Fusion

Macro Update: The UK and EU Under Strain Part Two

Andalusia.

The richness of this region’s heritage can be found in its architecture, cuisine, and culture. As my feet pound on the beautiful cobblestone roads here, I’m constantly reminded of the ancient civilizations which all resided in this place.

There are no other places in the world where one can find diverse cultures such as Roman, Moors (Muslim), and Catholic meshed so well together. The fusion works perfectly and magnificently.

Today, we can still see the remnants of its cultural past everywhere in Andalusia.

And wandering around the ancient cities in the region, I can’t help but think that while this melting pot of cultures somehow managed to find a way to the same place, in the present day, a similar experiment isn’t going so well.

Like the civilizations of old, the European Union (EU) is a varied mix of countries and cultures designed to benefit from working together. But in practice, the EU’s goal to be a well-oiled economic machine has started to fall apart.

The EU is meant to be a perfectly fused commercial zone where a unified currency and tax scheme ensure frictionless commerce, mutually-shared fair taxation and a common monetary policy.

Let’s briefly discuss how the EU faces a crisis of its own.

The Trio of Issues

The topic of financial woes in the EU requires monumental efforts to explain in detail. So instead, what we will provide here is a high-level overview of the pivotal causes.

It is a gross overstatement, but if we can boil down the financial dilemma into one main cause, that would be the lack of balance.

Lack of balance in: Currency, taxation, and debt.

And this created the mismatch and misalignment of each EU member’s financial interest and growth. The end result is the instability in the EU’s economy.

Let’s start with its currency problem.

The Euro

Using the Euro as a common currency among all its members provides a tremendous amount of convenience for the EU. The lack of cross-border exchange rate hassles encourages more trade and commerce and boosts productivity.

But the side effect of the common currency here is that member countries lack the flexibility to adjust their currency value based on the global financial situation.

This isn’t a problem for countries with smaller economies, such as Cyprus, Greece, or Portugal, who are benefiting from the one common currency system. Without the Euro, their own currency would not be as strong. So that means reduced purchasing power.

With the US Dollar (USD) soaring over 17% in 2022, these countries would not only have sky-high inflation, but also face insolvency. So they embrace the one common currency system because it lets them afford the living standards that they don’t have the means to provide for.

On the other hand, countries with high GDPs and robust exports, such as Germany, Finland, and France, are supporting the living standards of the smaller ones. They’re also the ones that take the brunt of an economic downturn.

These countries can’t devalue their currencies to make their products more competitive against other regions in the world. So because of a stronger dollar, they are running a current account deficit.

Tax Scheme

Another one of the fundamental issues within the EU is the inconsistent tax schemes across its member states.

