Floor It

Recession looks imminent. Debts are ballooning. And WWIII feels like its around the corner. Here's what happens next...

The highway was empty...

The exception was a 20-ton bus barreling down a construction zone at 65 mph.

A quarter mile ahead was a 50-foot gap in the I-105 South Central Los Angeles overpass.

Destruction was imminent… And no, the bus couldn’t simply come to a stop.

Some maniac strapped a bomb to the undercarriage that was rigged to explode if the hunk of metal dropped below 50 mph.

The response to this situation by the man helping the driver make decisions…

“Floor it!”

For all you Gen Zs out there, this was the build up to one of the most hilarious Hollywood stunt scenes of the 1994 movie Speed.

It prompted midcurving Physic students to quickly dub the moment as the “winner for the worst scene according to the laws of physics in any movie”.

But the end result was people didn’t care.

The movie was a major success and launched Keanu Reeves to stardom.

Keanu Reeves is what flew that bus. He was the chosen one before Morpheus offered him an escape from his reality years later.

And the truth of it all, we’re sitting here today barreling down a similar highway faced with an equally impossible gap.

Only this one is not on a deserted highway. It sits in the financial world.

Employment conditions are softening, inflation is sticky, and labor productivity is in the tank.

It’s an ugly setup. One that feels like that same 50-ft gap Mr. Reeves had to overcome.

The funny part...

The response we’re hearing from the Trump administration is much the same.

Floor it!

We’re accelerating at breakneck speed preparing for what may defy financial physics. Whether or not it’ll work, only time will tell.

But in the months to come, it means one thing.

We’re about to run things hot.

The Perp Walk

In the previous Espresso "The Divine One-Two" we touched on how the financial markets are mirroring the 1996-1999 bull run.

We are deregulating crypto and enabling competition. And the federal funds is inching lower (Get the 1990s Speed reference from earlier now?).

But with all the hype surrounding other sectors like AI, robotics, and other areas... Why such a push on crypto?

For that, we’ll need to better understand the most recent “perp walk”.

Perp walk is the name given for when police walk a criminal in handcuffs in front of the media. It ensures the press get the photos they need to run their stories on the captured perpetrator.

The term, to the dislike of the bankers, is also used for the annual Jackson Hole Symposium moment when central bankers take their walk outside the conference for the press to capture their ceremonial photos.

This year Powell was joined with European Central Bank President Christine Lagarde, Governor of the Bank of Japan Kazuo Ueda, and Bank of England’s Governor Andrew Baily.

These wide eyed, bushy tailed bankers were all gathered to symbolize something. As to what that something was, I haven't a clue. Nor do I care.

What I do care about is the presentations they were just listening to.

That’s because the who’s who of banking just got pilled… And based on that photo above, it's not sitting well.

You can see it in their faces. Baily looks moments away from collapse while Powell is squeezing his own hand to distract himself from the discomfort of it all. Meanwhile Ueda seems to have just seen a ghost.

Lagarde… Well, she looks unphased. Likely because she seems to be holding the pill in her right hand, refusing to accept reality.

So what the hell was this insufferable pill?

For some background, the Symposium is an event where bankers want to learn more about a specific topic. The topic this year was “Labor Markets in Transition – Demographics, Productivity and Macroeconomic Policy”.

Aka, how to get the peasants of the world to do more.

To prepare for the event, the Symposium asks academics to prepare research and a presentation many months in advance. The research is then held back until after the event.

This makes the gathering noteworthy since it tells us what the biggest worry of central bankers is globally. And we get to see what might ultimately become a solution to this worry.

As to what that problem and solution is…

For those that have been following Espresso for several years now might recall a three part series called Macro Cycles.

