Monday Market Update

This week narrative trading and on-chain data collide

The diversity of traders in the markets is impressive.

You have swing traders, scalpers, delta neutral strategies, 100x leverage players, narrative based, technical, pattern, indicators, mean reversion, on-chain, fundamental, and many more.

Many times we will see various groups differ on what the market is showing.

For example, when we broke the previous all-time high of $20,000 technical traders were anticipating a retest of this level before rising higher into what we call price discovery mode. And as price continue to climb indicators were getting overextended, overbought, and signaled the rate of bitcoin’s rise was unsustainable.

Meanwhile, on-chain data traders disagreed. In the previous rally this same area left technical traders in the dust.

On-chain analyst, Willy Woo, described it well on Peter McCormack’s podcast, What Bitcoin Did. He explained how on-chain data showed bitcoin that haven’t sat in wallets for very long were selling on the rise.

Meanwhile the wallets with bitcoin that tend to sit there longer, these were accumulating.

Willy Woo described it as the weak hands were the traders getting punished.

This recent event saw two type of trading groups with reasonable points, but one being proven right in the market.

This week we have two groups locking horns again. One the one hand are the narrative based traders point to the CME Ethereum Futures. And on the other, on-chain data traders saying bullishness hasn’t waned.

The Arguments

CME Ethereum Futures contracts began trading yesterday. If you take a look at the chart, after about an hour into the new product futures volume got so low that about one contract traded every 15 minutes.

Now, in the U.S. there was a Super Bowl being played, their big annual championship sporting event. Maybe that’s why volume was so low?

Regardless, many traders were expecting a major dump in price for ETH. That’s because when CME Bitcoin Futures opened up in December 2017, bitcoin’s price grinded lower for two years. It’s a historical market event that’s branded into the brain of every trader who was around at the time.

Now, to give the narrative some slack, CME Ethereum Futures are more of an institutions product. With the Super Bowl happening and the opening taking place on a Sunday evening, many believe the real action won’t appear until Monday morning. There’s some merit in this.

But on-chain data doesn’t agree with this trade narrative.

On our side, we sit on the on-chain side of things. We look at the narratives and as they approach we give more weight to on-chain.

With the CME event approach our team was expecting to bearish indicators to start percolating up late last week. They didn’t arrive. Instead price kept roaring higher. There was little slowing it down, and as I’m writing this edition of Espresso the signals are still showing bullishness.

Yes, ETH’s price took a bit of a hit Sunday. However, this was many hours prior to CME futures opening up. To us, that was the narrative trade.

On-chain is looking strong going into the week. Grayscale is picking up. And DXY is not showing any strength yet.

If this narrative proves to be a non-event then any softness in the market over the next few days looks to be short-lived. Grayscale looks to have approximately $250 million worth of GBTC unlocking. This is more than what we saw in the last two weeks of December.

Once we get a daily close over $40,000 premiums on Grayscale will likely expand as well.

Your pulse on crypto,

B

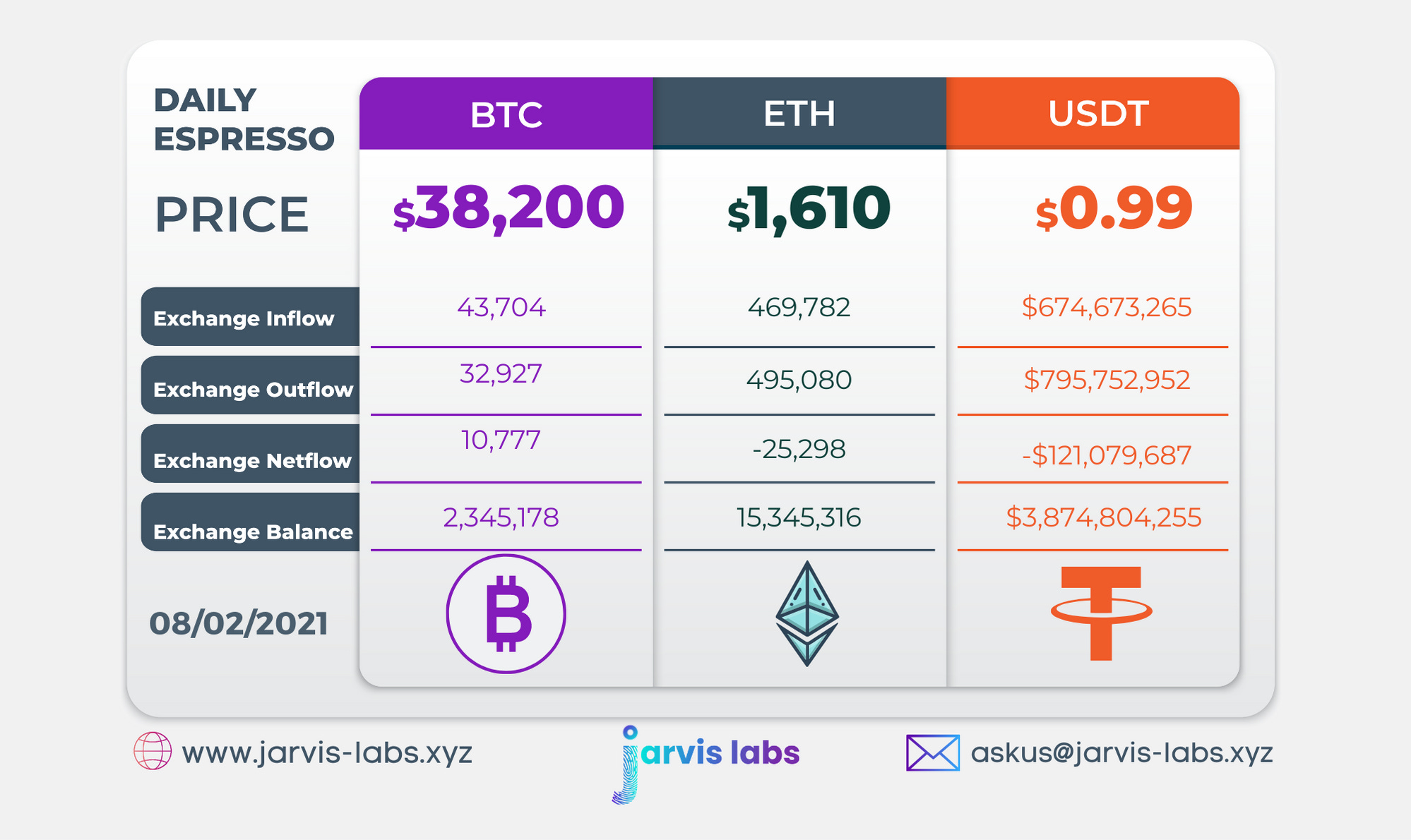

Daily Exchange Flows