How to Navigate a World of Higher Rates

Filtered: September 25 – 29

In finance, it’s very easy to get caught up in the smaller details and miss the forest for the trees when it comes to diagnosing the health of the economy.

But I would argue the opposite is equally dangerous.

Last week, JPow and the Federal Reserve decided to leave rates unchanged at a target range of 5.25%–5.5%. They also hinted at raising rates again at least one more time this year.

So naturally, the question on everyone’s minds is, when will the Fed finally start cutting?

While most media pundits endlessly speculated over the answer (which is probably “not for a while”), the team and I were more interested in a different one. Namely, how keeping rates this high for this long is starting to have effects on the economy – both traditional and crypto – and how we can take advantage when the pendulum shifts again.

So first, we turned the mic over to our world-traveling economist-at-large, TD, who’s an expert at analyzing the state of the world through the lenses of the various countries he’s visited, whether it’s Bali or Sri Lanka.

On Monday, he gave us the story of Japan, which is one of the few remaining countries that’s been keeping rates low and engaging in serious money-printing.

But that looks to be ending soon.

Japan’s yield curve control (YCC) program was designed to keep short- and medium-term rates low to stimulate borrowing and spending. But the government recently announced plans to start raising rates, which hints that it might be winding down its easy-money scheme.

Here’s TD on how this could play out on the global stage:

So what are the implications should [Japan] terminate YCC?

Internationally, we can expect turmoil and chaos in asset classes such as real estate and risk-on assets.

In the past few decades, the yen carry trade played a big part in what made all the speculation in the financial market possible. Investors and institutions borrow cheap yen at almost no cost to invest in other risk-on assets or real estate. One can make the argument that this trade allowed SoftBank Group, a $64 billion multinational investment holding company, to grow to its size today.

Many also partially attributed the flourishing of Silicon Valley to the yen carry trade.

Now, those investors and institutions that borrowed [yen] to invest will be going up against the double-whammy headwinds of [yen] appreciation and rising borrowing costs.

The global stock market will take a hit, as cheap money will not be available for investors and liquidity will dry up.

TD went into some more detail on exactly what’s causing Japan to potentially abandon YCC in the full article here.

Meanwhile, for how a landscape of rising rates is affecting the crypto side of things, we can turn to our resident token design expert, Kodi, and the latest Alpha Bites podcast.

For his weekly “Like It or Spike It” segment, where he gives us a snapshot of a handful of crypto news and projects, Kodi checked in on lending protocol Maker.

Unlike most protocols, Maker has actually been growing steadily during the bear market, thanks to its embrace of real-world assets (RWAs), especially U.S. bonds, which allow it to offer high yields to crypto users.

As a result, its income has increased from $40 million at the start of the year to $180 million, and it’s seen growth in plenty of other metrics as well.

Here’s Kodi with more insight:

What they are doing is they are using real world assets, mainly bonds, as collateral.

The way that Maker and DAI works is you give them ETH or some other token as collateral, and then you can mint DAI. And they've been shifting that towards bonds. So like right now, out of the over $8 billion in TVL, $3.4 billion of that sits in real-world assets. That's mainly bonds in American banks.

That poses some potential issues if they have run-ins with the law, so to speak. But right now, it's working great for them. It allows them to make a lot of money because they don't really pay the yield [on all the tokens deposited with them].

So yeah, it's good business for them. So as long as bond yields stay higher, then Maker will just keep on making new highs probably and will be a good token to be in.

If you’re looking for something a bit more traditional to take advantage of this high-rate environment, we have you covered there, too.

Our favorite janitor, J.J., shared some alpha on the podcast regarding a special exchange-traded fund (ETF) on his radar…

...No, it’s not that spot Bitcoin ETF. But it is something that could be a potential play as momentum builds for the Fed to start cutting rates (not financial advice).

The iShares 20+ Year Treasury Bond ETF (TLT) is essentially a basket of U.S. Treasuries with an average duration of over 20 years. Ans as J.J. outlined, despite its rough year, it’s still proving to be a very popular investment:

[TLT] is the second-largest ETF that exists.

There's currently $16 billion under management. And it's just been sinking like a rock since the Fed started hiking rates. And it seems like there's no bottom in sight.

However, according to Eric Balchunas of Bloomberg, people keep piling into it. There's been another $750 million allocated this week alone. And yet, it's actually still down on today and down on the week.

So it's just interesting to see. I'm not an expert on this sort of thing, but to see bonds falling the way they are, [TLT] has a pretty high correlation with Bitcoin. It’s something to keep an eye on.

It seems like when the Fed cuts rates, this would rise, or if there was a market crash, this would rise.

And it's seen as a safe haven. We saw it spike up to about $180, during the COVID panic. For reference, it's around $89 right now. So pretty sharp fall off the lows there. It’s something to keep an eye on from a macro perspective.

