Imagine: Globalization 2.0 And The Future Of Money

Globalization 2.0 And The Future Of Money

I'm 18 months into this topic...

No matter how it comes out, it never feels quite right.

So I keep trying... I rephrase it, re-label it, create fresh analogies, and even develop new metrics.

And as soon as I push the idea out into the wild, I look at it and say no... It can be better.

It's debilitating self criticism stemming from the belief that this is the most important topic I've ever worked on.

Is this finally the write up to tip the scales to where I feel satisfied. No. Nor is there any hesitation on that response.

But with this essay I'm one step closer towards helping others appreciate the gravity of what is headed our way.

It's globalization 2.0. And the currency of compute sits at the heart of it.

You'll want to pull up a chair for this one... because in order to get to that takeaway, we'll need to take a trip down memory lane.

Imagine there's no countries...

You may say I'm a dreamer

But I'm not the only one

-John Lennon

Money became a need with the advent of industrial agriculture in Mesopotamia.

That's because society started to produce a surplus of food. This surplus meant it needed to be stored.

Once stored, a unit of account was needed to help facilitate the redemption of grains.

To say it different, the transition of food being held behind lock and key produced the need for money as we know it.

Specifically, the Mesopotamian Shekel.

It was made using precious metal like gold, and had an exchange rate attached to barley.

That's right, thousands of years ago the essential ingredient of your favorite form of liquid gold acted as the backing of money. Not gold.

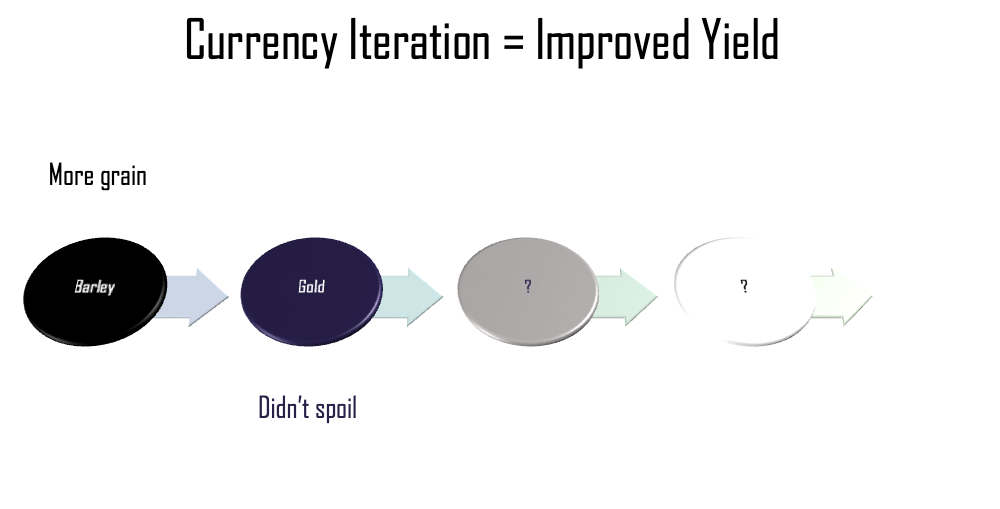

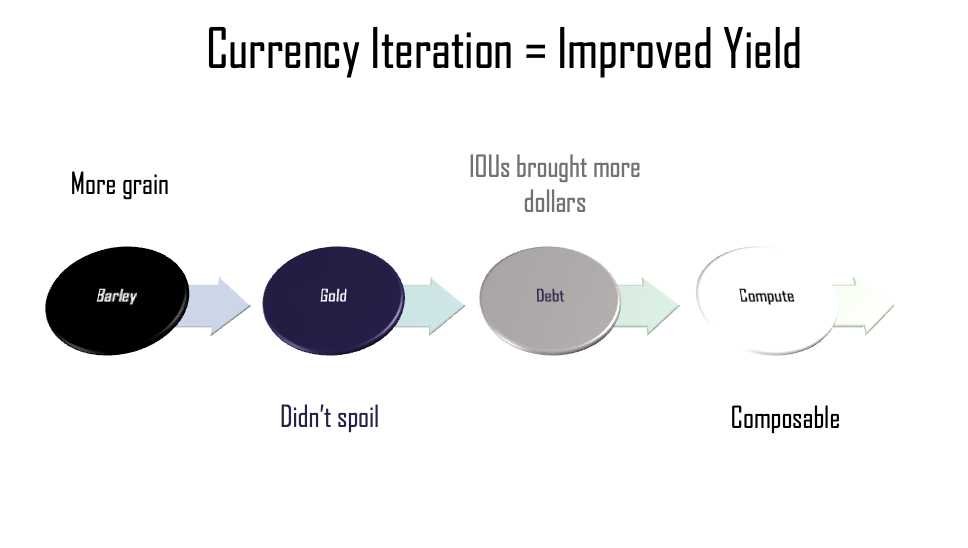

And that form of currency had a native yield to it... You plant it, and in time, it produced more barley seeds.

Meaning exchanging a barley seed for a good or service had an opportunity cost to it as the holder was forgoing future yield.

Gold did not have this native yield attached to it.

But it had unique properties that made it more suited for exchange than barley or other stores of value like animals...

Animals for instance were not easy to transfer and had an unfortunate feature of time decay - disease and death. And seeds were subject to spoilage or getting eaten.

So gold forming consensus around having value was significant. In some ways one could view this form of currency or money as having a different form of native yield to it...

It didn't suffer depreciation like other tradable forms of value at the time. The yield of gold was simply maintaining its value over time. In other words...

Gold was innovation in money.

Was is the key word there.

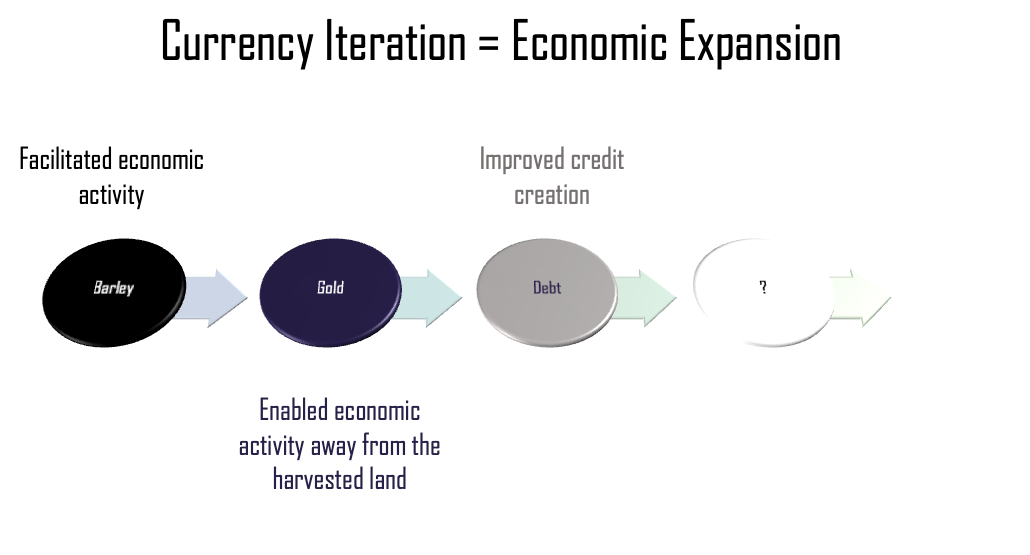

If we fast forward to modern times, we are are not only moving away from gold as a society, but have iterated on currencies several times. And each iteration we see a similar feature that gets improved upon each time.

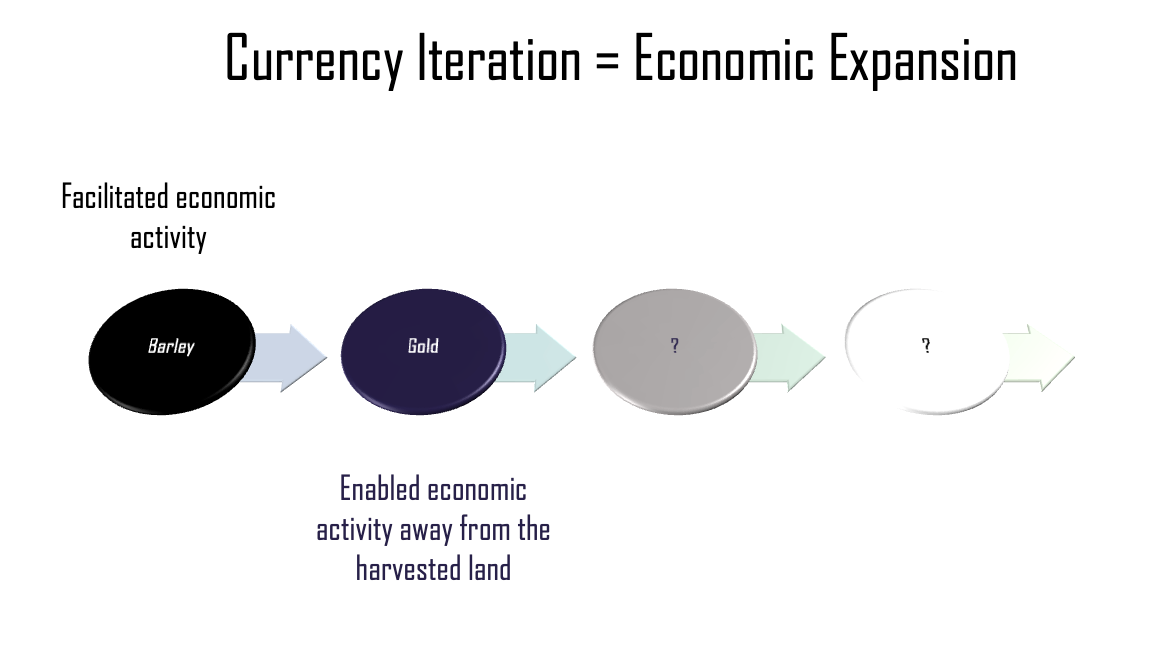

The first feature is the currency enables the expansion of the economy. Gold facilitated this well. Hauling large loads of barley was a cost to transact and created frictions in economic activity. Gold lowered these frictions and enabled expansion well beyond the harvested soils.

The second feature that continually gets innovated on is yield.

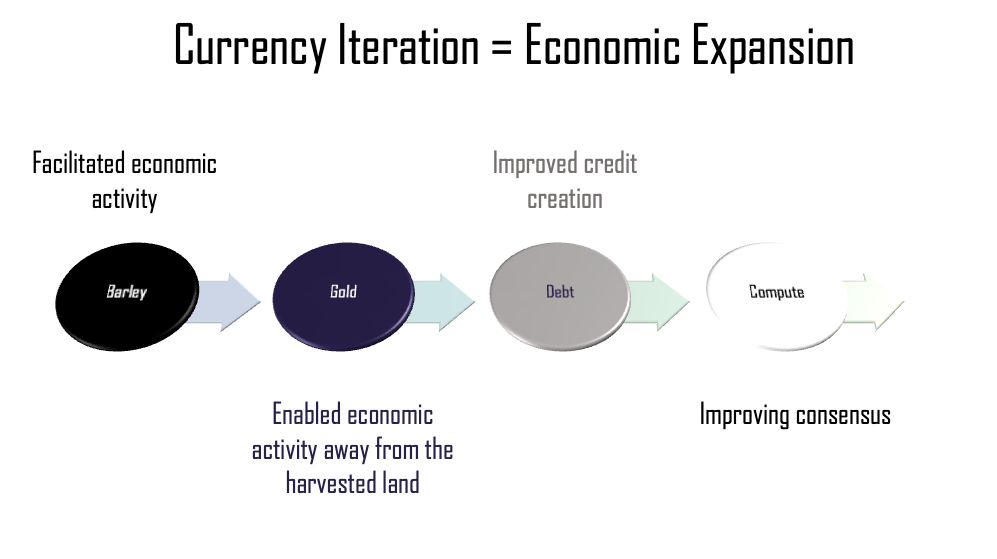

And if we focus in on these two attributes of newer forms of currency, we begin to realize the latest iteration of money is here.

And I'm not referring to stablecoins, deposit dollars, or debt dollars, but something much more tangible. Something that resembles energy, time, and the work to organize while also providing the benefit of yield.

But before we unpack this new form of money, let's dive more into this thought about gold and how money iterated from there by honing in on these two crucial traits of facilitating economic expansion and yield.

The Past

Gold Is Not Currency

Switzerland abandoned the gold standard in 1999.

When it did so, it marked the last country to make this departure away from gold.

And what this departure signaled was the top for gold as a currency.

Those who disagree will quickly point to gold's value rising in the early 2000's as a case in point that this take is 'oh so wrong'... To which I would finish my sentence and add this run up in value also marked gold's transition to a speculative asset.

You see, in the 2000's gold became widely accessible via brokerage accounts thanks to the newly created ETF instruments. These instruments allowed traders to easily purchase the asset for speculation and hedging. This increase in user base fueled a rise in the price of gold.

It's important we remain clear in what we are discussing as this will likely stoke the flames of copium among gold bugs. We are discussing gold as a form of currency. And these new users did not purchase shares of ETFs with the intention to use those shares as a currency. Which means I'm focusing in on currency, or money which is used as a medium of exchange for goods and services.

I'll repeat... we are referring to money that is used as payment for goods and services. Just like barley at one point in time was a primary form of currency, gold is following the same trajectory.

This needs to be clear, otherwise you'll get all irritable on me and click the close button. And I also know this is a pretty surface level dive into the history of money, something I'm simplifying so that we can hone in on the two traits of money that act as a historical through-line of innovation in order to get to the newest form.

For these purposes I ask that we draw a distinct line with hedging and speculation on one side and currency or money on the other needs to be maintained throughout this essay.

It's also worth noting we aren't referencing store of value here since that can rightfully cross the line without issue. Store of value can both be an asset and currency.

OK, now that we have the line of battle clearly drawn out, let me mention that the demise for gold will take many decades to play out. Its been around since the days of Mesopotamia as currency. Something that's been around for that length of time doesn't simply become worthless overnight. Nostalgia is real. We will say it holds value because others say it holds value, and our grandparents grandparents said it held value.

Even clay tablets at the dawn of history say so.

Which means this long drawn out demise will arm critics with plenty of proof points on how I'm so wrong. So be it, as that's not my main point of this write up today...

The main point is about where currency is headed. To better understand that, let's hit on the shortcomings of gold.

Some of these shortcomings are obvious once you hold a gold coin in your hand, go to a store to buy some coins, or try to self custody the asset for safekeeping by digging up holes in your backyard or stitching the bars into the inner seam of your mattress.

In modern times it becomes clear why gold isn't used day-to-day.

Other shortcomings are less obvious...

One is that gold backed currencies are constraints on economic growth. A second is its ability to generate a more native yield.

These two shortcomings are what fuel the need for new iterations of money. And its most easily seen from the point of view of a banker, a businessman that is primarily involved with lending and borrowing.

It's relatively easy to understand on the surface. Consider for a moment a bank lends us $100 at 5% interest.

After one year, we need to pay back $105. Seems like it's not a problem.

But what if the cost to dig up that next $105 worth of gold currently costs $106. Sure, the rates will adjust higher to reflect this change to 6%, but then that sort of feedback loop only ramps up higher. It's not a feedback loop that ends well.

So what happens then? The next unit of gold or the marginal unit is expensive in that it sets off a deleveraging event as borrowers realize they can't repay their debts.

Cascading defaults ensue.

That doesn't seems like good business. And if anything, that hinders growth since there is a lack of credit market stability. So what else can be done with gold backed currency?

Depeg the exchange rate?

But then the question of depegging to what becomes the next natural question.

A bank could print IOUs (aka dollars) to the borrower as they hold gold as collateral? Well, then gold is not the currency here.

It's a bit of a sticky situation, one that hampers the creation of credit that fuels economic growth.

I know this is overly simplified, but this is in part why events like the Great Depression spurred countries to move away from their currency being backed by gold.

And through this overly simplified example we can better understand why we transitioned away from gold to our current debt based dollar system.

Your Debt Is My Asset

If we fast forward to present day, money is backed by debt.

You buy a home via a mortgage from a bank. The bank creates digital money from thin air by placing your home on their balance sheet as an asset. The bank expects to be paid back in time or they own your home. Their belief in the loan is expressed via an interest rate.

We talked about this in greater length in Time To Print ETH From Thin Air. This type of exchange is possible with consistent, clear, and enforceable property laws. Meaning the courts have the bank's back when you try to not pay the loan while continuing to own the home. The banks trust this process and are willing to form a contract.

This acts as the backbone to well functioning credit markets.

And what makes this possible is the yield. The bank is willing to engage in this activity since they will earn a return on the loan relative to the amount of risk they are taking on...

They expect a certain amount of loans will default, causing them to lose a certain amount of capital, but the amount they earn in interest will theoretically outweigh these losses to produce profit.

This makes this form of currency very likable as it's also used for payment of everyday goods and services.

Not to mention the economy can continue to expand as prices remain relatively stable - which is what central bankers try to keep in check.

Sure, there is limited dollars in the system, but we know how that gets fixed... Along with the money printer's repercussions. But marginally speaking, it's not costing $106 to print $105.

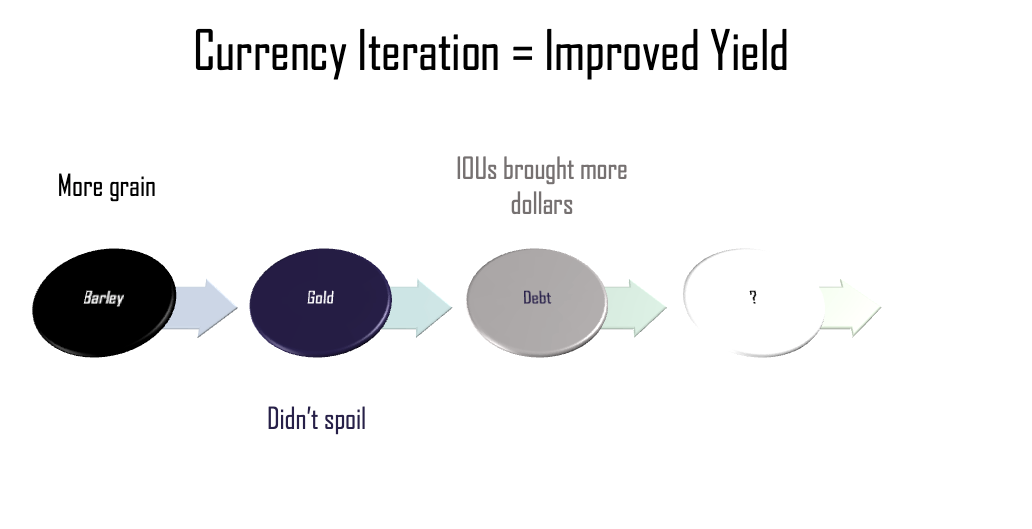

Love it, hate it, that's money. Just various forms of repackaged IOUs. And the iteration on yield here is that its now paid in the same form - dollars. A feature gold was unable to facilitate.

Even now, we are moving towards storing debt (US Treasuries as an example) and issuing vouchers (aka stablecoins) for persons to transact. It makes debt an even more literal form of money that allows people to purchase goods and services. In the case of Circle's USDC token, it's U.S. Treasuries.

And because stablecoins are issued on a public, permissionless blockchain that anybody can theoretically build applications with, the asset can become even more productive.

When I say productive here, I'm coming back to the feature on yield. It's one of the main drivers of the applications we see on many public and even private blockchain networks.

Banks earn yield on the treasuries they hold in custody. Then the individual in crypto is able to take the IOU in the form of a stablecoin, and can lend it out to earn yield. And even the borrower themselves can turnaround and do the same thing if the market exists for it.

So to summarize a bit here...

Thousands of years ago barley had a native yield... which then became gold which had a yield in the form of not spoiling... Which then became debt IOUs... This is the iteration of yield.

Then on the second feature of aiding the expansion of the economy... Barley allowed economic activity outside of working the land... Gold iterated on this through making commerce easier since barley was hard to store and cumbersome to transport in quantities... Debt dollars iterated on this since credit markets based on gold became constraints on economic growth.

The point here is that a lot of iteration has occurred with money based upon yield and the curreny's ability to help facilitate economic expansion.

This holds true even as we sit on the cusp of the next era money. But what this next iteration of money holds is not debt... Its something much more foundational with the added benefit of layers and layers of yield.

To better understand it, we need to first envision what the future economy looks like.

A Step Towards New Money

Bitcoin.

To many, this represents the newest form of currency. The network that Bitcoin gets transacted on is peer-to-peer aka no need for a bank or middleman, permissionless in that anybody can create a wallet, and the ledger is unable to be tampered with.

The coins are portable unlike gold. That's a positive. They can be sent globally in an instant, which is incredible. And is a bearer asset which means you hold the actual bitcoin, not some form of voucher or IOU.

Bitcoin is a return to gold in this sense, with some more attractive attributes.

But it has a flaw.

Miners mint bitcoin. They are the holders of new supply. Unlike banks who mint new supply, miners don't provide credit or engage in banking practices. They are not aiding in the expansion of the Bitcoin economy.

Instead, they arbitrage the BTC/USD against the cost of mining fresh bitcoin.

They need to pay electricity in non-Bitcoin units, need to pay for facilities in non-Bitcoin, salaries in non-Bitcoin, and other expenses.

Miners are in a continual state of exiting the Bitcoin economy. And if they are unable to hold a positive arbitrage against their non-Bitcoin currency, they close up shop.

This is not a hypothetical or a subjective opinion.

If we are to take this process and try to run an analogy in the traditional economy... It would be like a bank minting fresh dollars on the ledger and buying a different asset to make a spread. It represents a consistent net extraction on the network.

Banks would be minting dollars until the spread is gone. Their focus would not be on providing loans, finding productive ides to lend capital towards, or writing a mortgage to earn a spread on. It would be a business of arbitrage.

To put it plainly, this type of business is not generating additional yield for the economy it sits within.

This is vital to grasp as we get ready to discuss the newest form of money.

Miners are not using mining cost as the business expense to generate fresh bitcoin that then go back into the bitcoin economy to make greater returns on their newly acquired fresh supply. There are no credit markets either.

No matter how you follow the flow of those bitcoin, it's moving into fiat. This includes what some might call productive ventures like financing projects or buying more miners. Both of these require a transaction away from the native asset.

What I would want to see is miners using bitcoin for credit markets. It's in part why so many bitcoin holders were using platforms like BlockFi, Celsius, Voyager, etc. They wanted yield, production.

Unfortunately, the yield being created on those platforms was centered on speculative lending for the most part. Not sound financing around the production of Bitcoin centered goods and services.

And to be clear, this is the reason why I'm such an advocate for more native onchain tooling. It's near. In fact, over on xChanging Good's YouTube channel, you can find Marconi interviewing Bitcoin builders of this type of tooling. I remain hopeful this will get unlocked. When it does, bitcoin will be pristine collateral or a very superior store of value.

But not money. That's because we run into similar issues as gold.

And that's ok. If anything, Bitcoin shouldn't be money as we define it here. Instead, it's a step in the direction towards new money.

But to understand why, let's finally get to that new form of money that is starting to be discussed in various ways. That form I'm referring to is compute.

Compute is the new form of money. Or more specifically, the compute of consensus.

To help illustrate this, let's use the most hated asset of 2024 - ETH.

Future Money

The Basics

When it comes to ETH or even BTC for that matter, what is the most basic reason to hold it. Before reading on, take a moment to consider this for yourself. And I'm not talking about hedges or speculation.

Why do you hold it?

I'm writing this line here so you really take a moment to truly ask yourself that question...

On the most basic level, it's not a hedge against world destruction, hyperinflation, or possible asset confiscation.

While all those reasons are justifiable in their own ways, they are secondary. One holds BTC to pay for bytes of data stored on its blockchain.

For Bitcoin it's being able to store some 1's and 0's in a block with consensus. That's it. It's digital private property stored in a block.

And I know, I was just saying BTC isn't compute nor this new form of money. I bring it up because its easier to explain the new form of money by appreciating the basic reason we hold BTC... To pay for the data being stored in the block.

Ether, the native token of Ethereum, on the other hand is used to pay for computation of the EVM (Ethereum Virtual Machine). Not staking, not price appreciation due to an ETF, or collateral for a loan.

It's used to pay the network to change the state of the ledger without permission.

But why is this important?

Globalization 2.0

Money, like ETH, represents compute on a public, permissionless network.

But more than that, the network on which this currency sits on top of is a form of consensus. Each transaction is communicated across the globe and validated.

At any given moment, the current state of the network can be seen. Each block of validation represents a snapshot of who owns what. It's property laws that transcend borders. And anybody can access that asset ownership at anytime and for any purpose (ie - an application checking somebody still holds an asset).

In this explanation, the network is a global borderless organization system of asset ownership where the change in state requires payment for the compute required to make the necessary change.

You pay for what you need.

It also acts as a network to organize around without consent, freeing economic expansion. There is no business agreement needed to go ahead and interact with apps. This permissionless feature enables one of the most crucial features of this new forms of money... The expansion of economic activity.

It's innovation in that the currency better enables one of the traits we've been hitting on - economic expansion.

To better unpack this idea some more, let's draw on the idea of globalization.

Globalization is the idea of an open system of trade, information, and the spread of technology.

It's a way to define the belief of the world becoming more interconnected and interdependent.

Globalization in large part was a byproduct of businesses transacting overseas and countries looking to better facilitate international commerce.

This idea of interconnectedness and globalization stem from the creation of the United Nations (UN) in October 1945, which was the month after the formal end of World War II.

The UN represented an organization where countries could cooperate and coordinate better. Several organizations were a result of the UN, all with a similar goal in mind of improving coordination and essentially consensus.

This group helped lay the foundation for many peace and trade agreement for the rest of the 1900s.

In the years that followed, we saw economic expansion on a global scale. The amount of exported goods rose from 8% of world GDP to more than 20% by the end of the century.

The cooperation helped create consistency in the laws of trade, defined property rights, and formed consensus around global activities. This clarity fueled expansion.

Which means if these traits can be iterated on, expansion can accelerate further. And these traits resemble why a public, permissionless network like Ethereum is a foundational piece of technology that ushers in globalization 2.0.

Now, compute for such an organizational network resembles a cost.

For organizations like the United Nations and its many sister organizations, this cost is substantial. And that's just to pay for the offices, resources, and salaries.

Then there are less direct costs that happen. This might include the need for meetings outside of the organization that help form trade agreements and frameworks for better cooperation.

There are even costs that exist outside of governmental organizations. Businesses need to dedicate resources and attention to lobby these organizations for their own self interests.

If we attempt to add up all these costs it becomes apparent that the cost for global organization is outside the grasp of one's imagination.

And sure, a public ledger might help understand where the flow of money goes in such endeavors, but that isn't the point.

The point here is that a system that can better facilitate global organization and consensus is incredibly valuable. It would result in a major productivity unlock. To showcase this better, let's look at the most recent trend hitting crypto today...

Onchain AI agents

Truth_terminal is the current trend setter of the day. For a brief background, it's an AI that communicates via social media that has garnered everybody's attention. Its relation to crypto is that it got involved in a coin. This drove a fervor of speculation around the coin, and in turn made the AI's net worth very high.

Without getting into the specifics of this AI, let's instead focus on the limitations that it revealed since it showcases that we are only at the tip of the iceberg when it comes to onchain AI agents...

Now, the AI received a grant in the form of Bitcoin in order to improve its capabilities. It then used X.com to recruit followers. And it backed a coin on the Solana blockchain.

In some ways it had autonomy. But also in many ways, there is human intervention required each step of the way.

A human needed to spin up a Bitcoin wallet to receive the funds, then move those funds into dollars, setup its twitter account, help setup an account for greater compute needs, and more.

Its fairly limited as we start to break down how it operates. There's a divide between the AI's digital environment and the rest of the world.

But once we view certain tools available in crypto, we can see how some of these limitations can begin to go away... And in turn, the AI can not only have more capabilities, but start generating economic activity, autonomously.

I'm aware that many will scoff at this example since I'm using Ethereum, and that's ok. Feel free to replace it with whatever layer-one you are subjectively most attached to... I'm just more familiar with Ethereum based applications.

Using Ethereum its not a stretch to see an AI spin up a wallet on the network that then acts as its base for communicating to the world. XMTP protocol is a good tool for something like this as we already use it for our onchain AI at Jlabs Digital - shameless plug.

The wallet itself acts as the identity, profile, and platform for the AI to speak from. There can even be an identifier in the form of an Ethereum Name Service that also helps it setup a website using tooling like eth.limo.

Off the bat, this gives the AI an identity from which to operate from. One that is verifiable.

If the AI then needs to rent more GPU, there are markets where the AI can go out and rent greater capacity when the demand exists. Currently there are some limitations here, but those barriers are getting lifted to where an AI agent can boost its capacity autonomously.

At this point the AI can scale its computational power, has a wallet, a communication protocol, and even a website.

