Locals Only

The storm is here

The early morning sun hit me square in the eyes.

That paired with the sound of crashing waves in the distance coming in through the opened salt stained windows was as good of an alarm clock as I could ask for.

Mother nature was telling me it was time to wake up, I abided.

Still groggy and covered in sand from the beach bonfire the night before, I rolled out of bed. The wooden shack floor gave its familiar good morning creek as I took my first step in my morning routine: light stretching followed by coffee.

I stepped outside to enjoy the overly strong brew in the hammock and felt it…a sense so familiar after having grown up along the New Jersey shore it sent goosebumps up my arms.

There was a late summer chill in the air, and this time of the year in the northeast it could only mean one thing: waves were coming.

I rushed back inside, grabbed my laptop, pulled up surf forecast to confirm my intuition.

A cold front was working its way down from the north, creating what’s known as a nor’easter thanks to the weather system's collision with the warmer waters.

Best part, its arrival was the holiday weekend.

Not only would the storm clear our beach towns of unwanted tourists from North Jersey and NYC, but we’d also have 10-foot swells to ride. A drastic shift in fortune, after a summer full of obnoxious tourists we call “bennys” and choppy 3- to 5-foot waves.

The moment I had been anticipating all year was finally here, and there was only one thing left to do—wax up my board and prepare for the storm.

This past week I’ve felt a similar “big wave breeze” taking place in the Bitcoin market, telling me the storm of volatility we’ve been so eagerly anticipating might finally be ready to make landfall.

Let’s dive into some options data below to see if we can get a forecast on when it might hit.

Tide Shift

What a difference a week makes.

Just last week we were discussing how the volatility crush regime we’d been experiencing since BTC peaked in March was frustrating options buyers to the point of capitulation.

That all changed last Wednesday morning when the CPI report we mentioned last week as a potential catalyst fulfilled the prophecy and expanded BTC’s price outside of the long held range between its 100-day moving average (MA) support and 50-day MA resistance.

As the old adage goes: “Never short a boring market.”

We can see how clean this breakout now looks from a technical perspective when viewing BTC on the daily chart below:

The speed at which BTC has moved since the CPI print is no surprise.

It’s followed a very typical pattern in which price chops around and falls into long lull periods of consolidation. This price action bores most speculators—especially the tourists or “Bitcoin Bennys”. They move on to GameStop, Solana memes, or whatever else the market flavor of that week is.

Then when almost everybody is least expecting it breaks past a key resistance level, and not too long after ascends in a parabolic fashion, delivering big wave conditions for the most dedicated of traders who caught the trend change early.

Locals only.

This is a pattern every BTC trader is familiar with, yet trying to time the exact moments of its parabolic breakouts is easier said than done. It’s a task that takes considerable amounts of time, focus, and precision.

Not unlike tracking down the perfect wave.

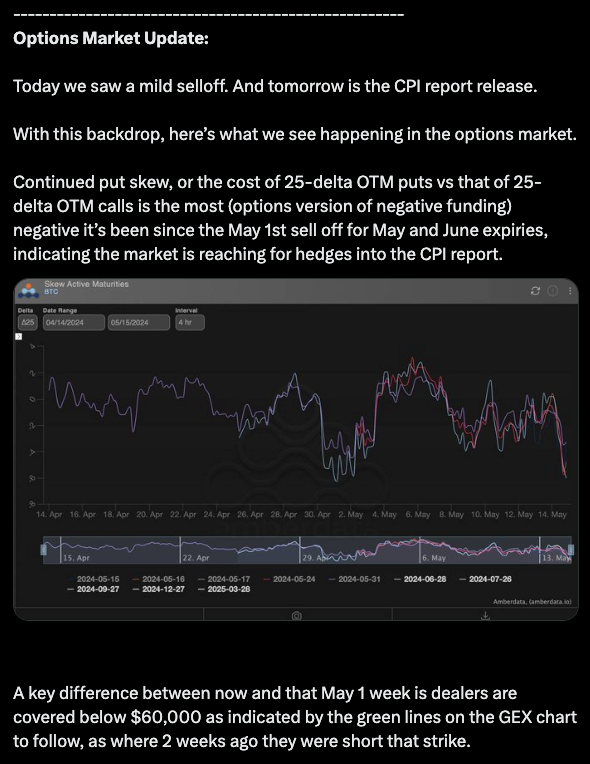

The set-up into the event was interesting as the market was hedging aggressively with out of the money puts and there was notable gamma fuel above $62,000 that tipped the markets hand and let us know if CPI was favorable, the upside expansion would come about rapidly.

You can see some of the note we provided to our clients Tuesday night in the tweet below:

How this relates to the market as it stands today is that we did indeed break past, retest, and hold above the crucial level of $65,000 and have since continued on above $68,000 - at least so far as of today’s writing.

This means option sellers, who are still largely short $65,000 calls expiring in May have had to shift their positioning and purchase longer dated call options to hedge against the calls they short sold.

Taking a look at the current Implied Volatility term structure as indicated by the light blue line chart below, and comparing it to the term structure we saw last week in dark blue, we can see that longer dated IV has been on an incline since last week’s CPI.

Judging by this it seems likely that the May call sellers have shifted their net short positions into long call spreads, where they are now short the May calls vs long further out-of-the-money calls dated for June or later.

This is a trade we’d been recommending on “The Trading Pit” numerous times over the past few weeks as far-out call premiums fell to near basement levels.

Taking a look at the December $70,000 call option below we can see how well its pricing has responded since we first mentioned it as a good risk reward opportunity at around $9,000 a couple weeks ago.

A good reminder of how rapidly options contract pricing can move once dealers are forced to hedge.

Far From Frothy

Interestingly enough however, despite all of this shift on the longer end of the curve we’re yet to see a steep jump in nearer dated, 30-day implied volatility levels which we can track on the BVIV chart below.

Though the 30-day IV index has shown some potential signs of bottoming over the past week, it's still far from raging towards new highs.

This is a potentially promising signal as it tells us that the rushed FOMO demand for near dated call options isn’t here yet, and that this rally may still have further to go before we see signs of froth.

Remember as we said last week, the big move will happen first - then rushed demand will follow after.

By the looks of things now, and barring a sudden reversal back into range below $65,000 into the end of May, it seems the next big swell could be in store for us by the end of Q2.

So hang on to your board, pray for surf, and await the big wave - they don’t come around all that often.

And as a reminder don’t forget to register for our live options AMA webinar taking place next Wednesday at 9:15 est (details and registration form in the tweet here / below). Bring your questions, you won’t want to miss this.

JJ

P.S. - Ben Lilly here, you wouldn't believe it, but JJ wrote this essay on Thursday last week. He wouldn't tell you, so I am since it was suppose to go out on Friday.

Which also means, consider registering for his event mentioned below. He's a savant.