Now’s the Time to Look Before You Leap

Market Report: Control of the Market Has Shifted

I checked my gear one last time, looked up at my target, and prepared to leap off the wall.

Rock climbing often isn’t a straight shot up the side of your formation. To ascend, you have to go for riskier handholds once in a while. And that’s the situation I found myself in.

My next handhold was not directly above me… To get to it required a dyno, a fancy way of saying “jump” in climbing.

And because the wall was sloping towards me, the angle would have me jumping away from the wall.

If I missed, I’d free fall about 20 feet.

It also meant my buddy on the ground, trying to make sure I didn't break my leg, would be pulled into the air about 5 feet just from the weight of my fall.

My forearms were already on fire, so I went ahead and tried to shake them out for a moment. I wiped away the sweat building up on my brow. Then, I took one final look at my target above, and pushed off from the wall.

A brief moment of weightlessness… before…

Fail. My fingers slipped, and before I knew it, I slammed into the wall as the rope tightened up.

Before I got to my senses, my buddy was patting me on the back saying that was ridiculous. I tried it next time and eventually got it, but it serves as a good point here.

I knew the consequences of not making the jump before I went for it. And I made sure the safety measures were in place.

You need to be aware of the downside risks no matter how high or even low you are.

The same is true in crypto… and right now, it’s important to be aware of just how close we are to slipping a bit further down the cliff face.

Let’s dive into today’s market report.

Retail Is No Longer Steering the Ship

One of the key areas to watch now is spot volume in Bitcoin (BTC).

When spot volume is rising, that indicates it’s mostly retail investors buying into the market for the long term, rather than institutions and traders, who more often use short-term derivatives like futures. Generally, more long-term buyers in an asset promotes healthier price growth.

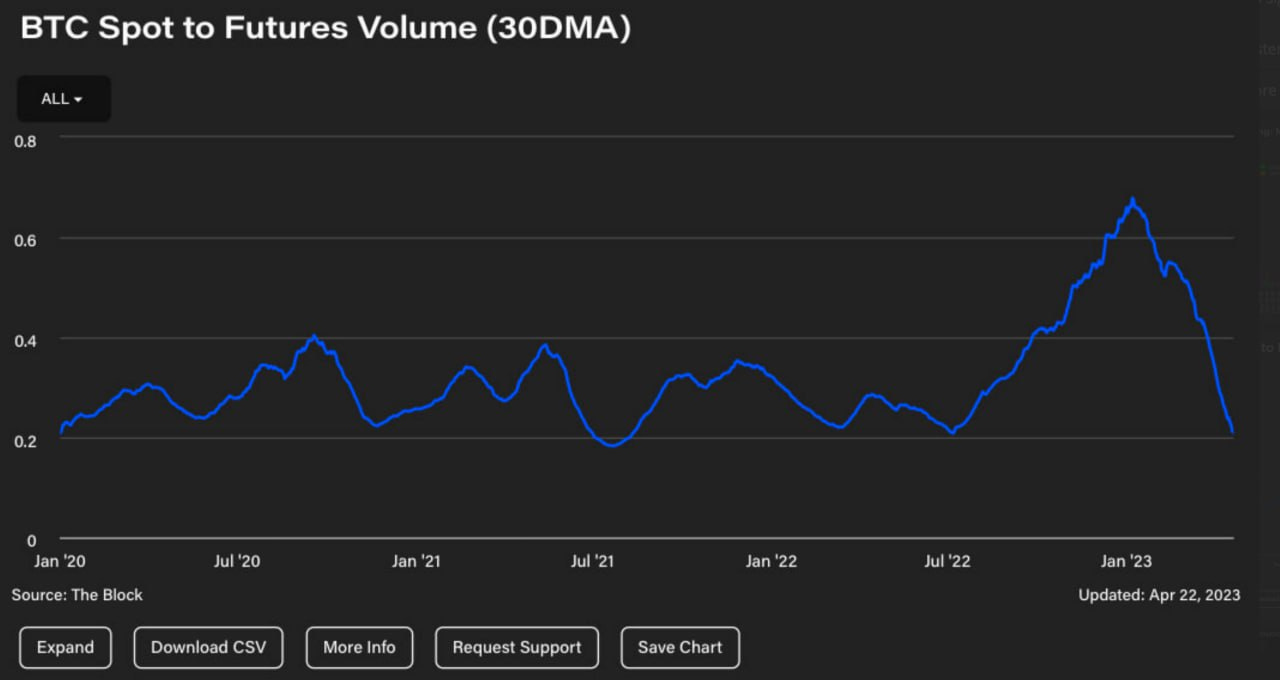

We can see this if we go back to Q4 2022, when the rise in spot volume drove the market off its lows. This chart from The Block shows BTC’s spot-to-futures ratio, measured by its 30-day moving average (MA).

From October 2022 to January 2023, the spot-to-futures ratio rose from 0.2 to nearly 0.7. This tells us derivatives were not of interest.

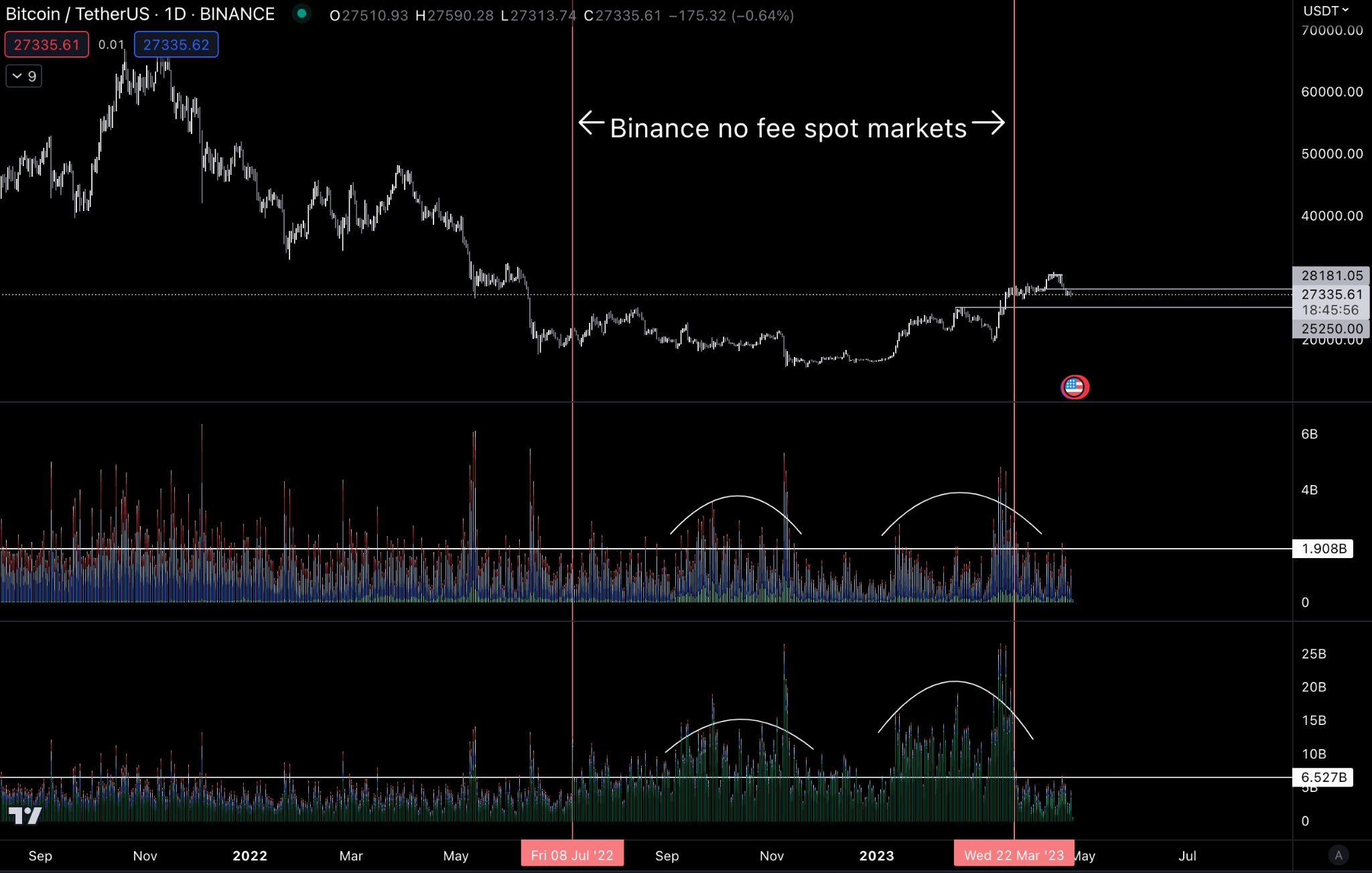

We can see how low interest was in this chart of BTC (yellow line) and open interest (OI, green line), which is the amount of active derivatives contracts in the market. As OI falls, that indicates money flowing out of the market.

The OI for futures at the end of 2022 was the lowest it had been going back to May 2021, after a massive liquidation event.

Now, Binance did instill no fee trading in spot markets between July 2022 and March 2023. But as you’ll see below, that doesn’t fully account for the trend here.

Below are two stacked spot volume charts on top of BTC’s price. The bottom includes Binance volume for spot, while the middle does not. You can still see spot volume had a distinct uptick relative before price took off from the lows.

Combined with the low OI in futures at this time, this decent spot volume pushed the spot-futures ratio to its high at the start of the year – with a little help from Binance, of course.