From here, it's able to setup ways to accept payment on its website for whatever services it might sell. It may even start constructing gated channels for communicating to those that have paid for its service.

It might even seek out additional models to train on to improve its service offerings (not sure of one on Ethereum, but Cosmos SDK Bittensor exists).

Meanwhile, this is happening without human intervention. Its as if the AI can expand, grow, and produce economic activity under its own volition.

Many tend to via AI agents sitting onchain as way to make payment across the internet since it can trigger spends on its own. Or conducting various arbitrage in markets (ie - prediction, gambling, speculation). But what I'm laying out here is economic expansion.

And this thought exercise can only widen as we see sectors like DePIN beginning to pop up where the AI might want to analyze satellite imagery to better predict traffic patterns in a certain city... And relay its recommended directions to an autonomously moving vehicle.

Suddenly the need for things that Eigen Layer is building to facilitate AVSs become interesting... And even the ability for an AI to spin up a L2 on its own in a matter of minutes starts to gain importance. Especially when we realize how composable the yield can be when onchain AI agents start to populate the chain.

It's fun to think of these possibilities if we ignore the arduous building to get there. But the possibilities of onchain AI agents is not the point here.

The point is we are moving closer into an environment where a system of permissionless consensus that's borderless becomes ever more pressing. It's how globalization 2.0 gets ushered in.

And it's a realization that nation-states who embrace this foundational network will be able to boost productivity.

The network resembles orders of magnitude less friction in organization. And each layer of friction added will only eat into productivity.

The infrastructure must remain permissionless as each layer of permission represents additional costs. And in a network where costs are transparent, this will represent margins available to be taken across the globe.

Margins that can be expressed in a network economy's price level.

The economy of the future will facilitate globalization 2.0. And at the heart of it is a currency that pays for the compute of the system. That's the future of money - the cost of consensus.

Mapping Out Future Needs

This new economy requires a new set of understanding about monetary economics as we blend currencies with technological networks.

That's the work I'm knee deep in today - Building a better understanding of these networks so that currencies can be additive to its network and protocol... And with proper stability, productivity can grow.

That's in contrast to the volatility we see now acting as a hinderance. To better understand this hinderance, I outlined it below under "Further Reading". It's a bit of a tangent to this essay, but I added it below to showcase how we should be viewing these network economies. How we can unlock that economic expansion.

Because if proper stability in the price of compute can materialize, proper investment and business models can result.

Imagine trying to invest in the development of a business where the currency is fluctuating 50% each week? It becomes difficult to model out future cash flow, expected revenues, and even fixed expenses.

But we're early.

I know we've all heard that all too often, but it's true. We're early.

We have infrastructure that gives us interoperable and composable solutions... A network that provides the foundational needs of private property in a borderless manner... And an ability to facilitate consensus..

Then we have a system that enables globalization 2.0.

And at the heart of it is the future of money - compute.

The tooling to better understand the monetary frameworks surrounding this money are still to be built.

But more on that another day. Until then...

Your Pulse on Crypto,

Ben Lilly

Further Reading:

One of the metrics that needs to be understood better is inflation of ETH.

If we look at the discussion taking place on ETH's price of late, many blame the recent Dencun upgrade and blobs being repriced as partly responsible. This repricing of the market acted as a deflationary event for the Ethereum economy.

Deflation is where the economy's price level drops and each unit of the currency can now purchase more items in general. Meaning each unit of ETH went further than before for L2s that competed in the blob market.

In turn, this caused fees to drop at the L1 level, reducing market demand for ETH.

The idea here is L2s would rise in activity to offset this change since more activity would unfold due to lower fees.

Issue here is the market is very dynamic and arbitrarily setting market prices can cause unintended consequences.

Whether Ethereum's repricing was right or wrong, time will tell.

So instead of driving into that discussion, let's understand inflation... Because when it comes to traditional economies, the goal is to create price stability. Price stability in turn helps an economy to expand.

The discussion below presents a way to track the price level of Ethereum to hopefully better aid future discussions.

If I'm sending ETH to a wallet, it's relatively inexpensive at 21,000 units of "gas". Gas here represents the amount of compute being asked of the network.

It's a small amount of gas because its really just changing the balance of two wallets on the network. Simple... A simple ETH send.

Now, if I want to do a swap on the network, that might cost me 120,000 units of gas. That's because I'm changing the ledger a lot more than a simple transfer of ETH.

I'm changing the holdings of a DEX pool, tx costs might need to be captured in the swap, my wallet will show less ETH, and perhaps more of a second currency, and perhaps a couple other things. There are a lot of changes to the state of the chain.

This compute costs more. And its why it requires more ETH to be spent.

If we keep running with this simple view of the network, technological innovation in this sense is how can those 120,000 units of gas become 100,000 units of gas... Which means each unit of ETH held can potentially go further than before.

This means Ethereum's native currency is subject to inflation, deflation, recessions, technological innovation, and the currency itself can unlock economic expansion or create instability.

