LSD Euphoria

Notes from The Lab: The ETH catalyst of experimentation

L.S.D.

I know what you’re thinking…

Tie-dye t-shirts.

VW camper vans.

That summer you spent on tour with Phish…

But Albert Hofmann’s hallucinogenic drug is not what we’ll be discussing today.

The LSD dosage I’m referring to is the abbreviation for “Liquid Staking Derivatives”.

You might remember last week where we discussed liquid staking when referring to Cosmos and ATOM 2.0…

Well today, we’ll go over what I overhead the team at Jarvis Labs talking about when it comes to these LSDs since they believe it will not only become prolific on Ethereum, but cause some major experimentation and fervor similar to what we saw in 2020.

Hi everyone, my name is JJ - the night shift janitor here at Jarvis Labs.

Once I started working here I noticed the professors of Jarvis Labs frequently leaving up charts, reports, and even equations on the whiteboard once they finally left in the middle of the night. The stuff seemed pretty important, so I started interpreting these things for myself.

It wasn’t long before I realized it was like trading cheat codes. And lucky for you, my friend is sick of hearing me talk about it.

Every week I will try to share the coolest and most exciting thing I find laying around the halls of Jarvis Labs. I hope you like it and follow me because if I get 1,000 followers on Twitter (@JLabsJanitor) my friend will buy me a pizza.

So be sure to click the subscribe button below to get a weekly “Notes from The Lab” sent to your email.

Trading ETH for LSD

The success of last month’s Merge means ETH is officially a sustainable source for yield creation.

As transactions get validated and blocks produced, tokens get distributed to those who stake their ETH to the network.

The result of this sustainable yield means protocols on Ethereum are starting to get more creative. Protocols are figuring out ways to provide staking services for their users.

And the team thinks it won’t be long before they dream up ways to take the passive ETH they earn through staking and use it to boost rewards for their users.

You can think of this as bootstrapping their protocol into greater relevance thanks to ETH staking rewards.

And at the center of it all is LSD.

Now, usually I find a chart from the lab to bring to you for the week’s Notes. But this week it is something a bit different.

I was doing my usual rounds of sweeps and scrubs at The Lab this week and I overheard a conversation taking place between the team’s analysts on the pros and cons of LSD use… again, the tokens, not the substance.

Thankfully I had my Talkboy voice recorder closeby so I was able to catch some details of their analysis, which I’ll sum up for you all below.

For those that don’t know about the reliable Talkboy, you can see my version below. The mic is in the upper right corner. Very simple and also effective.

Now, before jumping into the first token the team spoke about, for those that don’t know about Ethereum…

The blockchain network switched to Proof-of-Stake. And its switch means that anyone can now become an ETH validator by staking their tokens to the network. By validating the network stakers earn a reward for their activity. This reward is a variable APY paid in ETH, which currently sits around 4%.

This means based upon current yields, for every 100 ETH staked, the staker would receive about 4 ETH per year in return as yield.

An attractive offer considering that in the grand scheme of things ETH has been one of the best-performing cryptos since it was created in 2015.

But there is one catch… staking ETH requires users to pledge and lock up a minimum of 32 tokens (~$41,500). And right now that period of time is undefined.

This high barrier of entry prices causes most retail investors to be uninvolved. It also means those that can afford the 32 tokens are illiquid.

These two consequences is where LSD fills the void.

Staking pools have sprung up and let users deposit any amount of ETH by pooling it with other ETH deposits to make a 32 ETH stake. This means the uninvolved retail investor can get involved.

They’re offered by both centralized entities, such as exchanges like Coinbase and Kraken, and decentralized protocols, like Lido and Frax.

For an idea of how large this market is, these pools in aggregate account for over 3/4 of all ETH staked.

And when you stake your ETH with some of these pools, they give you what amounts to an ETH IOU token as proof of receipt.

These tokens are what we call a LSD, and they can be redeemed with the issuer 1:1 for ETH.

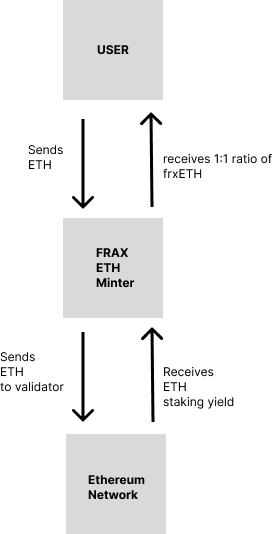

The graphic below shows a simple example of this process that the team described using the newer offering via Frax Finance:

- User sends 1 ETH to Frax.