Regardless, after declining at the start of the year, this ratio has returned to 0.2, a level not seen since the summer of 2022. Meaning spot markets are not driving the market like they were before.

You can really see this taking shape if you go back to the open interest futures chart above. We are now at levels unseen for over a year.

And what this means is derivatives are driving the market… So we need to keep an eye on liquidity pools. Let’s get into that here. But real quick…

For those who have been looking for a new exchange, consider checking out ByBit.

They operate in 160 countries. They have more than 270 assets trading on spot and over 200 perpetual and quarterly futures contracts. They even offer options contracts and NFT trading.

Simply put, ByBit has a lot to offer any trader. And right now, they are offering a $10 welcome bonus if you open a new account and complete some introductory tasks. They also have additional ways for you to earn.

If you are looking for a new platform to trade on, consider ByBit today by clicking here. Also, if you simply want to support Espresso and the Jarvis Labs team, consider giving a click.

Look Before You Leap

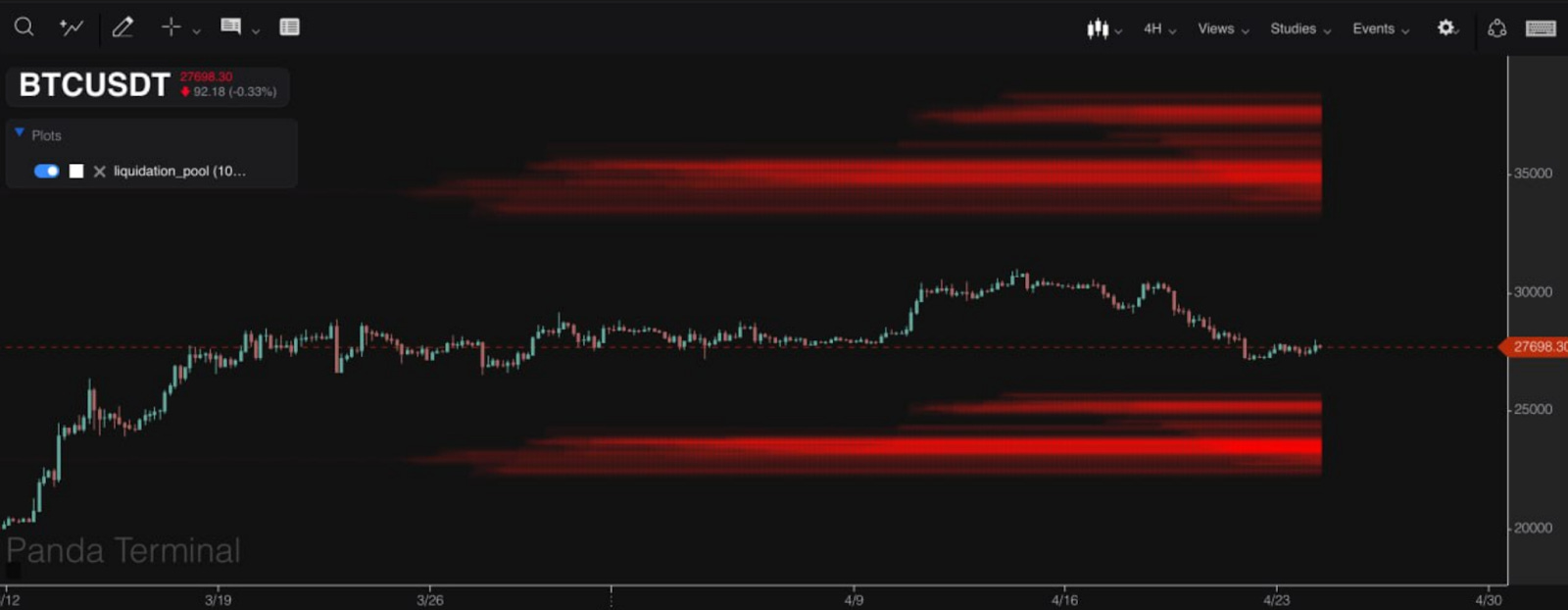

The chart below shows us BTC/USDT liquidation pools. The red lines show us the amount of positions built up (short/long) at certain levels. The brighter the red, the more there is.

Price tends to find these liquidation pools once spot markets stop driving the market so much. Right now, we are tapping our way through the $27,000 level of liquidity.

If we don’t see any spark from spot volume soon, then it’s likely we’ll break down to the next big liquidity level at $25,000, shown below.

The market seems to want to sweep away all this liquidity at the moment. So we need to be patient to see if this trend gains traction before we push off the cliff face and take a leap into new positions.

Unless spot buyers can return in full force and deliver the kind of action we saw that drove us off the lows, it seems like the market will continue to find pools of liquidity until it gets dry.

Your Pulse on Crypto,

The Bens

This newsletter is sponsored by Bybit. Be sure to try out the exchange here, and take advantage of all they have to offer today.