Early Signs of Life

Government Talk and Market Update

The U.S. Office of the Comptroller, U.S. Congress, the U.S. Federal Reserve, FDIC, Internal Revenue Service (IRS), and Biden administration all had things to say regarding cryptocurrencies.

The urgency happening in Washington DC is not necessarily uncommon. But with the Federal Reserve thinking about writing something on the possibility of issuing a Central Bank Digital Currency (CBDC), we can assume this is likely to be part of the reason.

Getting the groundwork laid out would help any rollout or development of a CBDC.

In fact, one of the regulators look to form a unified banking framework for crypto. Which is something that makes sense since most agencies in the U.S. government all look at this asset class in their own unique way.

Creating a unified approach would be a welcome assuming its not overly cumbersome.

Then there was the Biden Administration and the IRS telling businesses to report transactions over $10,000. Which is nothing to really get all crazy about. From what I understand, businesses in the U.S. already need to do this. This just restates what’s known.

What’s clear here is that cryptocurrencies are on the minds of regulatory officials and lawmakers. It’s why almost every major agency had news regarding cryptocurrencies. And based on many comments from these government officials, it doesn’t seem like crypto will be squashed away in the U.S. anytime soon.

Which is unbelievable in a way… How are we still wondering how cryptocurrencies stand four years after Initial Coin Offerings create a massive mania?

Regardless, any decent regulation can likely set a precedent for a good chunk of the rest of the world to follow. And possibly an Exchange Traded Fund to get approved.

Gaining clarity from the U.S. as stifling as its policies might potentially be, it can be a good thing. That’s because businesses around the world currently exclude U.S. residents and investors. And many have packed up and left the country all together.

Any clarity will change the game and allow more business and capital to flow to the space.

So where does this leave us today?

We’re still tracking news coming out of Washington DC in the lead up to June. You might remember we’ve hit on two noteworthy announcements that are expected to take place next month. The first is from FinCEN and its recommendation on VASPs, which can be viewed as a smart contract.

VASPs might become over regulated according to many, and hinder growth in DeFi protocols.

The second is the preliminary unveiling of the CBDC being worked on by MIT. We’re suppose to hear more on it next month.

Things are boiling up and it could be a boon for crypto, or a continued wet blanket. We’ll see.

Market Update

The market is getting closer to figuring itself out. That probably doesn’t come as much of a surprise.

But after big drops it can be difficult to gauge the type of bounce we’re witnessing.

Right now we have some favorable signs and some unfavorable ones.

A favorable sign was the incredible wick on bitcoin once exchanges came back online. While this was like letting shoppers into the store on Black Friday sales, buyers were not required to buy the dip. So the fact it did get bought up was a positive.

Then a tick on the negative column was that the bounce lost momentum when every lawmaker in the U.S. decided it was time to mention the word “cryptocurrency”.

While most any comment regarding cryptocurrencies from Washington DC tends to give the market a shutter, these comments weren’t really anything negative. So it exposed a bit of weakness in how they reacted.

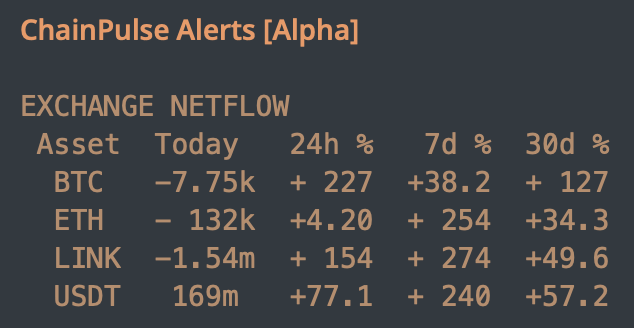

Regarding on-chain flows, they need to get stronger. They are slowly working their way in the right direction, but nothing overwhelming. Here are the latest netflows. This is now three days of negative flows for bitcoin.

However, we’re still getting bearish alerts on our end. These are transactions we label as significant, and in the short-term override general readings like the one seen above. We tend to only get about three alerts per day unless a selloff is imminent. Then things just get wild.

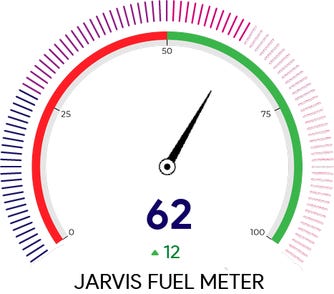

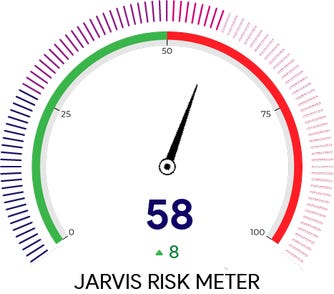

On the liquidity side of things we see improvement. Here’s our Fuel Meter and Risk Meter. They both help us gain insight into how much liquidity is in the market and how likely a quick correction is to occur.

The higher the fuel meter, the more liquidity is in the market to push prices higher. The higher the risk, the more likely a quick snapback on price is to occur… One that can cause cascading liquidations.

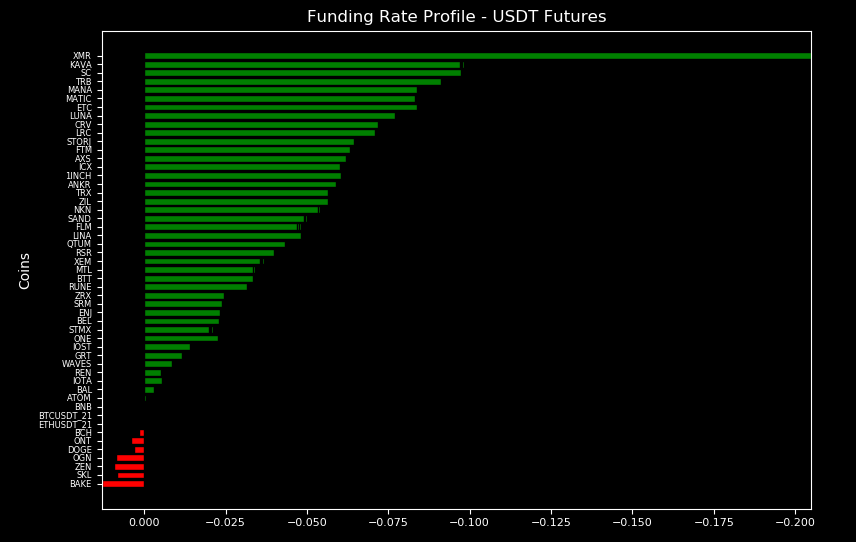

We also have decent funding rates as seen in our profile below.

0.015 is a baseline reading.

Based upon everything laid out here, nothing is getting too out of whack. And in a way, it’s like the global economy, starting to show signs of life again.

And while people start to feel more comfortable transacting and trading, it’s important to remain cautious.

The key thing to watch for in the coming days after the blood gets cleaned up in the streets... A time period when liquidity re-enters and positions get opened up… Is if somebody looks to see if the market is still soft to the downside.

This could change things quickly as the market is still very tentative and quick to react.

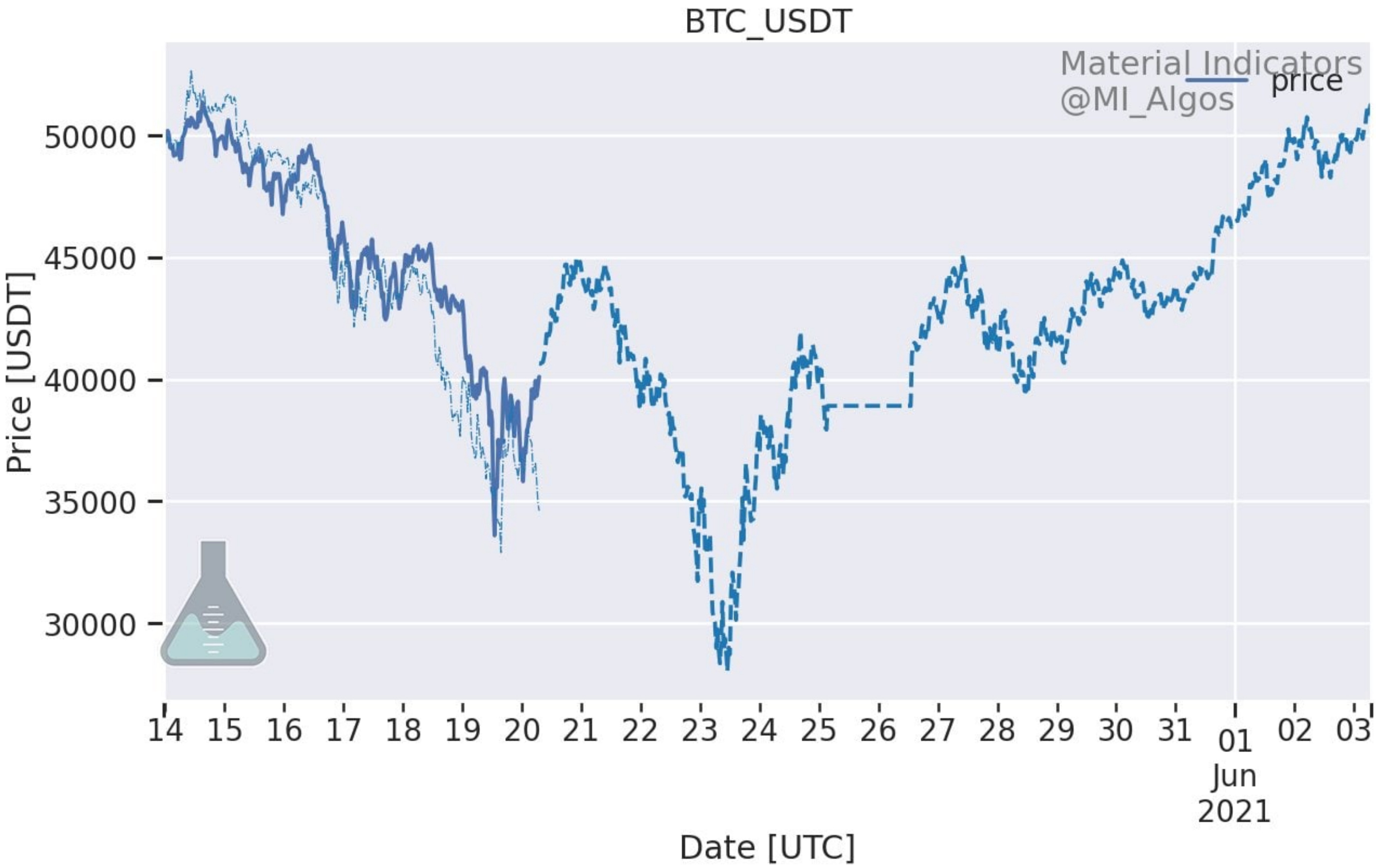

Nothing really visualizes this scenario better than a fractal from our friends over at Material Indicators. They do good work and their fractal is a great tool. We hope to build one ourselves one day, but for now, we can lean on theirs.

Fractals are ways in which price moved before. Patterns tend to repeat, and that’s what fractals are. They are similarities in price action seen previously that mirror the current price action.

Here’s the current one from Fred.

This was take on May 19th, and the bounce is playing out. If we see some softness this weekend, then here’s your playbook.

In order to nullify the fractal scenario we are keeping an eye on $45k for bitcoin. If we can overcome this level with a daily close, and see bullish flows, then we’re looking good.

In the meantime, let’s see what today brings as it’s likely to help give us clues into the above scenario.

Your Pulse on Crypto,

Ben Lilly