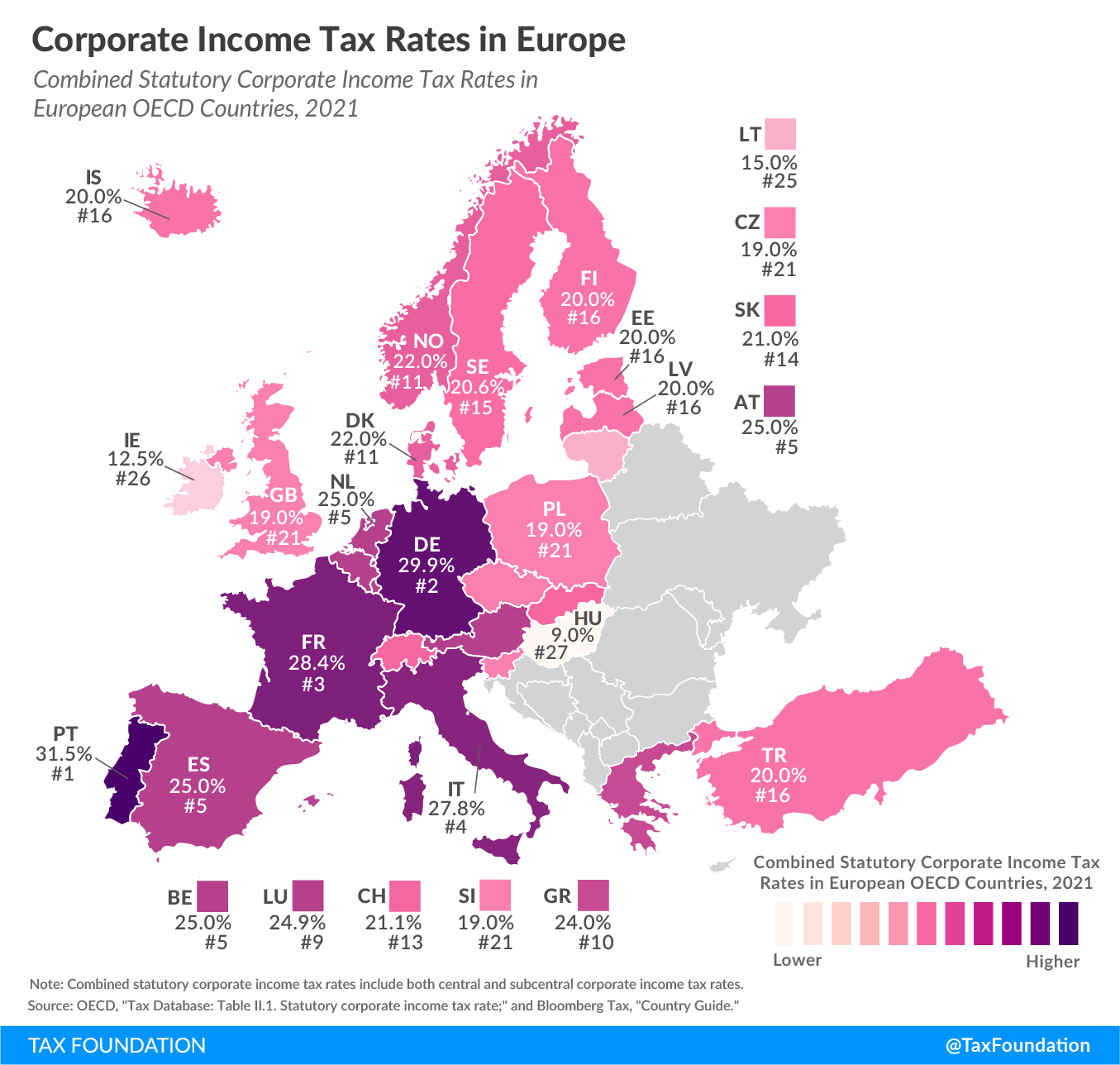

As a member state of the European Union, each country can create its own national tax scheme and determine the personal tax rate and corporate tax rate.

