Eyes on the Next Altseason

Weekly ChainPulse Report

The next tsunami of cash is expected to get its marching orders Tuesday. That’s when U.S. Congress is expected to pass the bill.

What it means for bitcoin on the surface is best conceptualized with a printer meme that’s rather overused.

But the surface isn’t for us.

Here in the Weekly ChainPulse Report we dive past the headlines and analyze what these Macro events mean for bitcoin.

Today is no exception.

What’s written below can be best viewed as a weekly roadmap that we lean on throughout the week. We’re hitting on the stimulus bill, the macro narrative for bitcoin, Grayscale, on-chain data and a chart of the week.

It’s a lot to digest so let’s get right to it.

Macro

First up, the stimulus bill is set to go to vote this week.

It’s an event that’ll likely be a near term tailwind. One that bitcoin felt a bit over the weekend as it rose about 10% before futures opened up on Sunday.

Many expect equities will follow suit, but we haven’t seen that happen as of yet.

As far as the topic we’ve been covering for weeks, yields, it’s an issue that won’t necessarily be a headline hitter right away. But make no mistake, it’s not going away until the FED steps in.

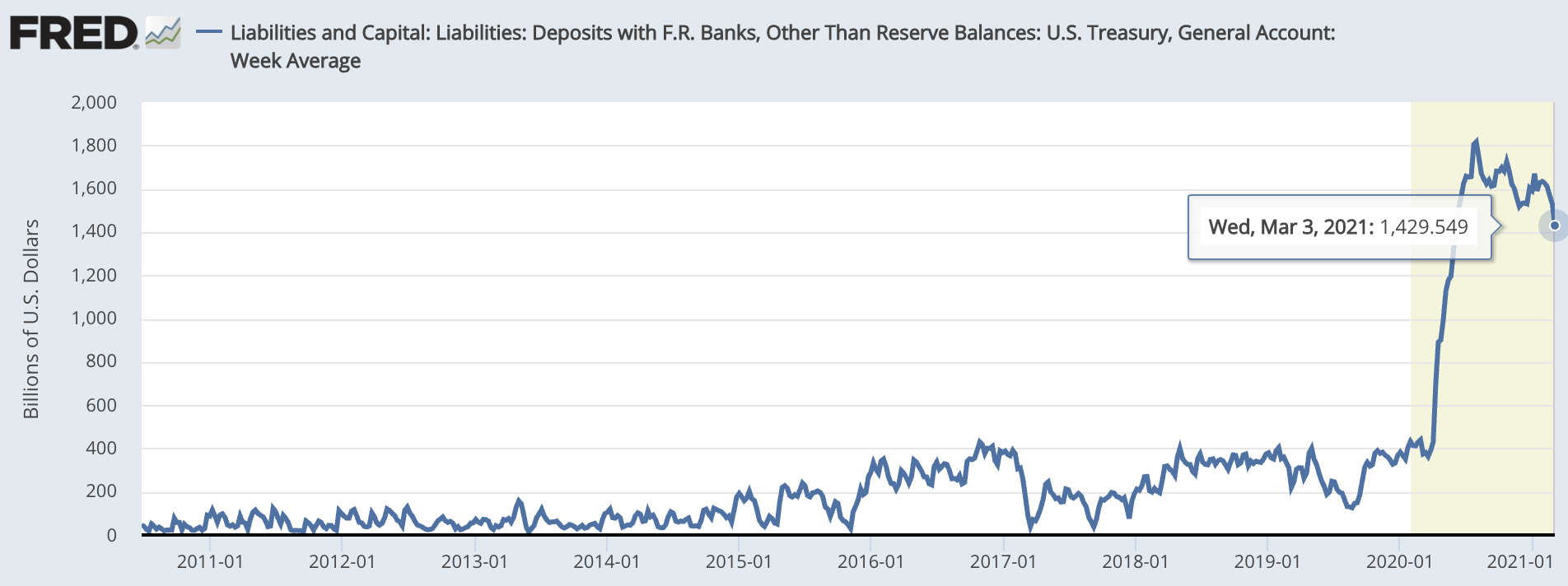

One particular reason is the Treasury is about to wipe out their coffers. Here’s a chart of the Treasury’s balance or general account.

It’s sitting at about $1.43 trillion. That’s less than the proposed bill. Which means there’s more debt coming. And with more debt means more bonds.

This creates a bit of a pickle.

Yields are rising, the FED hasn’t stepped in, and the U.S. needs buyers of its debt. Wiping out ones reserves is not a good way to remedy this issue.

Not to mention, the Biden Administration has its eyes set on a massive multi-trillion infrastructure bill.

Meaning more debt. Which means more bonds. Which means we have plenty of more talk regarding yields in the coming weeks to months ahead.

Luckily for debt buyers, and not tax payers, the U.S. is beginning to dream up an innovative solution for reducing the bond issuance…

Higher taxes.

I’m sure if you were to walk around the halls of Capital Hill you’ll likely hear grumblings of higher taxes. The thing is, for an equities market that’s on a tear, it’s enough to let the air out of it in the near-term.

It could be a massive damper on the equities market.

Luckily for bitcoin and crypto as a whole, the chart I showed you last week still looks good. It shows that bitcoin is showing a bit of a decoupling from equities.

Which means in light of all this stimulus spending, tax hikes, rising yields and talk surrounding the FED… Bitcoin has an opportunity to earn a seat at the table of macro assets such as gold, oil, reserve currencies and more.

If this happens, then bitcoin has the potential to separate itself from the premise of why everybody cares so much about yields right now…

Right now the rising yields are signaling the financial system is showing cracks.

Whether it’s a lack of demand for government issued debt, rising inflation concerns, or something else, the idea that investors might rush to cash becomes less of a concern for bitcoin investors.

Instead, bitcoin could potentially offer a way to shield yourself from the negative impacts associated from such events.

If it can earn the title of a global macro asset then a term I like to reference comes into play.

Escape velocity.

In a nutshell it means bitcoin would emerge as a macro asset at such an opportune time that its rise on the world stage would be somewhat reflexive. Reflexive in the sense that BTC acting as a legitimate hedge against the financial system would strengthen as it rises. And its rise would happen as such speeds that nothing can slow it down.

It’s a perfect storm of sorts.

So for the week ahead we’re looking to see how bitcoin reacts to the passage of the stimulus bill (bullish), rising yields and any discussion surrounding taxes.

The latter two items is what we really want to focus on more than anything else as it can set the table for bitcoin’s investment thesis for the rest of 2021.

Grayscale

The Grayscale beast.

Many folks have reached out to me lately about the premium dropping negative and claiming the Grayscale Effect is dead.

To shine a light on this I want to address two separate points.

The first is the discussion centered on traders doing an arb and borrowing coins to capture the premium of GBTC. This has gain a lot of popularity of late and I saw a lot of tweets discussing how this is a major issue in crypto.

To start, I personally know traders in this trade. Not a ton, but enough to where when I looked to gain some clarity on this situation and ask details on what rates they obtained in order to borrow capital for this trade, I was left a bit puzzled.

Nobody I spoke to knew a single entity borrowing capital to put this trade on.

Now, this doesn’t mean nobody is borrowing to do the arb. What it does mean is the impending black swan event due to Grayscale shares being traded at a discount is likely overblown.

Which leads me to my second point.

I don’t see how the discount continues past the month of May.

