Get Ready for the Reset

Filtered: Sept. 11–15

If you’re like me, you’re probably dying of thirst for some Hopium-Ade right now.

Bitcoin and Ethereum showed some life yesterday, which probably can be partially attributed to Deutsche Bank announcing it will offer custody of certain cryptos. But they have still stubbornly stayed range-bound.

Meanwhile, the latest CPI reading indicates inflation remains above the Federal Reserve’s target, so it’s unlikely JPow and crew will cut rates anytime soon. And despite the potential schadenfreude we can get from watching Sam Bankman-Fraud’s upcoming trial, it feels like the crypto community has already tuned out.

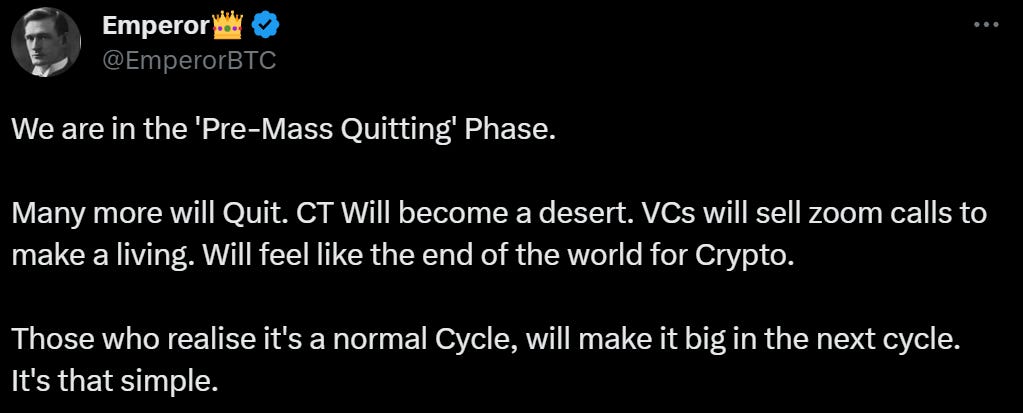

We’ve been wandering through this desert of a bear market for a while now. We’re desperate for some relief.

But how will we know when we’re finally making our way out of this mess, or if that hope is just another mirage?

Turns out, there is something to be on the lookout for that can quench our thirst: the Bitcoin milkshake.

If you caught the latest episode of Alpha Bites, you’ll know this is one of my top signals to be watching for as we near the end of this cycle. And it’s easy to spot, as I shared in the episode:

I want to see Bitcoin simply suck liquidity and volume out of the crypto market. When it happens, it often helps initiate a new flow of money and acts as almost a reset for the market.

And when volumes for altcoins and meme [coins] unfold, this tends to take place near the later stages of these mini-cycles. When I mean “unfold,” a lot of attention is taking place with these fringe, high-risk assets because interest is at a very, very low point.

But this is when Bitcoin decides to rear its head. It can attract all the outsized interest, volume, [and] liquidity from all the fringe assets and bring it right into its domain.

And right now, the moment we're waiting for is [when] Bitcoin is going to grab the market by the horns and say, “It's time to go. “We're moving forward.” And the type of liquidity suck that we're looking for is one on a multi-year type of cycle.

...

While [altcoins] were taking most of the volume, and some days we saw altcoins actually have more volume than both Bitcoin and Ethereum, especially in the perpetual futures market, now we're starting to see that wane a bit. A lot of the attention has gone over to the friend.tech side.

And to me, this indicates that we're really at the [last] stage of this cycle. And now it's just a waiting game. The pump is primed, the straw is in the milkshake, and we need to see Bitcoin make its move.

So what exactly could spark this move? It could be a spot Bitcoin ETF. But on the podcast, I pointed out another potential catalyst that could bring us out of this desert.

