Greed Is Good (Sometimes)

Token Insight: The Hidden Advantage Fueling Frax's Rapid Growth Among LSDs

A sharply dressed man with slicked-back hair stands in a room full of people. Microphone in hand, a thousand eyes parked on him, his presence is calm and commanding. The camera closes on him as he begins his speech.

"The point is, ladies and gentlemen, that greed, for lack of a better word, is good."

"Greed is right."

"Greed works."

This isn’t from real life. This scene belongs to the 1987 movie Wall Street directed by Oliver Stone. Michael Douglas plays Gordon Gekko, a ruthless financier inspired by the likes of Carl Icahn. I urge you to see it if you haven’t.

The movie is meant to be a cautionary tale against unchecked excess and the thirst for money and power. Yet my mind always goes back to Gecko’s speech.

“Greed works.”

Gekko is the villain in this movie. The thing is, he got this part right.

Yes, yes, unchecked greed is bad and leads to the dark side via route 666.

But the desire for more is not inherently bad. It’s what has brought us here.

Greed creates innovation. It leads to new opportunities and technologies. It’s what allows you to read this article on your laptop from the comfiness of your home, instead of on a cave wall by a dim fire next to the other Neanderthals.

We always strive for more. For better.

Crypto often gets a bad rap for having too much greed, and rightly so. But it was that greed that drove the innovation we’ve seen over the past decade.

And it’s what enabled one token to take a huge leap forward in the liquid staking space.

In this piece, we will see how the desire for more allowed a resourceful group of shadowy super-coders to bootstrap their Liquid Staking Derivative (LSD) solution by giving people what they want: moar monies. And now, it’s one of the top players on the scene.

Coming for Lido’s Crown

First, let’s do a quick recap of our previous piece, “The Liquid Staking Wars Are Just Getting Started,” to see where the LSD space is at.

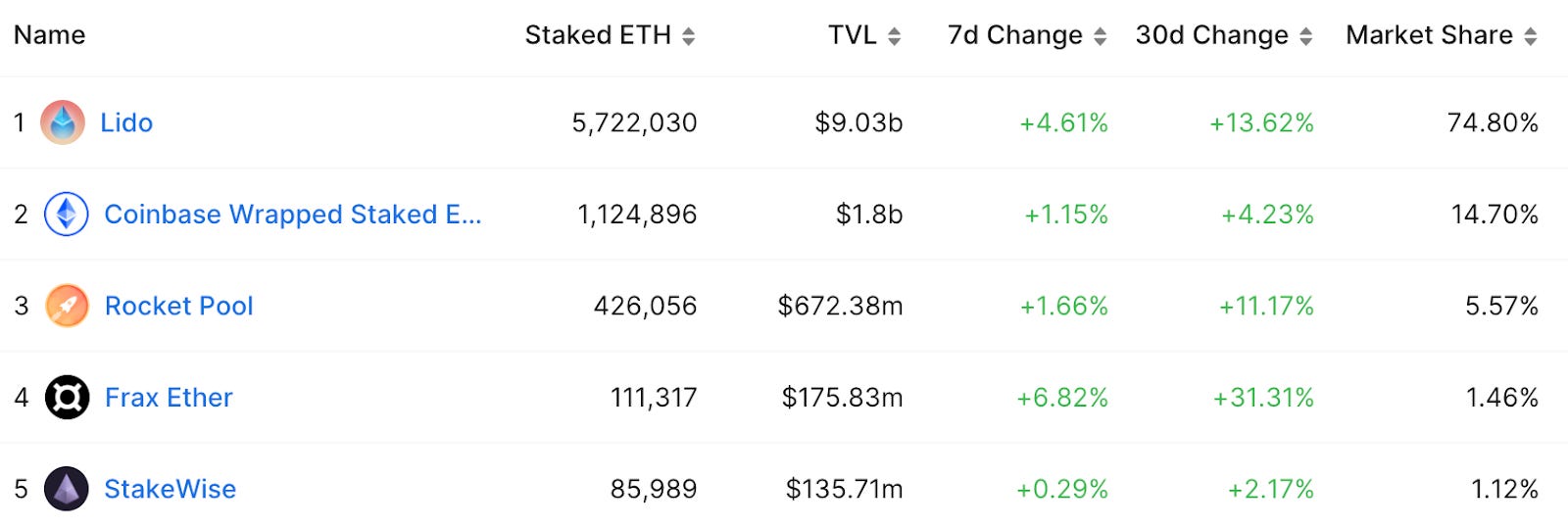

Lido is still the king of the hill, with nearly 75% of all LSD-staked ETH. Coinbase is a distant second. Rocket Pool is the top DeFi alternative to Lido, but it’s very far from catching it. Things haven’t changed much there.

The only thing that seems to have changed since our last piece is that Frax has moved up a spot to No. 4 in the rankings. Even more interesting, its growth has barely slowed down. Over the past 30 days, the amount of ETH staked via Frax has grown by more than 30%.

What has allowed Frax to become a staple name in the LSD arena? And how is it that it keeps on growing?

Paraphrasing that saxophonist from Arkansas, “It’s the yield, stupid.”

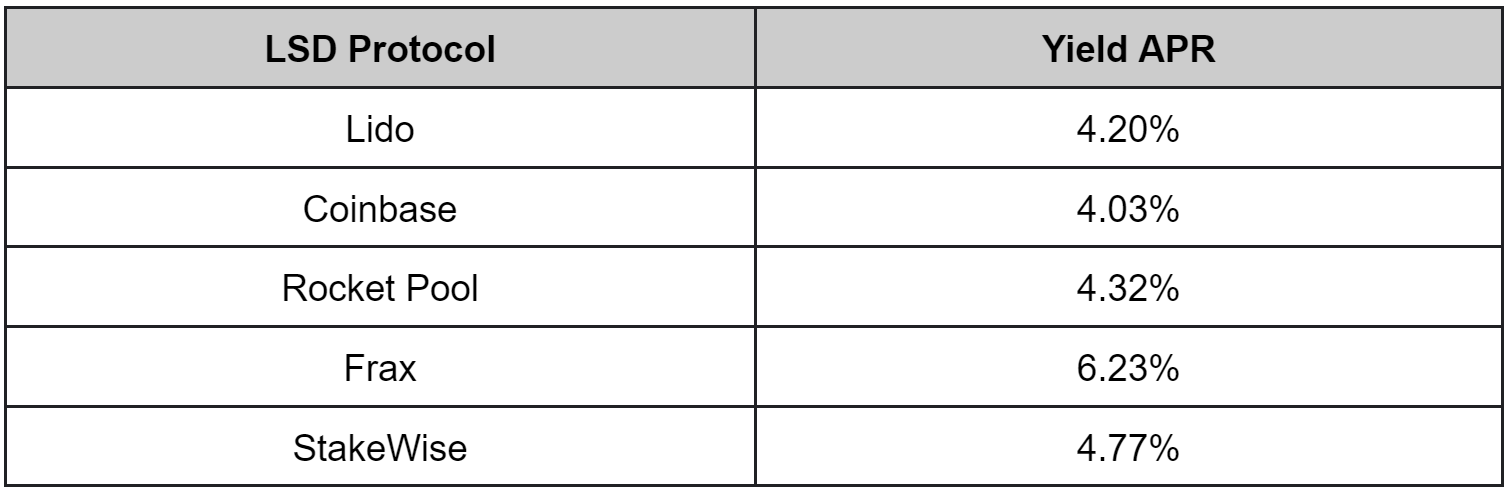

Frax consistently gives its users a higher yield than all its competitors.

The thing is, LSD protocols do not set ETH’s yield and have no means of changing it. As we saw in our last piece, “Not All Yields Are Created Equal,” ETH’s staking yield depends only on the amount of ETH staked.

So, LSD protocols need to get resourceful if they want to offer a higher yield than their competitors.

For instance, one avenue is to not only go after staking rewards but to try and capture fees from miner extractable value (MEV). Lido seems to be heading in that direction.

However, MEV is the dominion of galaxy brains and a tough market to enter. It is likely that LSD protocols will have to rely on third parties to capture a share of MEV fees. This takes control away from the LSD protocol, and of course, those third parties will want their slice of the pie.

Frax found an easier solution: good ol’ token design.

Frax’s Hidden Advantage

The way most LSDs work is fairly simple. You send them ETH, they send you a single derivative token (say, stETH).

This token represents your ETH, alongside all rewards and penalties that have accrued during staking. Your stETH balance will increase over time as you get the staking rewards, and you can swap your stETH back for ETH.

