Little Here, Little There

Here's your shopping list

Did the equity markets move crypto…

I saw that question pop up about three separate times yesterday.

My immediate response to that is no. Equity markets did not move crypto.

What we saw unfold in crypto was not a knee-jerk reaction. This was in the works for weeks. Movements like this take a lot longer than minutes.

Now, does that all mean that the two are unrelated? Not necessarily.

In fact, I believe a lot of this has to do with the Biden administration’s bark on taxes.

From what I hear and see, a lot of the proposed tax policies are causing a lot of capital to move around in preparation for what might come.

What might come? Only time will tell. And I’m not about to try and speculate, but whatever it is, taxes are about to rise. And we’ll soon learn how much bite comes with the bark…

In terms of the movements we saw leading up to the selloff yesterday, you might recall on Friday we made mention of the profit taking we saw unfolding in bitcoin over the last couple weeks.

This type of movement tends to run in parallel when capital starts to get turned over from altcoin to altcoin.

While its good for the market to witness such ‘churn’, the realized profits from this churn was moved to bitcoin before selling. It’s in part why bitcoin lacked any solid momentum to the upside.

The tell tale sign of what was at play was the type of altcoin moved to exchanges. These weren’t your average coins.

These were old and in some cases dusty stacks.

Its indicative of a major unloading. And its why we alerted our clients that it was time to lock in some profits on their altcoin holdings.

So the market sold off. Coins were getting rekt left and right. Old coin holders were transferring to new coin holders.

As we adjust our focus we’re forced to ask ourselves…

Does this mean we’re done? Pack up and come back in two years?

Not at all. Coins transfer hands from old holders to new holders in every major rally. And it tends to help propel the last leg of the rally. This is healthy.

And the fact it may or may not be tied to the Biden administration’s tax rumors, may or may not be coincidence. I’m leaning towards it not being a coincidence, and more about convenient timing with the market at such highs.

Which puts us back to the original thought of this being healthy.

We’re pumped.

This is something we wanted to see take place for weeks. What’s even more exciting is that Tether is flowing. The pumps are being primed.

On Monday a billion USDT got minted. And 700 million USDT was already at hand prior to that.

Nearly 600 million of that already went to buying up ETH and some altcoins on Huobi over the last two days. This is being used to buy the dips.

400 million went to Bitfinex, this tends to be used for bitcoin.

300 million was broken off like squares on a Hershey bar. Which leaves us with 400 million left in the treasury.

This was expected. Nobody moves over a billion dollars because the market just dips like that. Money moves at that scale because something unfolds the way it was intended to.

What’s interesting is we also have Digital Currency Group sitting there with about $550 million of dry powder ready to buy up GBTC shares in the open market.

Combined with neutral funding rates across the board.

This means the time to load up on spot is now. Which is why we are providing you with a shopping list.

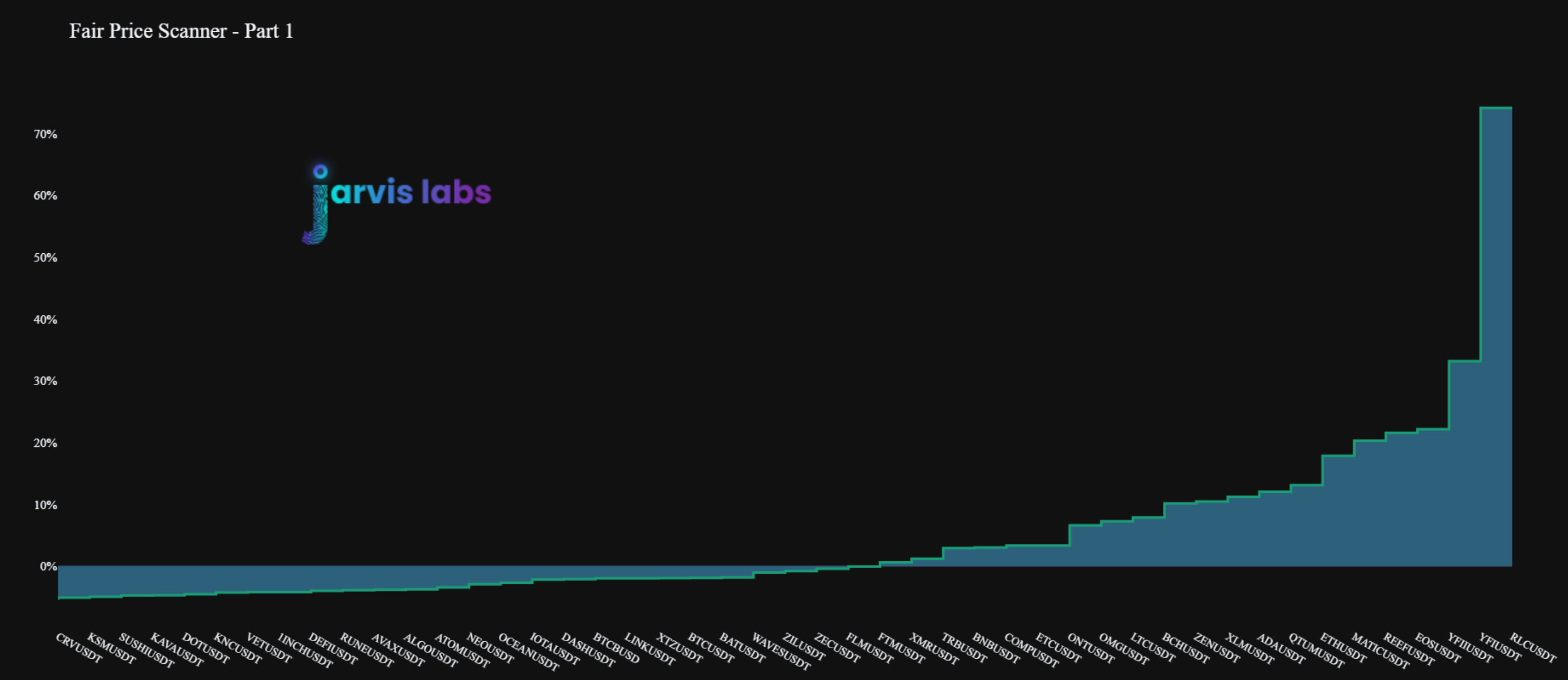

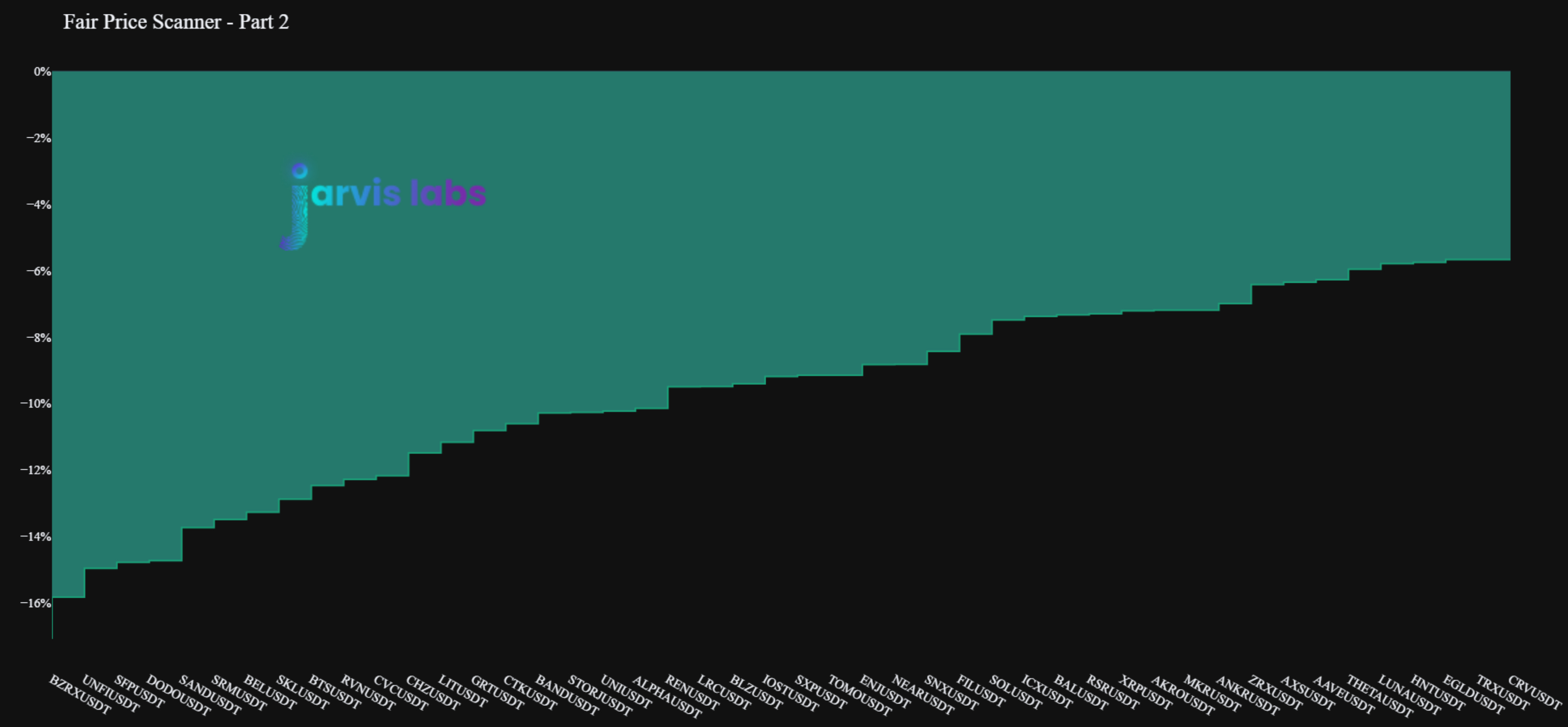

We don’t have a catchy name yet, so we’re just calling it the fair price scanner. The bigger the discount, the bigger the sale.

Part 1 is mostly expensive coins.

Part 2 are your cheap coins.

The way we calculate it is by using market mover data of accumulated prices, combine data about the volume at which the asset was accumulated at, and generate a weighted average price.

If the price of the asset is much higher than what this variable comes out to be, it’s viewed as ‘overbought’… Meaning its a riskier asset to trade.

This also means if the % is more negative, this indicates that the asset is trading at a discount to whale accumulated prices. Strong buy the dip potential during an alt-season.

Pretty handing metric to have on hand when it comes to on-chain data. This is filtered for who moves the market… You won’t find it anywhere else.