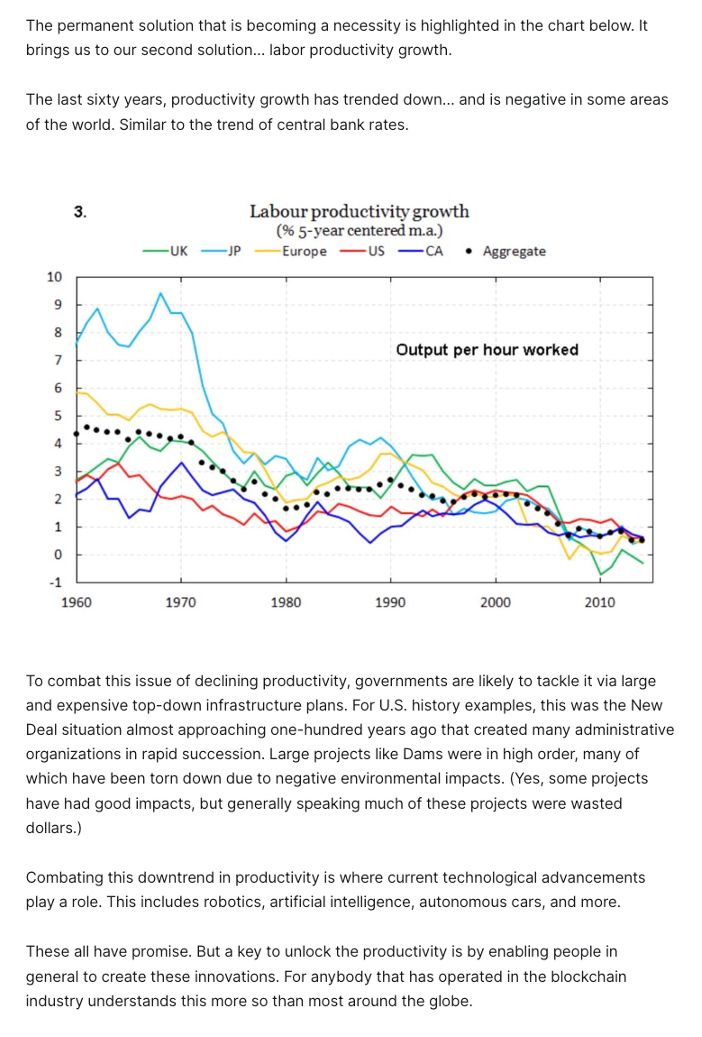

In Macro Cycles Part III: Restoring Trust, we went into detail on how the U.S. and the globe will need to fight inflation by addressing the decline in labor productivity.

The methods mentioned on what the government will turn were the obvious ones: robotics, AI, autonomous cars... and the less obvious one: crypto.

Here's a snippet from the essay.

Now, we need to realize that Macro Cycles was written more than three years ago.

At the time, Gary Gensler was issuing subpoenas and lawsuits at the same pace he was repeating that securities laws were adequate for today’s markets.

Laws that were written before the internet, before 24/7 markets, before crypto. Laws written when the U.S. was literally just coming out of the horse and buggy era.

I say all this because several of you reading these words on your screen believed I had one too many hits of crypto hopium given the sentiment of crypto at the time.

Don’t get me wrong, I get it… TerraUSD had broken peg and LUNA managed to wipe out $40 billion in market cap in a matter of days.

The world of crypto was literally being set ablaze with the final act of FTX yet to play out.

Gensler was calling crypto a boogeyman at every opportunity, and the view of crypto being a savior to productivity growth was written off by some of the most diehard supporters.

Even still, I didn't hold back. I doubled down in March 2023 and laid out a playbook on how stablecoins would be embraced by the administration. I broke down how stablecoins offered a short-term solution to the debt bomb since it changed money to debt dollars - a concept that's just now becoming mainstream today.

I write this back patting sequence of historicals in order to help credentialize what I expect to happen next.

So buckle up and stay with me here...

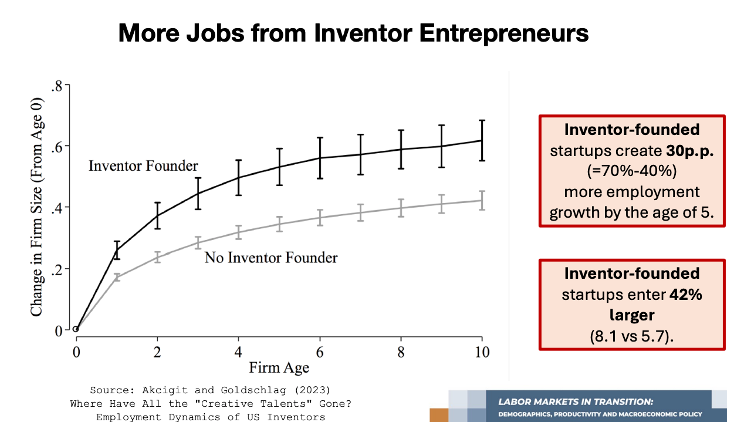

The bankers of the world were pilled with the need to boost productivity. And the slides that sum up the most important takeaways of the event are summarized in the two slides below.

Slide one… Founders that are builders create 40-70% more employment opportunities for the economy than non-builders.

The takeaway on this first slide should be straightforward…

Get out of the way of those wanting to innovate. Let them break stuff. And if anything, foster more of it because they create the jobs that make the ivory tower incumbents richer.

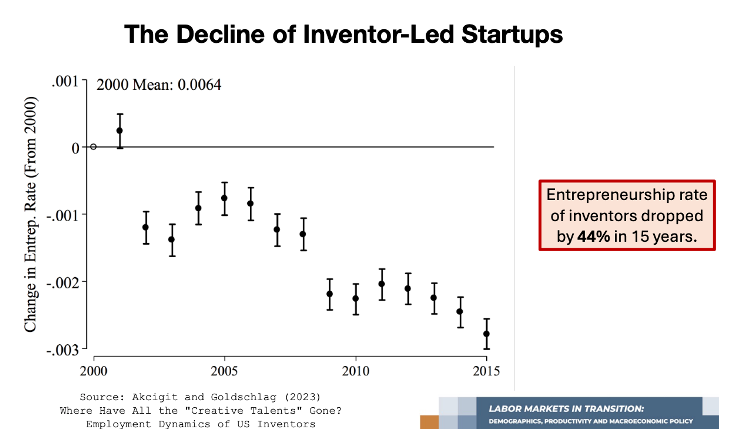

The second slide… We don’t have many builder-led companies anymore.

