More Upside, Less Downside

It's time to know your options

What piece of the crypto market is older than Muhammad, Jesus and Buddha?

And literally measures chaos or the potential of upcoming chaos at any given moment?

It’s the options market.

The topic of options is something I want to hit on for the weekend piece since now is as good of time as ever.

That’s because volatility is starting to drop and on-chain data is signaling bullishness ahead.

This combination provides us with an ideal situation for the most basic form of options. Today I’d like to break it down for you since it’s my understanding that many of you are rather new to the options world.

For those that understand options… Go ahead and skip right down to the second section labeled volatility. There I’ll break down today’s insight about what’s happening with implied volatility in the options market. This first part will be an introduction into options.

Let’s jump right in.

Options are an intimidating landscape to most investors. Rarely do investors or traders cross the rubicon to buy or sell an option.

For anybody that’s never bought or sold an option before, one quick glance at an options chain is likely to make you consider doing your taxes. It can be that frightening.

If what I just said sounds a bit like you, consider this…

Options contracts give you the ability to realize the upside of an asset while limiting its downside. Meaning you can risk a smaller amount of capital and not miss out on its gains.

Yup, upside with less downside.

A rather basic example is buying a June 26th, 2021 bitcoin call option. Right now a call option that’s “at the money” is around $12,500. At the money is jargon for the current price of bitcoin ($60,000).

What’s nice is you don’t need to buy an entire contract. You can buy $1250 worth and get 0.1 contracts. This gives you the right to 0.1 bitcoin if the price of bitcoin is more than $60,000 on June 26th.

If bitcoin is say $100,000 on June 26th, you’ll be able to buy bitcoin at a price of $60,000 per BTC. Since the contract is 0.1 you’ll buy $6,000 worth. And since the value of the contract is essentially 0.1 of $100,000 (current price of bitcoin), you enjoy a difference of $4,000.

Remember, the contract was purchased for $1250, which means your profit on that collateral is $2,750. 120% gain, not bad.

In terms of the downside, if bitcoin is $60,000 or less than the contract is worthless. That’s because you wouldn’t want to buy bitcoin for $60,000 if its current price is $50,000. That makes no sense.

Now, in terms of why this is interesting, consider the capital exposure.

To buy 0.1 bitcoin costs $6,000 if the current price of bitcoin is $60,000. If bitcoin moves to $100,000 then your 0.1 BTC is worth $10,000. Your profit is $4,000 or 66.7%.

120% versus 66.7%. Options look pretty nice here.

But here’s where the power of options is most appreciated...

Let’s say price moves from $60,000 to $45,000. Something that’s definitely not considered a black swan event by any means.

Your $6,000 is now worth $4,500. That’s a difference of $1,500.

In comparison to the example given above, you’d be out $1,250 if your options contract became worthless. Meaning you reduced your downside exposure by $250.

That’s the real beauty.

You’re able to reduce your risk on a timed trade - which is the key. Because with bitcoin many investors are just HODLers.

And that’s fine.

However, for the traders, options remove the chance of being liquidated and essential replace it with a time component. And just like trading in the futures market, we recommend only a tiny percentage of your holdings being used for such a basic strategy.

Keep in mind, this is a very very basic run through. I do this to try and show you options is nothing to be afraid of. If this description piqued your interest please go ahead and read our Options 101 Part One and Part Two articles. These are a much more robust guide in getting you started in options.

Plus, I promise it’s a much easier read than you’d expect.

After reading the two pieces you’ll understand what options are, what a call versus put is, what an options chain is and how to read it.

The last part that you need to know is volatility, and how it plays a crucial role in the price of options.

Because as volatility increases, there’s a greater chance for your option to be in the money at some point in time. This might sound odd, but if prices whips around between $50,000 and $100,000 every month, then buying a call option at $100,000 while price is $50,000 is rather likely.