Source: Tax Foundation

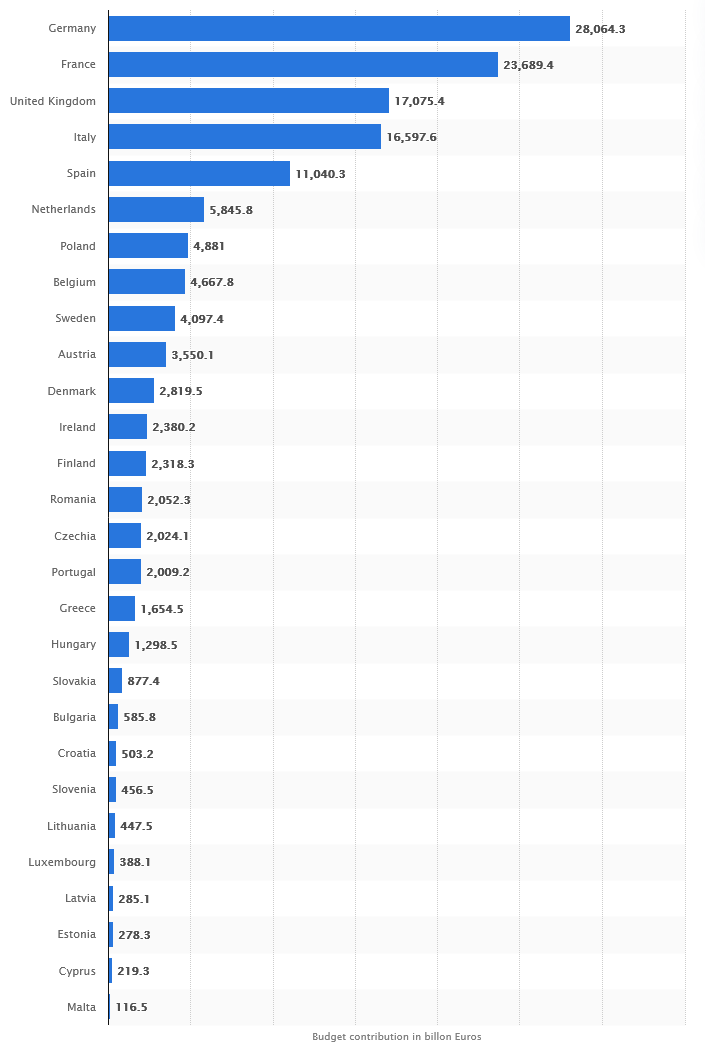

But the consequence of these different tax rates is that each member state contributed a different amount to the common budget of the EU in 2020, as shown in the chart below. This means that once again, countries with stronger economies end up supporting the countries with weaker economies.

Source: Statista

This is one of the main reasons that there are grumblings from the citizens among the stronger economies within the EU that they are subsidizing the lifestyle and the social welfare programs of the weaker economies.

The European Union Debts

The third factor affecting the EU is the massive amounts of debt some of its members have on their books. And it all ties back to the European Debt Crisis back in 2009.

While a few factors fueled this crisis, to keep things simple, we will focus on the main cause: the European Central Bank’s (ECB) interest rate policy.

The ECB sets one interest rate for the entire EU, regardless of the financial health of its individual member states.

But this one-rate-for-all policy created a structural mismatch because of each region’s macroeconomic conditions. The same interest rate that was considered high in the mature and industrialized economies such as Germany and France was considered low for countries such as Cyprus and Greece. Therefore, countries in the former group kept lending to countries in the latter group.

Then the music stopped when the subprime mortgage crisis in the US started to affect the whole world. Lending halted in Europe and the countries that were borrowing heavily all of a sudden found themselves in a bind.

As mentioned above, the one-currency policy is a nightmare because these countries cannot devalue their own currencies to make their products more competitive in pricing against foreign competitors. So they can’t grow their current account and fund their way out of this crisis.

The ECB and the International Monetary Fund (IMF) had to step in and resolve the European Debt Crisis via an austerity program on the promise of financial structure reform from these countries.

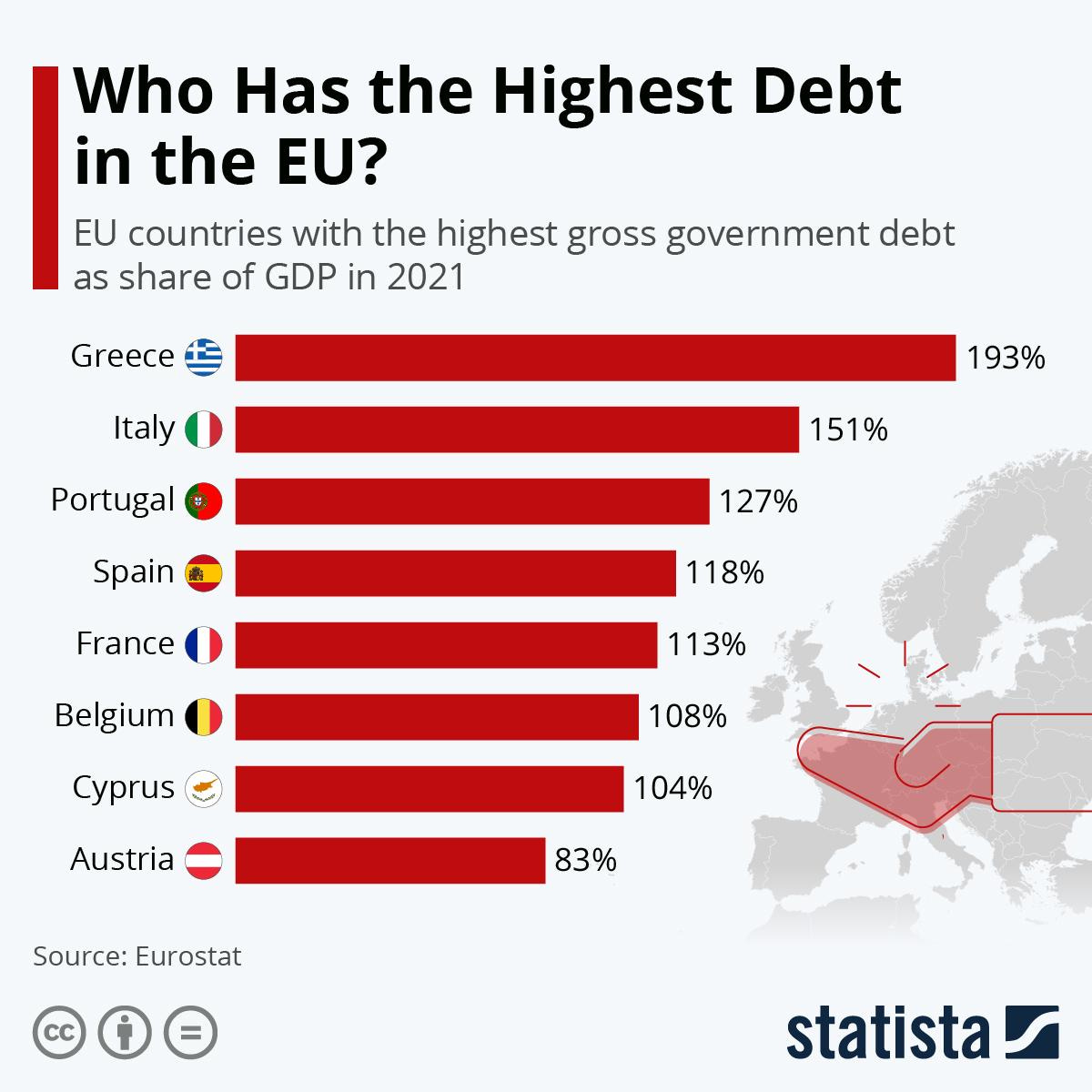

But as of today, the list of the most indebted nations in the EU is still riddled with the usual suspects.

Source: Statista

Some things never change.

Blending It All Together

The one-currency system took away the option of devaluing currency for when a nation needs to rescue itself.

Plus, the individual tax schemes from different countries means some countries do not pull their own weight when it comes to contributing to the common EU budget. But they demand bailout and austerity programs when caught in a financial bind.

It more or less resembles the dilemma from the tragedy of the commons. These countries just keep borrowing without exercising financial prudence on their part.

Then we have the one-rate-fits-all policy from the ECB. It not only creates macroeconomic mismatches, but it will be a major issue moving forward with the inflationary pressure mounting and an ever-increasing price tag for energy.