Frax’s founder, Sam Kazemian, did things a little differently. Let’s break down how it works.

The tokens

From the get-go, Frax implemented a dual-token system comprising frxETH and sfrxETH.

frxETH is an ERC20 “stablecoin” pegged to ETH. Don’t worry, this is not a UST/LUNA situation that could spiral and destroy your life savings yet again.

frxETH is completely backed by ETH. You send Frax ETH, they send you frxETH in return.

Holding frxETH on its own does not award you staking rewards. That’s where sfrxETH comes into play.

sfrxETH is not your standard ERC20 token. sfrxETH is instead an ERC-4626 vault. ERC-4626 provides a standard for tokenized yield-bearing vaults that represent an underlying ERC-20 token.

The tl;dr on Frax’s two tokens:

- frxETH is an “ETH-pegged stablecoin.” It does not accrue any rewards.

- sfrxETH is a yield-bearing vault. It does accrue staking rewards.

The mechanism

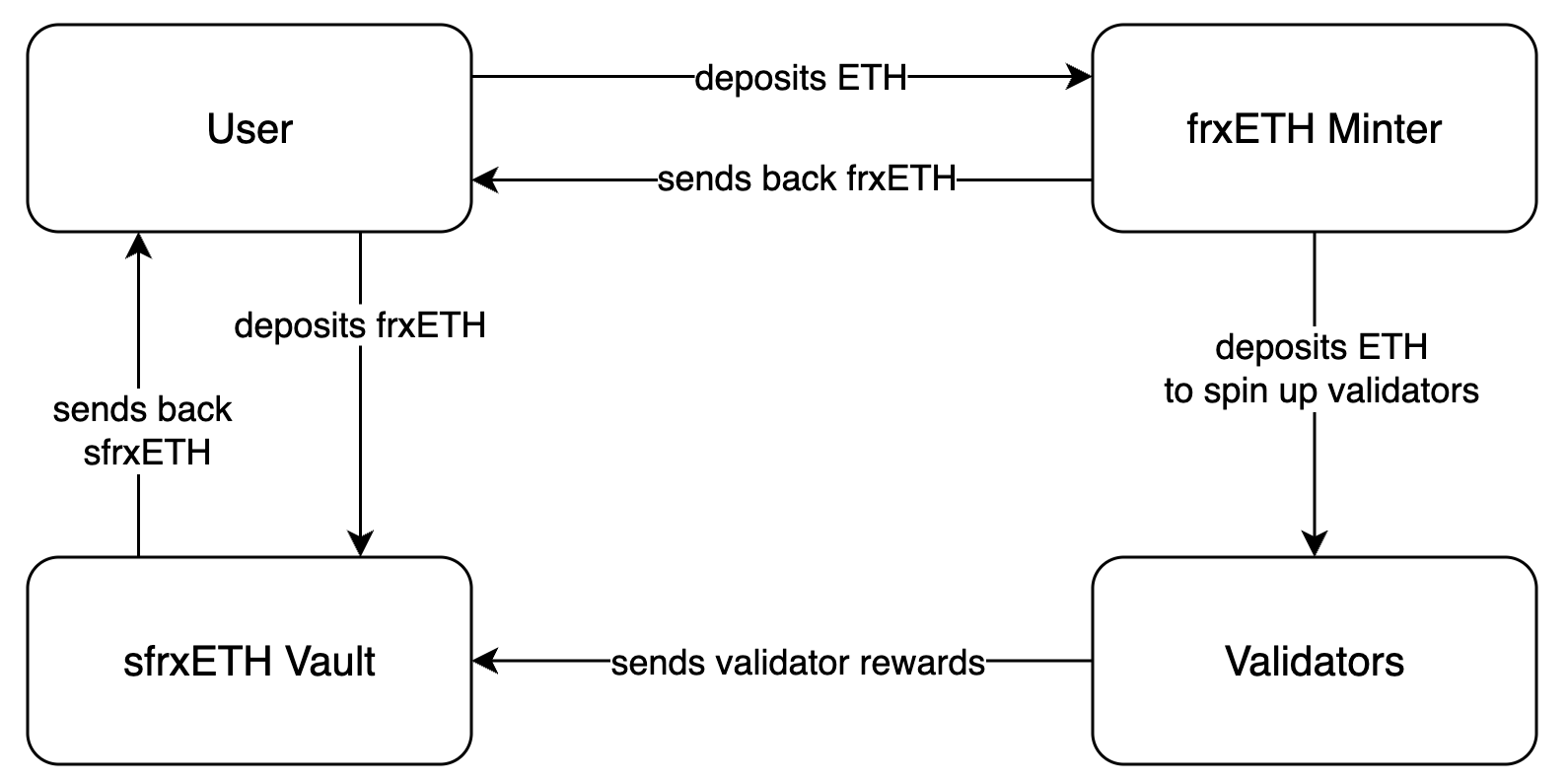

To mint frxETH, you need to deposit your ETH to the frxETHMinter smart contract. It will send you newly minted frxETH in return.

At the same time, this frxETHMinter will then spin up new validators using the ETH it has received and begin earning staking rewards.

The minter essentially sends these rewards to the sfrxETH vault.

Now, if you want to get access to these rewards, you need sfrxETH. This you can do by depositing your frxETH in the sfrxETH vault smart contract. You will get a proportional amount of sfrxETH in exchange for your frxETH.

This sfrxETH is a “claim” on a portion of the vault’s assets.

It’s important to note that the value of the sfrxETH token changes according to the value of the vault’s assets. Therefore, the value of your sfrxETH will increase over time as more assets get added to the vault. Whenever you redeem your sfrxETH, you’ll receive more frxETH than originally deposited.

Following the same example, you can convert your 1 ETH for 1 frxETH, and then send it to the vault for sfrxETH. At 4% APR, after one year, you can redeem your 1 sfrxETH for 1.04 frxETH and then redeem that frxETH for 1.04 ETH.

The magic

This is where things get interesting. You see, instead of sending your frxETH to the vault, you can instead become a frxETH-ETH liquidity provider (LP) on a decentralized exchange (DEX). The most dominant DEX for stables and pegged assets is none other than Curve (CRV).

Thank you for reading Espresso. This post is public so feel free to share it.

We will not get into all the complexities of Curve. Suffice to say that Frax controls a significant share of a token called CVX, which grants them the ability to direct CRV rewards to the liquidity pools they choose. Of course, they decided to give those rewards to their own frxETH-ETH pools.

This means that users that choose to become frxETH-ETH LPs get some juicy yields. Often, yields that are even higher than staking yields.

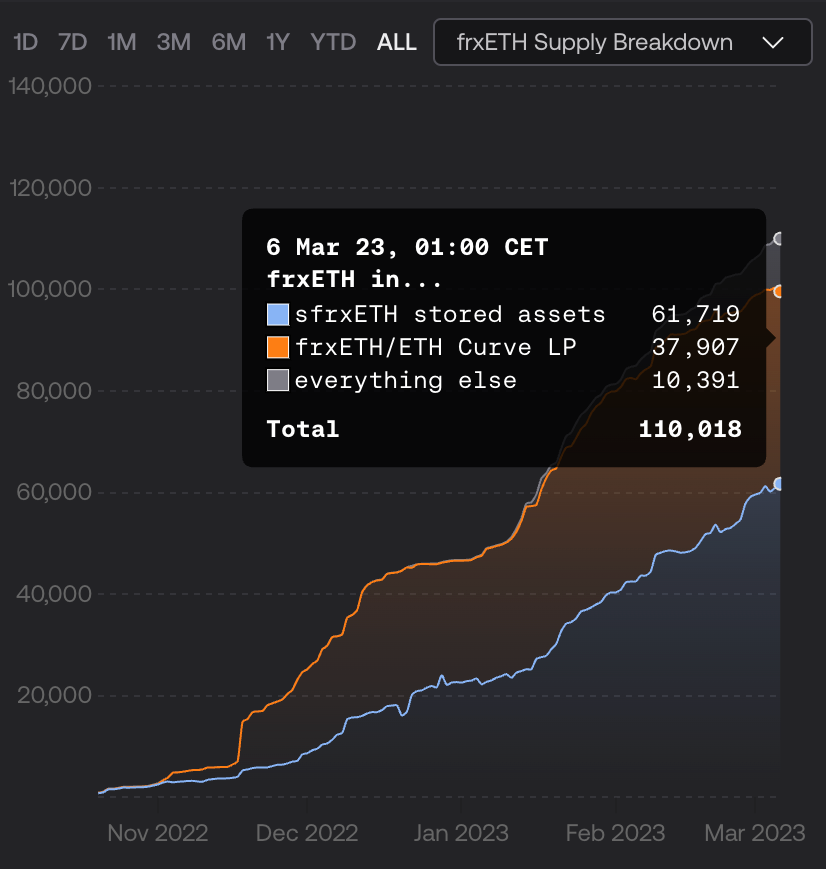

This allowed Frax to bootstrap liquidity for their frxETH stablecoin. It also meant that a significant share of the users that sent their ETH to Frax for validating did not enter the sfrxETH vault.

About 34.5% of frxETH is in the Curve LP, compared to 56.1% in the sfrxETH vault. The rest sits in various addresses and liquidity pools across DeFi.

The thing is, Frax is staking all the ETH they get. As they should.

This translates to ~61,700 sfrxETH getting the rewards of ~110,000 staked ETH.

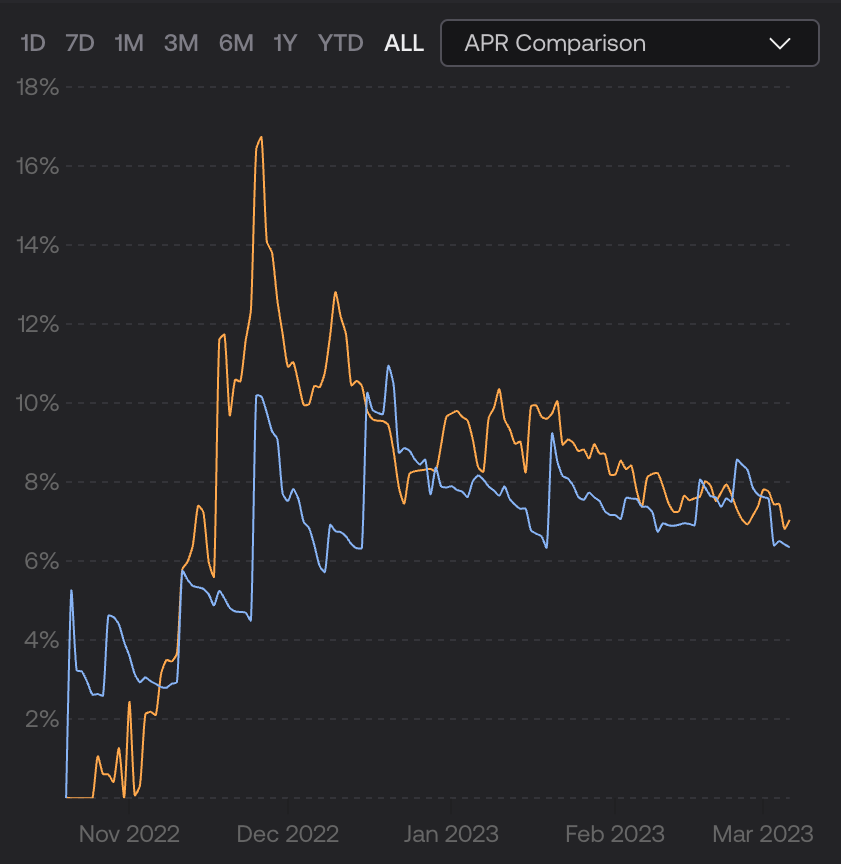

Users that hold sfrxETH are getting a 6.23% APR from staking (blue line below), and have gotten over 10% APR in the past. Lido’s stETH gets you only 4.20% APR.

The frxETH/ETH APR from Curve is nothing to sneeze at either, standing at just over 7% now (orange line below) and having been as high as 16% in the past.

So Frax gives you not one but two yield avenues, both with a higher APR than Lido’s. Not bad, Mr. Kazemian, not bad at all.

Greed Is Good

Lido has been around the block for a while, and their staking solution is tried and tested. There’s no reason to stake with anyone except them – unless you can get a little extra, of course.

So, unless your name is Lido, you need to juice up the yields to entice users. Bribe them, in a sense.

In other words, people are always greedy for more. Frax took advantage. Now, users can earn more yield, and Frax has catapulted itself near the top of the LSD rankings.

Gekko was right. Greed is good.

Keep it fun,

Kodi