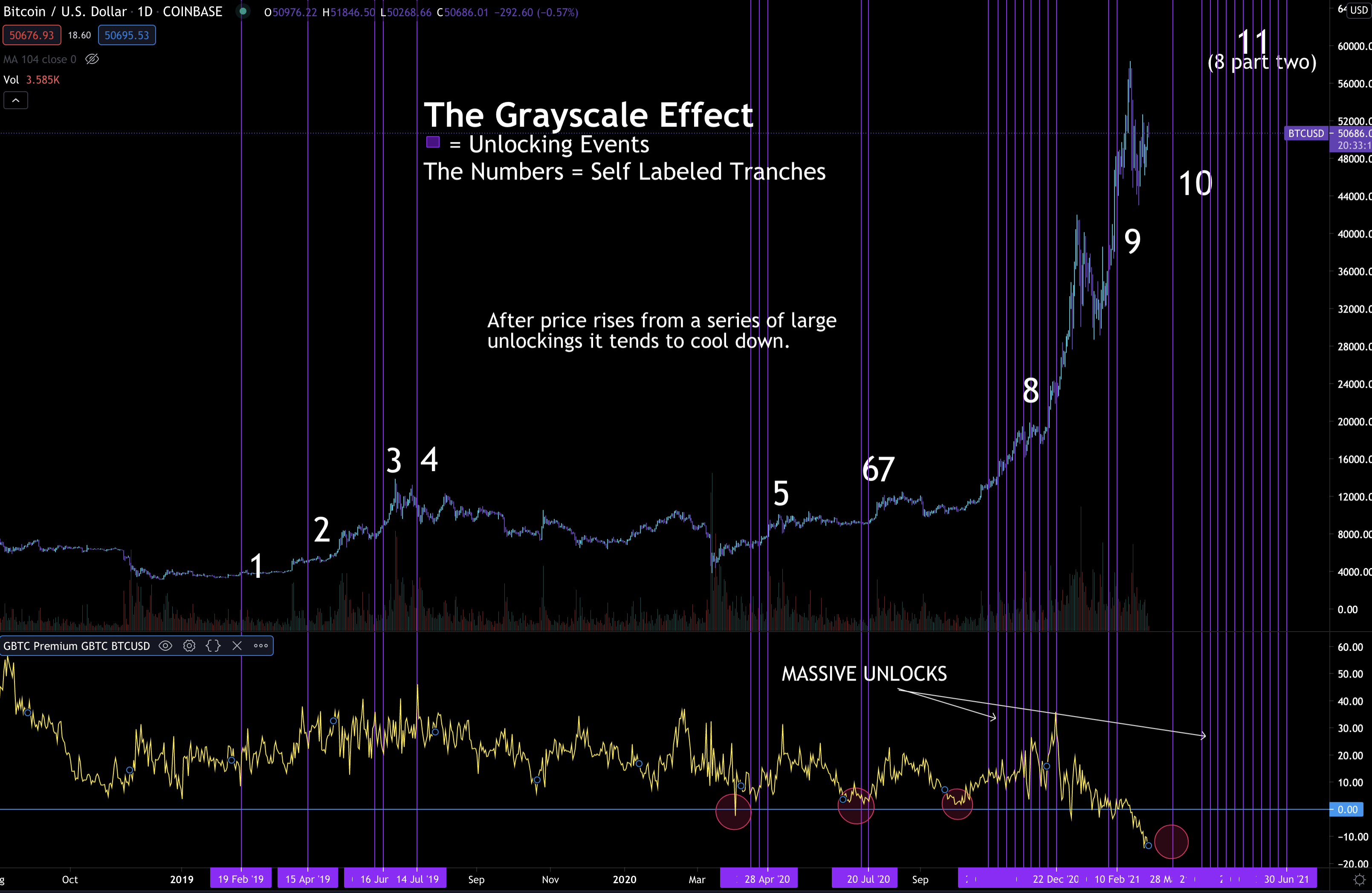

In the chart below I went ahead and circled in red when shares traded at or near a discount. All four of the most recent occurrences happened prior to a wave of unlockings.

And once the unlockings took place, shares traded at a premium again.

Now, back in late-2020 there was the largest wave of unlockings seen in history. This wave created a backlog of new shares waiting to be sold on the market. Over the last few months these newly minted look to be responsible for this discount.

What’s more, just like funding rates, the lack of FOMO in the market is contributing to this phenomenon.

If we weren’t in a bull cycle then there might be some warranted concern for buying GBTC. The fact is, we’re in a bull cycle. Because of this, the upcoming wave of unlockings points to this GBTC anomaly as an opportunity.

With shares trading at -10% to -14% discount, a wave of unlockings that begin this April, and the fact we’re in a bullish cycle are reasons that GBTC is a good buy right now.

The only caveat here is there might be more sideways price action in the cards.

