Gensler Takes Another “L”

Filtered: August 28 – September 1

Crypto this summer has been unusually quiet. But this week, you didn’t have to strain to hear the rejoicing that rose up across the market.

On Tuesday, a court overruled the SEC’s decision to block asset manager Grayscale from converting its Bitcoin trust into an exchange-traded fund (ETF). The battle isn’t over, but it makes the path to the first Bitcoin spot ETF clearer than it’s ever been.

Everyone responded as you would expect. BTC and ETH climbed 5% and 4%, respectively, in under an hour (they’ve both since almost retraced their upward moves). We saw mainstream news start sharing (positive) crypto headlines again. The site formerly known as Crypto Twitter (now X) suddenly sprang back to life.

Everywhere you looked, pretty much everyone was cheering and slapping each other on the back.

Well, except one person.

SEC chair Gary “Shades” Gensler likely wasn’t too happy about the ruling, which called the SEC’s denial of Grayscale’s proposal “arbitrary and capricious.”

The court pointed out that the SEC has already approved several Bitcoin futures ETFs, yet denied spot ETFs for the very same asset based on some shaky reasoning.

Reading between the lines, to me this looks like Gensler’s iron grip on crypto regulation is starting to loosen. And I said as much on this week’s Alpha Bites:

Back in April, we had Gary “Shades” Gensler show up. And ever since then, it's just been trending downwards in terms of his sway in the market and having things go his way.

It's been going absolutely wrong for him ever since. And this is just another mark against him.

...

And I don't think it stops here. I think if anything, it just raises more questions about how the SEC has acted against all of the entities involved in the space, especially with the most recent NFT litigation that just hit.

The SEC is clearly overreaching, and it gives Congress...that catalyst that they've been wanting to really drum up sentiment against him.

Sure enough, on the same day as the Grayscale ruling, another judge tossed out a class-action lawsuit against Uniswap. It claimed the exchange was liable for allowing the trading of “scam tokens” that hurt investors.

But the key detail is that the judge called ETH a commodity instead of a security. If that distinction holds, then all of crypto would be under the jurisdiction of the CFTC...not the SEC.

Clock’s ticking, Gary.

But before we forget, there are more than one potential catalysts that could catapult us out of this market...and we already know when one of them is.

Bitcoin’s next halving is coming up in April. But miner stocks have already had a hell of a year. Several have doubled and tripled.

On the podcast, independent analyst Ray touched on some factors to consider if you’re looking to get exposure to miners ahead of the upcoming halving:

After the halving, we're going to see a lot of hashrate volatility within the Bitcoin network. And we're actually seeing right now the trend of incremental bits of hashrate shifting back overseas, as sovereigns in the Middle East, Africa, South America, and other areas begin to bring a much more price-agnostic hashrate online

So some tells will be miners raising funding yet having high debt; miners who are selling their BTC reserves and their mined Bitcoin on exchanges more frequently; miners curtailing their operation and losing their share of hash rate; [and] miners liquidating older ASIC miners as they rush to upgrade their outfits.

Those will all be tells on which mining companies are stressed and which are well-positioned, and then you'll see that reflected through spot price. And if actual spot Bitcoin takes off, then there's going to be a certain cohort of people that begin to allocate there.

And if an ETF is approved, then Bitcoin mining stocks will become less attractive, because they'll be less viewed as a proxy investment to Bitcoin for institutions who at this moment aren't able to allocate to spot Bitcoin.

Meanwhile, if the Grayscale ruling still hasn’t lifted your spirits about the market, our resident janitor J.J. weighed in with some perspective on how this bear compares to past ones:

I came into Bitcoin and ETH in 2016, and I was kind of a summer child in that aspect. I basically bought it, and then it was up only for two years, and [I was] a bit naive to market cycles and whatnot. You just figure, “Okay, it's pulling back in 2018, whatever. It's gonna last a few months, and then it's gonna keep going up again.”

That's really when I started to research the larger trends there. But I do remember that cycle just being brutal.

And the difference between then and now is, back then there was a real feeling, especially as it relates to alts and Ethereum...Are we sitting on something that's never going to be worth value? Will these things actually come to fruition? And I think what the last bull cycle showed us is that there is real institutional interest for these things and actual applications are coming online.

So I think the conviction [today] is higher, which actually makes this bear market more brutal. We all know it's going to break at some point based on the fundamentals, but it's just not happening, which is frustrating. But I think it's easier in the aspect of, there is beyond a shadow of a doubt fundamental value to these things.

That topic of the “fundamental value” of chains like Ethereum was brought up earlier in the episode, too. If there is fundamental value to Ethereum, does that mean other chains offering similar use cases are destined to die out?

Our token expert Kodi had some thoughts about our potential multi-chain future:

You could have a world in which Ethereum is the only L1, and everything settles on Ethereum. But I think that is less likely than [there being] a multiple of different solutions to exist.

I don't necessarily mean that there will be thousands and thousands of options. You could have a series of very successful options, and then a few L1s that have trade-offs. So you would have your Ethereum, which is trying to be very decentralized for everyone to be able to validate the network and yada, yada. But it's also less performant.

