Not All Yields Are Created Equal

Token Insight: Ethereum’s Low Yield Is More Attractive Than You Think

Ah, the old, reliable United States dollar.

The physical embodiment of American prosperity and financial power.

A currency backed by the power of democracy, liberty, the rule of law…

…and the Gerald R. Ford class of aircraft carriers, a fleet of nuclear-powered behemoths 1,000 feet long and 100 tons, capable of carrying up to 90 Boeing F/A-18F Super Hornet jets and equipped with 4 Mark 38 25 mm Machine Gun Systems and 4 MK 49 Guided Missile Launching Systems.

With assets of that caliber, it is little wonder the U.S. dollar is the reserve currency of the world.

There's just one thing, though. All the fighter jets and laser-guided missiles can’t protect the dollar against the most dangerous weapon of all: the Federal Reserve’s printing press.

See, the Fed’s solution to most problems is to fire off the printing presses. Not that there’s much else they can do anyway. So Brrrr they go every time our frail financial system catches a cold.

The end result? Those dollars are worth less and less by the day. And no wonder! We have twice as many of those green fellows as we did 10 years ago, and 4 times as many as at the turn of the century.

Sure, you could put your money in bonds, now that rates have started to rise again. But since the turn of the century, the USD supply has grown 7.5% on an average year. In that time period, no bond has given a yield equal to that, not even close.

So forgive me for not wanting to hold my hard-earned wealth in that ever-diluting currency.

Luckily for us, cryptocurrencies offer an alternative.

Most cryptos have strict rules regulating their supply. Some have a hard cap, others dilute ever-so-slightly, but most importantly, they don’t change based on the whims of central bankers.

Plus, they pay decent yields through staking. According to Staking Rewards, Solana pays 7.95%. Avalanche pays 9.69%. Those are pretty great, especially compared to Ethereum’s 4.24%.

Yet there’s a reason that ETH is offering the better deal for crypto peeps looking for yield.

In this article, we will explore what makes ETH’s yield so special, and how to calculate your staking rewards, should you choose to stake your ETH.

Issuance ≠ Inflation

When it comes to analyzing a currency’s supply, there are some key differences between TradFi and crypto. So before we go on, let's set the record straight.

In traditional finance, the money supply measures the total currency in a country's economy. It's as if someone counted all the coins, bills, and bank deposits. Its growth refers to the amount that is added or subtracted (generally added) in any given period.

In crypto, issuance is the creation of new tokens. This is similar to the growth in money supply in traditional finance.

So, issuance equals growth in money (or token) supply.

What it does not equal, is inflation.

Inflation is the increase in the price of goods and services in an economy. In Ethereum's economy, that would be mostly the change in transaction fees. (Soon, we will be able to track actual inflation on Ethereum with a new metric we are cooking up at JLabs.)

With that out of the way, let's take a look at what drives issuance in Ethereum.

Our piece “Welcome to Deflation City” explored how the Merge and EIP-1559 changed ETH issuance.