Speaking of friend.tech, the decentralized social media platform that’s grabbing all the attention lately, on Alpha Bites our own token expert Kodi provided an update on how it’s doing, whether it can keep this momentum going, and the chances of an airdrop in its future:

[Friend.tech] went above $20 million TVL, almost $23 million right now. It was at $5 million just at the start of the month. It's gotten $7 million in fees by now.

Over the weekend, it paid creators [what it calls Keyholders] half a million dollars, which is three times as much as all these NFTs paid their creators. It also had more volume over the weekend than all of OpenSea, which it has happened before.

…

I don't know if it's very sustainable. People are also trying to farm it, because they suppose that there will be a token that is launched in the future. So you can see this as like farming a pool on Uniswap or whatever.

I don't know [if it will launch a token]. They're still tweaking things around the app. They didn't launch a fully developed app. If you played with it, the chat was very basic, and a lot of things were not fully there.

So I think between now and the airdrop, they need to have a better product. If there's another project, I think it will launch eventually. So I think they need to keep users on the platform by tweaking [it] or teasing this airdrop, [or by] getting some fees that can push the project up until a token is launched. And maybe they find a way to use the token in a way that makes sense and adds to the experience.

Kodi offered more on friend.tech and a few other interesting projects on his usual “Like It or Spike It” segment. But this week, the rest of us on Alpha Bites couldn’t let him have all the fun.

All of us, Kodi included, decided to break down a single project. Our pick was Arbitrum (ARB), the Ethereum Layer-2 that’s starting to fall behind its competitors.

To give you a taste of our analysis, I’ll share an insight from independent analyst Ray, who looked at ARB through the lens of its technical setup:

I don't think things look good for ARB on the price analysis side. You can look at these assets within two hemispheres, one being the fundamentals of the project. Do those inspire some sort of confidence to go long off of?

...And then the other being just raw price action. Is there a reason for price to go up if the entire market begins to go up, or if sentiment across the market goes up, or if Bitcoin dominance falls and altcoin dominance rises and we see altcoin prices as a whole begin to rise?

So, if we were to see the second hemisphere, where market conditions and sentiment improve and tokens improve as a result of that, then what traders would want to look for is a reclaiming of the range low and that $0.91-$0.99 price zone. That's also where the 50-day moving average is.

So typically, that's going to be resistance when you're trying to reverse the trend. If price could reclaim that $1-$1.15 range, then it's time to start looking at on-chain fundamentals, [like] governance proposals within Arbitrum.

If you’re interested in hearing the rest of our takes on ARB, and whether it can stage a comeback, be sure to listen to the episode right here, or on Apple Podcasts or Spotify (and tune in to Espresso on Monday…)

And finally, we couldn’t stop Kodi from picking apart even more crypto ecosystems in his Single Origin piece in Espresso on Monday.

You may have recently heard the surprising news that Rune Christensen, co-founder of lending protocol Maker, is pushing to build a second chain on Solana, rather than on its home network Ethereum.

It’s a bold move. But Kodi has an idea for another alternative they should consider: Cosmos.

As Kodi explains, it’s likely that blockchain apps will likely start building their own chains, in addition to occupying space on established L1s like Ethereum and Solana. This is called the AppChain thesis. And as he wrote on Monday, Cosmos is uniquely set up to enable that future:

Cosmos was built around the AppChain thesis. At its core lies the question: Instead of trying to fit all apps into a single blockchain, why not build each application as its own chain?

Cosmos believes that applications should form a myriad of chains, each designed specifically to host that application, and all chains should be connected by a shared communication standard.

Letting Cosmos handle the boring and hard bits (logic handling, security, governance) can enable you to offer truly great product experiences on Ethereum.

A project can leverage Ethereum's network effects and higher capitalization while using Cosmos for backend logic, interoperability with other IBC chains, faster transactions, etc.

This is a combination that we are likely to see more of in the future.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso:

- Maker’s Future Belongs on Cosmos, Not Solana

Alpha Bites:

Tweet of the Week: