I'm Back

Orderbooks have been leaning bearish for the last few weeks, and continue so into Powell's rate decision. Here's how to see for yourself.

Level headed, sophisticated, and global minds.

That’s how I describe you, the reader.

When we sit back and look at all the various personalities that sit in crypto, I’m incredibly grateful to be earning the support of what I consider to be the best group of traders and investors in the space.

It’s why over the past year each time I write, I often tell myself it’s not good enough. A book’s worth of words have been discarded in my pixelated waste bin.

I rationalize the paper crumpling click and drag mouse movement by saying it’s not original enough, not insightful enough, or think that people would rather hear about the next pump.fun token instead of my midcurving takes.

I haven’t shared this internal strife publicly, not even with my own co-workers.

But I’m my own worst critic. A fact that’s caused a serious case of writer’s block to persist.

It's time to bust through that wall...

My business partner, Benjamin, has been my biggest supporter in crypto. While I hadn’t shared this writer's block with him, he knew. He would mention from time to time how people miss hearing our conversational analysis through storytelling, whether right or wrong. And most recently he encouraged me to start small.

I owe it to him to give it try.

After all, he’s unequivocally the hardest worker in all of crypto. He’s the driving force of everything you see spill out of Jlabs Digital, PANDA Terminal, and more recently deploy.finance.

So this one goes out to him.

Now with the elephant in the room addressed, I need to level set with you all.

I’m a bit out of my game. I haven’t been keeping up with global politics, Fed speeches and research, Bank of Int’l Settlement publications and impending Basel III regulations, and even the more recent discussion surrounding a topic I once touched on regarding how bank collateral will be re-priced via the SLR (supplementary leverage ratio).

But by simply getting started, I know the insatiable need to find answers will surface.

My time of late has been spent tracking U.S. legislation surrounding crypto, building a framework to apply a macro lens to cryptocurrency assets, and helping to build analytical tools and even provide fully autonomous onchain tooling.

There will be plenty of time to get into all of that in greater detail at another date.

For now, I’m going to simply get started and spend a moment to say thank you to those that have stuck with our team through the years and viewing us as one of the premier shops in all of crypto.

Alright, enough of the sob stories. Let's have some fun and rip this writer’s block band-aid off.

The Book

When you place an order on an exchange, it’s a commitment. And when it comes to spot markets the commitment is much more tangible.

Sure, there’s some possible hidden leverage or hedging activities that can happen in the background, but spot markets are as close to true market demand as we can get.

To view these commitments we can observe current orders placed on the book. This tells us whether there is more bids or asks at any given time.

There are several metrics and tools out there to aid in this analysis. We can view heatmaps to identify where the larger orders sit or where holes might sit in the book that could cause prices to move with speed. But these don't really tell you how significant things are at any given time. It's an eyeball test at best.

Their helpfulness tends to be at what level things get interesting, similar to liquidity pools - which I'll use later.

When it comes to the amount of bids and ask, I’m more interested in knowing if books are leaning bullish or bearish. And can I see their significance as it relates to price action.