And for now, there are the L2s. They are better than Ethereum, of course, but they are not as performant as some of the more performant chains like Solana or Sui. And even Cosmos chains are also very, very performant. And the bull case for Cosmos and the App Chain is that you can change the chain in a way...that suits your application the most.

You can listen to our discussion in full, along with the rest of the episode, on YouTube, or on Apple Podcasts or Spotify.

And if that whet your appetite for more Cosmos content...we’ve got you covered this week.

For Espresso, Kodi took a closer look at the network and why it hasn’t been able to get out of the gutter ever since its biggest chain, Terra (LUNA), imploded spectacularly last year.

And he has an idea for how it can bring itself back from the brink:

The Cosmos network embodies the App Chain vision: Every application is its own Proof-of-Stake (PoS) blockchain, and all of them are interconnected.

But the problem is, this means nearly all value in Cosmos is locked in chains staking their native tokens to secure the network.

Contrast this with Ethereum, where only ETH is staked. That frees up a plethora of tokens from DeFi tokens to stables to NFTs to be used across the Ethereum ecosystem.

LSDs [liquid staking derivatives] can unlock this dormant value on Cosmos. By allowing stakers to mint derivative tokens representing their staked assets, liquidity can start to flow freely again.

And because staking is so core to Cosmos, the adoption of LSD platforms could be extremely rapid and widespread.

According to Kodi, one project on Cosmos is already building some momentum with LSDs, too.

And finally, yours truly stirred up some thoughts in this week’s Blend dealing with the big event last week: the Jackson Hole Economic Symposium.

Every year, central bankers from around the world gather at the nicest lodge in Wyoming to share their ideas on the economy.

These ideas give us hints at what may be coming down the pipeline from our economic leaders, especially from Jerome Powell or any of his cronies at the Federal Reserve.

I broke down several important topics that came out of the conference. Here’s a taste of one:

Number Go Up. NGU. It’s a “cure-all.”

We know this all too well in crypto. As asset prices rise, permissionless and decentralized blockchain technology becomes the greatest thing to ever happen in our society.

The media starts plastering various crypto founders and VCs on every magazine and talk show… And every move feels like the correct move.

The same theory applies to economic production, or GDP. When you have 100 million laborers working with more productivity, NGU. Every elected official’s policy that they implemented, every speech they gave, it all feels like it contributed to NGU.

Whether true or not, doesn’t matter. NGU cures all.

But once that number goes down… Well, things get ugly. And that number is starting to go down.

Which is why productivity was a major topic at the Symposium.

Paying attention to topics like these are how we can predict what the next big interest rate decision is.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso:

- The Solution to Cosmos’ Woes Is Hiding In Plain Sight

- The Next Crisis Is Already Solved

Alpha Bites:

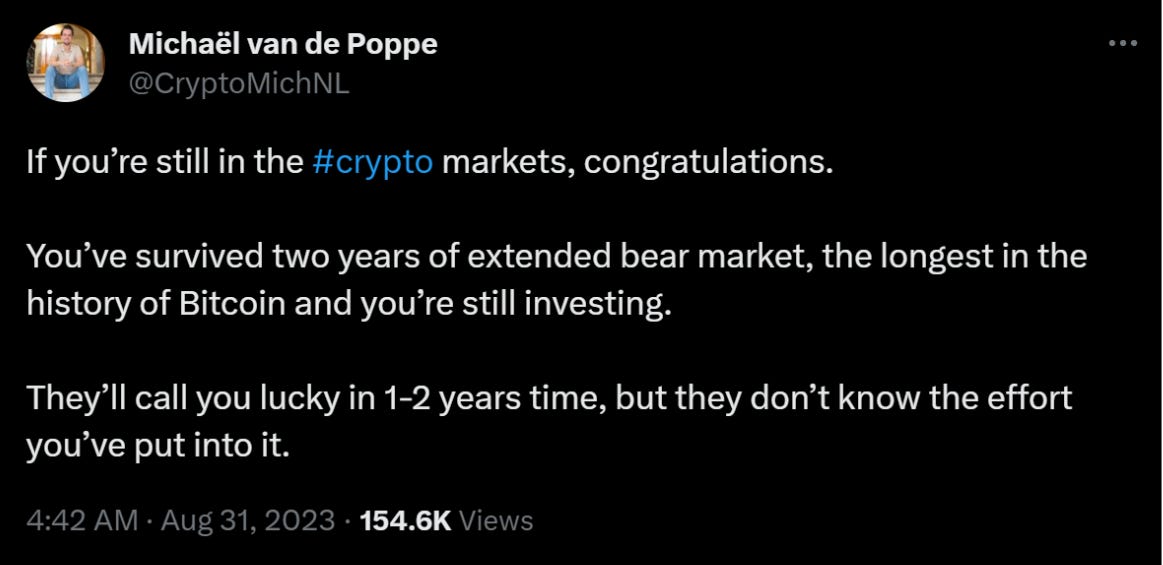

Tweet of the Week: