Irrationally Impatient

Weekend musings and market makers

The flash bang from over a week ago is still causing some after effects.

Depending on the type of trader looking at the market it can be considered a minor dislocation, negative sentiment, or simply impatience.

Whatever it is, the activity is on full display in the options market.

Over the weekend the minor softness in price that took place Saturday acted like a fresh bowl of honey to bitcoin bears.

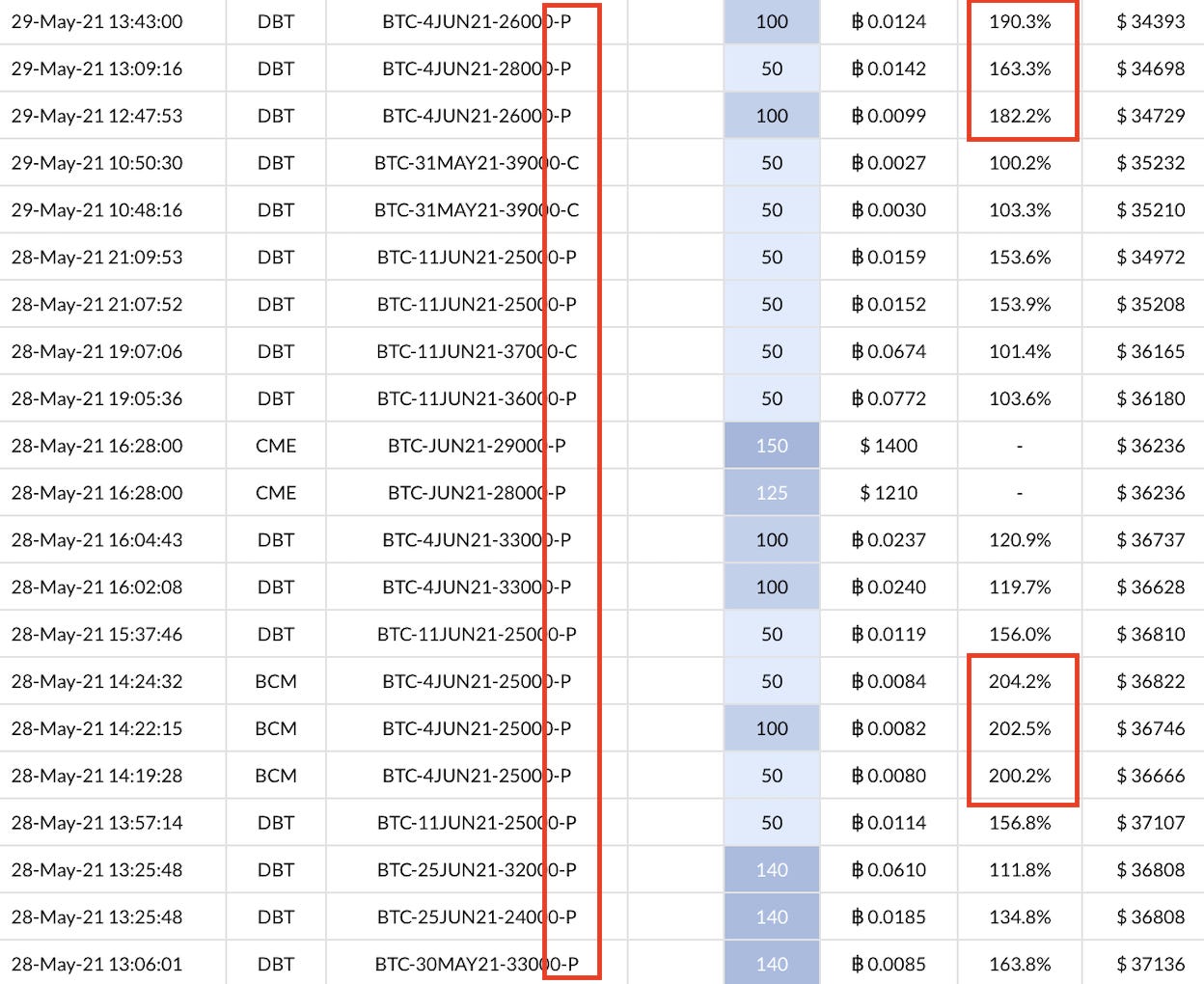

Here is a screenshot of >50 BTC options being traded around the time of the slight dip last weekend.