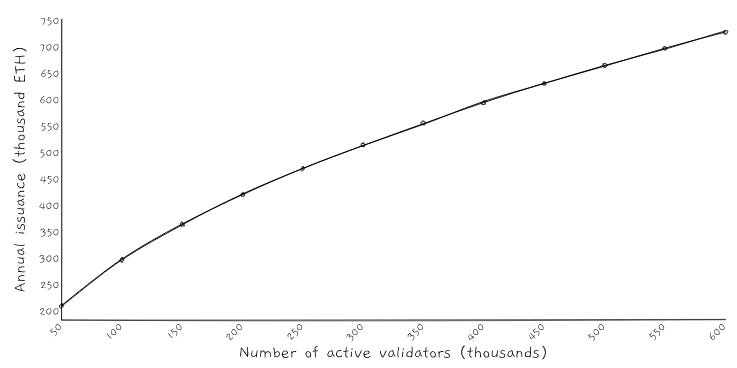

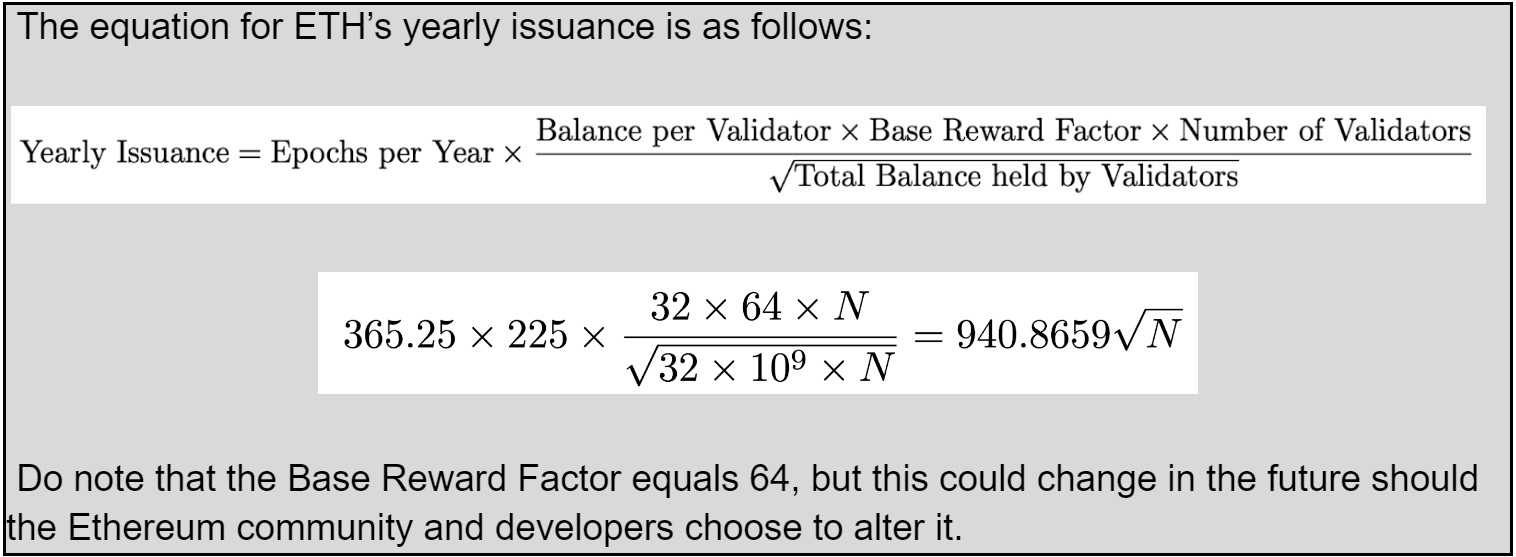

Long story short, since the change to proof-of-stake (PoS), only validators are issued newly created ETH. How much ETH is issued at any given moment depends on the number of validators, like so:

Trigger warning.

Equations in the gray box below. Feel free to jump ahead if you want to. This is just for those curious about it. It’s not needed to understand the mechanics of ETH issuance.

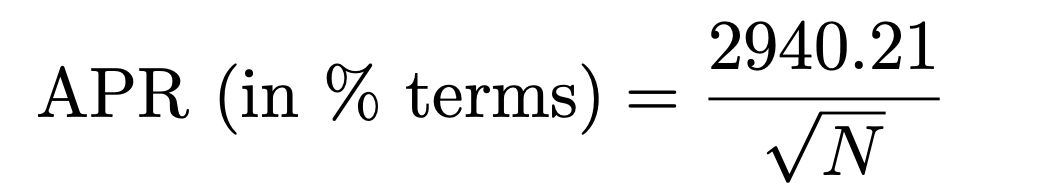

Now, if you want to calculate the rewards a validator can expect, just divide ETH issuance by the number of active validators. You'd get something like this:

This all means that, as the number N of validators increases, the reward per validator decreases, but only slightly, while ETH issuance increases. (The formula for rewards decreasing is 1 over the square root of N, and ETH issuance increases as the square root of N.)

