It Was On-Chain

Exchange Flows Before Elon's Tweet

The applause dies down and a hush falls over the crowd.

Anticipation is in the air.

The baton rises. Players draw in a breath with fingers eagerly poised, ready to bring their instruments to life.

The conductor gives the cue and like a horse at a starting gate we burst into action.

The tempo fast, bouncy. A few bars in, the band is completely in sync. Typically our conductor outlandish gestures and expressions riddle his face. But this time, with so many hours of practice… It’s a smile.

We can predict what he wants before he wills it into us with his baton.

We’re hitting every note. Stressing every accent.

It’s going almost too well.

And without warning one of the alto saxophone players begin tripping up. Her instrument squeaks as she blows too hard on her key section.

The crowd doesn’t notice. But the same can’t be said for the band. While subtle, the rest of the band is on notice..

The anxiety spreads like a virus, player after player falls slightly out of sync. Notes are early, four quarter notes are held a fraction too long. The conductor’s face exhibits the change in harmony as his face squirms with uneasiness.

And just as we think it can’t get worse… The drummer drops a stick. While only the band members knew the saxophone was off, everybody saw the wooden stick roll across the floor.

It was now chaos.

The conductor admits defeat and makes a sharp, swift circle with his baton. The playing ends. Silence ensues.

Amidst the awkward silence the conductor with his glistening forehead turns and apologises to the crowd. Defeat.

After watching on-chain unfold this week, I was quickly reminded of that concert.

What started out as clockwork turned on a dime as Elon didn’t just drop his drumstick, but chucked it at the conductor.

Let me show you what I mean.

In Sync

Upon waking Monday morning, I was greeted by positive netflows of BTC and ETH onto exchanges. It's a typical bearish sign as sellers began to show up over the weekend.

And staying true to the beat, both BTC and ETH started to sell off.

Even stablecoin netflows were negative in the lead up to the week’s opening. No new buyers were turning up to absorb the building sell pressure.

And pairing this up with technical analysis we got a high probability trading setup.

In the first chart below you can see on Monday bitcoin was pushing the 59k resistance zone that currently caps the market. It already was rejected from this zone the previous week. And with it getting the rejection while experiencing a wave of BTC inflows to exchanges, it was all working out smoothly.

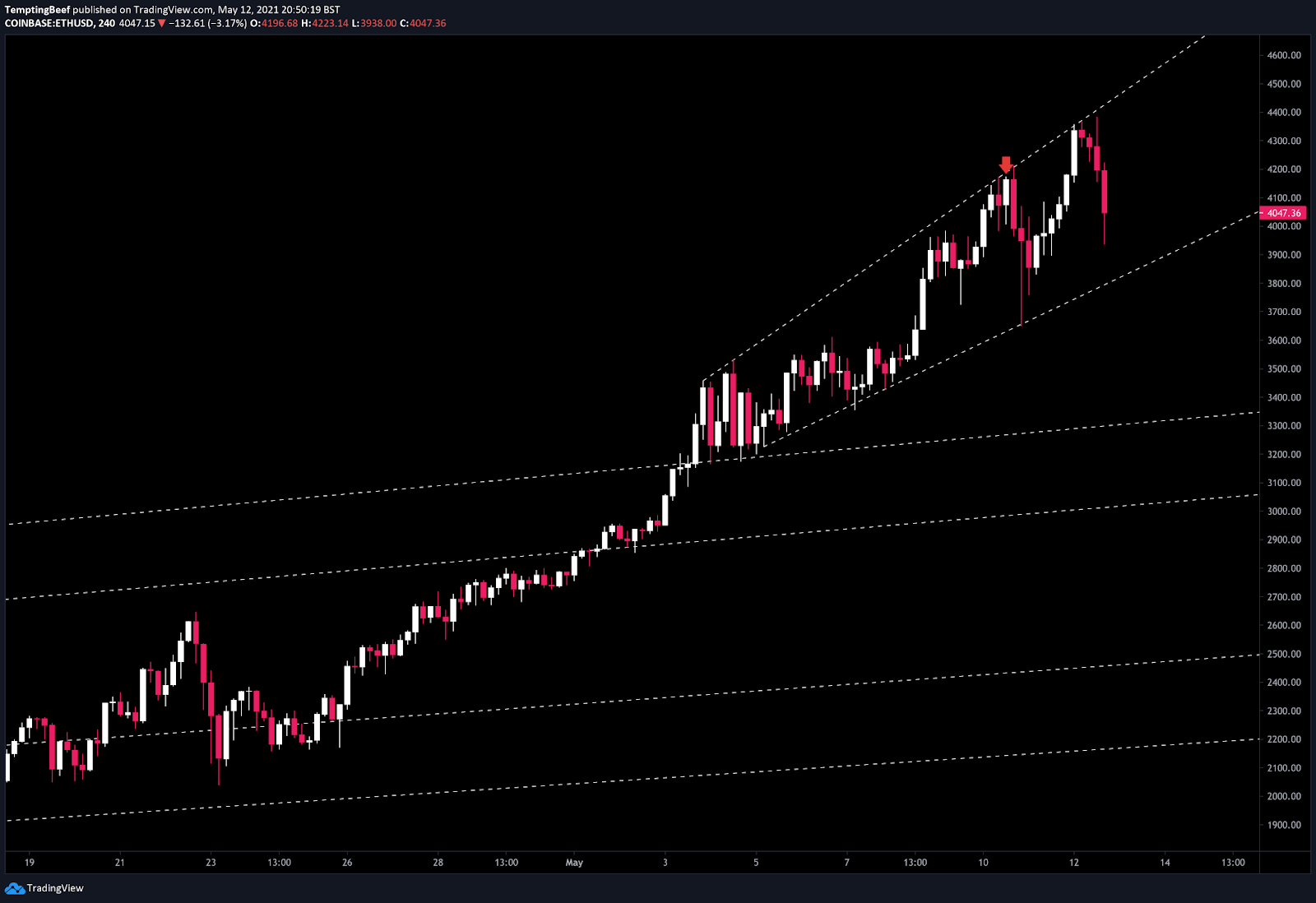

ETH was acting well within its cone.

So applying our formula of asset flows, stablecoin flows, and TA we had:

- BTC & ETH Netflows Positive: bearish

- Stablecoin Netflow Negative: bearish

- Price approaching resistance: bearish

With this combination, we had the trifecta bearish setup.

Falling out of sync

After a subtle drop on Monday, we went sideways on Tuesday.

But after that the subtle signals that something was afoot started to show.

As we mentioned before, Monday saw some bearish bitcoin flows into exchanges. But on Wednesday, we got an even larger inflow. You can see the spike in the chart below.

These spikes show us that there was unusual inflows of BTC onto exchanges, signaling an increase in selling pressure.

And given we already had the bearish trifecta, it made bad news worse.

ETH inflows echoed what was being seen in BTC...

And then I got the notification of Elon’s tweet and read the announcement that Tesla was suspending purchases with bitcoin.

He had just thrown his drumstick at the conductor.

54k folded, 50k followed, and price dropped like a stone.

Support was found around 46k.

And the irony in all this is 46k… It’s where bitcoin made an initial high after Tesla’s announcement on 8th February that they had purchased bitcoin.

ETH put up a good fight, initially refusing to let go of 4k but resistance was futile once BTC had sunk below 50k, the selling pressure took hold and price made a violent dip down to 3.5k.

What was interesting is I observed some spikes in stablecoin inflows around the time of both dips, telling me that some buyers took advantage of the sell off.

In a market where liquidity can dry up in a moment, witnessing buyers marching into exchanges was a positive.

Now while these spikes in inflows are extremely interesting it is clear market movers were already prepared for a sell off before Elon’s tweet hit.

This is another example of how watching the flow of capital in and out of exchanges can improve your trading results. The important part is to now rely on them singlehandedly. You need confluence with an existing thesis. In my case I use TA.

You might use something else.

If you do, please let me know. I would love to hear what you find useful.

As for now…

Stablecoin netflows have swung positive which is helping buoy price up for now.

However, I remain cautious. Even though we sit on a support, I want to see better netflows for bitcoin moving forward.

Especially as Elon continues to troll the cryptocurrency space by tweeting about DOGE.

In the meantime, be sure to follow me on twitter @tempting_beef to follow along as I post updates on bitcoin, ethereum, and stablecoin flows throughout the week.

Serving on-chain cuts,

@tempting_beef

P.S. - Ben Lilly here. I hope you enjoyed another essay from @tempting_beef. He really does a great job at breaking down netflows. Hopefully it improves your own results.

I wanted to pop in quickly to ask what other metrics, data, or analysis you want to see in Espresso. We can either build it if we don’t have it, find somebody doing it already, or show you the metric if we already have it.

Our goal is to build metrics and tools that help you find the signal in the mountain of data that’s in crypto. Let’s build it together. Enjoy your weekend. And as always, thanks for tuning in!