Gaining Momentum

Jarvis Labs and Market Update

The storm passed. Ocean waters were rough the last two days…

You spend the morning checking the status of your sails.

Operable.

You gain your bearings… On the horizons all you see are deep blue waters butting up against a pale sky.

No landmarks.

You glance at your compass…

Windward will do.

You hoist the sails and take position at the wheel.

Glancing up at the once stark white canvas you see the wind lacks consistency. The lack of a steady breeze leaves you subject to the ocean’s current as the boat rocks subtly from side-to-side.

No point in fighting nature.

You head to the bow to rest some more after the rough night hoping the wind will soon gain momentum from a rising sun…

Because without momentum you are not going anywhere.

And as I’ll explain today, the lack of momentum is the best way to explain both bitcoin and Jarvis Labs.

Let’s first hit on the latter…

Thank you… As many of you know we were stretched thin last month. And we are very grateful for all the support our readers and clients have given u during that stretch. It truly means a lot. We love this community.

In fact, I actually wrote a few pages on how much it all meant, but decided nobody wanted to read a tear jerker. At least that’s what I’m telling you… After all, helps me seem more stoic, right?

So instead of me blabbering through this update, I’ll hit on two things I think people want to hear…

First, Benjamin is doing better. Him and his family were battling coronavirus over the last five weeks, and we are very thankful everybody is doing better. We hope over the next week Benjamin fully recovers and can ditch the drugs he’s taking.

Second, after not publishing Espresso for five days, we’re getting back at it. It’s time to gain momentum. There is no time like the present to get started…

Which is what we are doing. No long-form essay, just an efficient market update before the weekend.

No time like the present to gain the momentum we lost.

As for bitcoin…

Market Update

There’s some bullish, and some bearish. Potato, Po-TA-to.

Depending on where you sit, you can build a case for both. So let’s do that today… And end it with what we need to be watching for each case to play out.

But first, let’s check out some ChainPulse metrics to look at market structure as we’ll lean on this for the bear and bull cases below.

ChainPulse

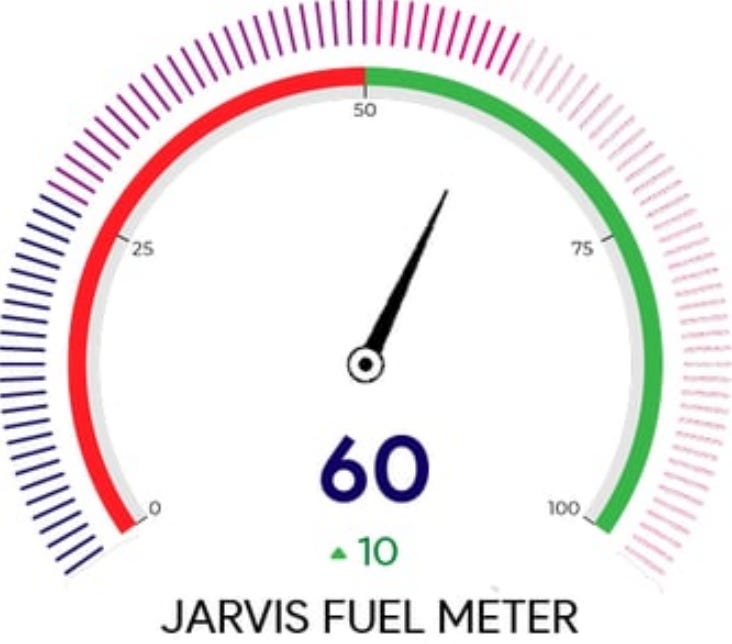

Our Risk Meter is beginning to creep up a bit as it stood at 55 yesterday. It’s sitting at 72 today. The higher the meter, the more prone the market is to a quick selloff.

We have a reading of 60 for our Fuel Meter. This is unchanged from yesterday.

The higher the fuel, the more liquidity is in the market to push us higher. It also is a sign of how healthy the market is at any given moment. The lower the reading, the less fuel to move higher and less fuel to buy any dip.

These readings mean we can start to consider taking a bit of risk off the table where appropriate.

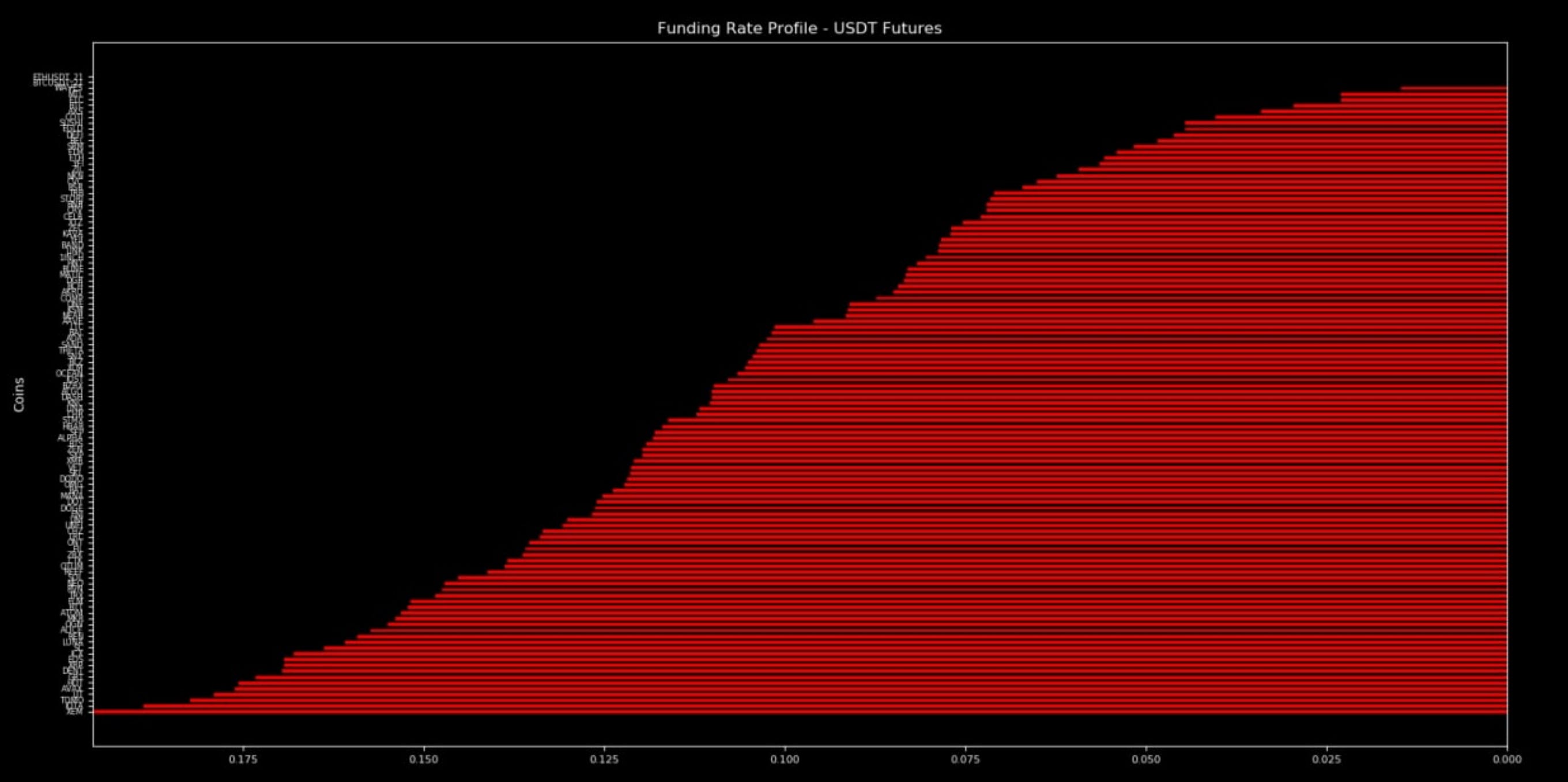

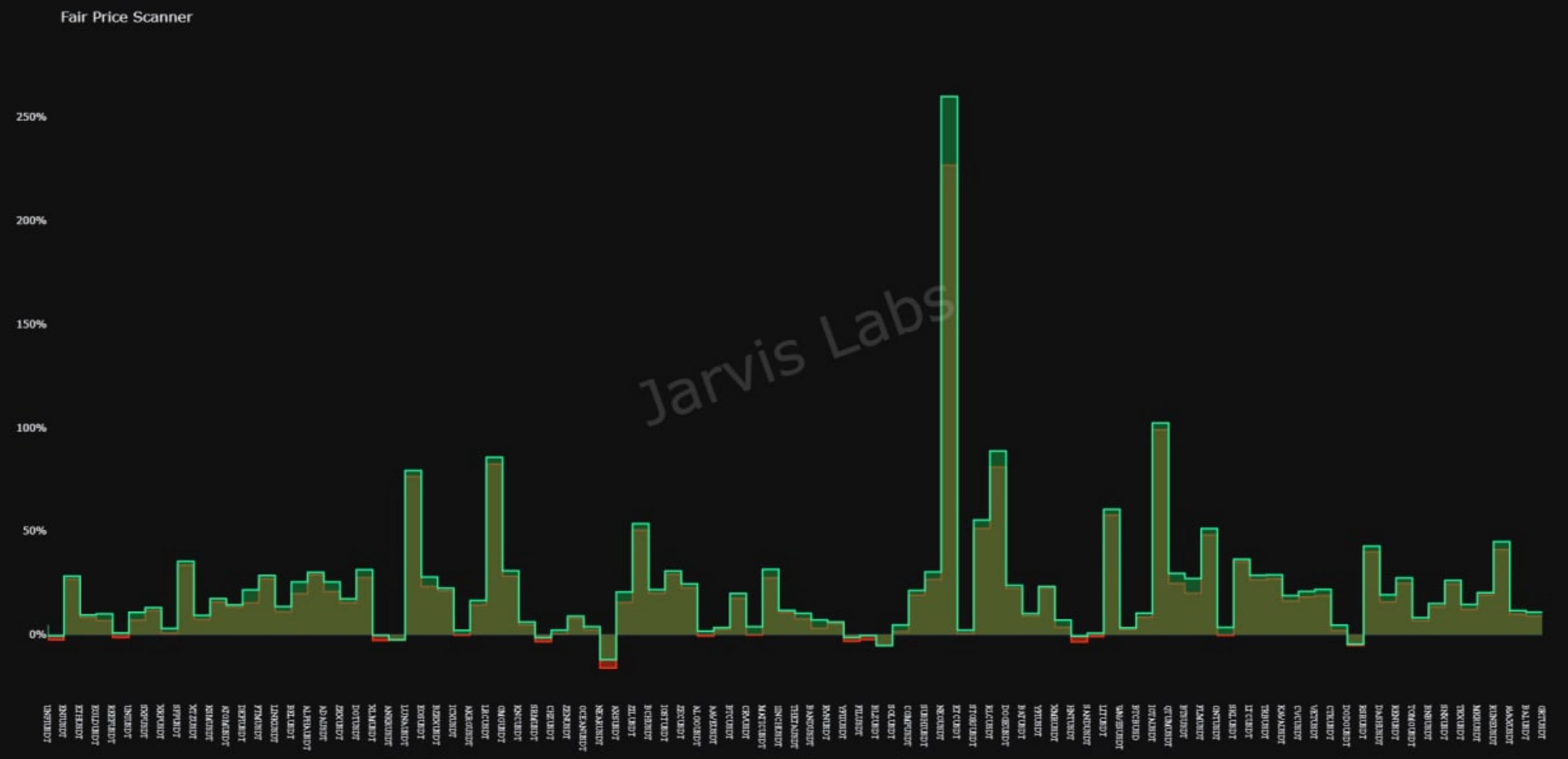

As far as funding rates there isn’t too much to be concerned about yet.

The higher funding rates are, the more traders are paying to keep a position open. If the bars are red, this means long positions are paying shorts. Green is the opposite.

A reading of 0.1 comes out to nearly 110% on an annual basis. This is the meat of the market right now.

During this market it was not uncommon to get readings above 0.4 for some context.

As far as the flow of capital right now…

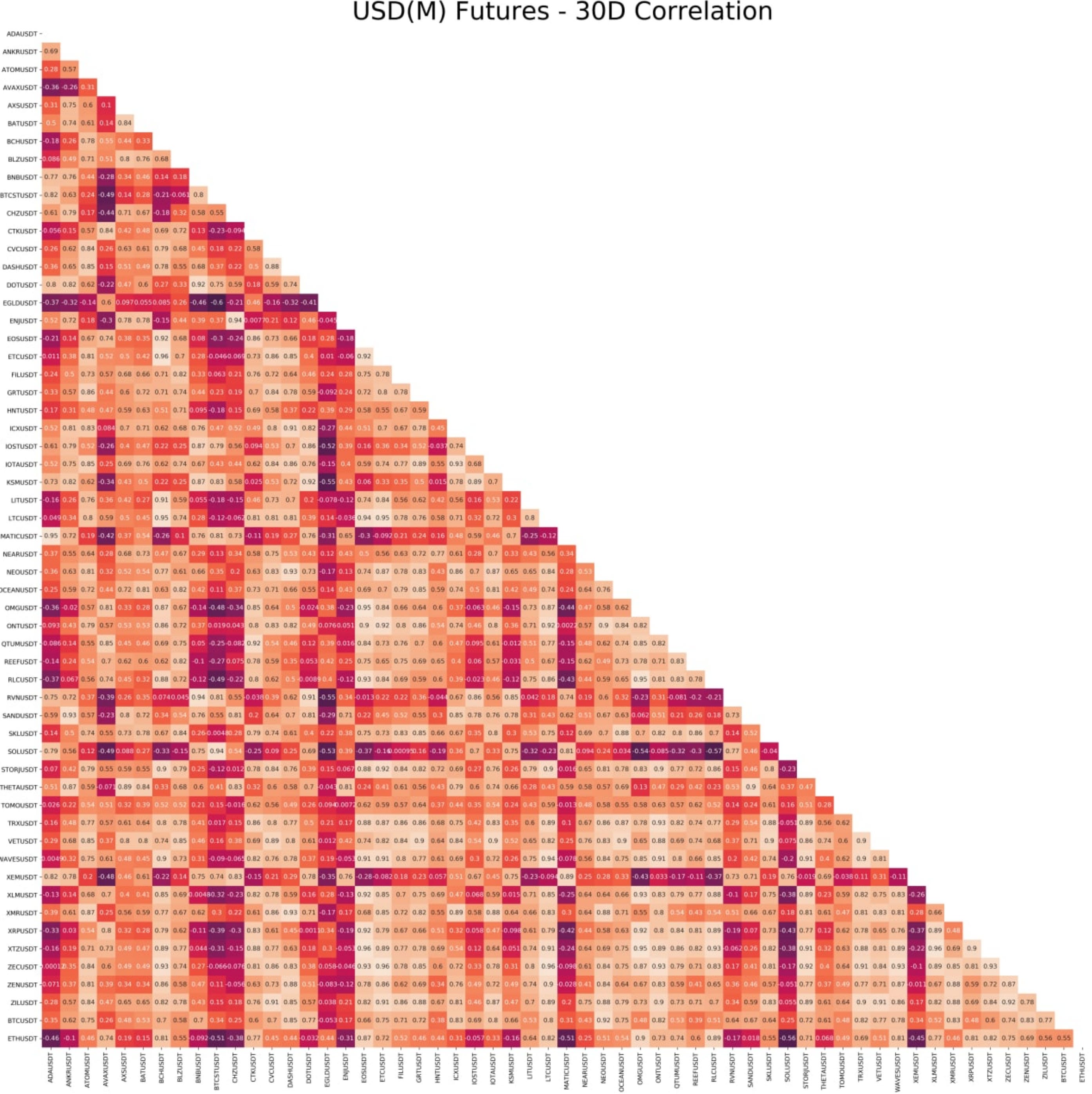

We are witnessing capital being rotated through coins more than ever. This tends to take place when bitcoin moves sideways for extended periods. The result of this rotation is the correlation between coins is very low.

This is a good thing. It means the market is healthy since its not moving in unison. We applaud diversity. Unfortunately for crypto this tends to precede a big move in bitcoin one way or the other.

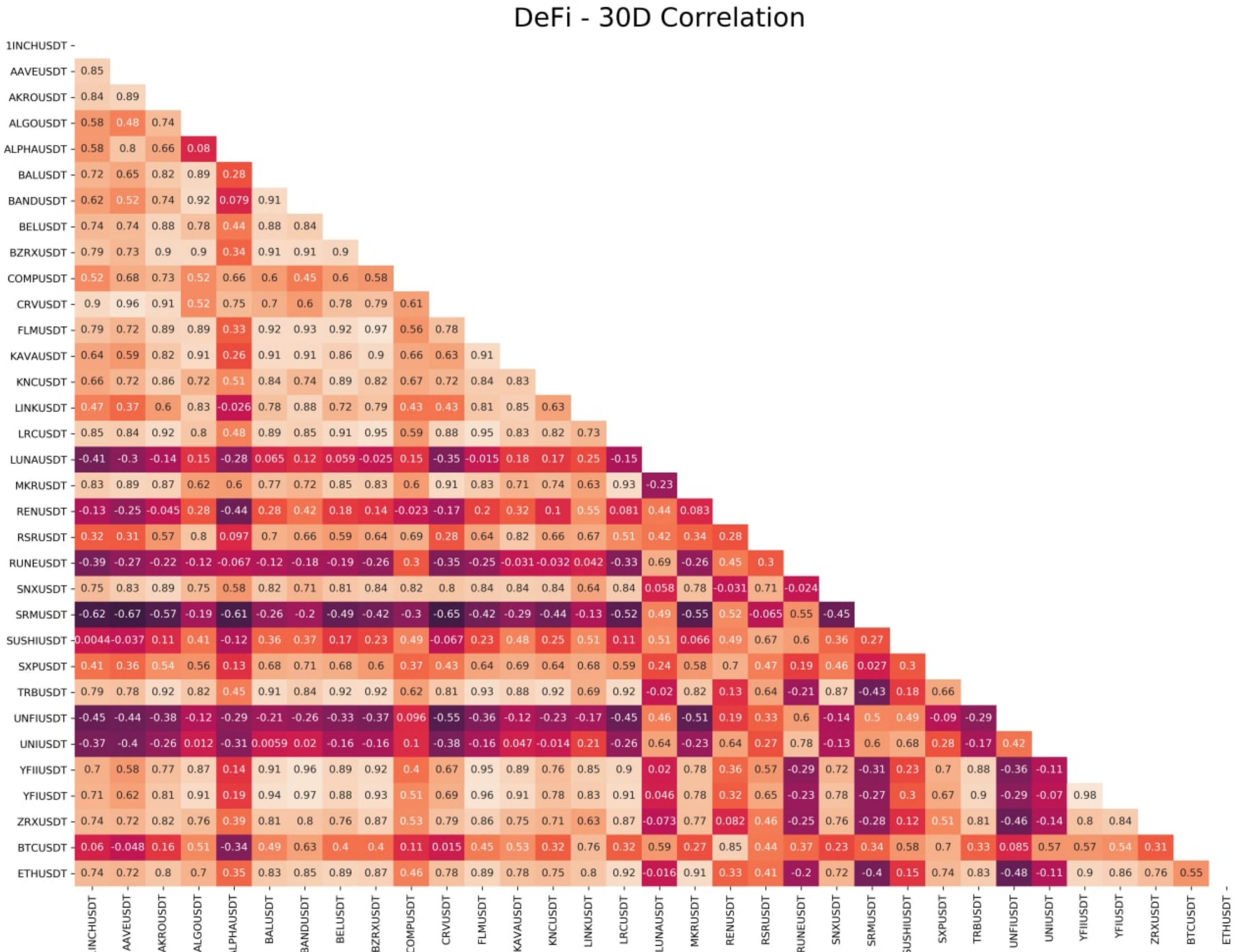

Here’s DeFi tokens…

As you can see, good readings. Lots of chances to diversify your position. The lackluster release of UNI’s v3 meant you could have longed 1INCH while shorting UNI since it had a -0.37.

That’s a nice DEX sector hedge play if that’s your cup of tea.

Lastly, here’s a new model we’ve been working on for the last month. It’s our “fair value” metric. We’ll explain more later on. But for now, just know the closer to 0 the coin is, the better value it has.

The higher its reading, the more expensive it is. If you want to find a coin that hasn’t pumped yet, here’s your manual.