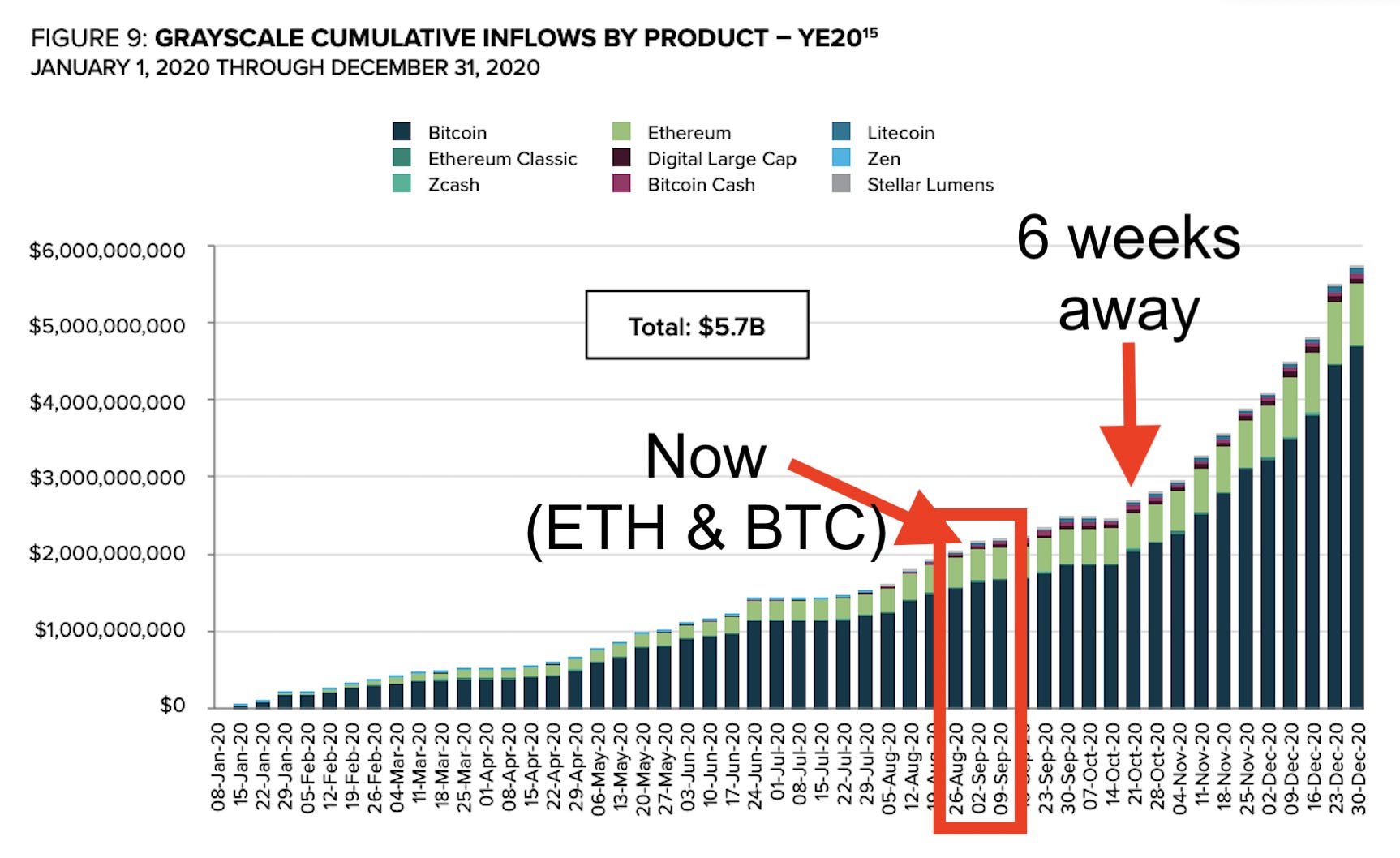

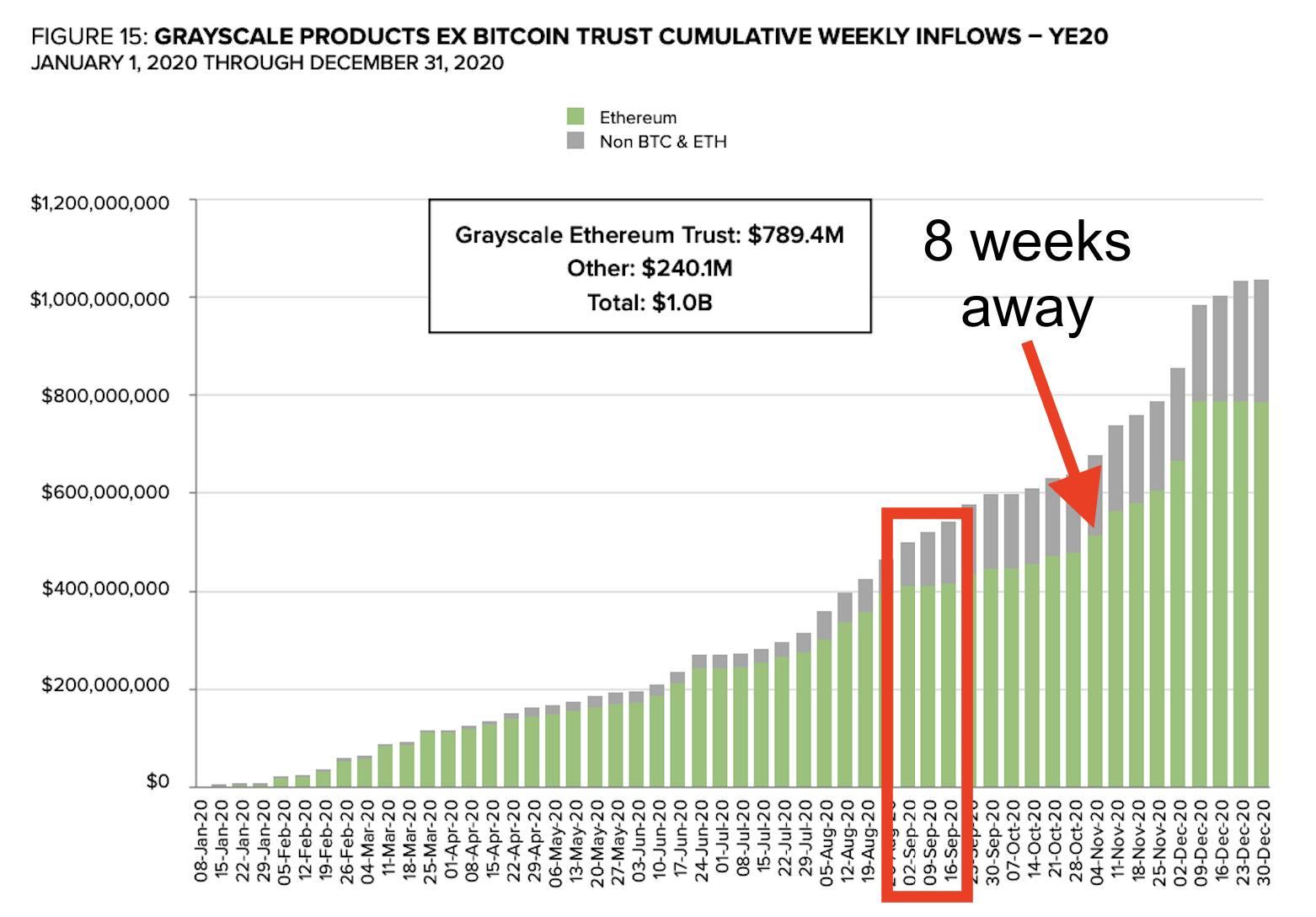

Take a look at the charts below. It’s a chart that shows the cumulative inflows by product for Grayscale.

The red boxes show where we are right now. As you can see, it’s pretty flat. Which means the price action associated with the Grayscale Effect is essentially null. We’re about 6-8 weeks away before we can start to pay attention to what’s happening with Grayscale unlockings.

ChainPulse

This weekend was a bit boring in terms of on-chain flows.

We saw 75 million worth of USDt flow out of Binance over the weekend. It’s an outlier that hasn’t been seen in several months now. Historically, the wallet has low correlation to price movement. However, it’s tough to ignore such large profit taking.

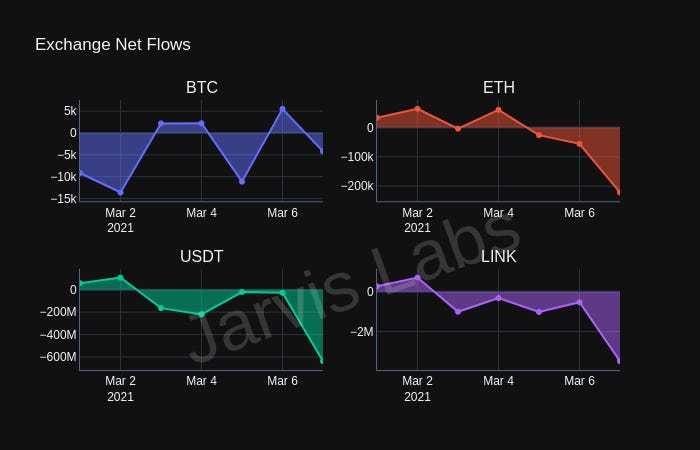

In terms of what exchange flows looked like, here is a look at the last seven days. Remember, positive netflows mean there’s more of the asset entering the exchange than leaving.

If the asset is BTC, ETH, LINK or another non-stablecoin a large netflow is interpreted as bearish since it represents selling pressure. A large netflow for a stablecoin is regarded as bullish since it represents buying pressure.

The opposite is true as well.

Here’s what the last seven days looked like.

Lastly, the 400 million USDt minted a week ago is sitting at Tether waiting to be deployed for the most part. The manner in which it’s getting deployed is lackluster since it’s being doled out in small pieces - One to two million at a time. Not the bazooka we’ve grown used accustomed to seeing. Approximately 110 million USDt has been used of the 400 million.

To be frank, there’s a lack of excitement from this weekend when it comes to on-chain activity.

Chart to Watch This Week

This is a new section that I decided to add this week. If I had done these in prior weeks it would have been U.S. government bond yields and DXY (US dollar index).

This week I have a crypto pairing. It’s ETH / BTC.

If you follow me on Twitter (@MrBenLilly - I hate “Mr” on my handle, but the handle w/o it was taken… and I lack any creativity) then you’ve likely seen me post this chart once or twice over the last week:

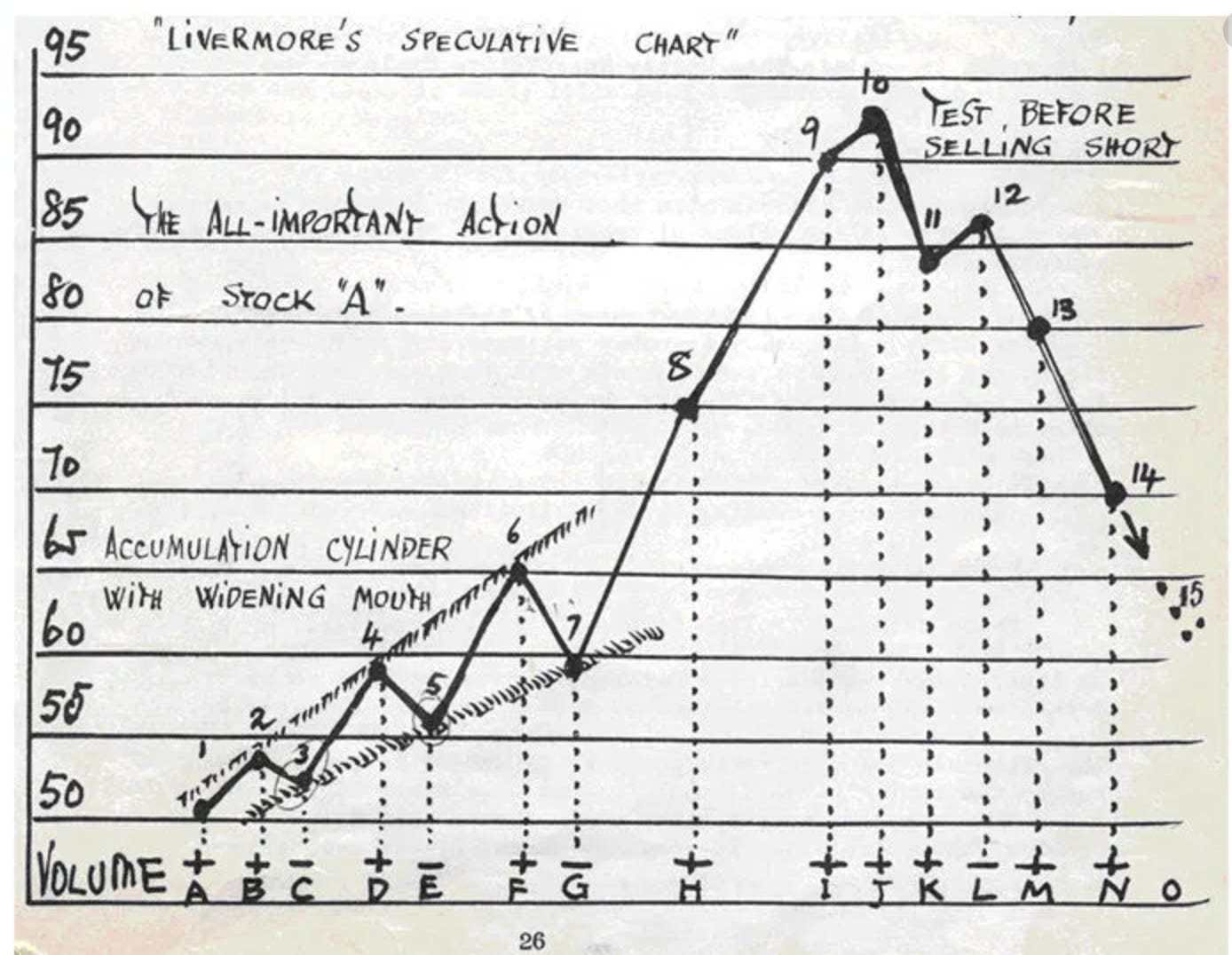

It’s a relatively well known chart that’s based on an old school trader, Jesse Livermore. If you’ve never read a book by him, I highly recommend it.

Now, I’m unsure whether the chart is actually his or not, but here’s the drawing that tends to get associated with him.

The main point of focus is the “accumulation cylinder with a widening mouth”.

It’s what we see going on with the ETH/BTC pairing right now.

I place the number “7” on my chart so you can get an idea of where we are based upon Livermore’s chart.

Additionally, there’s a vertical purple line to give you an idea of how long this pattern might take to unfold. It’s not exact, just a helpful way to think of duration when it comes to this playing out.

What I find interesting is the month of May (vertical purple line) matches up with Grayscale’s unlockings. Coincidence? Perhaps.

Regardless, the reason we need to watch this chart is because a confirmation on this patter represents something in crypto that’s relatively important.

ETH/BTC is a chart that acts as a barometer for altcoins (altcoins are coins not BTC or ETH).

Whenever ETH/BTC rallies, altcoins tend to rally as well. Here’s a chart to see what I mean:

As you can see the two tend to ebb and flow together. I’d expect something similar to happen again if ETH/BTC breaks upwards out of this cylinder.

To me, it’d signal altseason, which is when altcoins can go crazy for a few weeks. It’s an exciting possibility, which is why we plan to follow this chart closely in the coming weeks.

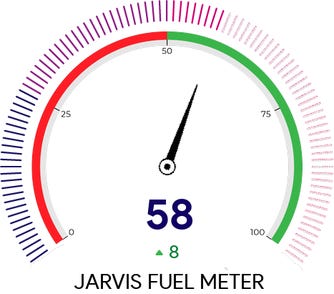

In summary, the market is in a feeling out stage. Risk and fuel meters are neutral.

In particular the discussion regarding Macro conditions will likely take some time to play out. As clarity regarding where BTC in relation to other assets emerges, and assuming its favorable, we expect bitcoin to decouple itself from assets like tech stocks.

If this happens then the road is likely paved for another leg higher as Grayscale’s unlockings materialize. The coming weeks might feel like a grind. And in reality, this should be a welcome.

As bitcoin fades from the headlines and traders lose interest, it allows traders like us to be ready to time the next major leg. Because when it does, it might be something similar to what we saw at the end of 2020.

Your pulse on crypto,

B