And finally, I have to tease a little bit of what’s become my favorite part of Alpha Bites: our “Beta Breakdown.”

Every week, the team and I pick an altcoin that could be a beta play to Ethereum once the bull market kicks off again. And we tackle it from several angles, including network activity, technical analysis, and monetary policy.

That last one is a specialty of yours truly, and I was only too eager to dive in to some of the flawed mechanics on display with this week’s pick, Avalanche (AVAX).

I started off with the most basic problem in Avalanche’s design, which is that its usage isn’t doing enough to offset its excess supply:

To get rolling on it in terms of the usage side of things, [AVAX’s] primary usage in terms of why the token exists is payment for transaction fees. And for a layer one, that's good to see. It's essentially the lowest form of usage.

... So in terms of how much we're talking about here, we're seeing about 1,000 tokens per day right now account for that usage. And these tokens are burned, and if we were to annualize that figure, about 360,000 to almost 400,000 per year [are burned at current rates].

It's down on the year, which is important to consider because the overall market is down. But to give a little bit of framing of how much is 1,000 tokens per day, we should look at the supply growth, which over the last year was 58 million tokens. And so the current burn rate is barely making a dent in terms of the new supply that's hitting the market.

To become deflationary, we really need to see well over 100,000 [AVAX burned] per day. The best days that it had, we saw it topping out at just over 10,000. So it's fallen short, which tells me we got a bit of supply overhang taking place on the Avalanche ecosystem, as far as how that supply is actually being used.

That was just a taste of the work that Kodi, J.J., and I put into analyzing AVAX. If you want to hear more of our analysis and get our assessment on whether AVAX can dig itself out of this hole, you can listen to the full Alpha Bites episode right here, or on Apple Podcasts or Spotify.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

P.S. We’re shifting our publishing schedule around as we ramp up to deliver high alpha content. As a result, Filtered will likely be moving to a less regular cadence until we scale up this new “formula”.

Espresso:

- Japan Prepares to Toss the Curve

Alpha Bites:

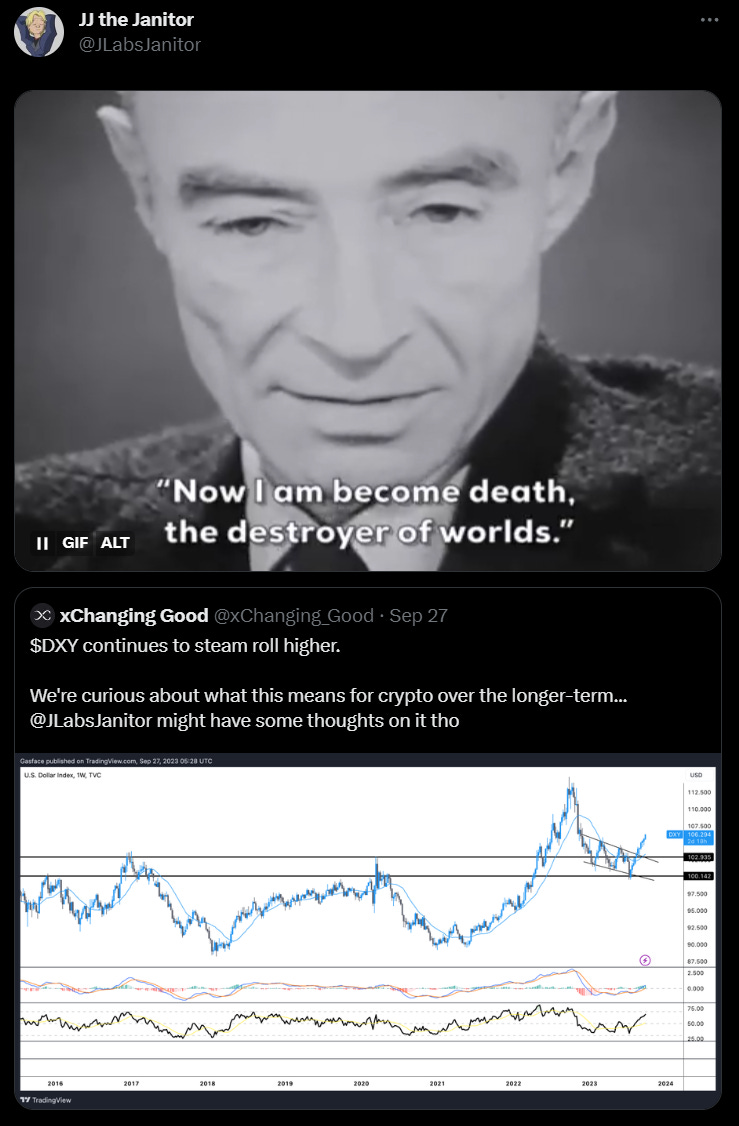

Tweet of the Week: