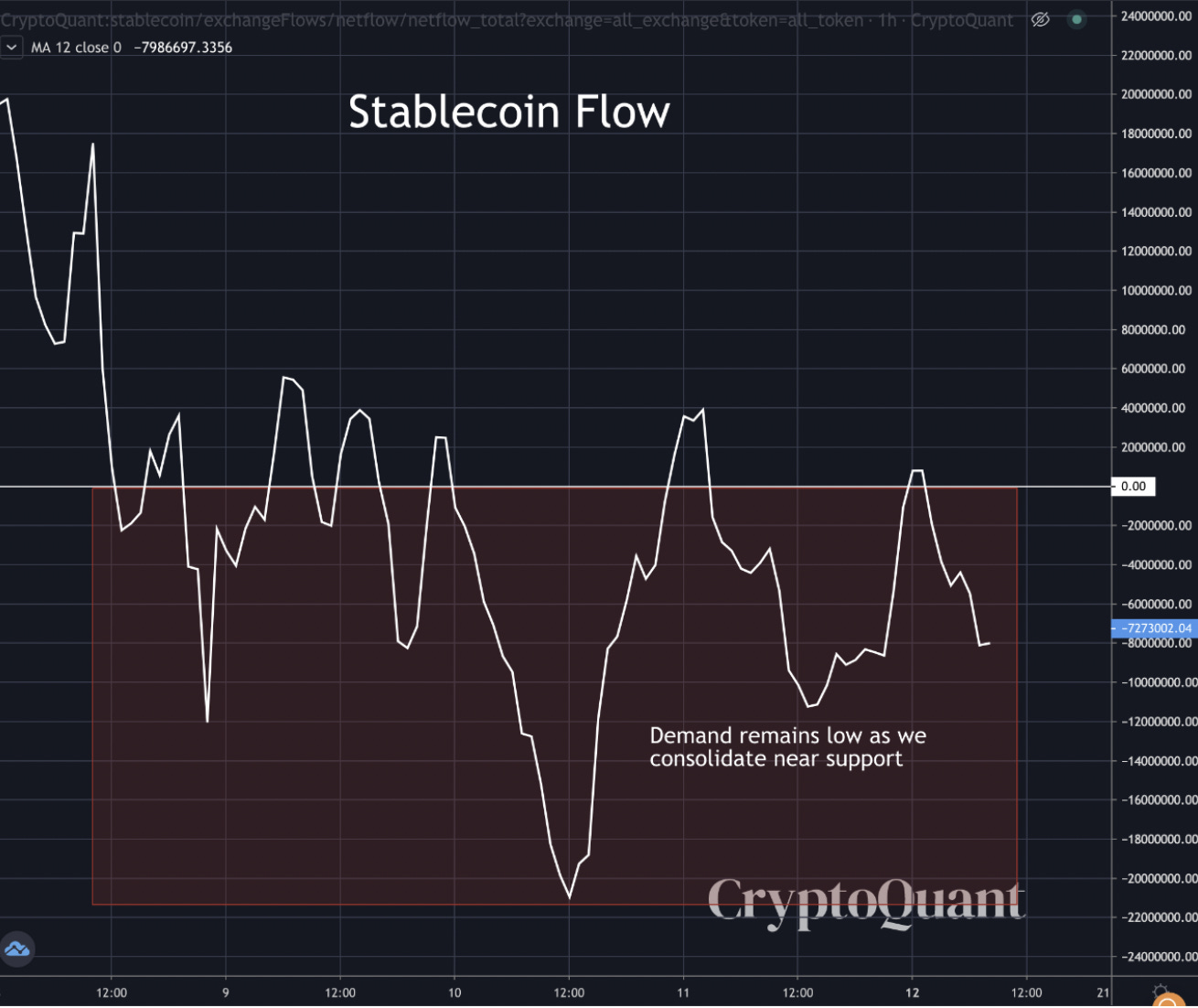

Some of you may have read my tweet of the chart I posted on CryptoQuant. Take it with a grain of salt. A lot of this has to do with me trying to send out some hints about the market in the most efficient way possible.

Tradingview would be better, but I haven’t thought enough about the best way to employ it. Regardless, the chart shows stablecoin flows on a 12hr moving average basis via the white line. The reading is consistently measuring outflows over the last four days.

In fact, one of the clearest signals in the market - Tether prints - has been non-existent for weeks. The printing press went cold.