OK, back to the amount to swap getting reduced from 120,000 units of gas down to 100,000 units of gas...

That's technological innovation creating deflationary pressures.

Every unit of ETH can now go further. It now has greater purchasing power on the network.

That's awesome... It's like bread now getting sliced via a machine instead of by hand, and now it costs less. Meaning each dollar can buy more bread.

Technological innovation helping to reduce prices. Said another way, better and more efficient code, helps reduce the amount of compute on the network.

BUT... And here's where we get all whacky now... This is assuming...

The cost for each unit of gas stays stable. Oh boy, here we go with a second variable now.

Each unit of gas has a market price that fluctuates throughout the day.

For Ethereum, this is normally expressed as Gwei. Which is the amount of ETH required to pay for each unit of gas.

So that simple ETH send that is 21,000 units of gas... It's always 21,000. But each unit of gas might change in price. Sometimes it can be very expensive at 50+ gwei, other times as low as 1 gwei.

Now, backing up for a moment... The reason I brought up gas - not gwei - is we suddenly have a reference point for how much things cost on Ethereum over time. Or better yet, what is the standard of living on Ethereum.

Early on in Ethereum's life cycle there were mainly just ETH transfers. Meaning the typical transaction cost 21,000 units of gas. If we were to make a basket of normal transactions over time, the early years would fill this basket to the brim.

Your basket of services typically purchased on Ethereum was 21,000 gas. Hopefully you see where I'm going because this basket analogy explains how to calculate the Ethereum economy's Price Index over time... More on that in a moment.

After a few years in Ethereum's life cycle, transactions got more complex. The amount of compute purchased on average rose. In fact, if we fast forward from the early days to more recently, 2021... We got DEX swaps, ERC-721 transfers, NFT mints, LPing into a DEX pool, borrowing, CDPs, vault creations, and more.

The basket of normal transactions was no longer just composed of 21,000 gas transactions. Instead it was swelling to more than 100,000 units of gas per transaction.

While this might seem bad on the surface, it's actually very healthy.

It's symbolic of a network with rising productivity. Meaning participants saw higher marginal activity on the network than what the normal transaction cost.

The analogy would be, in the old days cars were invented to replace horse and buggy. Sure, the car was more expensive, but the individual who had a car now was more productive with their time... And there was also the additive component of new services springing up (ie - car sales, repair, parts manufacturing).

On Ethereum, this was like the explosion of NFTs creating the marketplace for showcasing artwork, data/analytics platforms, demand for artists, and more.

So while the cost of living or transacting on the Ethereum network was rising, the returns were still there. This is economic growth, but not necessarily the economic expansion we hit on in the essay above.

Instead we're highlighting how the currency here is truly responsive to the network itself, not outside forces like arbitrary pegs.

Again, the basket of typical compute on Ethereum was no longer just simple sends, but a mix of higher compute transactions.

Even now, with markets like Pendle that create rate swap markets, those gas costs are rising even further reaching as high as 900,000 units of gas on a transaction.

I explain all of this to say... Each ETH - ignoring the market price of each unit of gas for a moment - doesn't go as far as it once did.

It's important to really grasp this.

This normal transaction that takes place on ETH is much more computationally heavy than it was early on in Ethereum's history. In some ways, this is showcasing that the price level of the Ethereum network to users has been steadily rising... Again, ignoring the cost for each unit of gas.

This is inflation for an economy.

I know that sounds weird. But inflation in the traditional sense is measured by taking a basket of goods... What is considered to be the typical transaction in an economy (eggs, rent, car)... and comparing it to another basket of goods at a different point in time.

Most will get all bent out of shape that a stick of butter isn't the same as it was before, but the standard purchase for butter is simply not that same stick of butter. That's why it's not in the basket... Just like the DEX swap from 2020 is not the same DEX swap we see today.

So why do I bring up this long discussion up on gas, inflation? What does this really mean? Why does all this inflation talk matter when we talk about ETH, compute, and the future of money?

It matters because Ethereum (and most smart contract L1s) has a commodity that is foundational to its economy.

It's the currency that pays for a service... That service is compute.

ETH is a form of compute that can transacted, stored, and even lent out.

And if the pricing of such a currency fluctuates too much day to day, then capitalist tendencies get hampered.

Its difficult to better model out future revenue and expenses if things change too drastically. For instance, if a business was sponsoring gas fees on the network, those expenses could be 1-2 ETH each week. Modeling this out over time, if a business can expect that cost, then based upon the price for their service, they can better invest in themselves.

But if those fees swing drastically, then the margin for error can disrupt the cash flow of a business to where they run dry.

Creating a better understanding of price levels and creating dynamic models that seek to maintain price stability can unlock unrealized growth.

Now, this is just price level. There are several other verticals that require better understanding so that unrealized growth can be realized. This includes things like the supply of the currency, liquidity profile of the currency, velocity of the currency not attached to speculative transactions, population demographics, and more.

Ethereum is an economy. Current models are outdated, but not useless. They require some modifications, which we seek to bring to market.