Eye on the Dollar

Pablo's Macro Hint

On Monday and Tuesday they were rolling in.

One, two, three… Four.

Literally just after we got the small short squeeze in the market. We half expected to see it given the FED was set to talk later in the week.

But watching various analysts turn bullish, data providers turn bullish, and various personality telling everybody this is why we HODL… We both felt deflated.

We kept quiet… Nobody likes to listen to a bear.

Nor the guy preach a market crash is imminent whenever price rallies. Wet blankets are simply annoying. Especially when everybody is trying to push bullish analysis… After all, bullish analysis sells.

So instead of being party poopers, we hung out in our private chat area letting clients know where we stood.

In the messages seen above, price just ripped through $40k.

And we all wanted the market to break $42k… Which is why those comments felt like we were cheating in some way.

But it’s not like we weren’t prepared. Our Feeding Grounds Chart that show onchain supports and resistances told us the $40-42k area would be a very difficult area to overcome.

In fact, those who have been with us for about a month now might remember those charts from May 24 and May 26 issues titled “No Man’s Land” and “Patient Parabolas”.

Well, the scenarios we describe in those two issues are still playing out. So if you are new to Espresso, it might be worth taking a few minutes and clicking those links above.

And for everybody, it means there is hope.

The first thought that came to mind when we got those bearish alerts near $42 earlier this week was a scene from the movie The Gladiator.

Near the end of the movie after Russell Crow is dead from a sword fight. After the funeral one of his friends buries a sentimental figurine in the dirt. He looks up and then says, I will see you again soon… But not yet… Not yet.

We’ll see you again $42k, but not yet.

So how long until we revisit? I have no clue. For now, I’m more focused on when we get some bullishness onchain to reverse out of the bottom portion of this trading range.

Now, for the newer readers, our notorious mega bear whale Pablo tends to be correlated to macro events. This tends to be news from the FED, governmental regulations, or movements in DXY.

It’s in part why my twitter mentioned a few bear signals prior to the FED meeting. And why I started to take note of macro indicators. The thought was Pablo’s movements would be linked to the FED. After Powell spoke and the tv pundits gave their hot takes, we took a second look to see if Pablo and the FED were correlated at all.

Well, the short answer is yes.

To see why, here’s what happened on the day the FED spoke. The end result was the FED decided to give banks a bit of yield on cash to the tune of 0.05%.

The result was the FED saw about $750 billion of cash come at them. They exchanged the cash for short-term treasuries, and the yields seemed to whipsaw a bit over the following day.

