Is Arbitrum the Beginning of the End for Airdrops?

Token Insight: How to Make Airdrops Great Again

As dawn’s first light creeps over the horizon, the farmer awakes, ready to face another day of labor.

He slowly gets out of bed and puts on his work uniform: a timeworn “APE SZN” hoodie and a disheveled T-shirt. Instead of boots, he wears a single flip-flop. He goes over to his computer and fires up MetaMask.

With the precision of an experienced harvester, the farmer begins his daily routine. He sends a small amount of dust ETH from a centralized exchange to a wallet, then bridges from one chain to another, experiments with various testnets, and makes a couple of small trades on decentralized exchanges with no liquidity. He repeats the same banal actions from multiple wallets throughout the day – all in pursuit of some free tokens.

This modern-day farmer is an airdrop farmer. It’s a very lucrative endeavor, and one that attracts more and more people by the day.

Before the Arbitrum (ARB) airdrop, it seemed like airdrop farming was done by a few people and talked about in whispers. No more. ARB’s drop brought airdrop farming to the front page.

Outlets like The Block run profiles on high-flying farmers, while these farmers themselves host Spaces on Twitter to share insights and strategies. Heck, even OKX is putting out guides on how to farm the LayerZero airdrop.

Airdrop farmers have hitherto been wildly successful. However, their very success could end up causing their demise – unless some changes are made to how we conduct airdrops.

But first, let’s quickly review how protocols benefit from airdrops.

Ben Lilly here.

For those who have been looking for a new exchange, consider checking out ByBit.

They operate in 160 countries. They have more than 270 assets trading on spot and over 200 perpetual and quarterly futures contracts. They even offer options contracts and NFT trading.

Simply put, ByBit has a lot to offer any trader. And right now, they are offering a $10 welcome bonus if you open a new account and complete some introductory tasks. They also have additional ways for you to earn.

If you are looking for a new platform to trade on, consider ByBit today by clicking here. Also, if you simply want to support Espresso and the Jarvis Labs team, consider giving a click.

What Good Are Airdrops For, Anyway?

A few things, actually.

In our piece The Right Way to Give Out Free Money, we talked about two of them: marketing and bootstrapping liquidity. There’s a third one, decentralization, that is arguably also important for many projects.

Let’s quickly review them and explain why airdrop farmers negate their benefits.

Marketing

Not many things will get your name out there as much as an airdrop, besides maybe an indictment by the SEC. But if we only consider how a team can generate publicity for their protocol, an airdrop is pretty much the best choice there is. People will talk about your protocol, they will interact with it in the hopes of getting some free tokens, etc.

Now, the reason one does any marketing is to get people to use your protocol. However, if users only use your protocol to farm the airdrop, and leave the minute they have those sweet tokens, you are back to square one – now, with fewer tokens in your treasury.

Bootstrapping Liquidity

Tokens are meant to be tradable. Unless you want your token to experience a slow death, you want to foster a healthy market around it. Since the only people holding the token at first will be the team and early investors, you need a way to distribute it to other users.

Unless you sell some of your tokens to retail via an ICO or an IDO and risk the ire of regulators, the best way to create this counterparty is an airdrop. This will ensure that the token is somewhat distributed on day one, creating a tradable, liquid market from the get-go.

Now, if the airdropped tokens go mostly to farmers, this doesn’t really work that well. Farmers will dump your token at the first opportunity they get, and again, you are back to square one, minus a bunch of tokens.

Decentralization

Airdropping a good chunk of the supply to users across the crypto-sphere should help decentralize a project. Emphasis on the should. Cause again, if all they are doing is dumping the token at the first opportunity they get, you just went through a whole lot of trouble for a whole lot of nothing.

But just how much are airdrops farmed? Is it really that big of a problem? Let’s try to answer this question by taking a peek at the latest big airdrop, Arbitrum.

The great ARB harvest

Arbitrum's airdrop had all the hallmarks of a successful drop, both by its relative smoothness and by the sheer numbers it pulled.

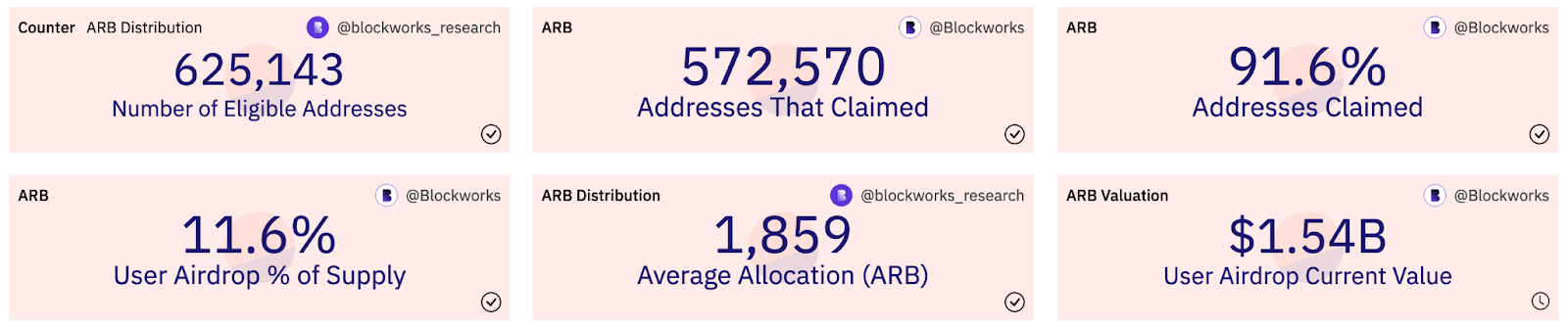

The airdrop constituted a full 11.6% of the total ARB supply – $1.54 billion at current prices. Let me repeat that. 1.54 billion crisp greenbacks, “conjured” out of thin air.

And 91.6% of all 625,000 lucky degens that got the airdrop have already claimed it.

Can you believe that? That Arbitrum has more than 600,000 users?

Yeah, me neither.

Neither did the guys over at X-plore. After running a community detection algorithm and applying more stringent restrictions than Arbitrum did, this is what they found:

- 279,328 of the 624,136 airdropped addresses (45%) were identified as same-person addresses. That is, the same person controlled more than 1 address.

- These same-person addresses received 557 million tokens, or 48% of the airdrop.

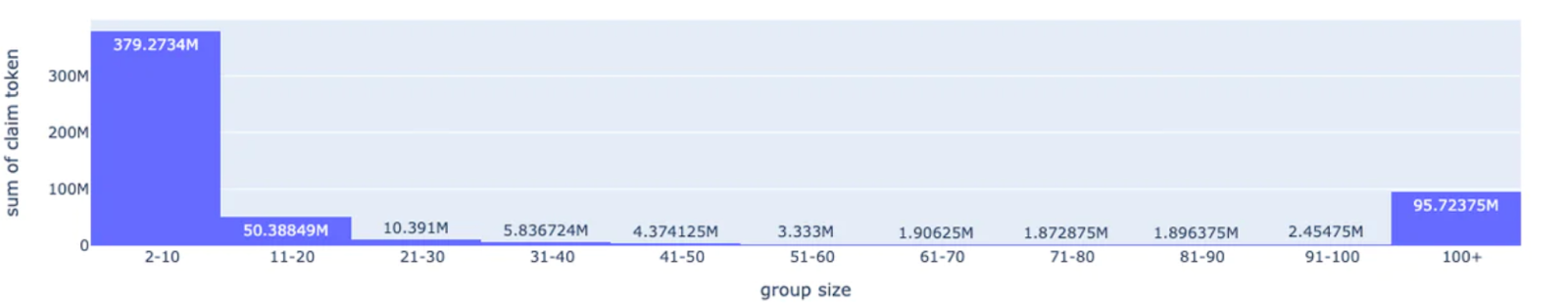

This is a histogram of the tokens received by groups of same-person addresses. The same-person addresses are grouped by the number of addresses each entity likely controlled.

430 million tokens (37% of the airdrop) went to sybilers controlling between 2 and 20 addresses. A full 95 million, or about 8% of the airdrop, went to farmers with over 100 wallets.

Airdrop farmers got a hell of a payday. And they’ve already moved on to the shiny new project.

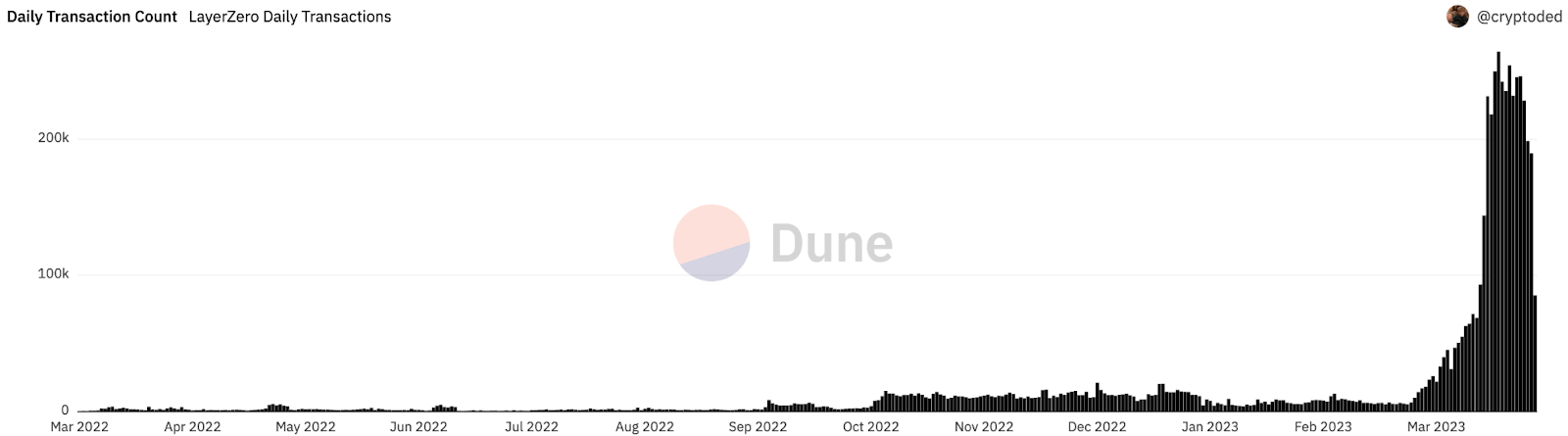

LayerZero is a cross-chain communication protocol that’s expected to launch an airdrop in the near future (although that hasn’t been confirmed). Below is a chart depicting the number of daily transactions on the network.

Take a wild guess as to when ARB dropped.

LayerZero is not a new project. It released its omnibridge Stargate in March 2022. As far as I know, it hasn’t released any new functionality lately.

And yet, its transaction count has gone through the roof, even while the fees on Stargate are much higher than in most other cross-chain bridges. Organic use, right?

Where Do We Go From Here?

Airdrops initially emerged as a powerful tool for bootstrapping protocols, encouraging user engagement, and stimulating network growth. I’d say they can still accomplish all this.

But if farmers continue to take advantage of airdrops and strip them of their benefits, fewer protocols will be incentivized to use them. If that means airdrops go the way of the dodo, then farmers could be their own worst enemy.

If we want airdrops to stick around, the way projects perform airdrops must change. Below we outline ways to make airdrops great again.

Reward Useful Behavior

You wouldn’t leave part of your inheritance to someone you once shook hands with. Neither should protocols shower tokens upon anyone that interacted with the protocol. Doing so will result in an influx of users seeking short-term gains, diluting the token's worth.

Protocols should only incentivize useful behavior.

This is exactly what Blur, an NFT marketplace, did in order to challenge OpenSea.

Unlike failed OpenSea killers like LooksRare or X2Y2, Blur chose not to incentivise trading. See, if you give free tokens to people based on their trade volume, they are just gonna wash trade like crazy, cash your tokens in, and leave you hanging.

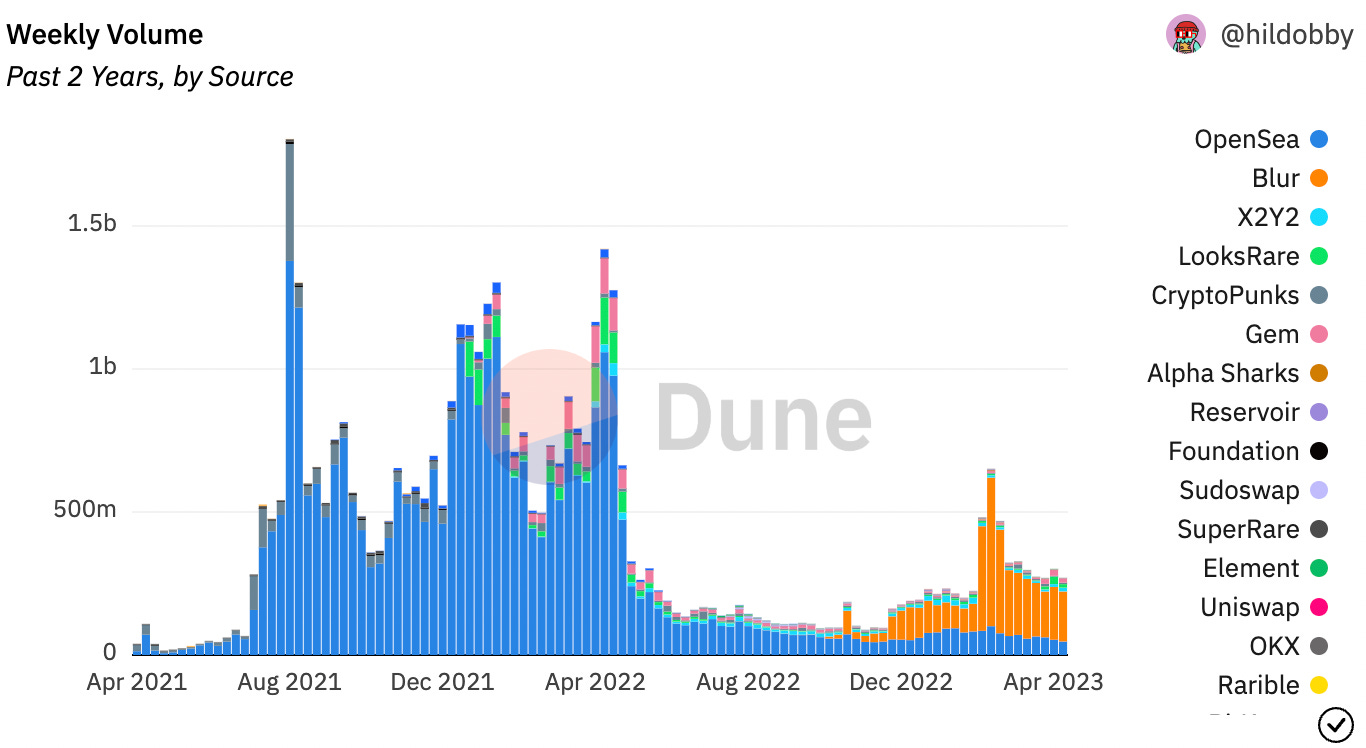

Instead, Blur decided to reward users that provided liquidity on their platform. The first token distribution occurred on February 14. And it seems to be working, as Blur has become the #1 NFT exchange by volume since February 1.

Over the last three months, Blur averaged between 50–80% of all NFT trading volume on Ethereum. OpenSea, once the unassailable NFT king, averaged around 40% back in February, and is down to 20% or less over the last two months.

LooksRare and X2Y2, the ones that incentivized trading through their own token, seldom manage to get above 10% of market share, and are usually below 5%.

Along with providing liquidity, here are some other useful behaviors that protocols could incentivize:

- Developer contributions.

- Bug bounties.

- Content creation and education.

- Data analytics: protocols could give tokens to Dune wizards that create dashboards of their protocols. Heck, if Dune ever released a token, it should give the lion’s share to dashboard creators, as the success of the platform depends on them.

- Staking for proof-of-stake chains.

Run Longer Airdrops

Traditional airdrops are a bit of a “Hey there, here’s your tokens, see you never!” This is a bit nonsensical. It’d be much better to distribute rewards over time to improve user retention and help foster long-term engagement.

In a continuous airdrop model, a small portion of the total tokens allocated for airdrops is distributed in phases, rather than all at once. Activity snapshots are taken over time to determine eligibility. This encourages users to stick around and actively participate in the ecosystem, as they need to remain engaged to continue receiving rewards.

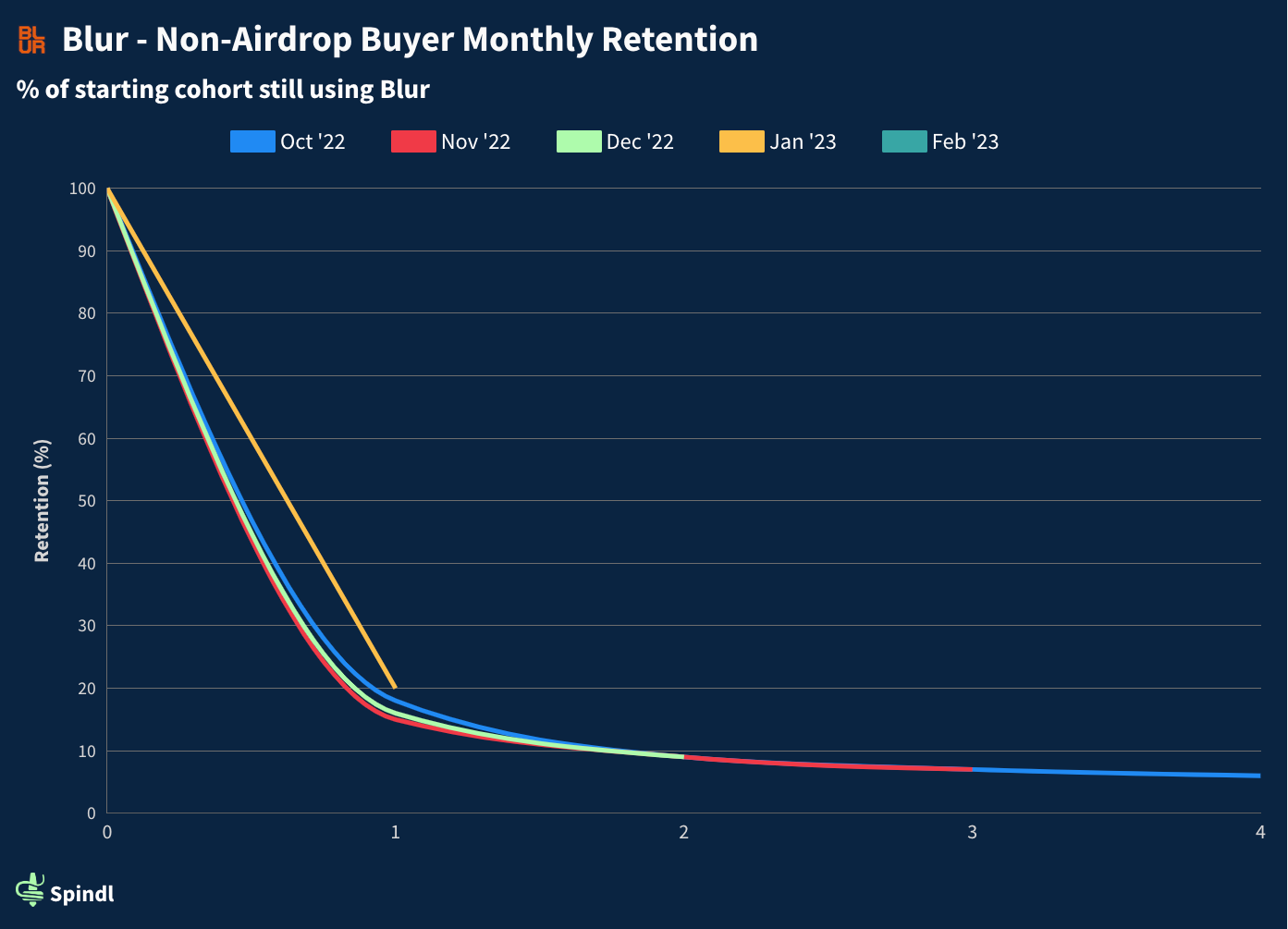

We’re gonna use Blur as an example again. This is what the monthly retention of a non-airdrop user looks like.

Less than 20% retention after one month, single-digits in two. Rough.

What happens when users do receive an airdrop?

That’s much better, wouldn’t you say?

Between 40-50% retention depending on the cohort after one month. From there, retention stabilizes and even upticks slowly as time passes. This is the complete opposite of the slow drip to 0 from the non-airdrop users.

Now let’s compare it to Aptos, a layer-1 blockchain that was touted as both an Ethereum and Solana killer and led by a team of seasoned ex-Meta employees. It raised a total of $350 million in funding from every major VC in crypto.

Aptos decided to do a somewhat limited airdrop in October 2022, and it was very much a one-time thang. Its total value locked (TVL) since launch looks like this:

Ethereum has a TVL of around $28 billion. Solana, even after the FTX fiasco and everyone and their mothers jumping ship, has a TVL of $270 million. So far, with a TVL of $50 million, Aptos hasn’t lived up to expectations.

So, to increase long-term engagement, just spread your airdrop over a lengthy time period.

I know what you are thinking. Does running a continuous airdrop mean that you are constantly paying users to stick around? Yes, that is exactly what you are doing.

Re-engagement campaigns are all around us. From the kickback you get at your local supermarket, to the discount you get from Uber Eats when it’s been a while since you last ordered food in.

So, instead of airdrops being a one-time affair, make them a recurrent thing.

Anti-Sybil Detection

Sybiling is the practice of a single user or entity creating multiple fake accounts to game the airdrop. Protecting against this sounds like a great solution in practice, but it’s quite difficult to pull off.

Most legit projects already try to run anti-sybil campaigns. Some are not too extensive or thought-out, but hey, at least it’s something. The issue is, airdrop farmers adapt and innovate to circumvent anti-sybil detection. And they will continue to do so. Congrats, you got yourself into a bit of an arms race!

Anti-sybil detection will only consume time and resources from the team, distracting them from actually making the protocol successful.

Plus, denying an airdrop to real users because your anti-sybil algorithm got it wrong is very bad publicity. It will likely turn away a few users for good (cough, Paraswap, cough).

All in all, projects are likely best served by outsourcing anti-sybil detection and maybe lowering their expectations. The goal of anti-sybil detection doesn’t necessarily have to be to weed out all farmers. It just needs to make airdrop farming so costly that all but a small few are discouraged.

Lastly, we can all remain hopeful for the future, as some projects out there like Gitcoin Passport aim to solve on-chain identity.

Don’t Do an Airdrop

I mean, there’s no better way to ensure that people are not farming the protocol.

But really, some protocols don’t really need an airdrop to succeed. Some don’t even need a token. Gasp!

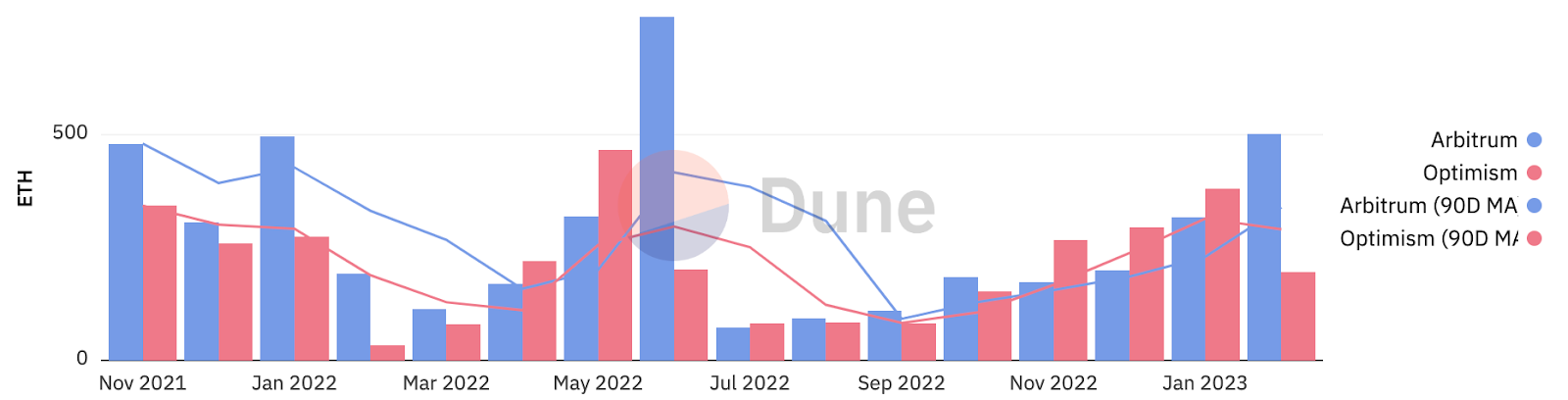

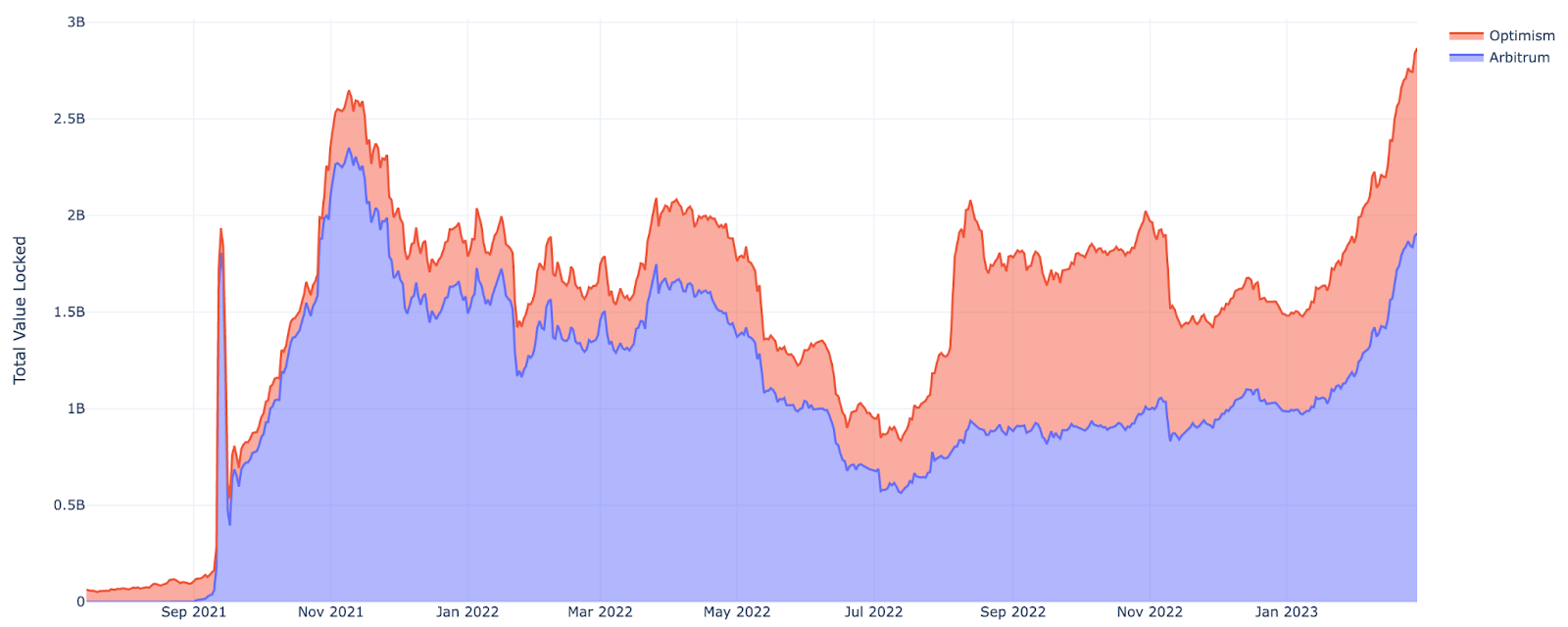

Going back to Arbitrum, it’s easy to make the case that it didn’t really need an airdrop. Even before releasing a token, it consistently had more deployed smart contracts and a higher TVL than its rival, Optimism.

The only period when Optimism seemed to put up a fight against Arbitrum was in the summer of 2022, after the Optimism airdrop and during incentives.

What’s even better about not having either a token or an airdrop, is that people will think that you might at some point. So, they will keep on using your protocol, in the hopes of qualifying for that airdrop that never comes.

Hell, I’m sure there are people out there still doing swaps hoping for the MetaMask airdrop (it’s me, I am people).

The Infinite Game

Airdrop farming, much like trading and life itself, can be viewed as an infinite game. In infinite games, participants adapt to an ever-changing set of “rules” that govern the game. And airdrop farmers have pretty much won and figured out how to game traditional airdrops to their benefit.

Airdrops can be very helpful, as we saw above. But the rise of sybil attacks negates most of their benefits. If airdrops are to continue being an effective tool, they must change. I hope that the ideas above are useful for teams launching a token, or at least give them something to chew on.

Keep it fun,

Kodi

This newsletter is sponsored by Bybit. Be sure to try out the exchange here, and take advantage of all they have to offer today.