- Frax’s ETH minter returns the user 1 frxETH token for every 1 ETH received.

- Frax then takes control of the user’s original ETH and stakes it to ETH’s network directly.

- Frax earns yield on the staked ETH and passes it to the user.

In this example, frxETH is the LSD. It gives liquidity via a derivative. And if users want to keep earning yield, they can drop the frxETH token into a vault where freshly minted frxETH from network rewards get deposited.

Chasing Yields of Yield

Here’s where I try to summarize what the team was discussing. So bear with me as I try my best to place it in my own words here.

With staking pools like Frax, their primary goal is to bring users to their platform as there doesn’t seem to be any other direct incentive.

Frax is a finance platform with a stablecoin at the center. And part of how the platform functions is driving value to its native FXS token.

Now, what the Jarvis team was discussing was that it was beneficial to the ecosystem for another service provider to arise. One that offers users the ability to stake their ETH without needing to take on the learning curve of how to set up a validator.

It also brings in the user with less than 32 available to stake. This is a net benefit.

But the fact is, if this brings new users to Frax, we will see this model iterate. Offering a way to stake ETH is great. But soon enough the protocol (not necessarily referring to Frax here) can make several decisions.

It can take a portion of the yield as a fee. Centralized service providers already do this. So it wouldn’t be unique. However, for a protocol this would translate to yield going somehow back to the native token. This might mean burning the token, distributing ETH to native token holders, or being dropped into a treasury.

All of these are ways in which a protocol can strengthen the characteristics of the protocol’s token.

But it doesn’t need to end there.

When it comes to ETH, it seems the Jarvis team is expecting something a bit more unique.

To attract retail to stake their ETH, protocols will ramp up user incentive schemes. These involve enabling investors to use their LSDs to earn additional yield, rather than just holding them.

What we should expect is that Frax and other protocols will begin to drive usage to their systems by tweaks in financial engineering that will give rise to food tokens 2.0.

Remember the food token craze of 2020 where users deposited tokens into the next great protocol with the hopes of earning free tokens?

This was how protocols attracted large sums of liquidity so their protocol could function. In exchange, protocols issued tokens as an incentive… many of which were food themed.

If this competition of attracting users with incentives such as secondary tokens. it could create flashbacks to DeFi Summer 2020.

While the team didn’t necessarily think it would be food tokens specifically, they seemed to believe protocols will soon push the limits on how they attract ETH to its platform.

Does this mean giving users high risk tokens in lieu of ETH’s yield?

As Mr. Lilly mentioned, what various forms of LSD will dealers be packaging up to cause the market’s next euphoric fix?

Whatever these incentives are, it seems to have the possibility of what might feel like a massive new wealth effect.

And if we only looked at things optimistically through my Mom’s rose colored glasses, we could say that all of this experimenting will be viewed in hindsight as ETH’s zero-to-one moment that enables mass adoption.

The reality is, we only need to go back two years in food history to imagine at least one manner in which this will play out.

“More money has been lost reaching for yield than at the barrel of a gun.” Ray Devoe

There is also the elephant in the room that every LSD is ultimately a less secure, more centralized version of ETH. As these new iterations start to rise, there is no saying the shortcuts that will be made that creates the newest forms of CeDeFi.

These protocols will essentially be mix and matching security + decentralization + liquidity + yields, and crossing their fingers that a catastrophe doesn’t strike.

While the team’s view of where this trend could go feels rather cautionary and skeptical, I felt it was insightful to share in the event we do see this trend pick up pace.

A couple weeks back I mentioned my grandpa’s favorite quote as being:

“Time is a flat circle. Everything we have done or will do, we will do over and over and over again—forever.”

Markets and human history are full of examples of disasters caused by people taking complexity for granted and placing too much trust in centralized systems.

It is my hope that LSDs don’t suffer a similar fate.

Only time will tell whether these innovations prove to be responsible and add value to the industry, or if they’ll be yet another example of interesting theories breaking once they encounter reality.

According to my Talkboy recorder, the team at Jarvis as a whole is cautious. But also thinking if it does unfold, they see it as very bullish for price outcome.

This is due to the simple fact that everybody, retail investors most of all, like the idea of getting money for nothing. Investors will unfortunately let their guard down, raise their tolerance for risk, and care less about the smaller details once more.

What I am excited to see is the novel approaches that protocols may dream up. As the Jarvis team hit on, there will definitely be nuggets of gold if such a gold rush unfolds.

What do you guys think?

Leave a comment here or message me on Twitter @JLabsJanitor!

Your friend,

JJ