Finding Waypoints in the Aftermath

Addressing Elon's Nuke

One of the most influential figures of our time, who was believed to be an advocate for bitcoin…

Dropped a bomb.

I don’t think we need to get into the details of it as you’ve likely scoured hundreds of various takes on various social media sites.

In doing so, its quite clear the shock has left everybody stunned.

It is the proverbial Black Swan event.

Now, as the dust still swirls all around us the waypoints that were once familiar are lost in the haze.

Aftershocks are still being felt and nobody is feeling like we’re on solid ground.

Luckily for our team one of the wallets we track seemed to be in the know. You all know who we’re talking about by now… Pablo.

He made three transactions this week. He sent 2k earlier this week, 2k about 36hrs ago, and then another 4k before Elon opened up the bay doors with his tweet.

Did Pablo know about Elon prior to his tweet?

I’m not sure.

But after watching this wallet act… Which in reality is not just one wallet… it’s clear whoever they are seem to know about big news before it hits the airwaves. Each time they seem to time the market and avoid major selloffs.

For this we are thankful to know about them. To be within their inner circle. And quite frankly, we don’t want to know who they are… As that would ruin some of the intrigue.

Instead, in case he or she is reading, we’ll just say thank you for helping us and our clients avoid major injury once again.

Now, like I said earlier, we are all recovering a bit from the shell shock. Elon’s twitter drop regrading bitcoin was a blow. And right now we can see the market is lacking the liquidity it had just a few days ago.

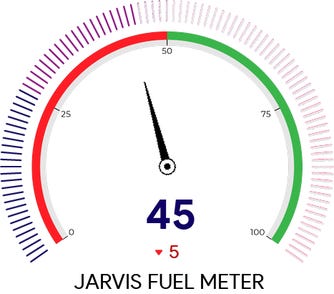

That’s in part why the Fuel Meter is sitting at a lackluster 45. Things change quick.

Part of the reason for this drop in liquidity is the movement of USDT.

In particular, the minting we saw from Tether not too long ago. Here’s what I mean... Not too long ago we said billions of dollars of Tether were moved at the drop of a hat. This happened on the heels of a selloff.

Moving over a billion dollars is not something you do in reaction to something. You do it because the market is unfolding as planned.

However, Elon’s blast was not part of that plan.

And in turn, the USDT is recoiling… We witnessed some of the recently minted USDT go back to Tether unused. This is odd.

In terms of why this happened?

We’re not 100% sure. Perhaps the Elon drop created uncertainty with potential buyers. Or maybe the buyers no longer needed as much USDT since it dropped more than expected. Or maybe ‘the plan’ isn’t working out as planned.

The why is always tricky.

But for us, we don’t really need to know the why. We simply understand that when USDT moves like this, it’s a bearish signal.

Money talks, B.S. walks.

What this means is we need to remain super cautious. And our mention of us being in a shit storm might have been an understatement. Regardless, we’re in it, time to weather it.

And as terrible and unsure as all this might sound… There are some positives.

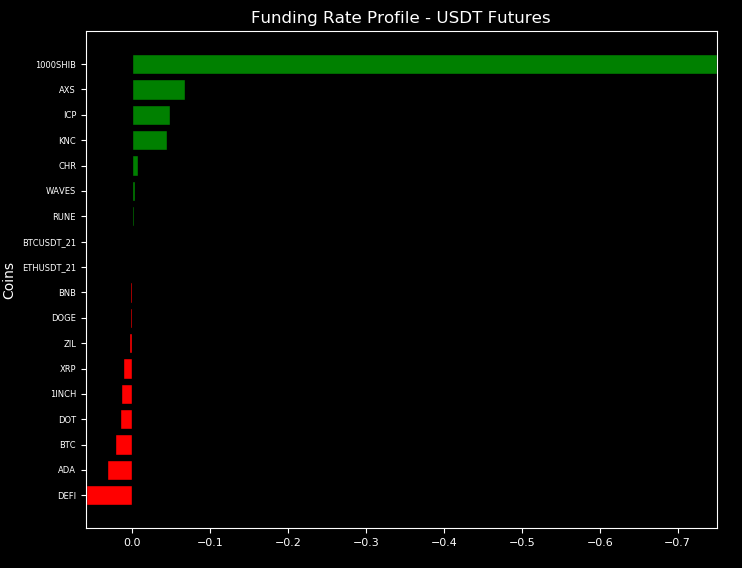

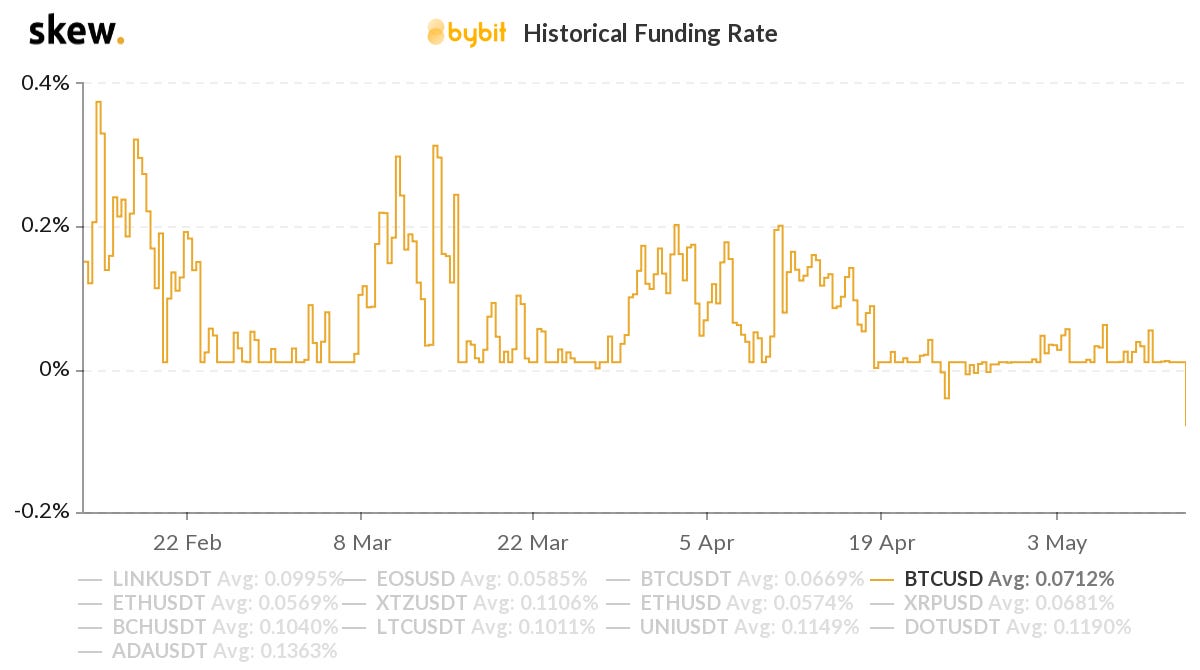

First off, funding rates. Not just a complete reset, but we’re now seeing some funding rates turn negative. This tends to happen when the market begins to act overly bearish.