According to BeaconScan, there are currently almost 520,000 validators, which according to the formula above, equates to around 4.08% in yield.1

If the number of validators doubled, you’d still get 2.88% in yield. If it tripled, you’d get 2.35%. So, the more validators, the less new validators joining affects your rewards.

If you want to keep track of the amount of ETH staked and the yield, be sure to check out this site.

On the surface, this may seem similar to other chains. As more validators join the network, ETH’s supply will grow, diluting its real yield.

That's just one piece of the puzzle, though. Let's take a look at EIP-1559 and why it could supercharge those yields.

ETH's Bonfire Party Never Stops

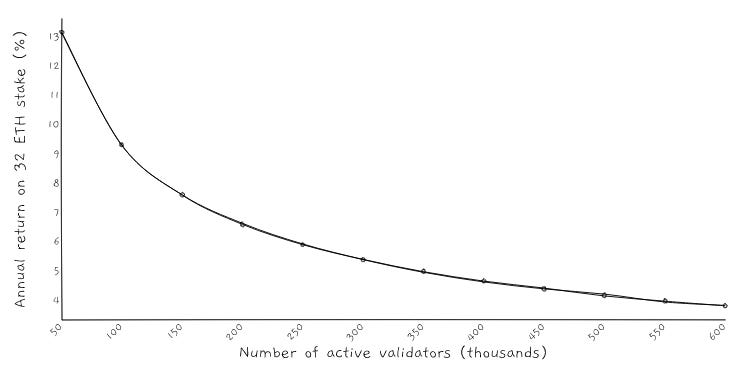

EIP-1559 was an Ethereum upgrade implemented in August 2021 that changed how users pay fees for transactions. But what is more interesting to us is that it introduced the burning of part of those fees.

Every time you pay for a transfer, do a swap on a DEX, buy an NFT or what-have-you, a share of the fees are burned. Those tokens are gone forever.2

And the higher the fees, the more ETH is burned.