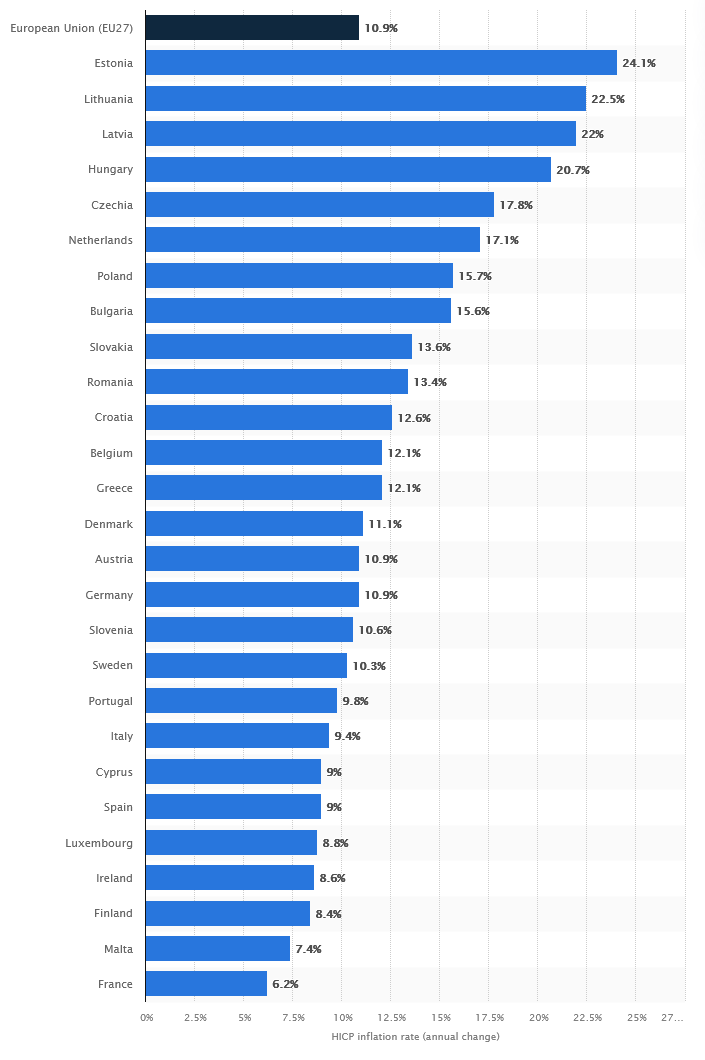

The chart below shows the inflation rate of each individual EU member state in September 2022. The top bar shows the aggregate inflation rate of 10.9% in the region.