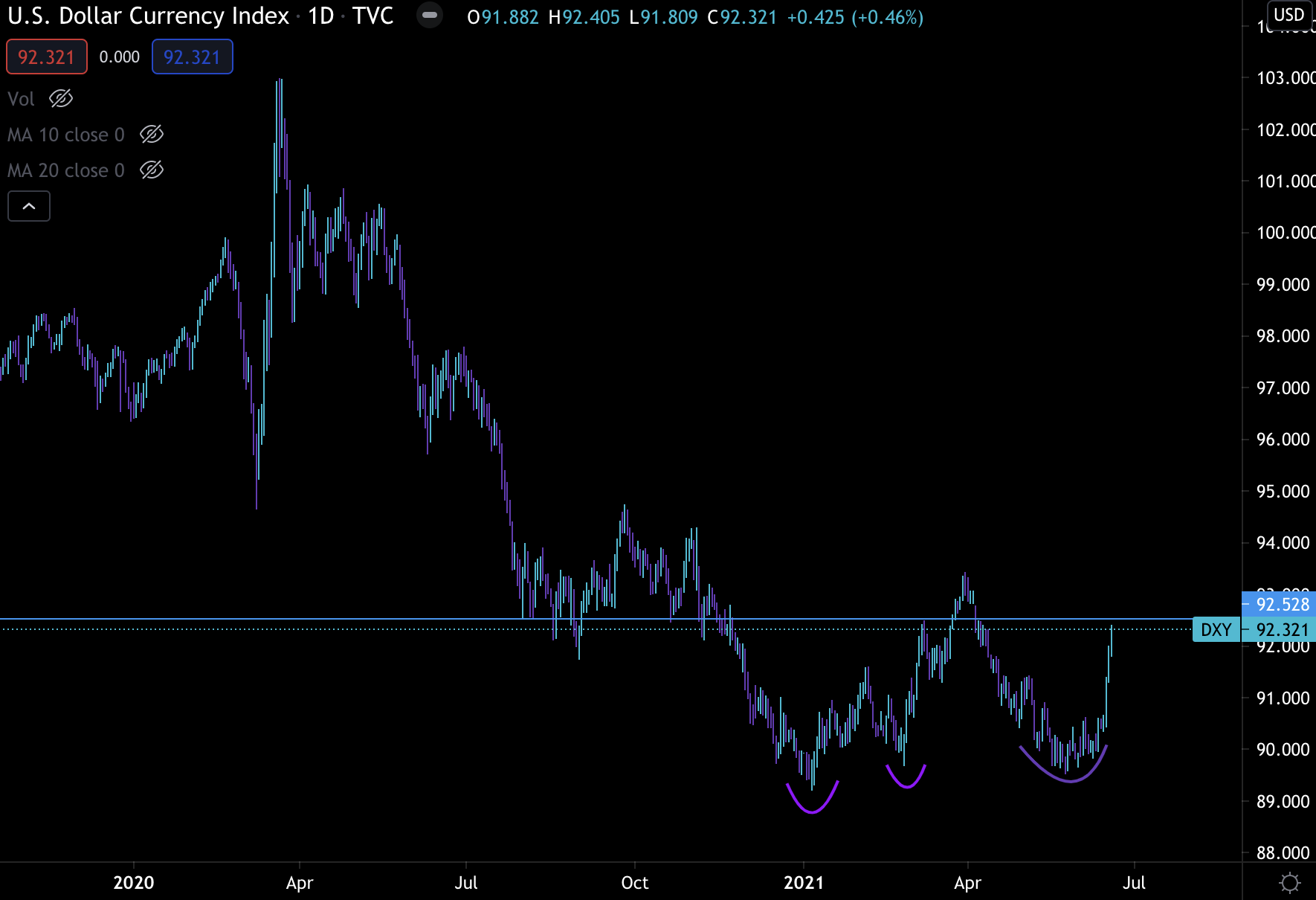

Simultaneously, this created market demand for dollars. We can see this with the price action over the last few days.

For any currency, this is a big move. And anybody who looks at chart patterns, this impulsive move is coming out of a quasi double bottom.

It’s a bit worrisome. It’s the type of move Pablo likely anticipated as he previously sold just after those two previous bottoms marked with purple curved lines.

This causes us to ask, how much strength does the US dollar index (DXY) have here? The US government likely doesn’t want a strong dollar when unemployment is higher than it wants.

That’s because a cheaper dollar helps create more exports and job growth. So some type of policy push can almost be anticipated in the coming week or two if this continues. My bet is on a massive spending bill to get this excess cash into the market somehow.

In the meantime, for the cryptocurrency party goers, a bullish DXY has not helped bitcoin. Which is why we will need to monitor this over the coming week.

So the things we are waiting for are our onchain sentiment model I call Knife Catcher (sorry Benjamin!) turn on. Typically we get a few warnings before it gets close to calling a bottom, we haven’t gotten a peep yet.

That means we will sit on our hands for now. The lower range of $30-32k is of interest from onchain support/resistance. It feels a bit out of reach, but since we haven’t seen Knife Catcher kick on, we can’t dismiss it.

And if we move into next week without any bullishness then we need to pay attention to DXY and any talk that perhaps the FED made what many believe to be a policy error. If we get that type of talk then something is likely imminent to reverse the bullishness in DXY.

But make no mistake. For the FED, the issue of simply too much cash in the system and not being able to raise rates is giving them trouble. Institutions are running out of places to stick cash. And any rise in rates will slow growth in the job market.

These issues will lead to another subtle move from either the FED or the halls of the US Congress. Until then we wait for onchain signals while hoping our friend Pablo stays quiet.

Until next week…

Your Pulse on Crypto,

Ben Lilly

P.S. - Follow along on Telegram for occasional real-time alerts on things like Pablo or the Knife Catcher model. You can join our channel here.