Lessons From An Inferno

The options market created a setup where call sellers were trapped in an inferno, here's how you can avoid a similar fate.

I couldn’t contain the chuckle.

It was the most obvious setup in my trading career.

This was two weeks ago, and Consumer Price Index (CPI) data was set to be released the next day.

Everything I could ask for as a trader was signaling to open a trade. Yet, self doubt engulfed me.

I had my checklist of indicators in front of me, all telling me it was time for a long-term call position:

- Options IV data - check.

- Relative Strength Index (RSI) - check.

- Bollinger Bands - check.

- Price in a downtrend on low volume - check.

- Negative sentiment - check.

But it was that last one that made me laugh.

I can’t recall a time any asset was more hated for underperformance than Ethereum (ETH) in 2024.

Heck, even I was guilty of this. In front of me the data was giving me a series of green lights. Yet I could feel Crypto Twitter’s sentiment influencing my core.

That’s the hard part in trading. The gut, bias. But you need to learn when to fade yourself and prioritize data over emotion.

I did, and quickly sent over my analysis to the Jlabs Digital quant desk with a recommendation we buy up some long-dated out-of-the-money ETH calls—the risk-reward was simply too good to pass up.

I believe my exact quote was, “This is probably one of those trades that will seem stupidly obvious in hindsight.”

Now, before you go congratulating me too much, we were only able to fill about half the size of the position we had hoped for.

We also had no idea this week’s white swan of ETF news was coming; we were just following what we saw in the data as a good risk-reward proposition. The honest truth here was most of the team was expecting a denial to come in, unlike the sudden wave of crypto Twitter pundits who were quick to high-five themselves after the white swan.

The reason for taking on this trade despite the guess that a denial was imminent was that the news would cause IV to spike. In turn, this would make long-term positioning more expensive even if spot price was lower.

It’s a trade that highlights the uniqueness of options.

Now, I’d like to take a quick moment and offer a mea culpa for not covering ETH’s options too much recently. It’s not the typical analysis I share. But it’s not for a bad reason.

You see, prior to this week, there’s been nothing much to talk about for the better part of two years. The post-Merge world of ETH options has been a relatively low volatility world dominated by Ethereum whales selling calls and buying puts to hedge their staked ETH exposure. They were eager to juice more yield from ETH.

It was a major volatility crush setup, creating a market as boring and methodical as the S&P 500.

But that all changed in a drastic way earlier this week when the news of ETH’s spot ETF approval suddenly broke.

It’s now given us great reason to dive into the data and get a better look at how this move unfolded. And what we might expect from ETH going forward.

Let’s dive in.

The Spark

The speed at which ETH ascended this week was no accident.

It was teed up by a massive gamma squeeze.

Remember, negative gamma signals to us the speed at which options sellers will have to hedge themselves and trade with price momentum after it breaks beyond a certain threshold. Think of this as “slippery” price action.

Below we can see how the market’s gamma exposure for May through the end of June looked a couple weeks back when we first entered our trade.

This was one of the signals that told us it was time to buy calls.

What we realized here is that the amount of calls that were being short sold would lead to a rather explosive move in the event that $3,000 was recovered, and fortunately that’s exactly what’s happened as Sunday night’s break beyond the level rapidly led to $3,800 by Monday after the ETF news broke.

The spot ETF news was like pouring gasoline on fire with this gamma profile.

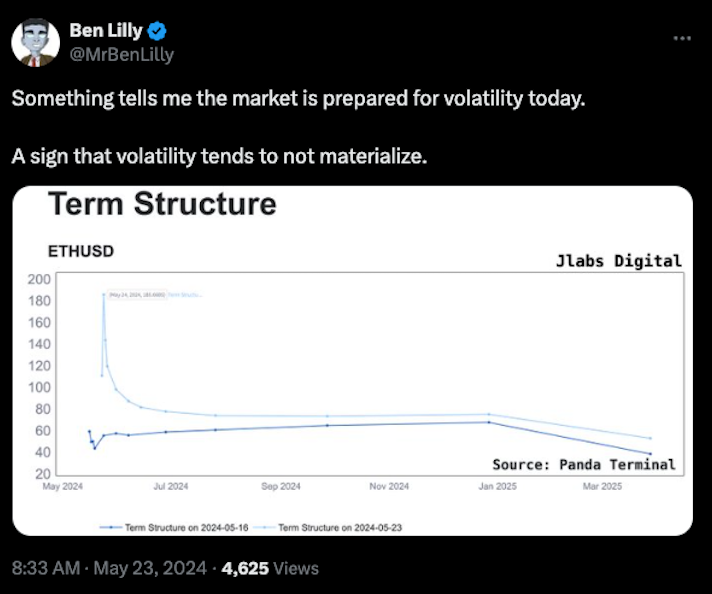

As you can see on the IV term structure comparison chart below from Ben Lilly, in just one week’s time IV for the May 24th expiries contract spiked from around 40, to over 185. That’s how bad sellers were caught offside and trying to hedge their short exposure.

They were trapped inside an inferno.

It’s what we’ve been talking about for the last few weeks - the upside move happens first, then rushed demand follows after.

That’s why it's important to be strategic when selling volatility. Don’t be the one trapped inside an inferno.

Selling contracts when IV is well over 100 represents a favorable risk reward, selling IV below 50 is not.

To see just how bad you can get burned, below is the contract price for May 31st, ETH $3,500 calls.

Pre-CPI last week, these were being sold for less than $15 per contract. On Thursday of this week they were trading over $520 each. That’s a loss of over 3,366% per contract for those who shorted them in search of yield.

Where do We go from here

Understanding the dynamics of all the above is crucial when looking at the ETH options market.

And to sum it up, it’s a sign post that the market has experienced a Changing Tide.

Participants should no longer expect the same boring price action from the asset as we move closer to the eventual ETF listing and institutional adoption of ETH in the second half of 2024.

From a 1000 foot view, the environment has clearly shifted and is increasingly bullish.

However in the near term, be weary of rushing into a directional options position at these elevated IV levels.

As Ben’s tweet on Thursday showed, ATM IV went up nearly 5x in a single week, and as a result, volatility was set to be suppressed in the days that followed. It’s not the time to be an options buyer with IV so high.

Into the end of the month, and early June we can likely expect some market consolidation from this week’s wild price action.

Such consolidation should flatten the IV term structure chart, and bring options premiums back to more attractive levels for buyers.

Wait, don't chase, and you’ll be rewarded when the next big wave to new all-time highs finally comes.

That’s the best advice I can offer you this week as we head into what will be a pivotal monthly close…

Watching the tape,

JJ