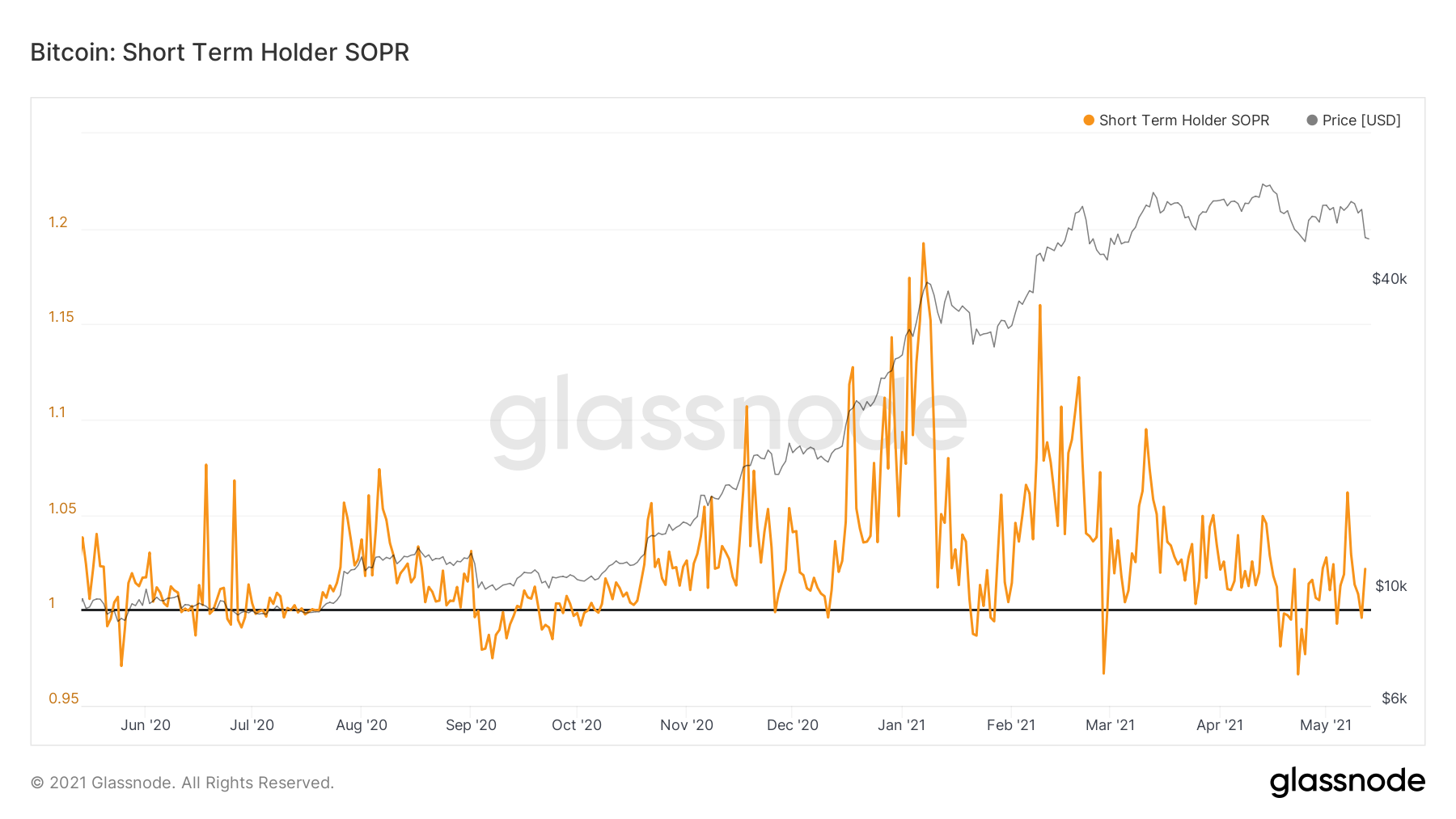

Additionally, SOPR got a reset. This indicator tells us how short-term holders are looking in terms of profit. Right now the metric is at one, which tells us we’re neutral…

Yet another metric that has witnessed a ‘reset’.

Then there’s Bybit… Its funding rate for bitcoin went negative. Last time this happened price bottomed out 24-48 hours later. Price then rallied $12k after.

So here we are holding on to our bags wondering when the dust will settle. Metrics like the above tell us we’re getting overly bearish in the market, and that can lead to reversals.

Unfortunately, the market still lacks momentum when it comes to liquidity and on-chain transactions,.

This tells us that futures traders still need to just wait out.

But with a lot of metrics now starting to get out of whack in the bearish direction, this tends to hint at a high probability for a reversal.

And with our long-term view that the top not being logged for this cycle, consider dollar cost averaging your entries on spot positions.

We will leave you with one more thought for the day… And it does not have to do with Grayscale. That’ll be for another day…

The Next Pairing

Start pulling up charts for XXX/ETH pairings. There are some interesting charts to look at. And with so much capital flowing into ETH, this might become reliable from a charting perspective.

Remember, the major pairing for DEXs is XXX/ETH, which is why these charts are becoming relevant.

Also, ADA smart contracts are coming soon, which might explain why ETH is flowing into ADA.

Here are a few examples of some ETH pairings to watch…

AAVE/ETH

SNX/ETH

ADA/ETH

OK, so that’s enough out of me today.

Don’t do anything rash. Spot is good. Futures is still a no go. And we’re still waiting for momentum to build… Also, start cycling through some XXX/ETH charts in your spare time.

More to come tomorrow.

Your Pulse on Crypto,

Ben Lilly