But if price hasn’t moved more than $5,000 in a year and the price is $50,000… Then the likelihood that a call option at $100,000 is worth something becomes very rate.

It’s what I mean when I say volatility can improve the chances that your options has value. Which is why options cost more when there’s more volatility.

We measure this using a term called “IV” or implied volatility.

It’s essentially how much volatility the market (buyers and sellers) are placing on that specific options contract.

Confusing enough?

If so, all you need to know is when volatility goes up while nothing else changes, the cost of an options contract goes up.

If volatility goes down, the price goes down.

So when volatility is low and you think it’ll increase in the coming days to weeks, it’s likely a good time to buy some options…

Which is why we’re writing this extensive tutorial on options.

The scenario we described above was using a high IV. We expect IV to come down, making the example scenario earlier more attractive from a risk/reward sense.

Volatility

OK, so good ole’ volatility.

When it comes to crypto I like to view it as a measure in terms of how board traders are. That’s because as price begins to consolidate over long periods and new highs nor new lows are being reached, traders lose interest.

It’s during this time that the amount of expected volatility (IV) begins to drop. And with a lower volatility comes lower prices thanks to the lower IV reading.

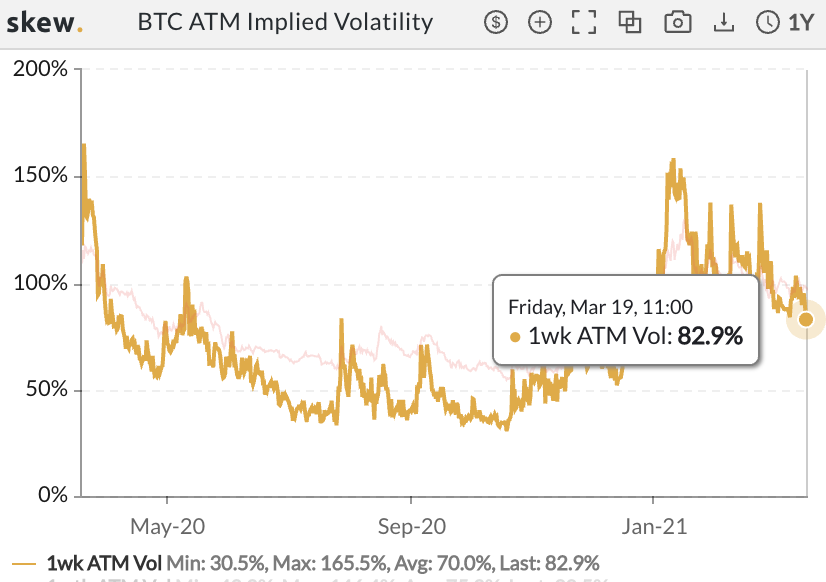

Right now, we’re beginning to see IV drop for options that expire in one week.

Here’s a chart of the one week IV for bitcoin options. It’s currently at 82%. This is down from a 152% reading that happened around January 14th.

(ATM stands for “at the money”.)

Now, these IV levels are only starting to drop. So this isn’t something I would recommend getting involved with right away as they are still pretty high. This is more of a “putting it on your radar” type of thing.

That’s because if IV suddenly drops in the coming week or two, it’ll be time to act.

Also… you might be asking why I just put a chart of options that expire in one week instead of the ones that expire at a later point in time.

Valid point.

To explain why, let me first say that IV drops in the closer to maturity options before being seen in the longer to maturity options.

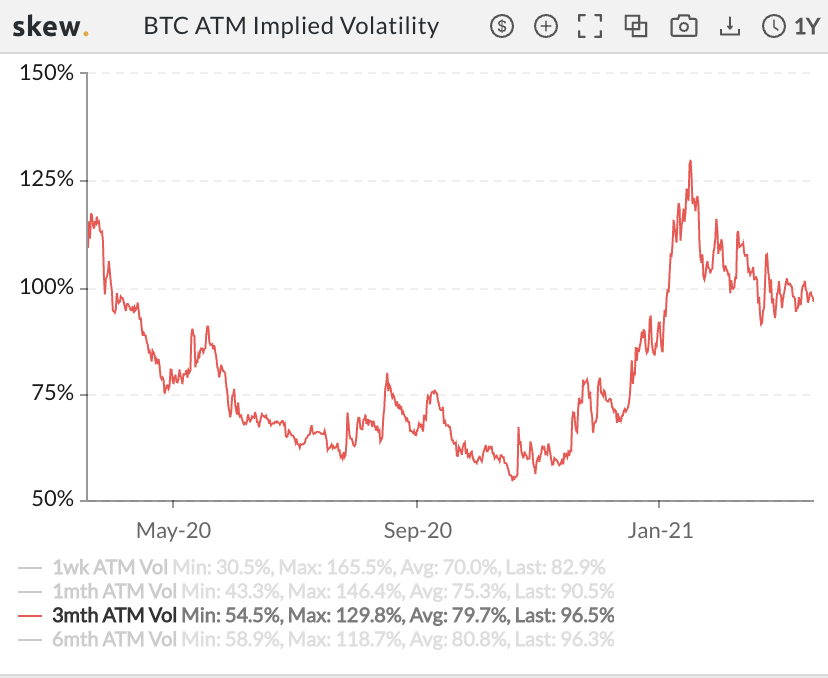

And since one week IVs are starting to drop, we can expect three month to expiration options to start dropping in price soon. Here’s what the three month IV looks like at the moment.

As you can see, it’s starting to consolidate in a narrow range. And similar to what happens when price consolidates, we might get a break to the downside in the coming week.

Again, that’ll be the time to act.

OK, so volatility drops and a price rise feels imminent. So now what?

Well, it’s time to decide what calls and what expiration date we’ll get for our contract.

For our team we’ve been discussing over the last few weeks the combination of the Grayscale Effect coming into play in May/June, the FED allowing bitcoin to keep running, and on-chain data pointing to higher highs in the future.

Needless to say we’re expecting price to go up. And if we were trying to keep things very basic our game plan would involve buying call options.

In terms of which ones, June or September are attractive. If you recall, December 2020 was powerful in terms of the Grayscale Effect, so that recurring unlocking time period would put is at the end of June, so it’d be the month we want to set our focus on.

As I write this, the price of bitcoin is $57,400 and a call option with a strike slightly higher ($60,000) is trading at $12,500.

If you’re conservative then that’s a nice target as your breakeven point on the option is $72,500 (strike price + the premium paid for the contract).

Again, we still think premiums are a bit steep. So consider this our initial piece to confuse the bejesus out of you.

We know options are tough to understand at first, so please fire away with questions in the comment section below. Our goal was to get this out to you early enough to help you feel confident with options before it’s time to act.

We try to prepare you before the moment.

Your Pulse on Crypto,

B

P.S. - Lifetime members, if you’re looking to hook up an options account to Jarvis AI, please reach out to Benjamin. We can get you situated. We don’t recommend putting anymore than 5% of the capital that’s used by Jarvis AI. Meaning if you have a $200,000 account, don’t put anymore than $10,000 towards the options strategy.

P.P.S. - Our ChainPulse update yesterday hasn’t changed.

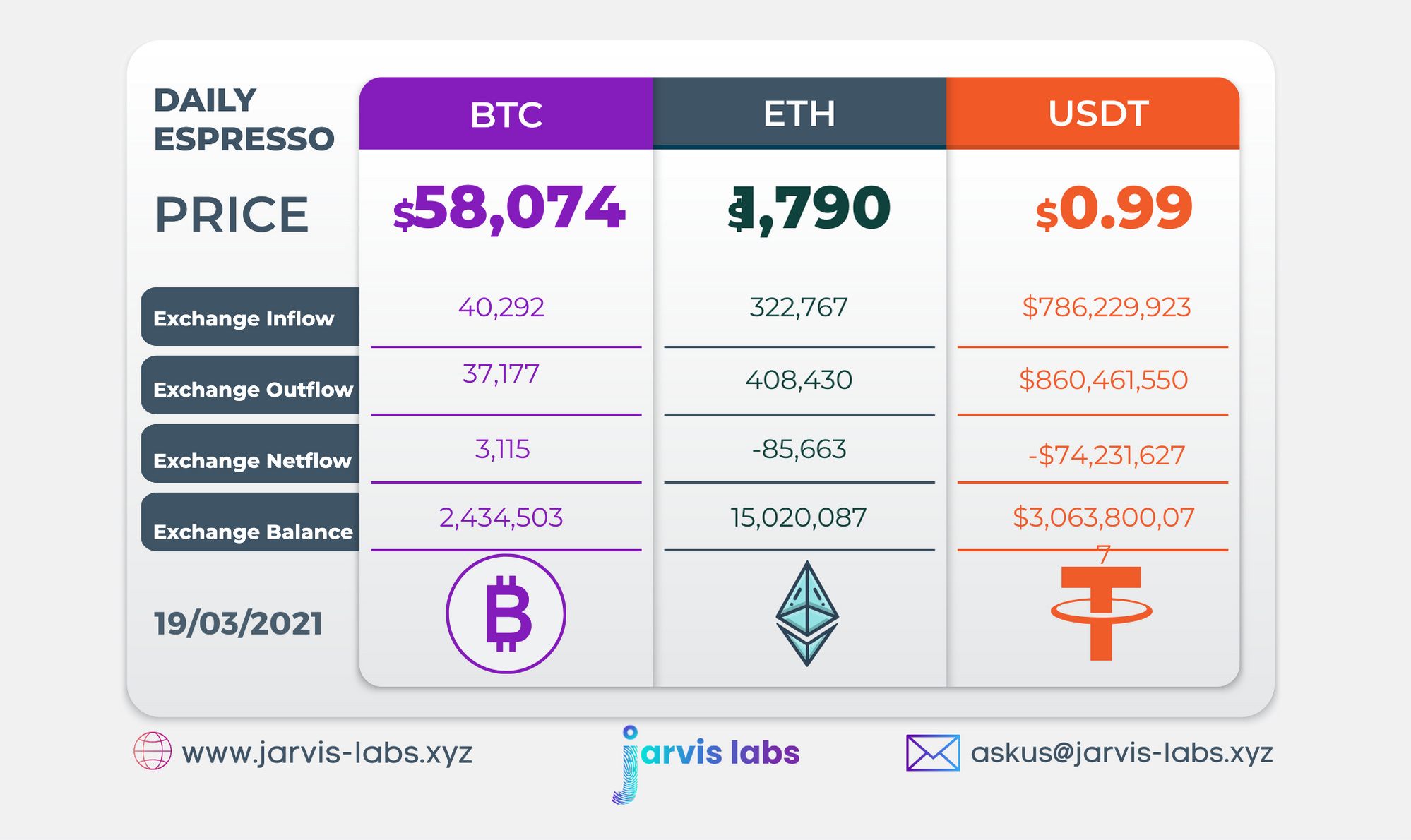

Below is our daily exchange flow data. This is a great gauge for understanding if BTC, ETH and USDT are flowing into exchange or leaving. If BTC and ETH are entering exchanges it can generally be viewed as bearish. The opposite scenario is bullish.

When USDT is flowing into exchanges it’s typically viewed as bullish. The opposite scenario is bearish.

This should only be used as a general gauge. Tagging the exact wallets these flows move into or out of helps improve the reliability of this data, which is what we do at Jarvis Labs. To date we have over 800 market mover wallets and 16 million wallets tagged all together. Consider us your on-chain trackers.