Which is to say, regulation has successfully scared builders from starting a businesses.

A 44% drop in builder-led startups in the last 15 years is nothing to gloss over. Compound this issue, and that's a lot of jobs over the last decade.

Sure.. there were some other slides and talks that were enlightening.

A few tidbits were provided on large corporations getting too many government research subsidies in comparison to smaller startups… The decline in birth rates is becoming a systemic issue for global economies… and The old “Taylor principle” for inflation was officially thrown in the trash can.

But as it pertains to markets, the two slides above are crucial. They signal that bankers and government authorities need to improve productivity by embracing innovation.

Accelerating, not regulation, is the solution to the productivity gap.

Which makes this next part all the more exciting…

Q4 Is For Crypto

An analyst I follow, called Capital Account, on financial legislation and lobbying efforts mentioned last weekend that the top priority for Mr. Atkins and the SEC is unequivocally digital assets.

The analyst does not focus on crypto. Which makes his takeaway on crypto all the more interesting.

The reason for Capital Account's takeaway was a government employee mistakenly posted the SEC chairman’s agenda on the internet. The agenda lays out what the SEC will tackle for the months to come. ]

Luckily, some savvy individuals were wise enough to screenshot some images before it was taken down. (The agenda has since been released on Sept 4.)

What was seen in the agenda was an ambitious push on the following topics: small company capital formation, crypto market structure, some deep in the weeds crypto topics, and giving more Americans access to alternative investments.

It was a sequence of items related to what Mr. Atkins laid out in his “Project Crypto” speech delivered just over a month ago. The agenda was proof the SEC is preparing to not just talk the talk, but walk the walk.

The SEC "Project Crypto" speech was something I made mention in The Divine One-Two by stating “you’re not bullish enough”. That's because most of the world is not quite connecting the dots on what is taking place.

The U.S. is not just making crypto investing ok or acceptable in traditional markets… It was a discussion on how to bring the financial system onchain.

The administration, regulators, and lawmakers are going all in on crypto.

The SEC’s current agenda is a continuation of that sentiment.

To showcase the gravity of it all, let’s connect the dots real quick on the U.S. administration’s push and what was said at Jackson Hole...

Innovation is now a necessity to boost productivity.

The U.S. is moving forward at an accelerated pace to embrace the digital asset industry. It's a main solution to the issues portrayed at Jackson Hole – Not enough builder-led companies.

Now, it's September 4 as I edit this piece before publishing on Sunday Sept 7, and I’m expecting before this gets published, we’ll see the newest draft of CLARITY Act make the rounds with a fresh wave edits for the Senate to review.

On the heels of the release, crypto will be the main talking point coming out of Washington for the next four weeks as Congress looks to vote on the bill before September comes to a close.

This means in the weeks to come, crypto talking heads will get asked by financial news outlets to come on air and give their insights…

Which in all reality, for us crypto natives, we already know who those talking heads will be and what they'll say.

Tom Lee: I’m sleeping in my office until ETH hits $80k.

Saylor: There’s only one chair.

Novogratz: I have SOL tattooed on my skull because it’s top of mind.

Meanwhile… as the shillers shill, you’ll have Bessent, Trump, Lutnick, Sacks, and other Washington D.C. players shouting at the world saying crypto is the future. It's necessary. And it'll bring the golden age of innovation back to the U.S.

Even Eric Trump will thank himself for telling you to buy crypto some months back.

The relentless shilling is about to unfold just as CLARITY Act gains mindshare in Washington D.C.

And the important piece to all of this...

Their proof point for success... Whether it's Trump, Tom Lee, or lawmakers is price going up.

The biggest shills we’ve ever witnessed are about to blast the world with their message.

We’re not confined to crypto twitter anymore.

The game is bigger. It's the global stage.

And crypto in this equation is the physics defying solution for Trump and Co. to clear that 50ft gap that exists in labor productivity. It'll be a unified message to...

Floor it!

Which is another way of saying, don’t underestimate this moment.

Bessent gets to control the yield curve through stablecoins. Trump gets to make billions in profit from his crypto grifting. Wall Street gets a new asset class to profit from. And the U.S. dollar gets to undercut nearly every sovereign currency to strengthen D.C.'s geopolitical bargaining power.

Those are the incentives.

We may not like some of the realities here, but we’re all just a passenger on this proverbial 1990’s bus that's about to try and clear the gap to pull a financial market repeat of the dot-com era.

We’re accelerating with no sign of slowing down.

So what does this mean for the future of crypto and financial assets? Well, that's where the bold prediction comes in...

And it's the topic for Part Two as it requires a lot of ink to be spilled. When it comes out, I'll also introduce an opportunity you won't want to miss out on that plays right into this prediction.

Until then...

Your Pulse on Crypto,

Ben Lilly