Harvesting Bitcoin Yield With Options

Options Market Update: 7 Mar 2024

The options market is entering hyperdrive.

This comes after the brief wick to all-time highs on Tuesday morning.

It’s the sort of thing that awoke one of the most dormant charts in crypto - BVOL.

And it’s a move you want to take note of.

Here’s what I mean, B-VOL is the oldest volatility index in crypto which provides a score based on the rolling 30 day annualized volatility BTC experiences daily.

It just broke above its bollinger band on the weekly chart for the first time since 2021.

That’s three years for those trying to do the math.

And what it’s telling us is that extreme intraday moves as we experienced this week, will become the new normal for BTC in 2024.

This expectation of future volatility is now finding its way into options contract pricing as well.

We now have calls trading at extreme premiums as the market crowds into position aiming for a breakout above $70,000.

To see what I’m referring to, here’s an example of what currently sits in the options book.

What you’ll see below is that all calls in the April 26 expiry and beyond are currently trading at an implied price (strike price + premium) of over $70,000. Meaning in order for the owners of these calls just to break even at expiration Bitcoin’s price would have to be well above new all time highs.

This is creating a lucrative opportunity for those wishing to hedge some of their long exposure.

More specifically, one can post their BTC as collateral and sell calls against it to capture the premium. This caps upside exposure at the implied price of the contract, but also allows them to keep the premiums should price not rally to meet expectations over the next few weeks.

We can think of this as harvesting yield on your Bitcoin.

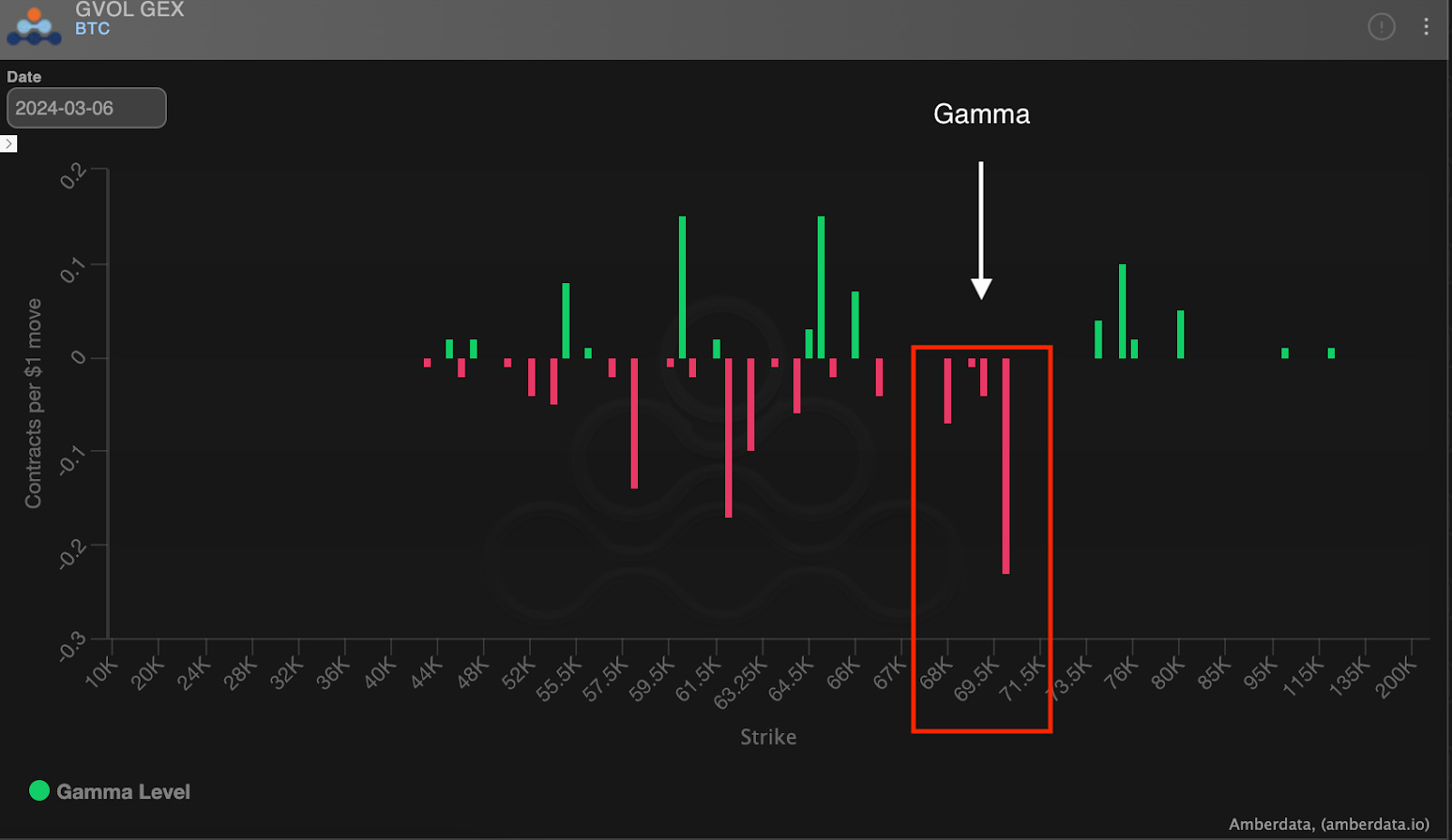

Additionally, it’s worth noting that options dealers remain heavily short strikes between $68,000 - $70,000 throughout March.

We can view this on the GVOL GEX chart below, which shows us the gamma exposure of options market makers.

You can think of gamma exposure (GEX) like price moving through mud or sliding on ice. It’s friction.

On the chart below, the strike levels which dealers are long are indicated by green lines and their short positions (negative exposure) are indicated by red.

When price reaches areas of large dealer short interest (red), such as the line $70,000 I highlighted below, we can expect a lot of price resistance as they’ll sell spot BTC to protect price from reaching their short positions. This is gamma acts like mud on price.

But in the event that price manages to breach past these short gamma levels, the opposite is true, as dealers then have to rapidly buy back long exposure in order to remain delta neutral. This forced reaction from dealers is what leads to gamma squeezes like the one we unpacked last week. That’s the slippery ice scenario.

So at present we have two opposing forces battling it out: options buyers paying a steep premium to try and force BTC’s second gamma squeeze in as many weeks, and options dealers doing their best to keep price pinned below all-time highs.

Inevitably this stand-off will end with one side or the other being forced out of or into new positions to cover, and that should bring with it only more volatility throughout March, which B-VOL already seems to be alluding to.

Volatility begets more volatility.

As the picture becomes clearer we’ll keep you updated, and be sure to tune into tomorrow’s episode of The Trading Pit where I’m sure we’ll have plenty more to discuss in regards to this topic.

Until then…

Watching the tape,

JJ

P.S. - Ben here, be sure to tune into JJ’s newest video on options. He will be going over a topic similar to what is mentioned in this article as this strategy is one you’ll want to be well versed in as the current bull market continues.

The video will premier on March 8 at 14:15utc (9:15a New York time). JJ will be there to answer any questions you might have for those that want to improve their options trading knowledge. Hope to see you there. You can go here and enable notifications to be alerted when the video drops.

And here is the latest Trading Pit episode to come out of the xChanging Good studio. Have a great weekend.

March 5: