Knife Catching During The Inferno

The free money glitch is causing a global inferno. Here's why we caught the knife.

The free money glitch came to an end.

It was 2021...

BTC was just making its first ascent to $60k.

And the canary in the coal mine dropped like the premium on Grayscale's Bitcoin Trust.

As the premium turned to a discount, it was the end of an era...

One where investors could purchase Bitcoin on spot, go to Grayscale to exchange Bitcoin for shares of the Trust at par value, and after waiting six months could turn around and sell those shares at a premium on the open market.

The free money glitch was juicy. So much so that during a six month period starting in October 2020, $35 billion flowed in to the Grayscale Bitcoin Trust.

The end result of the glitch produced the most dominant entity in the $2 Trillion crypto market.

But like all too good to be true crypto fairytales... The heros turned out to be greedy villains.

Their insatiable appetite caused bodies like Three Arrows Capital, Celsius, BlockFi, Voyager, Genesis and others to float down the river of liquidation as the market began to spiral out of control.

The end of the free money glitch caused a nasty deleveraging event. If history is any lesson to crypto traders, these things take time to unwind.

So as this new trading week begins, and the mushroom cloud of the Japanese Yen carry trade rises to the sky, we are reminded that soon the bodies will begin to float by.

And there is sure to be many. The carry trade was one of the most popular yield trades over the last several years...

It was the latest free money glitch. Only this one took place on a more liquid and larger financial stage.

It's so large that shockwaves are blasting through crypto, forcing everybody to ask if more are coming.

I have to think yes.

Now, I'm no Forex or Japense macro expert, so this essay will not dive into the Japanese carry trade that is said to be trillions in size.

Instead, I'd like to quickly give an update on two things. First, what to watch for when it comes to yields and the possible rate cut coming. And second, the positive signs coming out of J-AI today.

You won't want to miss today's update.

Jerome

Last week we dove into Jerome Powell's FOMC press conference via Wait For The "Beep".

In the essay, we discussed how uncomfortable Jerome appeared throughout the Q&A session. It was like a friend who tried to be as noncommittal to your upcoming weekend rate cut party as possible, as they know they've already made plans with somebody else.

As we look back on that uncomfortableness, we have to wonder if Jerome knew his inaction would ignite the fuse that created the market's current mushroom cloud.

I can only speculate.

But what we can say is that Jerome likely got the deleveraging event he was hoping for... An event I personally believe he was hoping to see before cutting rates.

My reasoning requires us to be quite objective for a moment...

If the U.S. Federal Reserve were to cut rates before a deleveraging event, markets could get further stretched to the upside.

The Nasdaq was already up 23% since Jerome stopped hiking a year ago. GDP was at 2.8% on an annual basis compared to the last quarter's annual figure of 1.4%... And the surge was said to be in part because of high consumer spending... The same kind of surge that brings the inflation boogeyman to the surface.

Said differently, if things were to continue at their pace in the face of a rate cut, the economy might have gotten even more extended to the upside. Which in turn could result in a greater whipsaw and volatility event in the future.

Or said differently, greater price instability... Which goes against the Federal Reserve's mandate.

Allowing a deleveraging event like we're currently seeing, before cutting rates, might in fact create greater price stability long-term.

It's a bit of an odd thought. But if the Federal Reserve is in fact non-political, this makes sense.

For those that say the Federal Reserve does things for political reasons, I'd ask why they didn't cut last week then? That would have been the correct move, politically.

So as naive as I might be, their current inaction feels inline with their price stability mandate.

But the hard truth here...

I have to think we're not even close to the end of this money glitch deleveraging event.

For those in crypto who witnessed billions get unwound in the $2 Trillion industry due to the free money glitch ending... This might be trillions in a hundred trillion dollar industry.

The bodies from this explosion will be numerous once they start floating down the river.

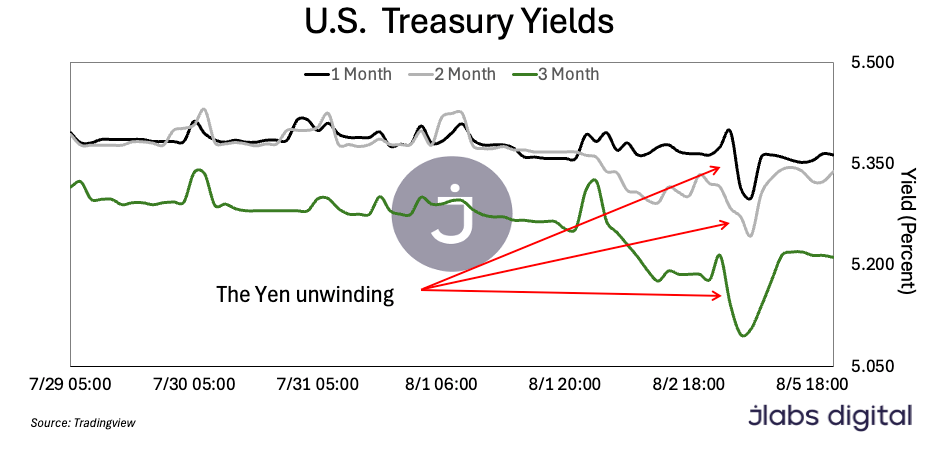

Regardless, what we can do while this unwinds, is monitor U.S. Treasury yields (hide your excitement, please). Reason we want to do this is yields can show hints at how much more we have left in this unwind.

For those that recall from the prior essays, we can get a sense of "normal" by looking at short-term treasuries (The November Cut).

To re-state some of the reasoning quickly, the overnight borrowing rate sits at 5.33%. This is the benchmark rate for which everything stems from. Depending on how much rates are expected to drop in the future, yields will reflect that expectation depending on their maturities.

We also know with decent confidence that rates are expected to fall in the coming months (either September or November). Which means any U.S. Treasury that is expiring after this date should have rates slightly less than that overnight rate of 5.33%.

I know some analysts are screaming for 50-75bps cuts this week, but that seems like overly negative sentiment and speculative. Not something to use to make a trade.

Getting back to where rates sit... Both the one-month and two-month are trading right around that 5.33% figure, even after the whipsaw of the last few trading days.

What's interesting here was the whipsaw in yields as the Yen trade first began to unwind. We can see it in the chart above.

But here's the thing... That Yen trade is selling U.S. Treasuries, not buying.

That's important. Selling means yields should be higher.

As people sell debt in mass, those debt instruments need higher yields to attract buyers. This means the unwind is cloaking what was our visibility into a future rate cut.

Nonetheless, we can apply a bit of a discount to what the market is showing since this selloff should create a temporarily yield premium. Which is to say, I believe the chances for that cut might have grown with this deleveraging event underway.

But here's the thing...

Any cut by the Federal Reserve would exacerbate this Yen carry trade unwind. That's because a rate cut would weaken the U.S. dollar relative to the Bank of Japan's Yen... A central bank that is raising its rates as of last week.

Said differently, Janet Yellen of the U.S. Treasury and Jerome Powell's jobs got much, much harder. Their margin for error is getting very narrow.

Most will sit here and call them idiots for allowing this to happen. But they want to see deleveraging. I almost expect them to have a gameplan for this as I'd wager that this Yen carry unwind was an elephant in the room that was addressed by all.

We'll see more of their thinking here in the days to come.

In a year where I personally believed the Federal Reserve would become less of a factor, they seem to primed for even more of the spotlight.

And as we watch this drama unfold, let's not forget how long it took crypto to deleverage and unwind its carry trade.

There will be aftershocks. Try to take it day by day for now.

As for what the day is showing in crypto...

ROSI

One of J-AI's 48 models is called ROSI - Reversal Onchain Sentiment Indicator.

Long time readers might recall this model as it tries to time bottoms. Early on we called it the knife catcher. It literally tries to go against all market wisdom and test fate.

Because of its risk taking approach, we pair ROSI up with other models to help generate greater confidence in the 80+ algorithms that power our autonomous trading software beast, J-AI.

Nonetheless, it's one of several models we like to watch during selloffs. Here are times in the past when ROSI fired off buy signals on Bitcoin.

You might also note that ROSI is lighting up today.

Now, using this model by itself can be strong. Its grabbed some great wicks.

But what many probably don't realize is that it takes more confirmation than this for J-AI to plunge into a market inferno like this.

There needs to be a change in orderflow.

For those who follow our free Telegram channel (here), you might have seen us post over the weekend that J-AI was beginning to view OI, funding rates, and long v. short ratios favorably.

The market structure was improving after Friday's selloff. But orderflow nor whale movements were favorable .

That last part is crucial to realize. We need to see trades, not just orders, show up before having confidence in taking a position.

Without seeing any buyer step in with size, why risk being first.

It's like seeing a food stand with nobody in line waiting to buy a plate. The instinct from somebody looking might be, "Something must be wrong over there".

But you immediately place a few hungry people in line, others will gladly wait to place their order without those lingering thoughts entering their mind.

Those individuals standing in line placing their order is exactly what J-AI tracks. Once it sees orderflow pick up, that's the confidence it needs.

Reason being, whether it's just a mean reversion or longer term trend reversal, odds are we can get a great entry.

J-AI saw such conditions hit on Monday, and now finds itself beginning to manage its current positions while also looking to size in.

The question then becomes, based upon the ROSI chart above, is this just a bounce... Or a major trend reversal.

For now, the models that are being triggered indicate this is likely to be more of a bounce than a longer term trend reversal.

And while bounces can lead to trend reversals, I have some doubts that happens here based upon what we touched on earlier.

The aftershocks are likely coming. Let's keep an eye on them in case they impact crypto again.

Until next time...

Your Pulse on Crypto,

Ben Lilly

P.S. - Thank you Scott and JB for your comments in the last issue. I encourage others to comment as well. Let's get this conversation up and going with greater regularity. Also, if there's something you want our team to dig into, feel free. We will do our best to be a useful insight for you.

Scott, your comment related to the massive debt volcano is very timely. As Yellen and Powell's job now get harder, this volcano will look uglier and uglier. Hard to ignore.

JB, nice position there. How long do you look to keep the position open?