One last note before we end today’s shot of espresso…

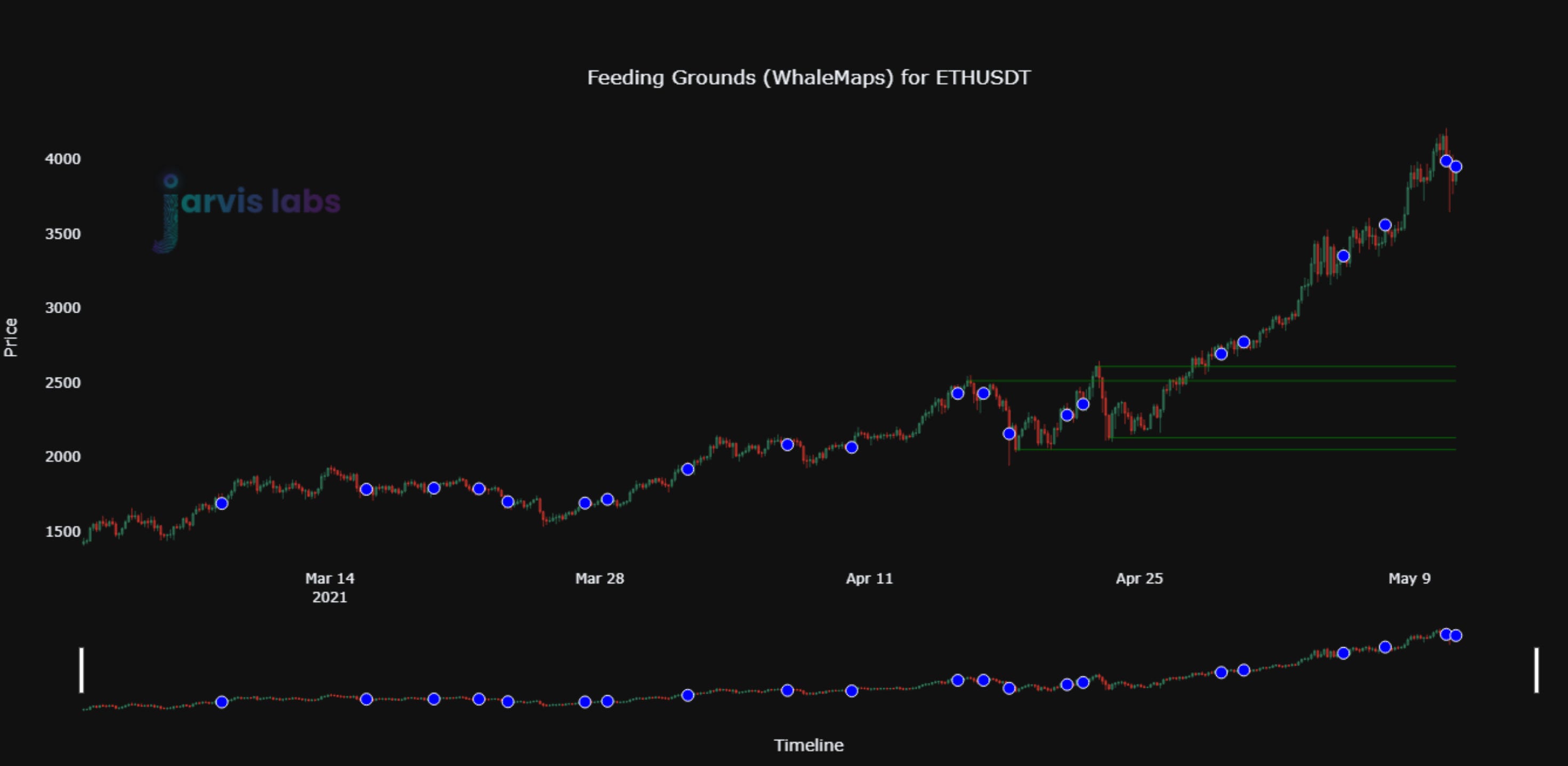

We are still bullish on ETH. Somebody is backing up the truck on it right now…

There’s a lot of data that goes into the chart above. And frankly, we can’t really get more granular than what you see. If we did, then we risk a lot of alpha. So you’ll need to take us at our word.

To wrap it up…

Good time to buy on spot. Average in over the course of this week. For you futures traders… Don’t make any mistake here. Sit on your hands. I know funding rates are insanely low, but make no mistake… We are still in a shit storm.

Your Pulse on Crypto,

Ben Lilly

P.S. - Did anybody see the Iran talks? I haven’t had a chance to dig into this as much as I’d like to with everything going on in crypto right now. But this is a major global event that should be tracked.

This is the type of deal where oil executives, financiers, China, US, and Russia all have a part to play. Even SWIFT is involved. Believe it or not, whatever gets hashed out in these talks - which we likely won’t know the full details of - is likely to be tied to digital assets at some point down the road. Just something to think about in case you see a headline or two in the coming weeks.