Alright, moving on to the two cases…

Bear Case

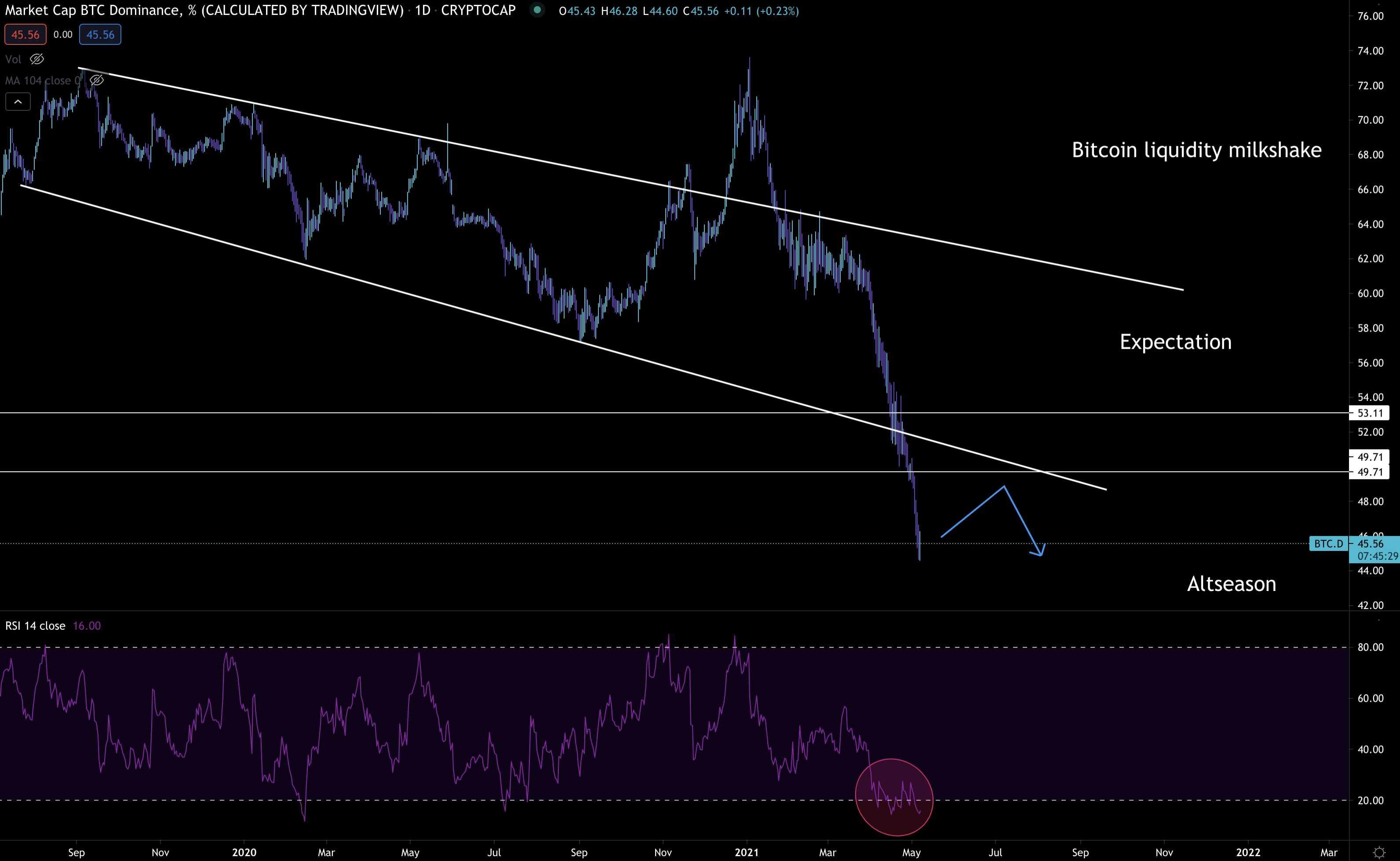

BTC.D on lower timeframes (1hr and 4hr charts) has a major bullish division forming. This is getting ready to show up on the daily as well.

We’re starting to get the bubbling up in alts we mentioned would happen in the CoinTelegraph interview from a couple weeks back. Here’s the chart updated showing the division that is about to form on the Relative Strength Indicator.

If we get a reversal we can expect bitcoin will suck up a lot of this new capital that has entered altcoins.

I’m secretly hoping for this since it will setup the market for the last leg higher.

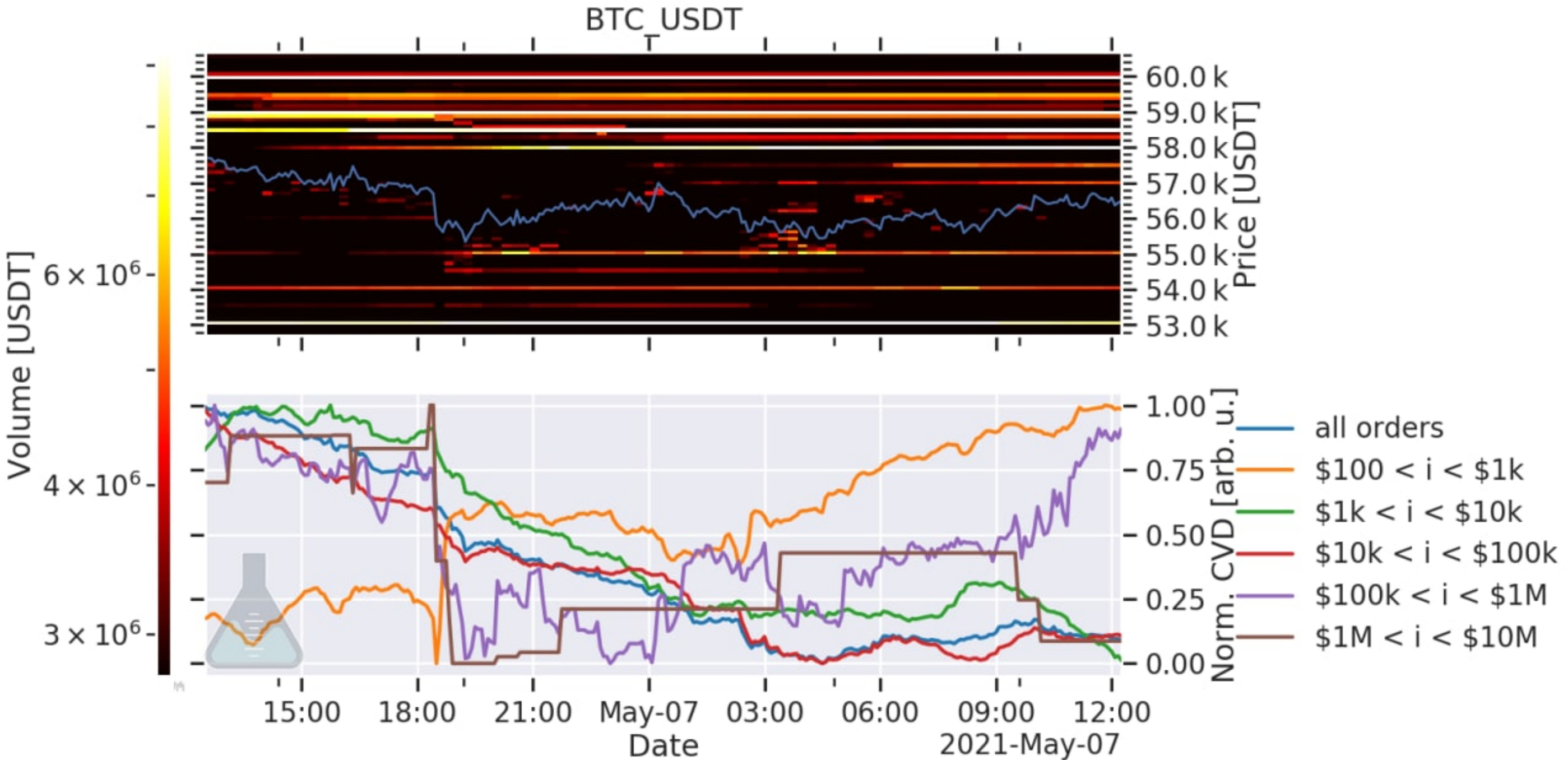

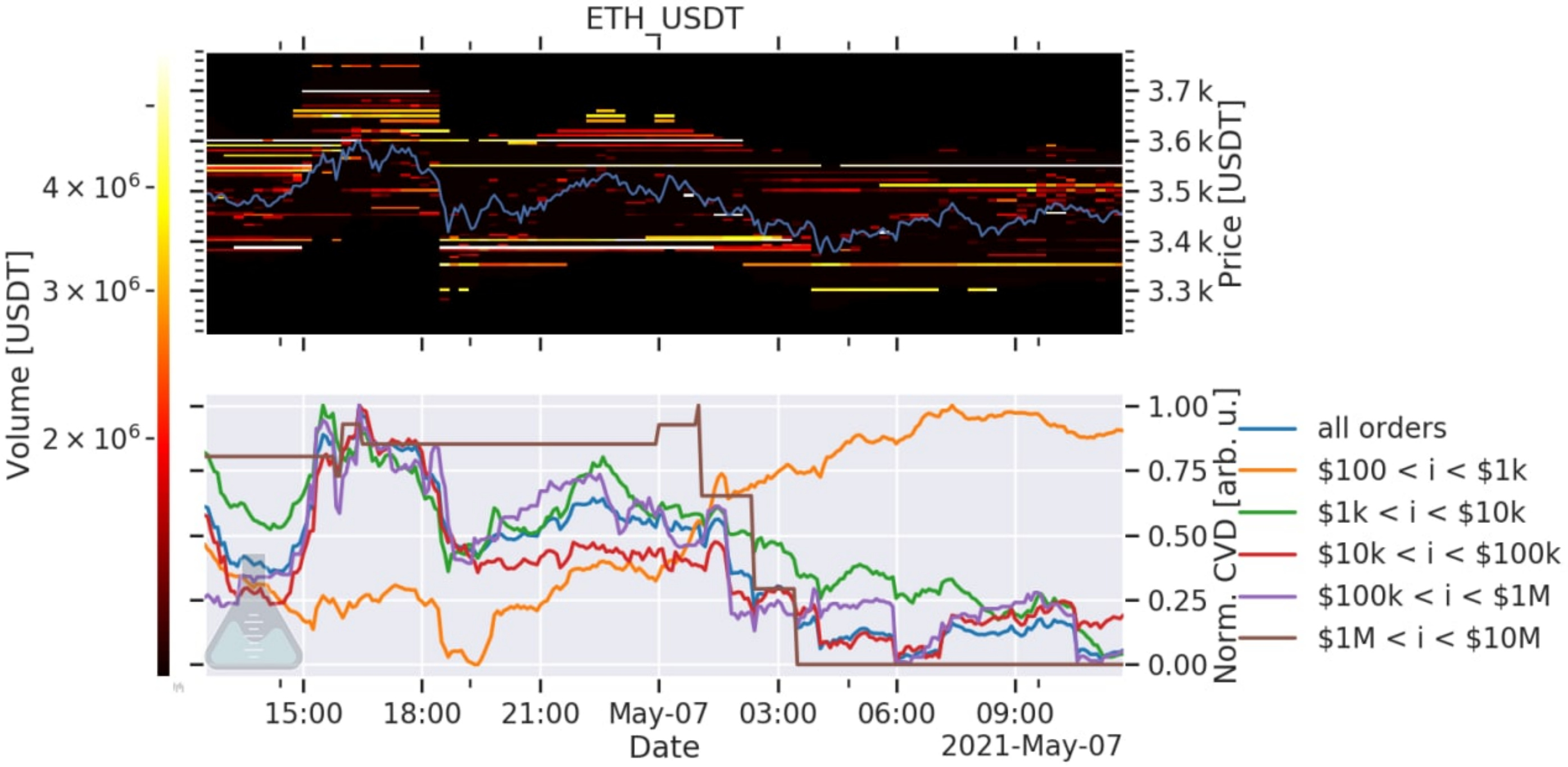

CVD is a metric we like to look at from Material Indicators. It let’s us know if retail or whales are pushing the market higher through market buys or pulling it lower from market sells. It shows us who’s buying and selling.

Right now whales are neutral. They aren’t pushing the market either way, meaning price really has no momentum in either direction.

BTC

ETH

This isn’t really enough for us to go on to decide up or down. So because we’re at elevated levels and nobody seems to be stepping up, I tend to view it as a bit bearish. Especially when we pair up CVD with what we see on-chain…

Pablo just sent 2k BTC to exchanges the other day, just prior to the mine price drop.

When bitcoin enter exchanges, we don’t necessarily know if they are sold right away. Sometimes price takes a day or so before making a move. Flows like this are more about correlation in the following time periods.

Gut tells us he hasn’t sold yet.

The way you should think of these type of warnings is similar to how you would track a criminal. If the criminal tends to commit the crime in a certain way, it’s an indicator.

For trading we can think of it like a trader tending to always sell given a certain set of conditions, then based on their ‘strike’ rate you will choose to follow them… Or ignore him.

Pablo is one to follow. And his “MO” is selling into a soft market.

When we pair this up with the on-chain profit taking we see taking place for bitcoin over the last two weeks, we can paint a pretty strong bear case for a drop.

Not a “top is in” type of bear case, but more like a drop where altcoins get whacked 30-50% while bitcoin drops 10-15%.

Then soon after bitcoin leads the market higher.

BTC.D, CVD flows, and on-chain flows hint at an upcoming selloff. If it were to happen, altcoins will experience a much steeper loss.

But what follows is sure to be very strong price action higher. Most big rallies tend to start with disbelief.

Breaking the knees of altcoins before we rally is a great way to generate disbelief.

Bull Case

Grayscale unlockings have begun.