The interesting note in the image below is only three of these contracts were not put contracts.

Additionally, I highlighted some percentages on the right side. These are Implied Volatility. Many times you can loosely gauge how expensive or inexpensive a contract is based upon these values.

These values near 200% are a bit on the high end. Not to mention the amount of liquidity on a weekly contract that’s out of the money like this is rather low. Usually there are only 2

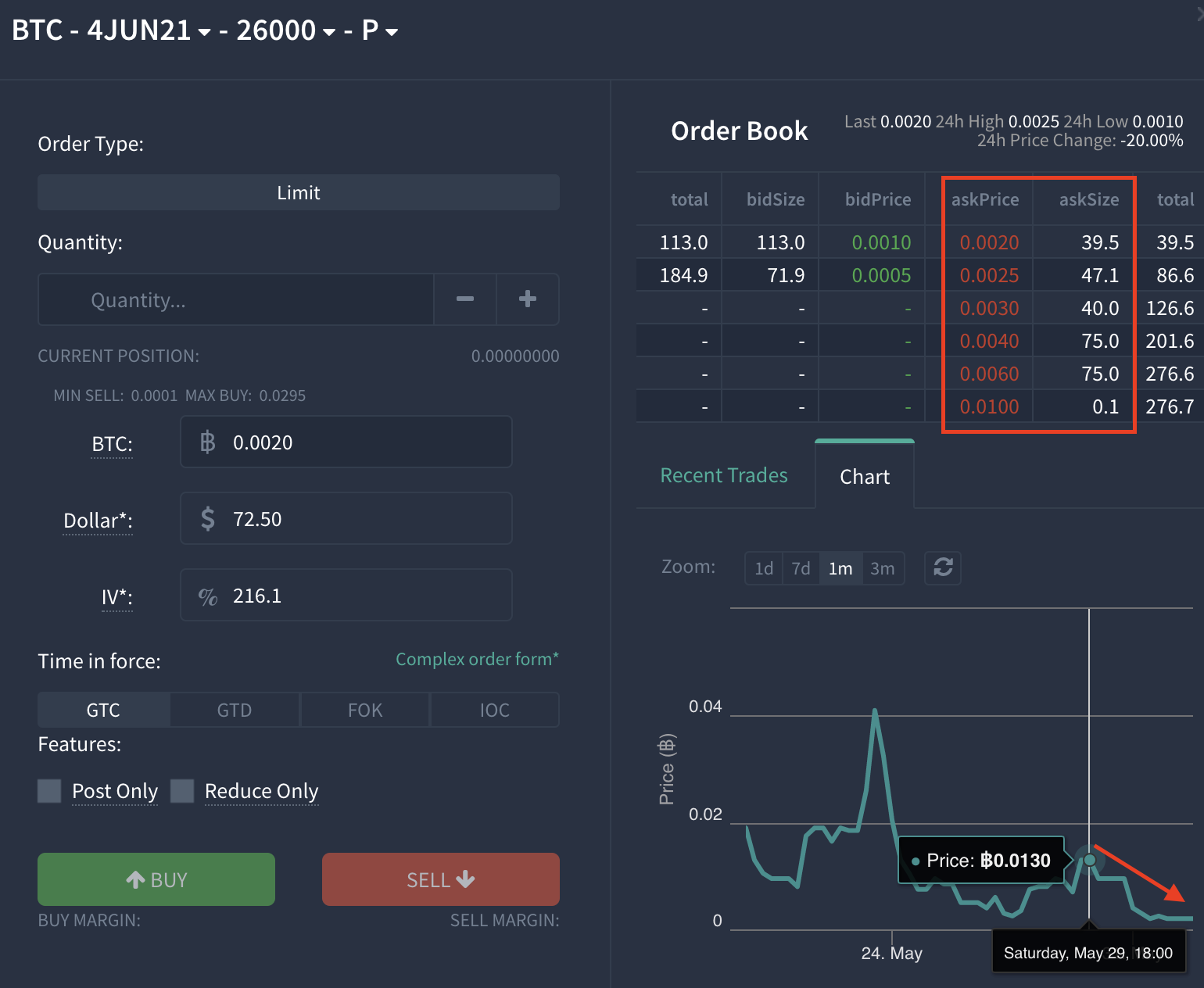

Not to mention the amount of liquidity on a weekly contract that’s out of the money like this is rather low. In the image below I drew a red rectangle around the 26k strike June 4 put contract. As you can see after the 39.5 contracts, the cost goes up 25% for another 47.1 contracts. And 50% higher for the next 40.

In the bottom right of the image is the price of those contracts when price got a little shaky. The put contracts sold at 0.013 BTC were the ‘top’… and now the contracts are trading at 0.0015 BTC… Almost a 90% drop in value.

Now, what’s more… we can see this premium being paid for downside protection is historically expensive thanks to our next metric. It isn’t simply just a one off event from this weekend, its the current market structure today.

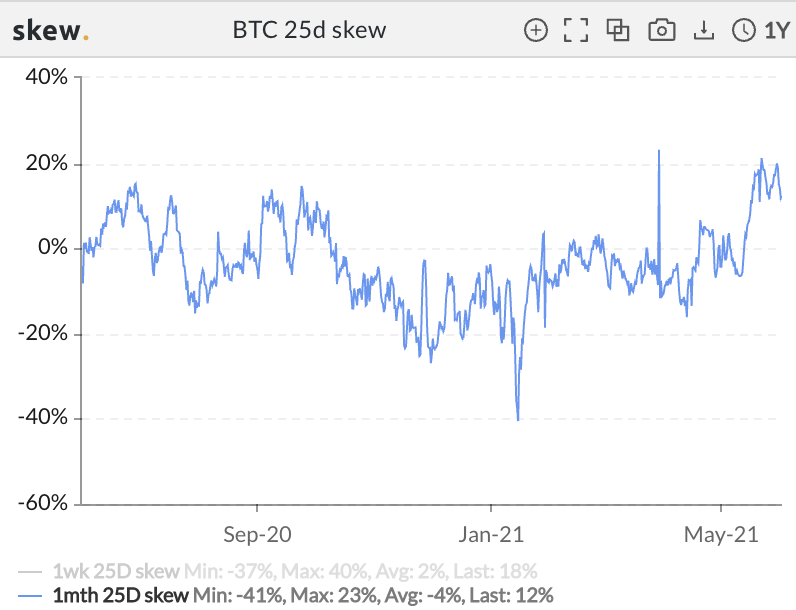

Here’s the 25d skew. It’s a fancy way to view whether puts or calls are more expensive to one another. Right now, puts are commanding top dollar.

I used the one month dated contracts in the image below. As you can see, puts are about 20% more than calls right now.

This is an expression of the overly bearish sentiment in the market right now. And its why I refer to it as after effects from the selloff as it’s not the first time we’ve seen this.

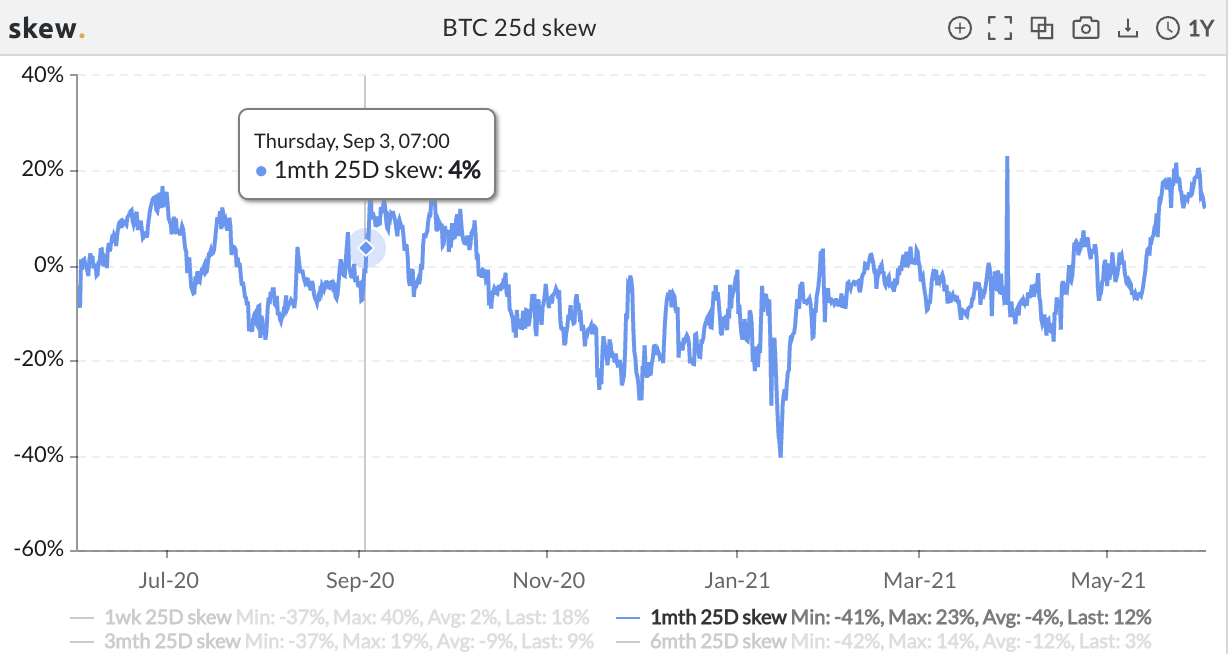

Looking back on the history of 25d Skew and the price charts, I’m reminded a bit of early September.

It was the last time the 25d leaned bearish overly bearish. Here is the 25d skew for early September 2020.

Similar to now, price was fresh off a drop. Only difference is the magnitude being 21% versus the nearly the clearance sale we got recently.

Here is the chart showing what the price action looked like after the drop. Look a bit similar?

You might remember this as a rather boring period in the market. Similar to what you might be feeling today.

For market makers, this is when they are making bank in what’s termed selling volatility. Its when you sell options contracts because you can pocket the premium thanks to the heightened implied volatility… Or said in another way, market makers are cashing in on people making impatient movements.

Its in part why the major put contracts being purchased over the weekend is almost laughable.

If somebody were really that concerned about bitcoin dropping 20-30% in a few days, there was likely a better way to make that trade.

Purchasing overpriced put contracts when the market is overly bearish is simply not a well thought out trade.

When you see irrational trading like this, it’s not something to follow.

Big money is not always smart money. The smart money was the market maker there, providing the liquidity to the irrational buyer.

Which is similar to what we see on-chain right now…

The main flow of capital is in stablecoins going to smart contracts. USDt being used in smart contracts when from a hair under 15% to nearly 19% over the weekend.

This is a sign of opportunity in the market.

The main opportunity is not seen in opening up positions, but rather in collecting premiums from providing liquidity.

Unfortunately this is not a game that’s well suited for retail. Placing funds in a smart contract in low amounts tends to price out the market.

Paying $50 for a smart contract fee on $10,000 is 0.5%. And when you consider the fact when you want to pull the capital out of a smart contract it’ll likely be in a high gas environment, there goes any incentive to lend capital for yield.

Especially when your stablecoin yields are 2-2.7%.

It sucks. And when interest in the market becomes overly bearish, we’re fresh off a drop, and the market is flush with stablecoin capital… this is what you get.

We’re likely to now see DEX volume start to drop and in turn see yields drop across crypto.

This is likely why DeFi is getting walloped right now. What’s more, I’m not entirely sure the bottom is in for DeFi.

We’re big advocates for it and believe the protocols that power this realm are must owns. However, there is one looming threat that we feel is coming sooner rather than later.

Its a topic for tomorrow. But without leaving you completely hanging I’ll leave you with this.

Tether has a $62 billion market cap. $1.77 billion of which is on exchanges. And a bit less than 19% are sitting in smart contracts… $2.5 billion of which just moved into these contracts over the last few days… Without any AML/KYC done on the funds.

I have a feeling regulators don’t like that. And it’s in part why we’re seeing some bankers beginning to sound the alarm.

June is here, FinCEN is near.

More tomorrow…

Your Pulse on Crypto,

Ben Lilly

P.S. - One of the issues of watching paint dry trading environments like we see today is we tend to have more time looking at risks in the market. This is one of those situations.

So don’t get mixed up in believing we think this bull market is over. We are not saying that at all. In fact, we believe today’s market is unique to the bull runs we saw in 2013 and 2017 thanks to DeFi and stablecoins. It’s in part why we believe the best is yet to come, it’ll just take a bit longer than what we expected.