Source: Statista

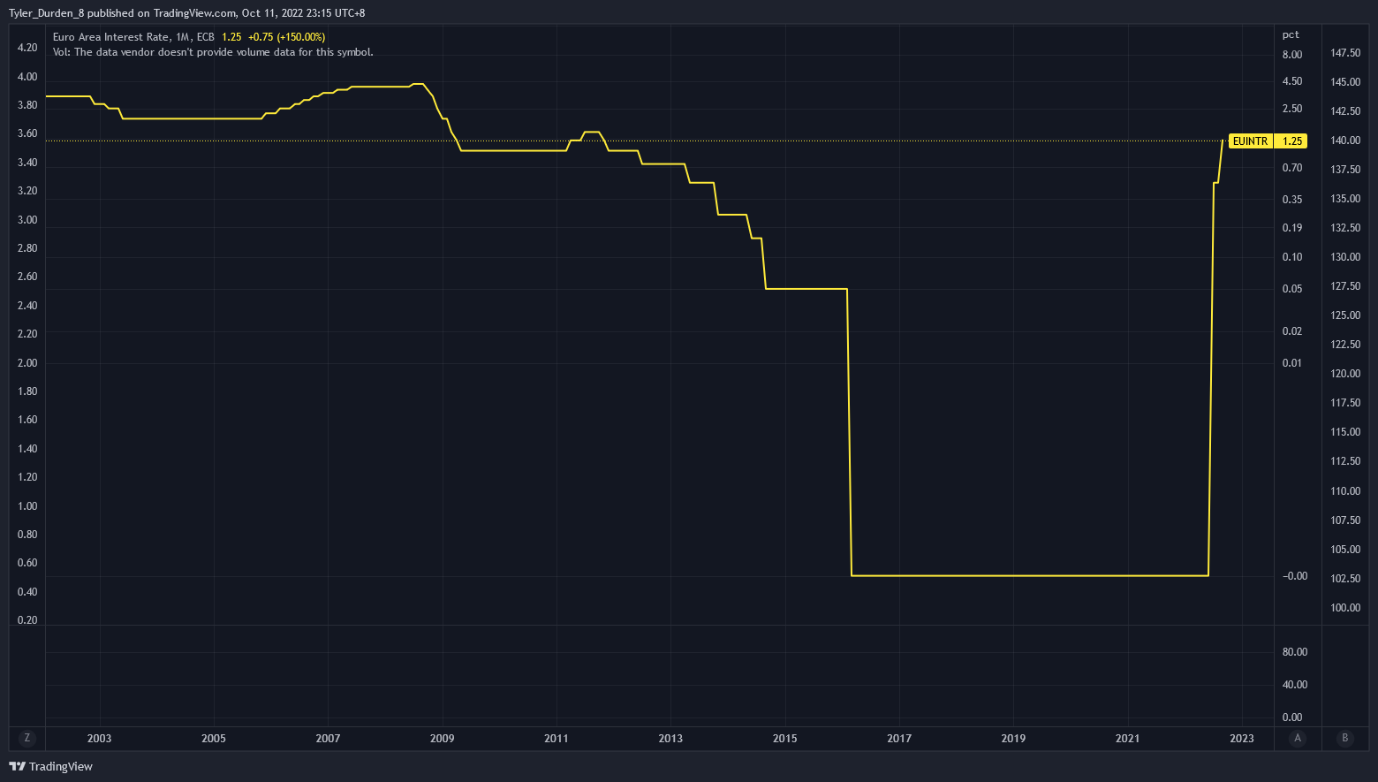

Now, the chart below is the current ECB funding rate for the entire EU. As of now, the ECB funding rate is at 1.25%.

Meanwhile, the Federal Reserve’s (FED) is at 3.25% and the Bank of England’s is at 2.25%.

Both the US (8.2%) and the UK (10.1%) have a lower inflation rate compared to the EU.

Battling double-digit inflation with the pace that the ECB is raising its rate is like bringing a knife to a gunfight.

But the ECB cannot raise its rate aggressively like the US and the UK, because countries like Italy, Portugal, Cyprus, and Greece will not be able to refinance their existing debts and will end up in bankruptcy.

At the same time, most of the members have inflation north of 10%, with Estonia at the top coming in at 24.1%.

The combination of consequences from the aforementioned factors is what makes the European Union's financial status extremely difficult.

It is a nightmare scenario for the European Union, and the night is still young.

The morning cannot come soon enough.

Yours truly,

TD

P.S. - As a follow up to last week’s discussion on the UK, I wanted to provide readers with a quick update on the situation.

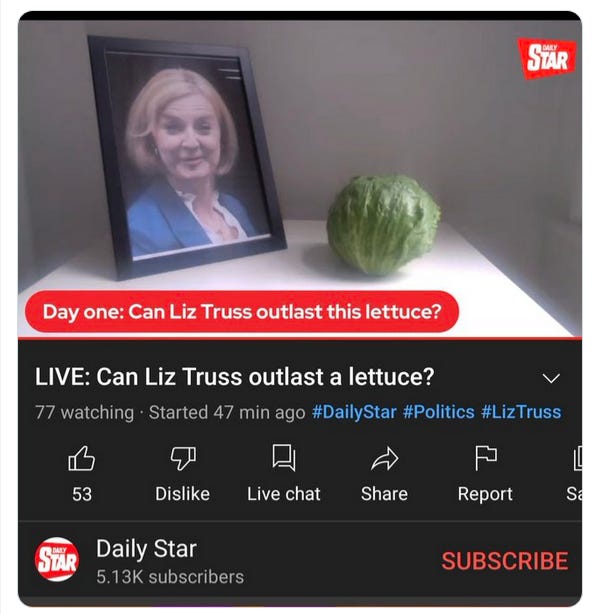

This image says it all.

On October 14, a UK tabloid set up a livestream video of a lettuce and asked whether it would last longer than Liz Truss’ term as prime minister (PM).

Since we published our update last week:

- The lettuce won. Liz Truss got ousted on Thursday. She was the PM for only 45 days.

- Kwasi Kwarteng, the long-time partner in crime of Truss, resigned a few days earlier as the chancellor of the UK. He lasted only 37 days.

- The new chancellor, Jeremy Hunt, is going to reverse all of the tax cut measures that Truss proposed.

- Despite the recent turmoil, the Bank of England will go forward with its quantitative tightening (QT) measure and start selling UK bonds (Gilts) on November 1. But to calm the market’s nerves, it will not sell the long-dated Gilts that caused the pension fund scare.

- The UK still has a budget shortfall of 42 billion pounds (GBP) . The challenge for Hunt is filling that gap after Truss’ proposed tax cuts caused chaos in the market for Gilts and GBP. But where will that money come from? Hunt has an uphill battle ahead of him.

The United Kingdom’s rough ride will not end anytime soon.