Miner Migration

Notes from The Lab: Watching miners leave Ethereum

Sweet silence.

It was Thursday night and The Lab’s halls were swept and trash receptacles emptied.

I was on my way home to watch the second half of the Chargers vs Chiefs game with my pet duck Orthis.

And as I was heading out, the familiar blue light from Mr. Ben Lilly’s office was shining.

I decided to walk over and say goodnight before heading out in case he needed anything. As I entered, and before I could speak, he quietly said, “The times they are a-changin’, JJ” without looking up from the screen.

“Miners are on the move.”

Before showing me the charts on the screen, he quickly asked if I read John Steinbeck’s The Grapes of Wrath.

It’d been a long time ago, but I told him it was about The Dust Bowl after The Great Depression. And how greedy farm owners were treating workers poorly.

“Exactly” he chimed in. “The irony of it all was in the size of the migration. There were millions of workers who fled West at the time. Conditions were terrible. But through their sheer numbers they would rescue themselves by cooperating. Deliverance through cooperation. ”

Suddenly getting home in time to watch the game became a distant priority.

Mr Lilly then went on to detail the second order consequences that are taking place as a result of ETH’s recent Merge to Proof-of-Stake (PoS).

“The same way changing conditions forced those farmers to leave the land they settled, ETH’s embrace of PoS consensus has forced miners out of the network they helped build… And watching the migration can lead to the blockchain’s equivalent of valuable real estate like California” he said.

I was following his thoughts and realized he was clearly on to something.

Ethereum came to existence in 2015. In blockchain life that is a lifetime. And during this lifetime Ethereum used a Proof-of-Work (PoW) consensus mechanism.

PoW requires miners to record transactions and secure the network using very powerful computers. In exchange for all their computing, miners are rewarded in the network’s token.

There are tens of thousands of ETH miners who’ve made a living by harvesting the yield of the Ethereum blockchain.

But now that ETH has switched to a Proof-of-Stake consensus. These miners are no longer need.

Which is why they are migrating elsewhere.

The chart below of ETH’s hashrate shows that the migration was well underway as early as August.

Hashrates reference the total computational power mining the blockchain.

What hashrate also signals is that the higher it is, the more robust and secure the blockchain. This can make it more attractive to developers, users, and investors. Which is why Mr. Lilly seems to be following this migration.

To highlight this movement some more, let’s look at the hashrate charts Mr Lilly showed me as they are starting to hint at where this value might be moving to. And perhaps, where a bountiful blockchain of tomorrow might reside.

Heading West

To explain the differences between PoW and PoS would require its own essay, to keep things brief and on point of today’s topic let’s just summarize the differences as this:

- Proof of Work requires miners and hashrates, Proof of Stake does not.

- Both PoW and PoS advocates are ideological. They prefer one method of consensus over the other.

Because of this culture war there is no shortage of skeptics who would rather see Ethereum on PoW instead of PoS.

And as we just discussed, there is now no shortage of out-of-work miners who have the means to power these PoW chains.

Meaning the future destination of hashrate might be an early sign of where future developers go to.

Below we see an example of miners on the move, starting off with Ethereum Classic, ($ETC) the unaltered original chain of Ethereum which runs on PoW.

Following ETHs successful PoS testnet completion ETC’s hashrate immediately rose due to miners switching networks.

In a matter of days it went from a <20 TH/s vulnerable ghost chain, to a robust hashrate of over 300 TH/s.

In fact, ETC’s current hashrate is now on par with where ETH’s was in early 2021, making it a viable alternative for PoW ideologues.

Next up is the freshly forked ETH PoW coin, $ETHW.

Despite this chain only having existed for a few hours it has already lured in some miner migrants, reaching an impressive 71 TH/s on its first day of existence.

This migration hasn’t been confined to ETH alternatives either.

Below we see an older PoW chain, Ravencoin ($RVN), experiencing a large rise in hashrate over the past month.

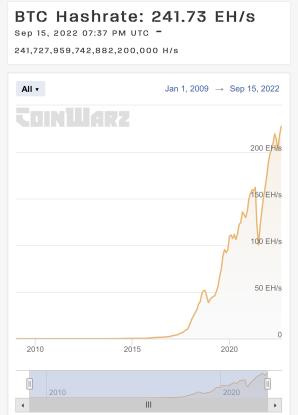

And of course, the king of PoW, Bitcoin’s ($BTC) hashrate has benefited as well.

This past week it climbed to new all time highs thanks to the influx of ETH mining refugees.

If you build it they will come?

What these dislocated miners are attempting to do is bring the same vibrancy they helped create on Ethereum to new networks.

Not unlike how Okie migration settlers used the farming skills they learned on the prairie to create the grape growing empires in Northern California we know of today as Wine Country.

But whether or not the long term demand will be strong enough to sustain these miners’ new ventures still remains to be seen.

What Mr Lilly explained to me is that the JLabs’ onchain analysis team, Chainpulse, will be keeping a close eye on how this develops going forward by monitoring things like:

- A derivative value of TVL (total value locked)

- Miner wallets interacting with the ecosystem via smart contracts, not just exchanges. This he said showcased utility in the blockchain outside of just yield extraction.

- Onchain interactions coming from non-miners, with a consistent growth in this demographic.

These were the few I remembered. He hit on about a dozen the team is watching here. While doing so he made clear he isn’t just staring at hashrate, he wants to see if this migration begins to create sustainable economies.

The metrics were all new to me. Which is why I asked if he plans to write about them. To which he quietly said “soon”.

He’s always refining it seems, so hopefully he can unveil them sooner rather than later.

In the meantime, I’m curious to see how this migration plays out.

As of now, the market clearly prefers PoS. And while that is the case today, there is no reason why the market can’t prefer a PoW chain in the future. Which is why we need to keep an open mind about this.

What happens next remains unwritten.

“Up ahead they's a thousan' lives we might live, but when it comes, it'll on'y be one.”

― John Steinbeck, The Grapes of Wrath

What do you guys think? Leave a comment or message me on Twitter @JLabsJanitor

And as always, thank you for reading.

Your friend,

JJ