Whenever fresh USDt entered the market is was an indication of fresh demand in the market. It implied new entrants or new money flowing into crypto.

Instead we’ve had silence as we continue to go sideways.

When we pair it up with a few internal models of ours, we get bearish yuck all around.

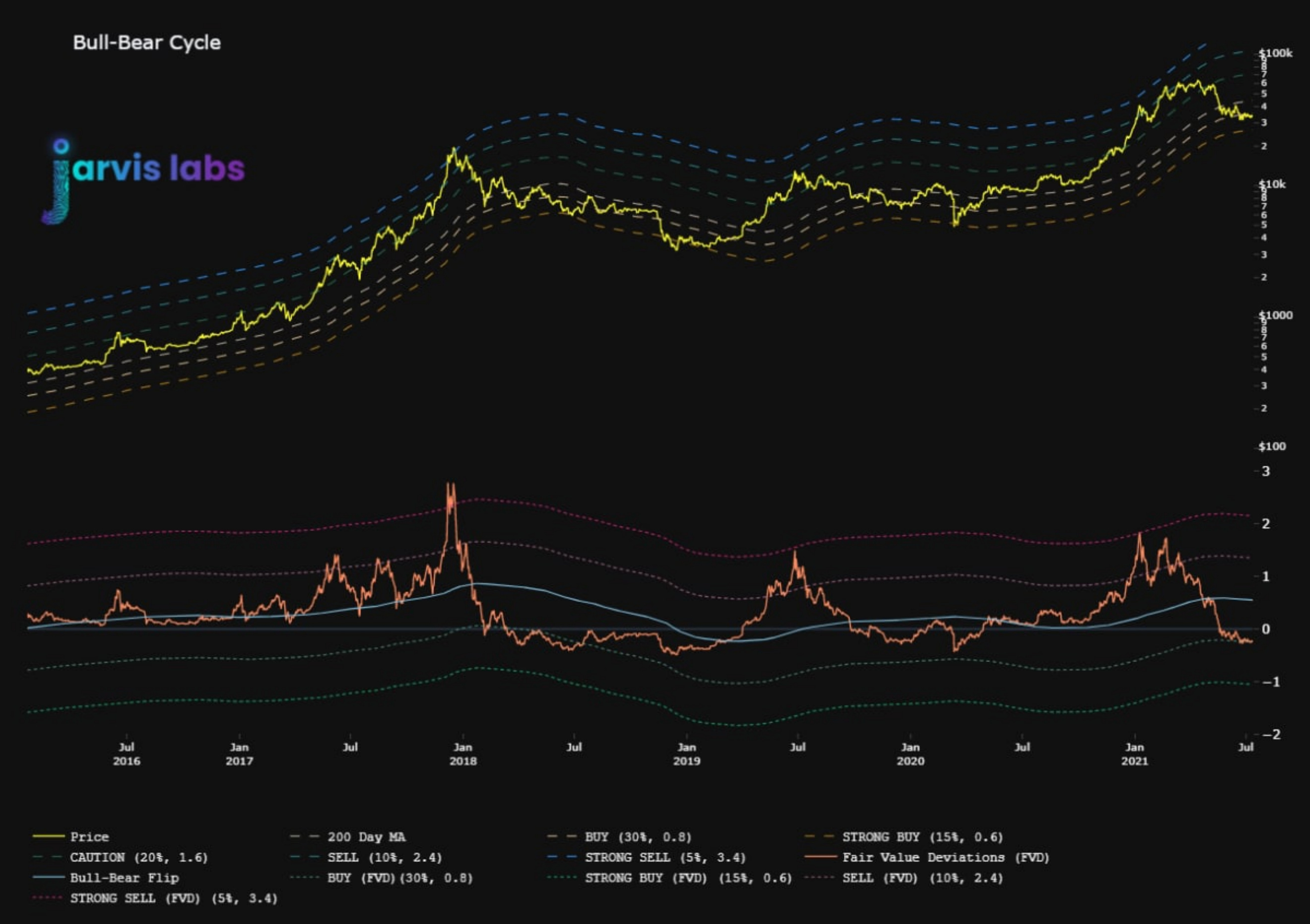

The one model some of you might be familiar with is the bull/bear cycle indicator. The area to pay attention to is the bottom half of the chart. There’s a dark blue line that serves as the bull/bear divide. If the orange line is below it, then the model signals a bearish market.

We have yet to show any meaningful strength via the orange line.