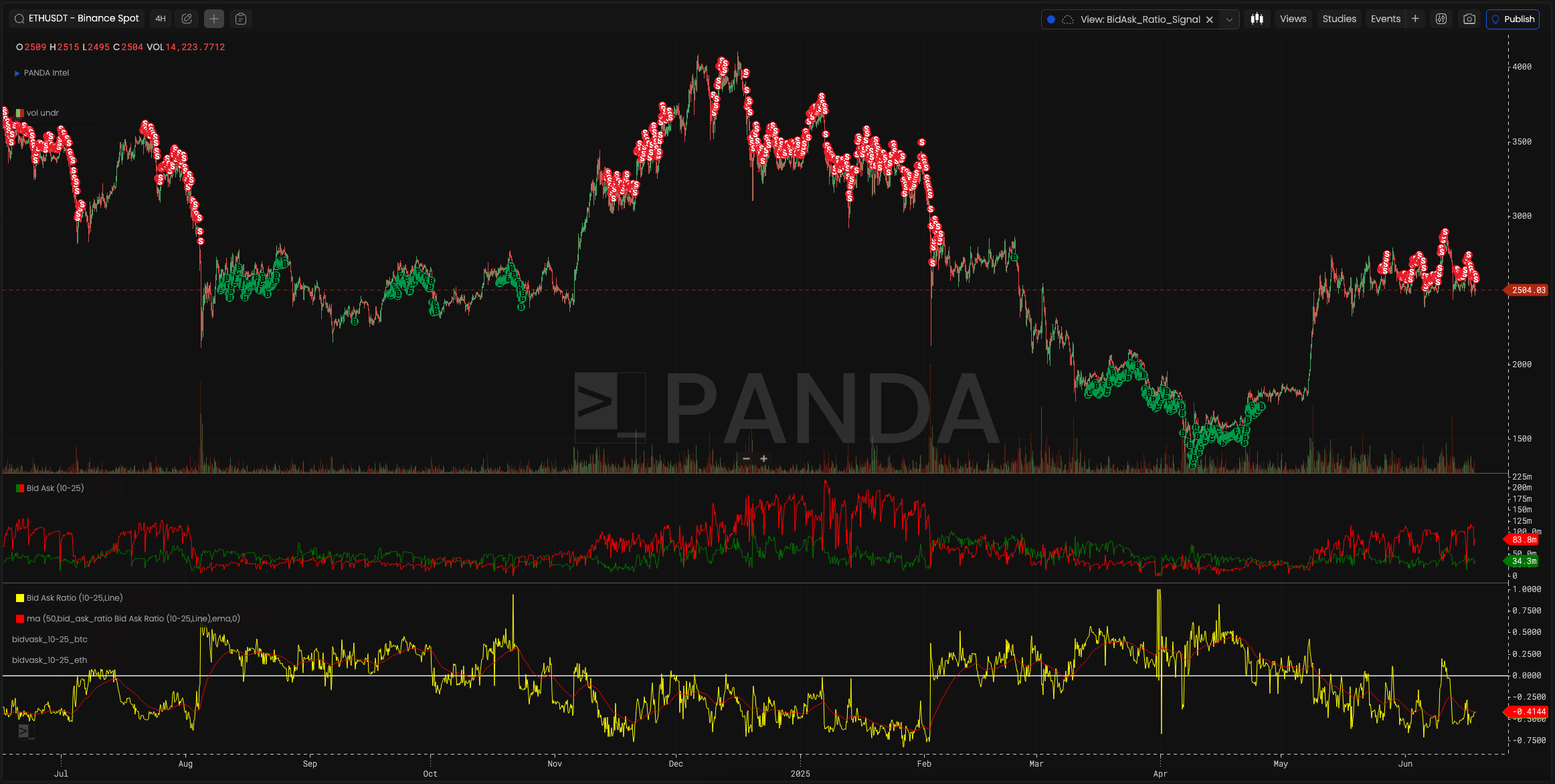

Looking for this bias helps address the question of what regime we are in. And looking at the chart below, we can see Bitcoin is leaning bearish when it comes to the books. (You can click the image to play around with the chart yourself.)

Now, the chart above probably looks a bit crazy. I'll explain a bit what's going on...

The yellow line at the bottom is a bid/ask ratio (10-25). That means it's calculating the amount of bids versus asks on the book that sit 10-25% away from current spot. Moving the ratio away from current spot prices helps filter out some lower timeframe activity.

I then smoothed out the ratio with a moving average and clicked a few buttons to create some conditions that create the red and green bubbles. Those conditions are simple... When the moving average is leaning bids, green bubble. When it's leaning asks, red bubbles.

What we can see is on the recent push to $110k, the asks began to pile up and haven't let up - producing a wave of red bubbles.

No good.

And it's not just Bitcoin either... Ethereum is showing a bearish leaning as well.

Only difference with this chart is the signal doesn't show unless I change up the logic a bit. Basically, once the moving average on bid/ask ratio rises above 0.2 then it's bullish. When it falls below -0.3 it's bearish.

This likely has to do with Bitcoin being the bell weather asset of crypto, and the bids/ask really need to stack up to matter.

So what do we do with this?

Farm

There's the more obvious take of shorting, but that scares me.

Powell could have already dropped rates and sent markets into hyperdrive by the time you read this. Or perhaps he hints at the likelihood that collateral requirements for banks will change, allowing them to pyramid more credit on top of their books (SLR ratio).

There's also two pieces of crypto legislation making the rounds in U.S. Congress. For instance, the GENIUS Act just got passed in the Senate. It now moves over to the House of Representatives where lawmakers will need to decide if the stablecoin bill should get wrapped up in the more broad framework bill or let it standalone. Once that decision gets made, the market might respond.

For those reasons, shorting scares me.

There's the option to construct a position of going long one asset and short another that is showing signs of a technical breakdown. This can also fly in your face if a catalyst pops up at any moment.

The other alternatives is to simply reduce some positions and ladder in a few entries. This is more appealing.

Then finally there's also the ability to go delta neutral. Funding rates are still positive for the most part, and if you're able to place those positions on assets showing higher funding rates then you can gobble up >10% yield on the position.

After all, crypto has become really good at farming yield.

There are now vaults for stablecoin yield spread out everywhere. It's a way to hide out while things look more favorable.

It's in part why the team launched deploy.finance, you can launch a delta neutral agent on hyperliquid in just a few clicks (current 7d avg is 15% apy). The agent manages the position and risk so it's completely hands off and done in a self custodial wallet. Give it a try if you haven't already, the Jlabs Digital crew curated the agent.

But those wanting to bottom tick some entries, we can look at the liquidity pools.

This chart shows $102k and $99k as areas of interest.

If price gets down into these levels, it'll be important to monitor the books to see if bids begin to surface again, shifting the book to a bullish bias.

We can also hone in on the book closer to current spot prices (1-10%) to better time this, which is something we can come back to in a later post if price does take a little tumble.

Until then, we'll wait and see what Powell says and how the book responds in the days to come.

Thanks for having a read and being a continued reader of Espresso. Look forward to getting back into the thick of it.

Your Pulse on Crypto,

Ben Lilly

P.S. - Hat tip to Cole. His post help spark this analysis on orderbooks. You can find it here: https://x.com/ColeGarnersTake/status/1935037226142023771