In fact we just saw a 12k chunk of BTC leave Coinbase. This is typically correlated with Grayscale flows. However, with Grayscale not accepting new investors for bitcoin and Ethereum products, we need to assume it’s a different type of institution - unless Grayscale opens up in the next week or two.

On-chain indicators across the board are looking great. But that doesn’t mean price will simply go higher because of this. It’s more of a way for us to gauge if price has room to move higher.

Right now they are signaling that there’s room to go higher.

There’s also great liquidity in the market. And with capital being rotated in altcoins we’re seeing more and more capital creation taking place.

What to Watch

What is clear is the market lacks certainty right now.

Hopefully we explained that view using the two scenarios described above. Before deciding if the bull or bear case holds more weight there are really two things we are watching…

First is more on-chain activity like the Coinbase outflow of 12k BTC we just witnessed. This is bullish since it takes selling pressure off the exchange.

Second is continued profit taking. Jarvis AI has been rather cautious because of this. And frankly, we are leaning a bit bearish in the coming week or two… you probably guess that after reading the two cases above.

We hope to see profit taking subside over the coming weeks. If not, the bearish case will hold more weight. We won’t realize higher highs until these profit takers exhaust.

So where we stand right now is the market looks good. Pablo is creating a bit of an overhang… And if you need to do something, consider trimming profits and exercising caution as not everything is as clear as it seems.

That’s it for now.

I know I said it would be quick, but I guess we had a lot to discuss. And over the coming week expect us to form a stronger view on the market as we gain momentum on our though process again.

We hope to build that view here in Espresso. So follow along, share, and please leave a comment below on what you’re looking at.

This is a conversation. We learn from you just like you learn from us. We don’t see everything, but as a group we gain a bigger edge.

Glad to be back.

Love you guys,

Ben Lilly