Not So Fast

Not so fast

Jerome Powell decided to not issue that proverbial check I mentioned last Wednesday.

Heading into the press conference, everyone was eagerly awaiting if he would shoot down the market’s expectation that rate cuts were imminent. And if he would drone on that the Federal Reserve needed to maintain rates higher for longer… The usual broken record-type of commentary.

Instead, he told the market to go ahead and run.

The signal he gave was rate cuts are coming in 2024. And the Fed will not be shy about it.

It was a vocal pivot heard around the world.

The markets responded strongly to that dovish press conference. And now we are hearing bankers getting ahead of themselves.

Some are now expecting rates to begin their move lower as soon as the end of Q1.

Goldman Sachs was most notable for saying they forecast a 25 basis point (bps) cut in each meeting starting in March of 2024. This means rates would drop by 75 bps before the end of Q2 2024.

Woah, that escalated fast. It felt like yesterday that we thought the Fed was way too hawkish.

And now we see Powell popping New Year’s Eve bottles of champagne for the market – it’s party time.

But just like Lee Corso from College GameDay says…

“Not so fast, my friend.”

Slow Down, Mr. Market

If you recall in Wednesday’s issue of Espresso, we said if Powell didn’t deliver the market a “check” in the press conference, that you would hear about it in the days that followed.

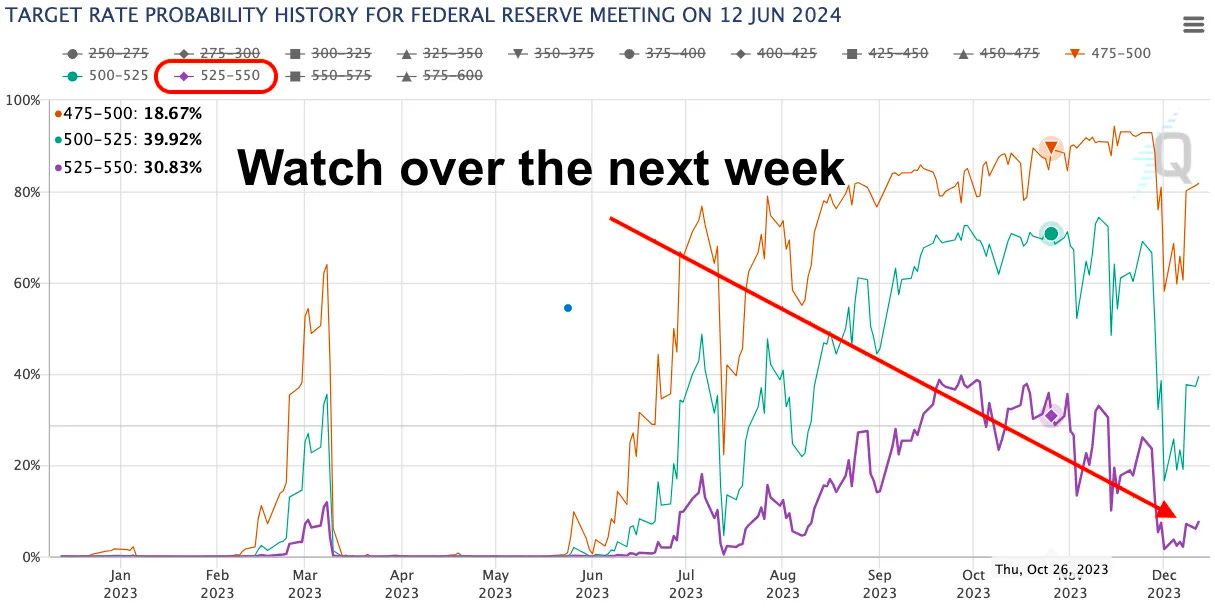

For those that didn’t have a read, I’ll drop a chart that sums it up.

In this chart from last week, the purple line is what current rates are. The chances that these rates remain this high in June of 2024 sat at 8% before the press release. And there was a 32% chance that there would be one rate cut by then.

As of Friday, that chart now looks like the one below.

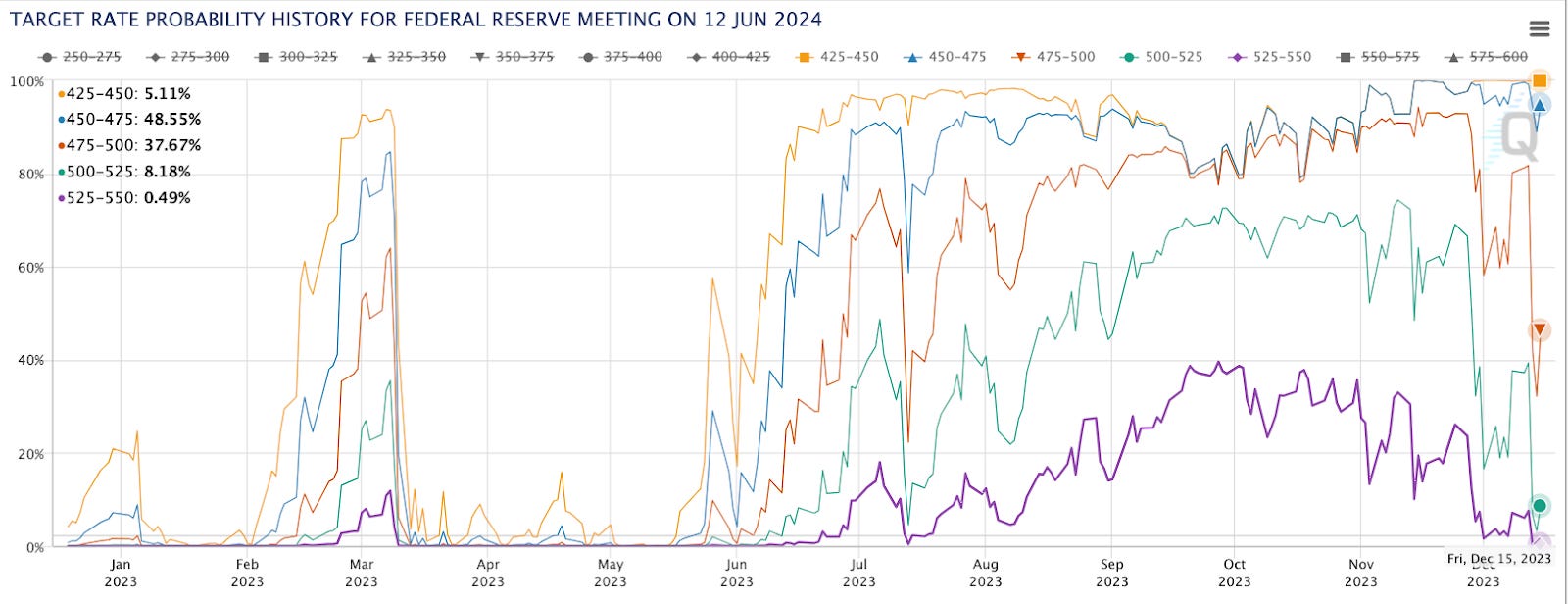

Note that the purple line – the probability that rates would be unchanged – is now essentially 0%. Meaning the market is assigning a near-100% probability that rates will be lower by the end of Q2 2024.

And so Goldman Sachs’ view is now the consensus, per the blue line near the top, which represents the probability of three rate cuts by the end of June next year.

That is a drastic change. Market expectations are clearly swinging more dovish than the Fed intended.

We know this because of what is happening today… The media is now trying to issue that proverbial check we expected from the Fed.

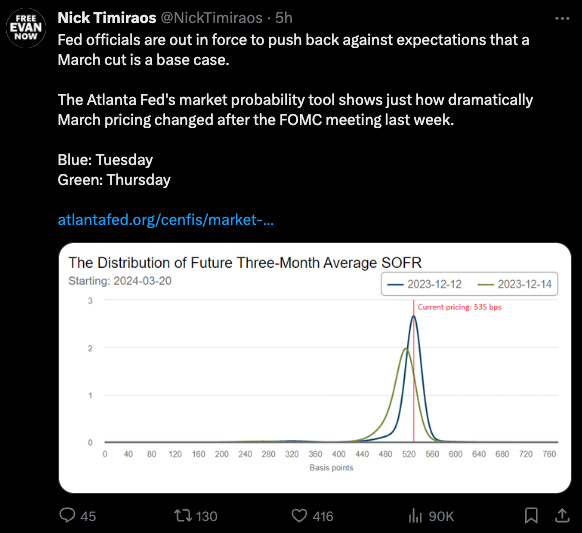

Here is Nick Timiraos, a Wall Street Journal correspondent who is often quoted as the best view into what is happening at the Fed, saying the market needs to relax on that March rate cut.

Check issued.

But is the check being felt? My current impression: barely.

I would expect to hear more hawkish views come from the Fed via the media this week. But nothing outright hawkish. The pivot is on; it’s just about a few speed checks here and there.

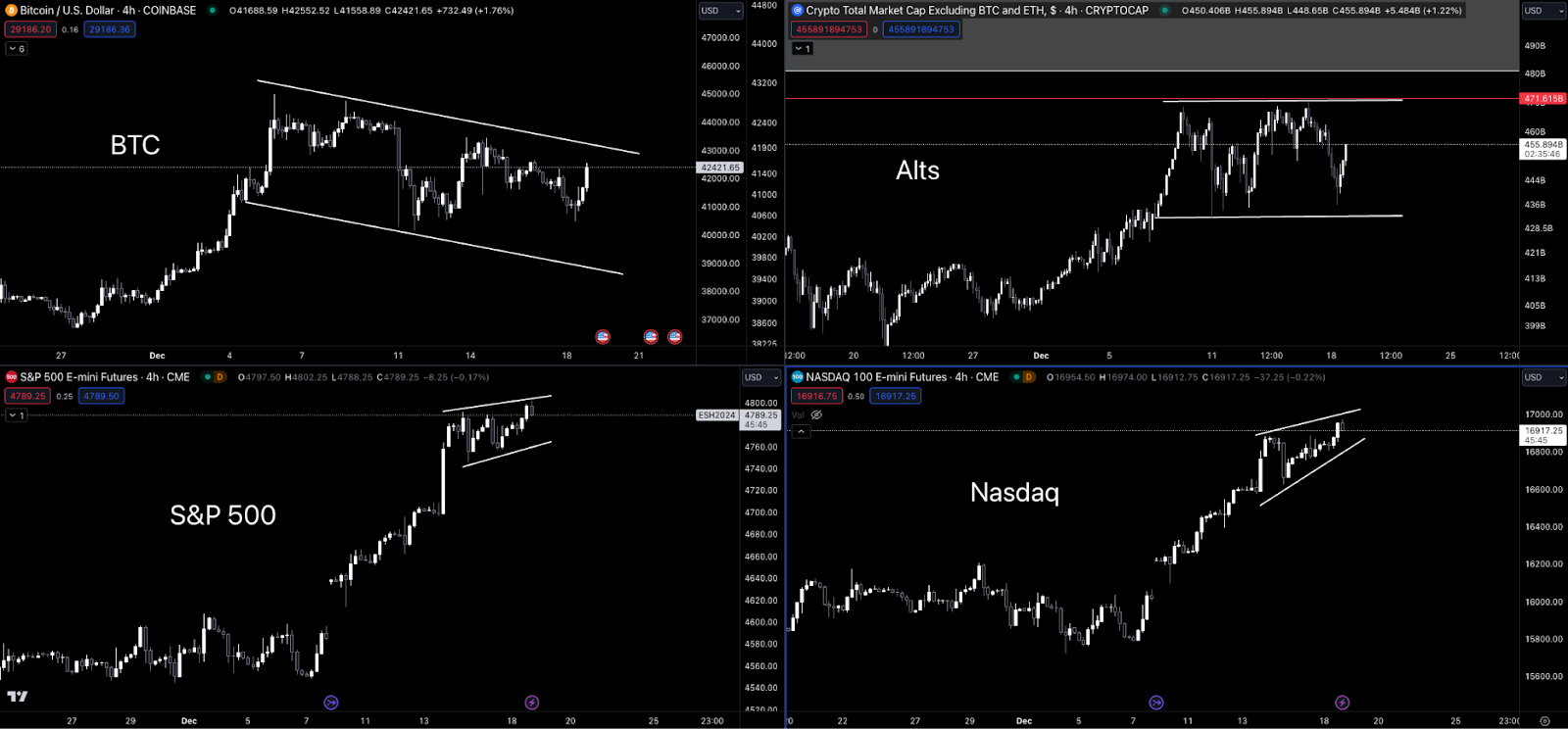

And while the market consolidates this week as the Fed tames the bullish vibes…

We should keep one chart at the forefront of our minds as we come into the new year.

The Party Is On Its Way

It’s the U.S. Dollar Index, DXY.

As our friend J.J. points out, the relative strength index (RSI) on the DXY is always an important line in the sand to monitor.

On the monthly view of DXY, we are there, testing it now. I dropped some red vertical lines whenever the RSI dropped below the 50-mark, so you can see how quickly DXY fell in the months that followed.

The orange line is Bitcoin.

It’s an insanely bullish setup. Like meltup quality (Macro Cycles: Part One Eurodollars-type of setup).

So, what does this mean here?

Well, the Fed is wanting the market to just chill out a bit. Sure, there’s a feeling in the air that the parents are out of town for the weekend, so let’s throw a massive party… But you still need to be cool about it all.

Which is to say, the higher probability setup here is that DXY does not immediately break through the 50 RSI level until a few months into 2024 – likely when rate cuts start to be realized in March, as Goldman Sachs predicts.

That’s the “Not So Fast” scenario.

The lower-probability setup is that this 50 RSI line acts like paper hands, meaning DXY’s floor falls out, and market FOMO ensues.

That’s the “go, go, go, go” mentality.

That’s the situation to monitor in the coming weeks as the market starts a cooldown… a healthy consolidation or perhaps even a greater pullback and correction.

This is all about finding out how soon the partying starts.

So don’t be worried if a deeper correction arrives, as it’s an opportunity.

As to a few levels we are watching for if that opportunity does arrive…

Here’s a chart of ETH.

That’s what I’ll have open on my screen if a selloff happens and ETH/BTC holds its support. And then it’ll be all eyes on the DXY.

Until next time…

Your Pulse on Crypto,

Ben Lilly