If price decides to trend lower from here, it’ll be encroaching on a strong buy reading. This is seen in the top half of the chart with the lowest dashed line. There has only been a few opportunities to buy based on that reading.

Will we get that strong buy?

Only time will tell. For now we remain bearish. Not even market movers are making much activity. Our internal feed has actually been silent for literally three days… And to give you perspective, I don’t know if that has happened in the 12 months since the team put the alert system together.

Needless to say market movers aren’t acting, demand for stablecoins has gone extinct, and our models are showing negligible strength.

In fact, the only bullishness we can churn up is no major inflow spikes for bitcoin and the funding rates for futures are neutral to negative.

Negative funding rates can result in a bullish effect in the market as it represents when trades are getting too crowded. Crowded trades hint at reversals, especially when it happens with a strong selloff.

And that is the entirety of our bullish case. As you see, the bearish arguments are far outweighing our bullish ones for now.

Which leads our team to believe the next test of $30k will be one to watch.

We remain the bear among bulls…

Your Pulse on Crypto,

Ben Lilly

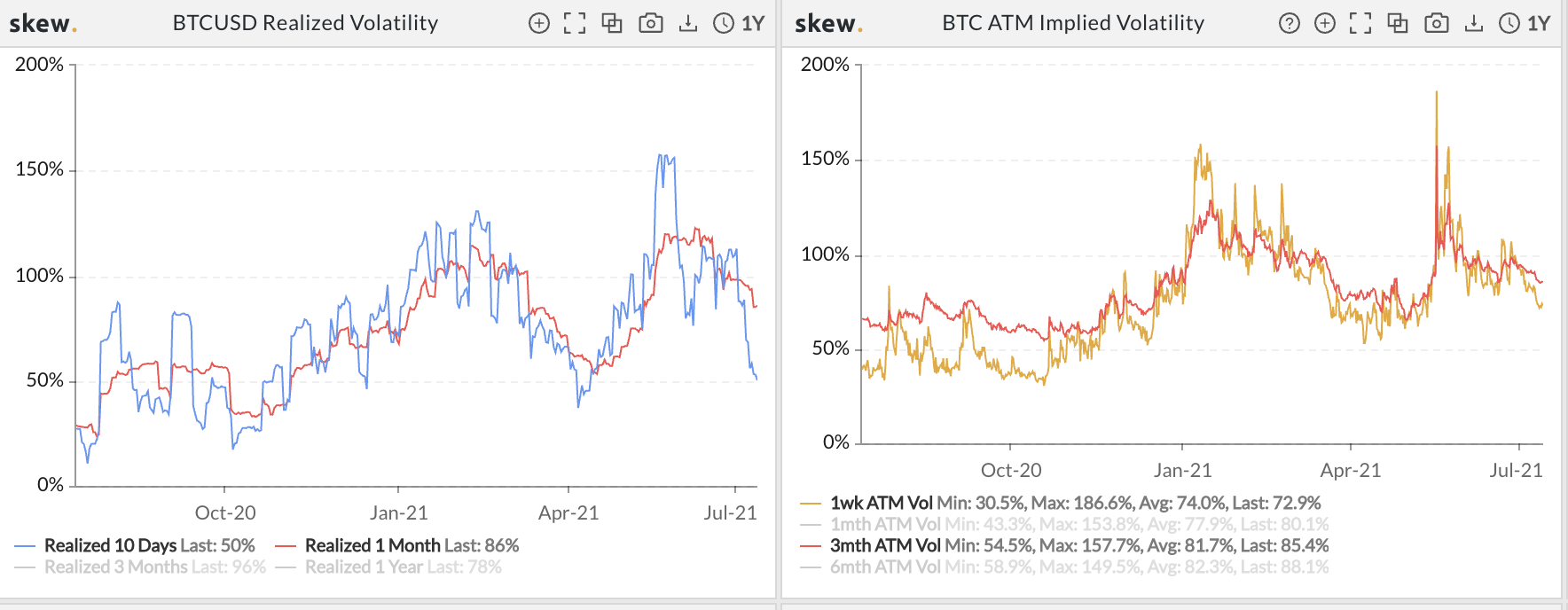

P.S. - For those playing the options market, volatility is getting lower… It’s almost time to straddle up.

Shorter time framed IVs are dropping hard, which means longer dated expiries are bound to follow any day. Building up a straddle position as price begins to compress and consolidate on $30k might prove to be a nice play.