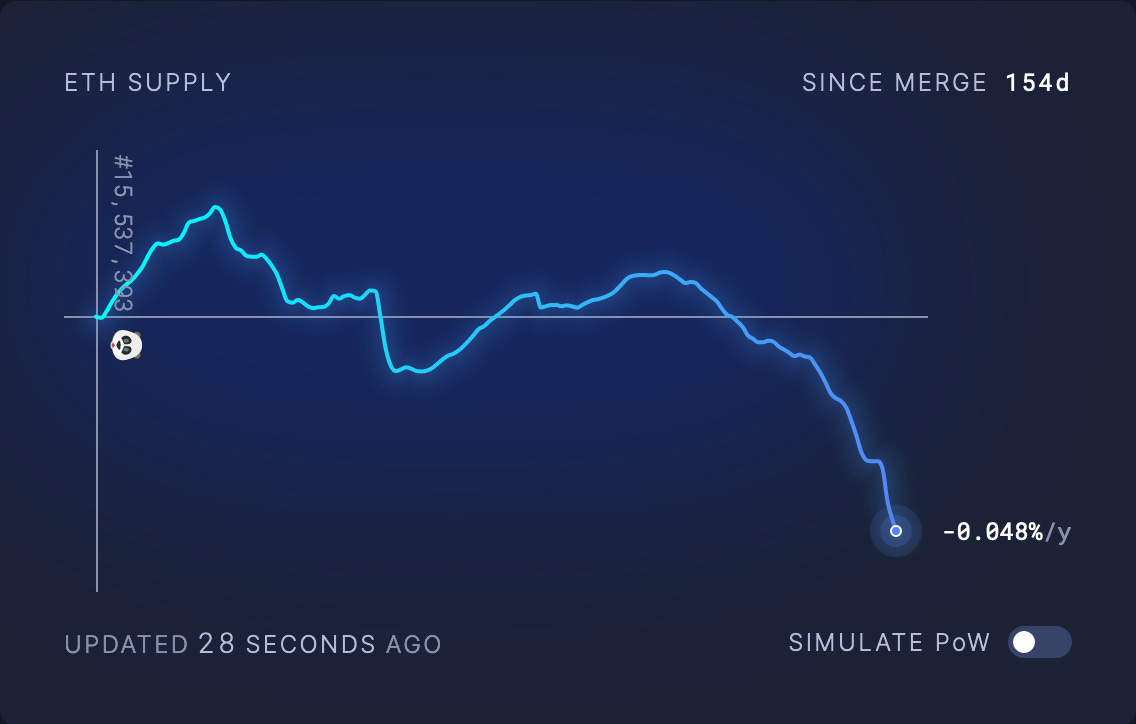

For ETH to become deflationary, gas fees need to average 16.6 Gwei3 or higher. Since EIP-1559 was implemented, gas fees have averaged 51.9 Gwei, turning ETH deflationary. Indeed, ETH supply is down -0.014% since the Merge in September 2022.

If gas prices stay at this level, this is what burn and issuance would look like over a year:

As you can see, Ethereum would burn almost three times the amount of ETH issued, and the total supply would drop by 1%.

However, one must remember that we are in the midst of a bear market, and activity on-chain is muted.

During the DeFi and NFT bull markets of 2020 and 2021, gas fees of over 100 Gwei were the norm (you can check historical average gas fees here). If EIP-1559 had been implemented before, 3.5 million ETH would have been burned in 2021 and 1.8 million ETH in 2022.4

Should conditions similar to those occur again, we’d be burning a whole lotta’ ETH.

Putting It All Together

All this talk about supply is important if you’re trying to find a quality yield.

If you were to just look at staking yields and ignore supply, Solana or Avalanche might look like better opportunities than ETH, with their 7% and 9% yields, respectively. But if you are thinking of staking any of these tokens, you need to calculate your real expected rewards based on supply.

You do so by subtracting new issuance from the expected yield. For ETH, that would be the 4% annual yield from before, minus issuance. Good thing is, issuance right now for ETH is negative, so it acts as a tailwind instead of a headwind.

It is not so for other chains, however. This is what staking rewards, both simple and adjusted, look like for the major PoS chains.

See the difference? If you consider how much new AVAX and MATIC is entering the circulating supply, they don't seem like such great options anymore. Hell, Solana seems to have taken a page out of the U.S. dollar playbook and is actively diluting stakers in their network. Never mind SOL holders.

When it comes to yield, there’s more to consider than which one appears to be the “highest.” If the token supply grows too much, that dilutes your yield. So if you’ve got a mind to get rewards from staking, do make sure that the chain of your choosing is not printing your rewards away.

But Ethereum does one better, since it’s actively reducing its supply by burning tokens through fees. And as more people use Ethereum, the more ETH will be burned.

Right now, that makes Ethereum the best chain to stake for a “safe” (as safe as anything can be in crypto) and real yield.

And if you want to calculate your rewards for staking ETH, you can use the formula below:

Keep it fun,

Kodi

The number differs from the 4.24% from Staking Rewards we mentioned above because they take the average over the last 30 days. ↩

Again, please refer to our previous piece “Welcome to Deflation City” for a more thorough explanation of EIP-1559 and its impact on the supply of ETH. ↩

One Gwei is one-billionth of one ETH, or 10e-9 ETH. To calculate the equivalent in USD, multiply by the price of ETH and divide by 1,000,000,000. ↩

Estimates based on gas spent and average gas fee data from Etherscan. One must consider that EIP-1559 also altered how the fees are spent, and only a portion of the fees are burnt. ↩